Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin standstill near $20,000, consolidating in a narrow trading range of $19,500 to $20,300 as investors are cautious over comments from Whitehouse. The White House has considered restricting or even abolishing the proof-of-work process that supports Bitcoin and its blockchain network, dealing a devastating blow to the foundation of the digital asset system.

On Friday, the White House Office of Science and Technology Policy released a report recommending measures to mitigate the environmental implications of cryptocurrency “mining,” specifically greenhouse gas emissions.

White House Proposes Banning Bitcoin Proof-of-Work Mining

The White House suggested that American politicians and regulators may soon impose stricter measures due to the high carbon footprint of cryptocurrency mining. President Biden issued an executive order demanding the information in March.

In its most recent report, the White House Office of Science and Technology Policy stated that crypto miners must reduce greenhouse gas emissions with the help of the Environmental Protection Agency (EPA), the Department of Energy (DOE), and other government agencies.

The report also suggests that if regulatory action fails to influence American climate goals, proof-of-work mining, which is used to mine bitcoin, should be banned. This is not good news for the pair, as BTC/USD is falling due to the announcement.

Dip in Bitcoin Dominance, Ether Overtakes Bitcoin

For years, Ether has struggled to compete with market leader bitcoin. However, its objectives may be becoming more realistic at this point. For example, the second-largest cryptocurrency has surpassed bitcoin in market capitalization ahead of the critical software upgrade, the merge. If it is successful in the coming days, it has the potential to reduce the energy consumption of its Ethereum blockchain significantly.

According to data portal CoinMarketCap, Bitcoin’s dominance, or share of the cryptocurrency market’s market value, has dropped from 47.5% in mid-June this year to 39.1%. Ether, on the other hand, has increased from 16 to 20.5%. However, it still has a long way to go before overtaking bitcoin as the most popular cryptocurrency, a transition known among enthusiasts as “the flippening.”

Despite the competition, some market participants believe bitcoin continues to hold the crypto crown. According to Hugo Xavier, CEO of K2 Trading Partners, if the cryptocurrency market rises, its dominance could reach 50-60%. Many experts, however, believe that the upcoming Ethereum merger, which will attract many cryptocurrency investors to ETH, has the potential to flip Bitcoin; as a result, the BTC/USD exchange rate is falling.

Bitcoin Standstill amid Crypto Winter

The 2TM Group, which owns the Brazilian exchange Mercado Bitcoin, announced the second round of layoffs, affecting 15% of the current workforce. Poolin, a Beijing-based mining pool that accounts for 10% of the Bitcoin network’s hash rate, announced the same day that it would suspend ETH and BTC balance distributions due to liquidity concerns.

Furthermore, at an industry conference on September 8, SEC Chair Gary Gensler stated that he would support a legislative proposal authorizing the Commodity Futures Trading Commission (CFTC) to oversee and supervise nonsecurity crypto tokens and related intermediaries. He previously stated that Bitcoin is not a security but rather a commodity; as a result, it is not subject to SEC oversight.

These events indicate that the cryptocurrency market is in winter, which is why the market leader BTC/USD is falling.

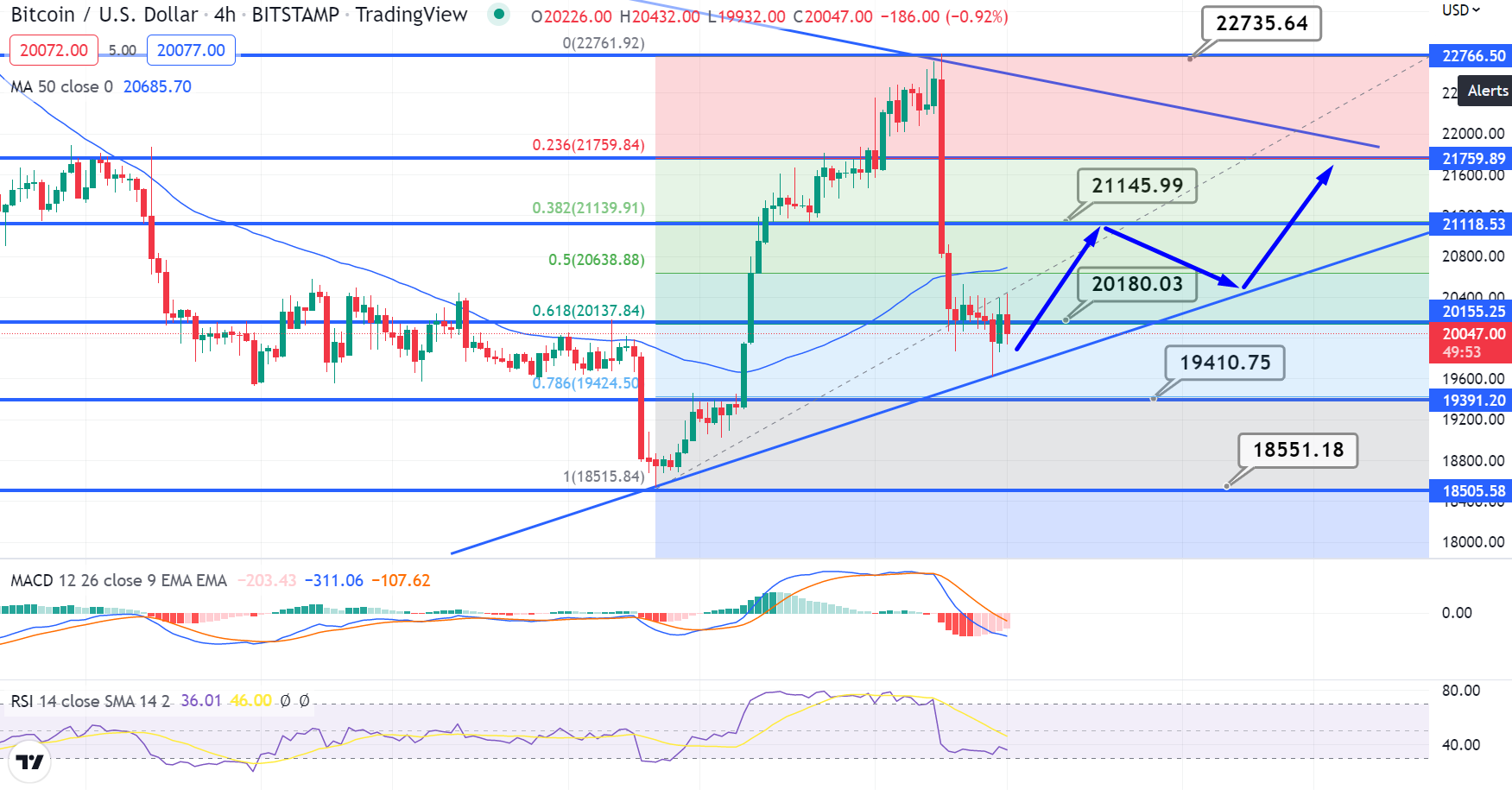

Bitcoin Price Chart – Source: Tradingview

Bitcoin Price & Tokenomics

The current Bitcoin price is $20,043.39, and the 24-hour trading volume is $37 billion. The BTC/USD opened at $20,226, reached a high of $20,432, and a low of $19,932.

Bitcoin has fallen by 1.88% in the previous 24 hours and 4.08% in the last seven days. CoinMarketCap now ranks first, with a live market cap of $383848654706, a maximum supply of 21,000,000 BTC coins, and a circulating supply of 19,150,881.

Bitcoin Daily Technical Levels

Support Resistance

19,700 20,901

19,300 21,231

18,550 21,813

Pivot Point: 20,130

On the technical front, Bitcoin has reached the 61.8% Fibonacci retracement level of $20,130 and is now descending towards the next support level of $19,400. In the daily timeframe, the upward trendline may extend support at $19,700, and a break below this may expose the BTC price to 19,300 or 18,550. Alternatively, resistance remains at $20,180 and $21,145.

Related

Join Our Telegram channel to stay up to date on breaking news coverage