Join Our Telegram channel to stay up to date on breaking news coverage

Last week proved to be eventful in the Bitcoin and cryptocurrency market as the collapse of three major banks led to a sharp decline in digital asset prices. However, the market experienced a turnaround following the Federal Reserve’s announcement of supporting banks with $25 billion, providing much-needed relief.

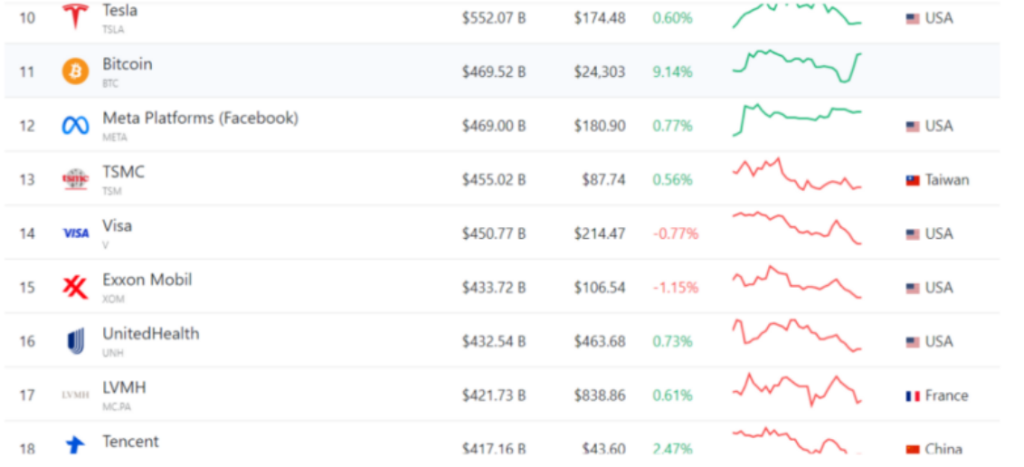

As per current data, Bitcoin’s market capitalization has surpassed that of JP Morgan Chase, Exxon Mobil, Meta, and Visa, and is rapidly approaching that of tech giant Tesla.

Bitcoin Market Cap Jumps Above Key Players

According to Companies Market Cap, Bitcoin’s market capitalization has now climbed to the 11th spot among all assets by market capitalization, with a surge of 9.7% over the last 24 hours. As of press time, the market cap has reached $471.86 billion.

Bitcoin has now surpassed tech giant Meta in terms of market capitalization, with Meta’s market cap currently at $469 billion. As of March 13, Bitcoin’s market cap was $433.49 billion, placing it lower than Meta by $37 billion. However, within just 24 hours, Bitcoin’s price surge pushed its market cap above Meta’s, making it the new leader.

Despite the recent market volatility, Bitcoin has surpassed Visa’s market capitalization for the third time in its history. Bitcoin’s market cap is more than $20 billion above that of Visa, marking a significant achievement for the world’s most valuable cryptocurrency.

However, despite this recent surge, Bitcoin still has a long way to go to catch up with assets like Gold and Apple, which boast massive market caps of $12.59 trillion and $2.380 trillion, respectively. Nonetheless, the fact that Bitcoin has managed to surpass Visa’s market cap three times is a testament to the cryptocurrency’s growing popularity and value in the financial markets.

When comparing the performance of gold, Bitcoin, and Apple over the past 24 hours, it appears that gold has lost value, with a decline of 0.48% in market capitalization. Meanwhile, Bitcoin has shown remarkable gains in the same time frame, far surpassing the gains made by Apple, which rose by only 1.33%.

This shows the volatility of the cryptocurrency market and the potential for high returns for investors willing to take on the risk. It is also a reminder of the importance of diversification when investing, as each asset class can perform differently in various market conditions.

What is The Reason Behind The Bitcoin Rally?

Despite the recent challenges faced by the crypto market due to the banking sector crisis last week, Bitcoin’s price rally was boosted at the start of this week. The rally can be attributed to several factors, including the Federal Reserve’s support for the banking sector to mitigate the impact of the recent crashes.

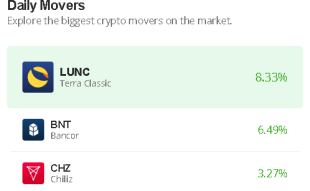

On March 12, the Federal Reserve Board announced that they would provide funding to eligible depository institutions to help them meet depositors’ needs, which helped the crypto market surge. As a result, Bitcoin gained 10% in value, and Ethereum experienced a 15% increase in price. Other digital assets followed the trend, increasing trading volume, market capitalization, and prices.

Coindesk, a leading cryptocurrency news outlet, reported that the Interbank Funding Stress Indicator had surged to its highest level since the pandemic crash. This development has led some experts to speculate that gold and Bitcoin could benefit from the situation. The report suggested that investors seek alternative assets to protect themselves from the risks associated with traditional investments like stocks and bonds. Given their reputation as safe-haven assets, gold, and Bitcoin are expected to gain more attention in the coming days.

Additionally, the Interbank Funding Stress Indicator surge has fueled speculation that the Federal Reserve may pause its plans for another interest rate hike. This expectation is reflected in the FRA-OIS spread, which has increased to 54.00, its highest level since March 2020, according to MacroMicro data. As investors seek safe havens during times of uncertainty, both gold and bitcoin are often seen as beneficiaries.

Join Our Telegram channel to stay up to date on breaking news coverage