Join Our Telegram channel to stay up to date on breaking news coverage

Following major selloffs, the cryptocurrency market has lost billions of dollars in recent weeks. To deal with the current recession, certain exchanges, including Coinbase, Gemini, and Crypto,com, have announced layoffs.

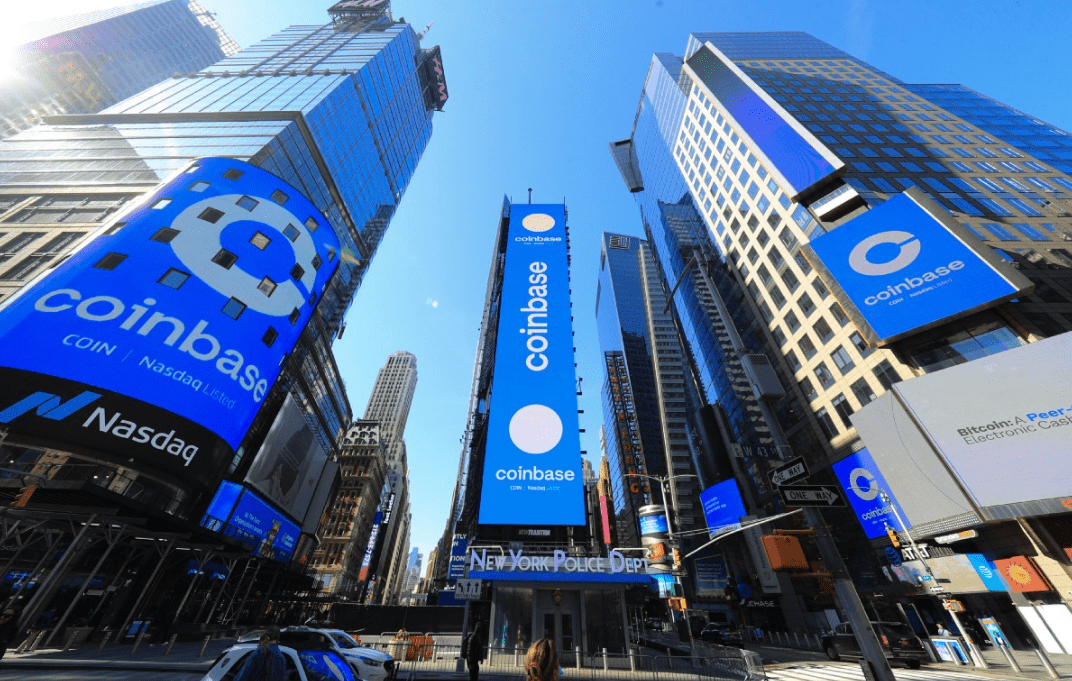

In the United States, Coinbase is one of the leading Bitcoin and altcoin exchanges. The firm went public on the NASDAQ in January of last year. Coinbase has been one of the worst-affected exchanges in the present recession, despite its large user base and growth into new nations.

Brian Armstrong, the CEO of Coinbase, said that the business will lay off 18 % of its workforce. This translates to around 1100 persons.

In India, the exchange has already laid off 8% of its workforce. The exchange would be able to remain robust during this economic slump if staff were laid off, according to Armstrong.

Visit FCA Regulated eToro to Buy Cryptocurrencies

Your capital is at risk.

Armstrong also wrote on his blog that he has been in talks with his management team about laying off people for the previous month. He attributed this decision to present economic conditions, the necessity to decrease expenditures, and the exchange’s rapid growth.

Owing to the increasing instability, the firm declared in May that it would no longer grow its employees as anticipated. The corporation also recently declared that its hiring freeze would remain in effect, and that offers to anyone who had not begun working would be rescinded.

The crypto market isn’t the only one being impacted by the continuing financial industry downturn. Netflix has also revealed intentions to lay off personnel in order to deal with the current economic downturn.

Coinbase Shares Take Massive Hit

Over the last year, Coinbase stock has been on a downward trend. After the exchange announced a net loss of $430 million in Q1 2022, the stock took a huge fall. Users on the platform were likewise alarmed by the financial report.

When Coinbase went public last year, its stock soared to $350 per share. These shares, on the other hand, have plummeted in value, now selling at roughly $51 at the time of writing. The company’s market capitalization has likewise plummeted to $11.37 billion.

Coinbase, which currently has around 5,000 employees, is cutting off staff because the business hired too many people too soon.

Coinbase Share Price – Last 1 year

According to the CEO, Coinbase began with approximately 1,250 employees last year but rapidly realized that usage of crypto goods was skyrocketing.

According to Armstrong, at that time, firm managers had to figure out how many more people were required to staff the crypto-mania.

According to CoinMarketCap, on Monday, the total market value of cryptocurrencies slipped beneath the $1 trillion mark, and reached to $983 billion for the first time since January 2021.

According to Bloomberg News, the most popular cryptocurrencies, such as Ethereum, Solana, and Tether, have all lost value in the sell-off, while Bitcoin has dropped to its lowest price since December 2020. Coinbase’s competitors are also seeing layoffs as a result of the losses.

Crypto.com CEO Kris Marszalek stated in a tweet Friday that the firm planned to let off 260 people, or 5% of its staff.

Buy the Dip via eToro Platform Now

Your capital is at risk.

According to Bloomberg News, cryptocurrency startup Gemini Trust, which is controlled by the Winklevoss twins Cameron and Tyler, also announced intentions to lay off 10% of its employees earlier this month, marking the first time the company has had to do so. Bitso, Buenbit, and Mercado Bitcoin are among the crypto firms that have laid-off employees.

This is not the first time that a crypto bear market has hit the markets. Many investors and analysts are hopeful that crypto would bounce back soon.

Read More:

Join Our Telegram channel to stay up to date on breaking news coverage