Join Our Telegram channel to stay up to date on breaking news coverage

Just like quite a lot of other countries on its continent, Argentina has a lot that Bitcoin could help it with. Thankfully, a lot of the country’s citizens have noted this, and are beginning to adopt it.

Adoption on the Rise

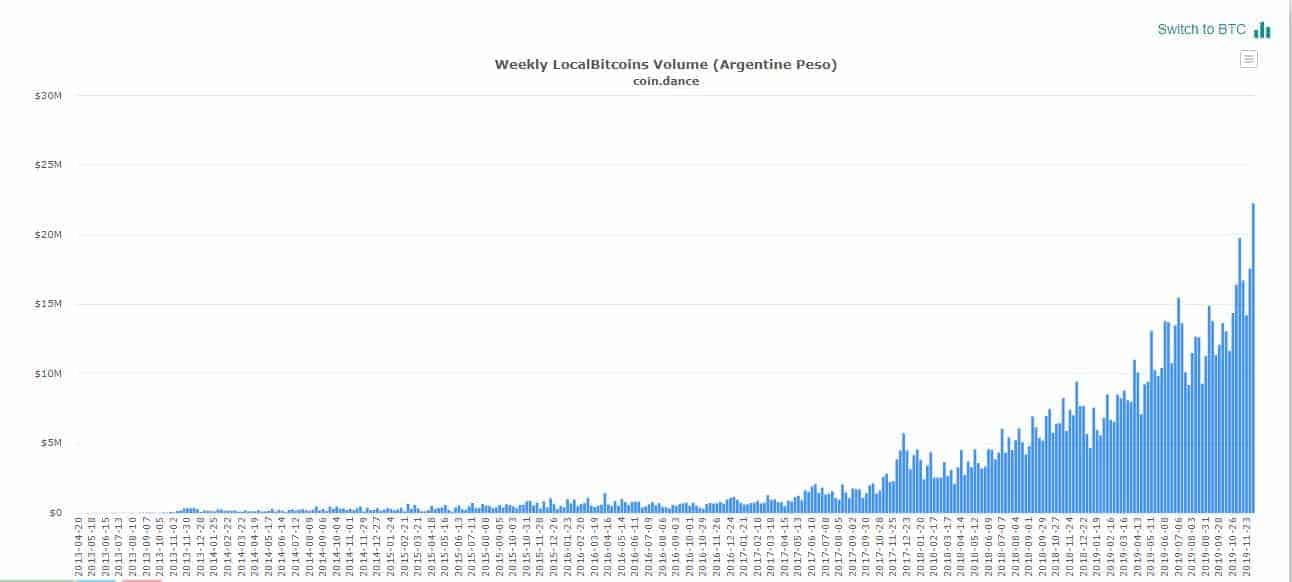

Fresh data from market aggregator Coin Dance has shown that the volume of Bitcoin traded on popular peer-to-peer cryptocurrency exchange LocalBitcoins from Argentina hit a new all-time high for the week that ended on December 8. Through the first week, about 22 million Argentine Pesos ($366,990) worth of the premier crypto asset was traded between Argentinians.

However, it is worth noting that high Bitcoin trading volumes in Argentina isn’t so strange. As the chart shows, the previous record (20 million Argentine Pesos, $333,000) was only gained at the beginning of November. In addition to that, the overall volume of the asset is seeing consistent gains, albeit during a period where the high level of inflation in the country is causing the number of Bitcoin shrink.

Hope in the Face of an Underperforming National Currency

There has been a lot of talk about Bitcoin being a solution to Argentina’s economic woes, with many suggesting that the asset could even help provide the country’s citizens with a way to store their wealth while the Peso continues to slide down. Months ago, news medium Reuters forecasted that the economy of the South American country would stand at 53 percent in December 2019.

My country, Argentina, is about to impose a new currency control where you are not allowed by legal mediums to obtain foreign currency.

This is happening at the same time the country has over 50% annual inflation rate, putting at risk people savings.

Bitcoin solves this. pic.twitter.com/BX0KUxwtSB

— Nico (@CryptoNTez) December 9, 2019

In the face of these, the Argentinians began to rely more on the U.S. Dollar. As expected, this turned into an incredible reliance on the Dollar and a ballooning national debt. Over the past five years, the exchange rate of the Peso to the Dollar has fallen by about 85 percent, as it almost seems as though the citizens convert their salaries and disposable income to the greenback as soon as they earn.

Hoping to remedy things, newly-elected President Alberto Fernandez immediately introduced a macroeconomic policy in which he capped the Dollars available to savers from $10,000 per month to just $200.

In a statement at the time, Central Bank chief Gido Sandleris pointed out at the restrictions would have been required to ensure that the Argentine economy remains stable, and in spite of the Peso reaching a record low in August, there was undoubtedly a point for the validity of the move.

Regardless of all that, it is rather obvious that Argentinians have lost faith in their national fiat currency. Since they can’t get their hands on as many Dollars as they would have liked, the citizens of the country seemed to have found some solace in the world’s most popular cryptocurrency.

Speaking in an interview with industry news medium Cointelegraph last month, Daniel Popa, the chief executive of the Anchor stablecoin, explained that thanks to the considerably lesser level of government manipulation, Argentinians still trust cryptocurrencies as a better store of value than the Peso, despite the increased volatility that the former asset class has shown over the past few months.

Join Our Telegram channel to stay up to date on breaking news coverage