Join Our Telegram channel to stay up to date on breaking news coverage

The COTI price has soared 118% in the last week to trade for $0.2202 as of 3:20 a.m. EST time.

Over the last 24 hours, the price has dropped almost 5% with trading volume dropping 31%. This points to interest shifting away from COTI.

In hindsight, however, the surge in the COTI price comes after BlueBit exchange listed COTI token, welcoming the COTI Network to its spot market, paired with Tether (USDT) stablecoin.

🎉 #BlueBit is thrilled to announce the listing – $COTI

🌐 We welcome @COTInetwork addition to our spot market, trade COTI/USDT on #BlueBit. 🚀

🔹 Trading pair: COTI/USDT

🔹 Trading will open on 2024-2-26 at 14:00 (UTC)

🔹 Deposit will open on 2024-2-26 at 12:00… pic.twitter.com/slDWsDZPTl— BlueBit.io (@Bluebit_io) February 26, 2024

The surge caught traders off guard, with investors who missed the rally looking on with regret.

$COTI

I wish I could listen to my brain and do 100X long 😭

Well nothing goes 99% accurate

it pumped without me https://t.co/Q8k5Jjh7U4 pic.twitter.com/kQcwcFz2IL— Cryptoworld $FET to $100 (@Crypto69ine) February 26, 2024

Nevertheless, perpetual traders could have a lot of entry points to short the COTI price as investors are already cashing in on the gains made over the week.

$COTI – what a sight to behold

Great team. Great setup. Great PA.

This community is 💎 hands 💯

2X and we just lifting off … https://t.co/cehtbb9rn1 pic.twitter.com/fjo1MQ3wjX

— 🔱chirocryptø🦅 (@chirocrypto) February 25, 2024

Traders looking to long the COTI price also have a chance, though high risk is still intact. Both perspectives will be showcased and detailed in the analysis section below.

The COTI Price Prediction: Opportunities To Short Or Long COTI

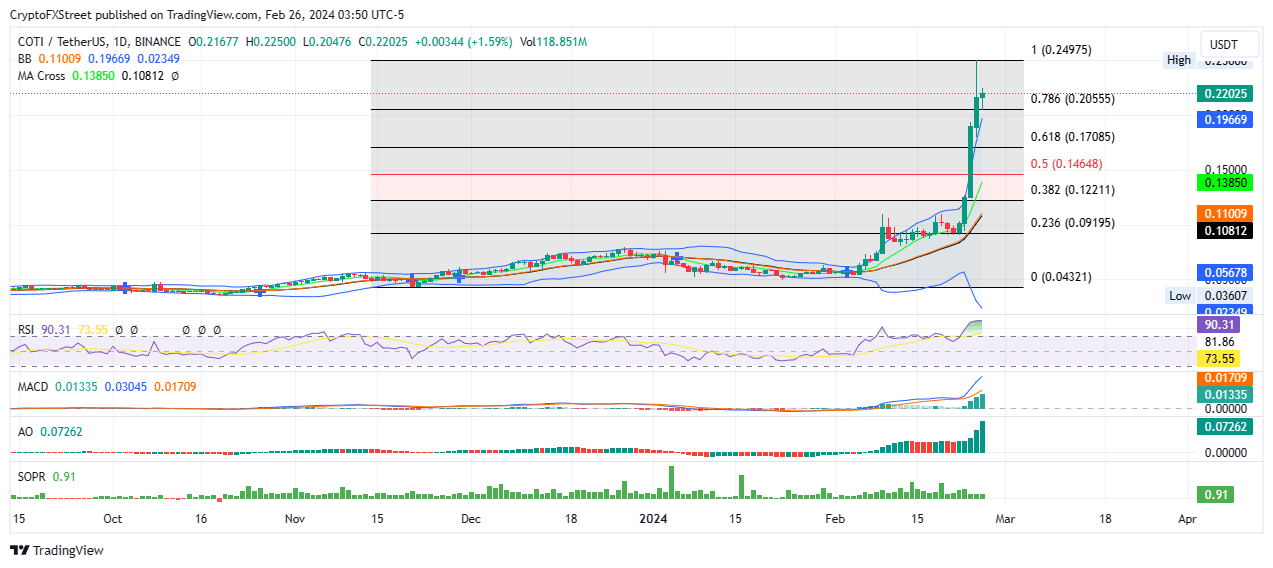

With the Relative Strength Index (RSI) at 90, COTI is massively overbought. However, the trajectory remains broadly northbound, increasing the odds for a further upside. Notably, Welles Wilder, best known for his work in technical analysis and as the father of multiple technical indicators making the core tenets of trading software, says an asset is considered overbought and ripe for selling when the RSI is just about to cross below 70.

More importantly, the Spent Output Profit Ratio (SOPR) for the COTI price indicates a correction may not be due just yet. This is because the SOPR remains below 1, at 0.91 at press time, as a 30-day moving average (MA). For the layperson, this ratio suggests that COTI holders who are sitting on unrealized profits at current the COTI price are not showing any intention to cash in on their gains made over the last week.

These features suggest a pullback may not happen at this point. In this respect, investors should not succumb to early profit booking as the COTI price could realize more gains. They should consider waiting for the SOPR rate to ascend above 1 before they can short the market.

The Moving Average Convergence Divergence (MACD) and the Awesome Oscillator (AO) indicators reinforce the above supposition. To start with, the MACD is moving above its signal line, while its histogram bars are flashing green with large volumes of histogram bars in positive territory. This suggests the prevailing strength of the ongoing bullish cycle. The same is seen on the histogram bars of the AO indicator.

COTI Price Targets

Enhanced buyer momentum could see the COTI price reclaim its peak of $0.2497, marked by the Sunday intra-day high. In a highly bullish case, the altcoin’s price could clear the aforementioned blockade before recording another local top. The next logical target for COTI would be the $0.2500 milestone.

TradingView: COTI/USDT 1-day chart

Converse Case

On the other hand, the RSI position also puts the COTI price at high risk of a correction. The fact that it has broken above the upper band of the Bollinger indicator at $0.1966 also increases the odds of a correction.

If the bears have their way, the COTI price could lose immediate support due to the 786% Fibonacci retracement level of $0.2055. Below this level, COTI could drop to the 61.8% Fibonacci level, the most important retracement level of $0.1708.

If the aforementioned level fails to hold as a support, the COTI price could slip through to the midline of the market range. This is marked by the 50% Fibonacci retracement level at $0.1464. Before the bullish thesis can be invalidated, however, COTI must drop past the 38.6% and 23.6% Fibonacci retracement levels at $0.1221 and $0.0919 levels respectively.

With the COTI price at a high risk of a correction, investors are looking at Sponge V2, which analysts say has outstanding potential for gains after launch on on additional exchanges. Analysts have even listed it among the best web3 projects and as a top pick for investing in the decentralized future.

Promising Alternative To COTI

Top meme coin Sponge now has more than $10.84 million staked and bridged following the migration to the Polygon network at the beginning of February. Sponge’s strategic shift to Polygon was very timely for the Ethereum Dencun upgrade, with reduced gas fees and faster transaction times for Ethereum Layer 2 networks like Polygon featuring among the perks.

📣 Attention, #SPONGERS!

Here is some important information to remember about $SPONGE V2!$SPONGE V1 has officially been discontinued, and V2 has been launched on #Polygon! 🔥

Learn more about the token details below 👇https://t.co/TCdxgXx40w

🧵1/3 pic.twitter.com/YZzXOlKmHY

— $SPONGE (@spongeoneth) February 6, 2024

Polygon was the choice network for the migration as it provides a good hub for up-and-coming gaming platforms such as Sponge. This is because of its low fees and superior transaction speed compared to Ethereum.

Ethereum’s Dencun upgrade (EIP-4844) is scheduled for March 13th and is expected to reduce gas fees for DEX swaps.

Here are the projected gas fees for swapping on a DEX on Optimism, Arbitrum, Starknet, Polygon zkEVM, and zkSync.

Bullish on $ETH betas. pic.twitter.com/BQgLMMT3O5

— 𝗰𝗮𝗹𝗶𝗱𝗮𝘅 (@caldiax) February 26, 2024

Sponge V2 is taking the crypto gaming scene by storm, coming after the success of its predecessor, Sponge V1. The well-executed migration process has led to billions of $SPONGE V2 tokens being staked, amounting to nearly 20% of the circulating supply. Stakers are earning token rewards at 187% per annum on Ethereum and 817% per annum on Polygon.

Market participants do not have much time left to take their last chance to buy $SPONGE V2 before centralized exchange listings begin. So, if you are interested, act fast to secure tokens now before it’s too late.

This is what happens when you miss out on #SpongeV2 🤷♂️🧽$SPONGE #PEPE #DOGE #SHIBA #100x #Bullish #Crypto #MemeCoin pic.twitter.com/EJwBFTM5FJ

— $SPONGE (@spongeoneth) February 22, 2024

Also Read:

- Sponge Staking And Bridging Blasts Past $10m, Ethereum And Polygon SPONGE V2 Yields At 190% And 968%

- Sponge Unveils Strategic Pivot To SPONGE V2 On Polygon Network Following Liquidity Pool Attack

- Alessandro De Crypto Sponge V2 Presale Update – High-Staking Rewards Investment Opportunity

- Crypto YouTuber Crypto Boy Provides Update on Sponge V2 Ahead of Its Upcoming Listing

- Investors Flock to Upcoming Sponge V2 Meme Coin as Staking Pool Surpasses $4 Million in Value

- Could the Sponge V2 Relaunch Hold a High Upside Potential?

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage