Join Our Telegram channel to stay up to date on breaking news coverage

Thanks to pioneering cryptocurrency innovations, reinforced regulations and world-leading graduate talent, Singapore has emerged as the world’s next technological hub. In this post, we’ll look at Singapore’s impact on the bitcoin market.

Singapore’s Pioneering Bitcoin Tech

Over the past 12-18 months, we’ve seen Singapore at the forefront of the cryptocurrency market, crafting practical solutions to key challenges. This includes two key inventions: the use of bitcoins for payment at shopping malls and the introduction of a fiat-crypto exchange, which is still in its infancy.

Bitcoin’s price has fluctuated significantly across the past few years, with price drops largely credited to bitcoin not emerging as a practical payment solution for the mass market in a way that people hoped.

Many within the cryptocurrency industry have been looking for price stability, as these price falls have only been good for contract for difference (CFD) traders who have often gone ‘short’ on the market. This is one of the benefits of CFD trading, as it allows people to trade on markets that are heading up and down in price. However, with Singapore at the cutting-edge of the market in implementing solutions to these issues, analysts believe that we’re likely to see the price of bitcoin rise, as some of the negatives that have long been associated with the market have been eradicated.

Singapore’s Status on the World Stage: The Business View

Thanks to Singapore’s continued success in the cryptocurrency and tech markets, specifically mobile tech, Apple has recently become one of the country’s top employers, with the company attracting graduates to work on their new projects, including their new “cryptographic” developer tool, which was announced in June and will be their first step into the bitcoin market.

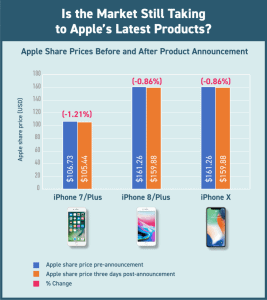

Apple remains the biggest name in mobile tech, with the iPhone 7, iPhone 8 and iPhone X all receiving rave reviews. However, early scepticism surrounding the announcements of the three models meant that we did see negative changes in their share price in the days following the announcements, as the below graph shows. But with a new team on board and a focus on their new CryptoKit software, optimism is high for their next release, which is due in September.

As a side note, it should also be noted that due to the quality of their work and the esteem that Singapore’s tech industry is held in, Apple and other employers are willing to pay well above the average Singaporean salary for tech workers, as the below chart visualizes. This has led to Singapore attracting not only graduate talent, but also top talent from around the globe, allowing it to compete with current tech capitals, such as Silicon Valley.

With this level of innovation in the cryptocurrency market, it’s unsurprising that the World Intellectual Property Organization also currently rank Singapore as one of the world’s most influential economies, ahead of China, Japan and South Korea.

Within the survey, Singapore ranked highly for regulatory quality. Again looking specifically at bitcoin, Singapore became only the second country in the world to regulate the cryptocurrency in 2014, placing it at the cutting-edge of the marketplace.

Is Singapore the new Silicon Valley?

This continual technological innovation has improved the Singaporean economy, strengthening the Singaporean Dollar in the process. As we can see below, the Singaporean Dollar has either stabilized against or made gains on four currencies in the past five years, with tech and cryptocurrencies playing a major role in this economic growth.

Looking to the future, with Singapore acting as a hub of entrepreneurial activity in the cryptocurrency and tech industries, it appears likely that other businesses such as Apple will look to use Singapore as a base. However, with many businesses still aloof to the idea of bitcoin as a payment solution, and with hackers recently stealing $4 million from a Singaporean cryptocurrency exchange in June, Singapore still has a long way to go before it can rival Silicon Valley and traditional financial capitals.

Join Our Telegram channel to stay up to date on breaking news coverage