Blast, the recently announced Ethereum Layer 2 blockchain from the non-fungible token market platform Blur, continued attracting more users, with total volume bridged, surpassing the $1 billion mark in just weeks. The highly anticipated network is slated to launch officially in February 2024.

Blast has reached $1.1 Billion in TVL!

85,836 community members are now earning yield (~4% for ETH and 5% for stables) + Blast Points.

Excited to share all that we've been working on behind the scenes in the new year! pic.twitter.com/0jkIPGStJw

— Blast (@Blast_L2) December 27, 2023

Blast Hit $1Billion Crypto Liquidity

Data compiled by Dune Analytic, an on-chain data aggregator, indicates that Blast continues to gain massive traction among investors and traders. At the time of writing, the Blast Layer 2 network has seen more than $1 billion in crypto liquidity bridged.

First announced last month, Blast is an Ethereum Layer 2 blockchain network developed by Tieshun Roquerre, the founder of Blur, after raising $20 million in the seed funding round. Roquerre raised seed funds from high-profile crypto venture capital firm Paradigm and the Standard Crypto.

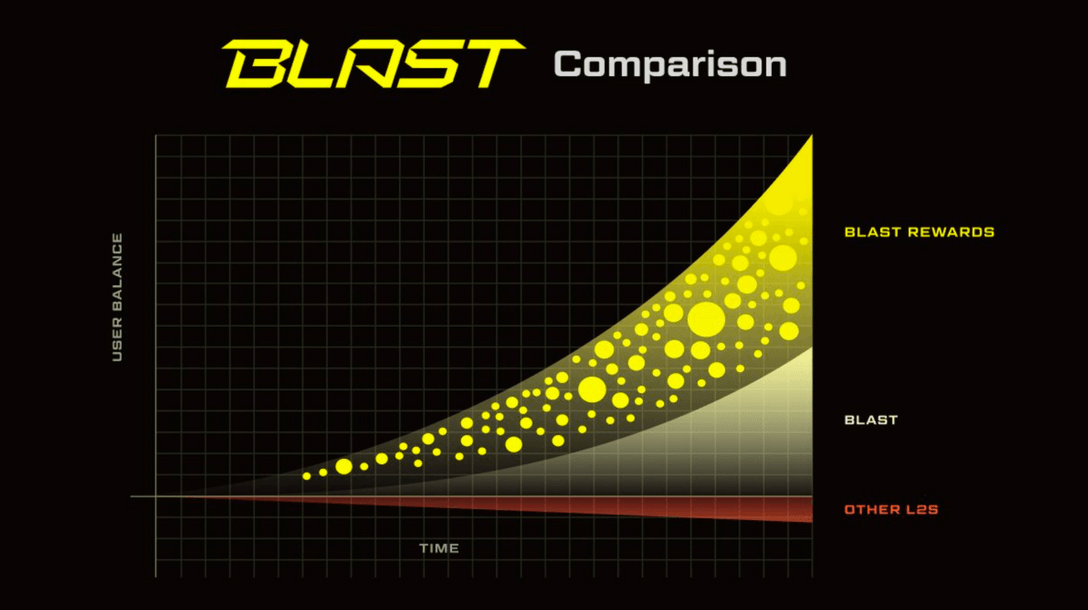

Blur NFT marketplace founder anticipates using the upcoming Blast Layer 2 network to tackle the high transaction cost for digital assets, offer new trading instruments (NFT perps), and generate massive yields. Blast Layer 2 network has received a warm reception among traders and investors.

Blast Set To Launch An Airdrop In May 2024

Last month, the developers of the Blast crypto project announced plans to launch an airdrop sometime in May 2024. During this reward program, investors will get Blast points as well as a yield of around 5% on any digital assets staked and redeem them in exchange for crypto liquidity.

In the meantime, Blast has received massive criticism from some crypto users, with some describing the project as a Ponzi scheme. Most crypto community members have criticized the crypto project for receiving deposits before launching the platform.

The crypto community is not the only stakeholder criticizing Blast. In an exclusive interview with CoinDesk, Dan Robinson, General Partner and Head of Research at Paradigm Venture Capital Firm, noted that the platform’s marketing campaign “crossed lines” and that his company did not want to accept deposits before the blockchain went live.

Related NFT News:

- Top Selling NFTs This Last Week Of December 2023 – Daily Trading Volume Rankings

- Blue-Chip NFTs Are Back; Floor Prices Rise +10% In The Past 90 Days – Analysis

- NFT Artist Beeple Faces Massive Criticism On X After Posting An Immoral Content

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users