Join Our Telegram channel to stay up to date on breaking news coverage

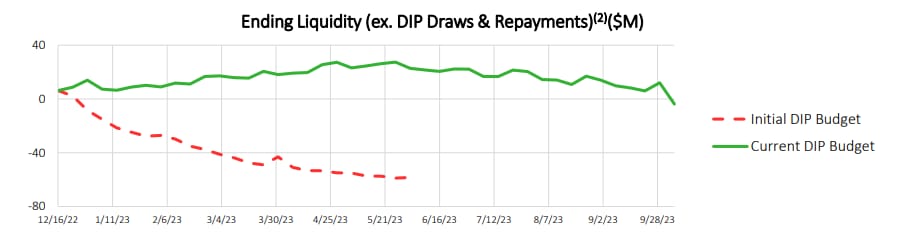

Core Scientific, a bankrupt Bitcoin miner, is making significant moves towards its September bankruptcy exit and expects a substantial boost of $46 million. The company’s lawyers recently filed a May 22 statement in a Texas Bankruptcy Court, highlighting the improved liquidity position of Core Scientific since the initial filing.

As a result, the company intends to file a reorganization plan in the near future. This positive development comes as creditors demand an expedited process for the insolvent crypto miner to emerge from Chapter 11 bankruptcy.

Core Scientific Negotiating the Reorganization Plan

The reorganization plan is currently under negotiation with key stakeholders, with the aim of building as much consensus as possible regarding the future outlook of the revitalized Core Scientific after emerging from bankruptcy proceedings. The company’s legal counsel has indicated that a reorganization plan could be reached by September 25. This timeline accounts for a 90-day exclusivity extension granted to Core Scientific to formulate a plan for debt repayment. However, the company has the option to expedite the process to satisfy its creditors’ demands for a faster resolution.

Creditors have voiced concerns about the lengthy duration of Core Scientific’s bankruptcy proceedings. Originally expected to last six months since its commencement in December 2022, the process appears likely to extend well into the following year, which has caused dissatisfaction among the firm’s numerous creditors. Creditor MassMutual’s representative, Thomas Bean, expressed objection to the extension request, emphasizing the need to avoid incentivizing Core Scientific to prolong the case and neglect its financial obligations to lenders.

Adapting to Market Conditions

According to Core Scientific’s legal counsel, the company requires additional time to develop a business plan that adapts to the dynamic landscape of crypto mining. The current market conditions, characterized by increasing Bitcoin prices and hash rates alongside decreasing power costs, have significantly improved the profitability of mining operations.

This positive trend has allowed Core Scientific to generate more revenue, enabling it to pay down $6 million of its debt. Ronit Berkovich, an attorney representing the debtors, highlighted these factors as contributors to the need for more time.

However, some creditors, including 36th Street Capital, expressed the opinion that Core Scientific, given its tenure in the crypto industry, should be more agile in responding to the ever-evolving nature of the market.

Jared Roche, a lawyer representing the aforementioned creditor and several others, emphasized that the crypto industry is inherently dynamic and requires swift adaptation. Roche argued that the debtor’s claim of needing time to address evolving business conditions should not serve as an excuse, as it is characteristic of the immature and constantly changing nature of the industry.

Core Scientific Set for Bankruptcy Exit – Market Factors Contributing to Liquidity Boost

According to the filing made to the Texas Bankruptcy Court, Core Scientific attributes its improved liquidity position to several market factors. Firstly, Bitcoin’s price has surged by over 60% since the company’s bankruptcy filing in December 2022, rising from $16,904 to approximately $27,000. Additionally, the company cites a 24% decrease in power prices and a 54% increase in the blockchain’s hashrate since the petition date. These favorable conditions have contributed to Core Scientific’s estimate of an additional $46 million in funds once the reorganization plan is finalized, despite the delays experienced during the bankruptcy proceedings.

Furthermore, Core Scientific is anticipating a significant windfall from Celsius Network, as it claims that the bankrupt crypto lender owes them around $11 million. The two entities have been engaged in a protracted court battle since October 2022, when Core Scientific accused Celsius of failing to pay its power bills.

Once hailed as the largest mining company in the crypto industry, Core Scientific experienced a rapid downfall in November 2022 when Bitcoin prices plummeted amidst FTX’s mid-November implosion. Despite going public with a valuation of $4.

More News

- China and Russia Accelerate State-of-the-Art Payment System for BRICS and SCO Currencies

- Market Uncertainty Looms as Cryptocurrency Concerns Arise Amid U.S. Debt Limit Deadlock

- Hong Kong’s Cryptocurrency Guidelines – Reinforcing Financial Hub Status Amidst Challenges

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage