Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price is down by almost 2% in the past 24 hours to trade for $61,330 as of 03:09 a.m. EST, on trading volume that soared 144%.

A rise in trading volume indicates increased activity and interest in trading BTC. This heightened trading volume combined with a price drop could indicate increased volatility in the market. With this manner of uncertainty, the BTC Fear and Greed Index is 30, signifying fear.

Bitcoin Fear and Greed Index is 30 — Fear

Current price: $60,277 pic.twitter.com/oSxTa4UNap— Bitcoin Fear and Greed Index (@BitcoinFear) June 25, 2024

Meanwhile, markets are digesting the massive overhead pressure on BTC. This is following reports that the German government and Mt. Gox are selling their BTC.

Germany is dumping $3B and now MtGox is dumping $9B Bitcoin. pic.twitter.com/O5zWlzr6iG

— Charles Edwards (@caprioleio) June 24, 2024

Based on the report, Mt. Gox scheduled repayments of $8.5 billion worth of Bitcoin to creditors in July. In a statement to Cointelegraph, IG Markets analyst Tony Sycamore says this sell-off may not be so bad for the Bitcoin price as many expect.

“The repayments have been coming for a long time,” he said, acknowledging, “They are happening against the backdrop of deteriorating market sentiment, technical selling, and outflows from the Bitcoin ETFs.” As such, Sycamore believes that much of the speculative “hot money” in crypto had left to chase “greener pastures” in mega-stocks like Nvidia and Apple in the equities market.

The analyst believes that while the sell-off is expected, the Bitcoin price sits on strong support on the 200-day moving average, which could provide a good inflection point for recovery. “I think we’ve just had a flush. The cause of the flush is all of these effects culminating in the expectations of Mt. Gox selling,” he said, adding, “I suspect it probably offers a pretty good entry point for people that have been holding on for better buying levels.”

Bitcoin Price Prediction

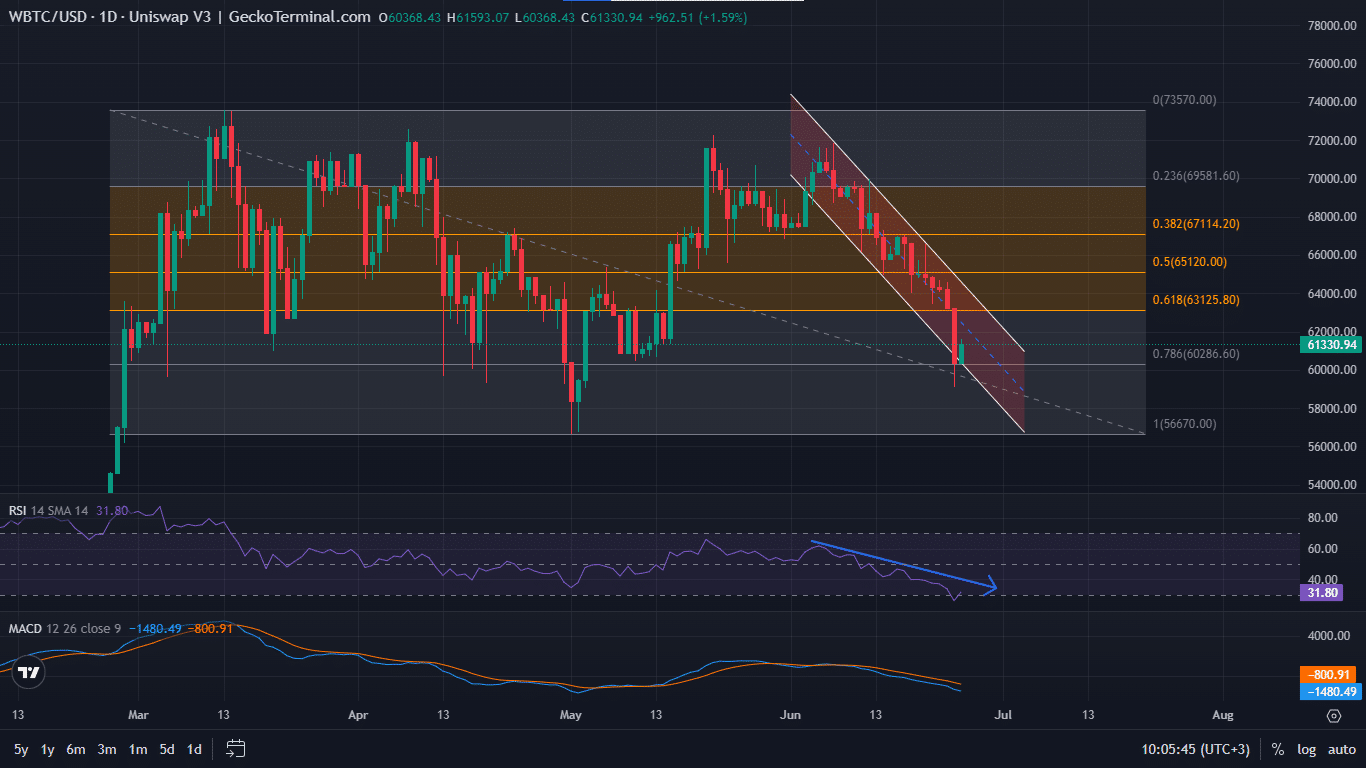

The Bitcoin price is attempting a recovery, recording a green candlestick on the one-day timeframe. However, BTC remains in the thicket seeing as bullish momentum remains weak. For starters, the Relative Strength Index (RSI) remains below the mean level of 50, with prevailing lower highs.

The Moving Average Convergence Divergence (MACD) is also in negative territory and below the signal line (orange band). This suggests that the short-term moving average is below the long-term moving average, indicating a potential downward trend.

Traders often interpret this as a signal to consider selling positions or to be cautious about taking long positions. This stands until the MACD moves back above the signal line or into positive territory, signaling a potential bullish reversal.

Increased selling pressure could see the Bitcoin price lose support at the 78.6% Fibonacci retracement level of $60,286. Such a move would see the BTC price sweep the liquidity that resides below the aforementioned level. In a dire case, the pioneer crypto could extend a leg down to test the bottom of the market range at $56,670.

GeckoTerminal: BTC/USD 1-day chart

On the other hand, if the bulls buy the dip, the Bitcoin price could push north. Nevertheless, only an escape above the Fibonacci Golden Zone at the 38.2% Fibonacci retracement level of $67,114, confirmed by a candlestick close above the 23.6% Fibonacci level of $69,581 would vindicate BTC from bearish hands.

A stable or decisive candlestick close above the aforementioned level would set the pace for reclamation of the peak of the market range of $73,570. Such a move would constitute a climb of 20% above current levels.

Meanwhile, investors are flocking to 99Bitcoin (99BTC), the latest Bitcoin derivative token that is poised for parabolic gains, YouTuber Today Trader says.

Promising Alternative To Bitcoin

99Bitcoins is a long-established educational platform that is pioneering a new Learn-to-Earn rewards model.

Boasting best-in-class educational resources and visual learning courses for crypto beginners, this project has earned a place among the most trusted names in crypto circles.

The project traces back to 2013. Starting out as BitcoinWithPayPal.com, what was once a simple domain has since transcended to a true Web2 fashion. Transitioning to Web3 with its $99BTC token, 99Bitcoins promises a groundbreaking earn-as-you-learn experience for users of the website.

Since 2014, $99BTC has been at the forefront of #Crypto education.💡

🧠 Experienced Guidance: Decades of combined knowledge.

⚡ Wide Range: Covers multiple #Cryptocurrencies.

📖 #LearnToEarn: Reap rewards while you learn!

Get started: https://t.co/NXD7DAamqr#Bitcoin $BTC pic.twitter.com/lJjLgkgVI2

— 99Bitcoins (@99BitcoinsHQ) May 5, 2024

99Bitcoins incentivizes learning through a unique mix of gamification and a leaderboard reward system. This ensures users feel like their learning is producing tangible benefits. Put simply, you earn crypto while learning about crypto.

Revolutionizing #Learn2Earn! 📘

🎓 Why It’s the Future:

With the $99BTC Token, you can earn rewards simply by expanding your #Cryptocurrency knowledge.

The Numbers: 🔢

– 79 hours of Courses

– 709K Followers

– 2.85M SubscribersTake a look: https://t.co/NXD7DAamqr#Bitcoin pic.twitter.com/rtBrEJjaZA

— 99Bitcoins (@99BitcoinsHQ) May 5, 2024

You can also stake your 99BTC holdings for rewards as high as 745% annually. So far, upwards of 1.4 billion tokens have been staked.

Short on time? Simply stake your $99BTC tokens on our website and earn passive rewards effortlessly!

Join now! 👉 https://t.co/nA4Lw89WA0#99Bitcoins #Crypto #Presale #Alts pic.twitter.com/av0mkMvIbR

— 99Bitcoins (@99BitcoinsHQ) April 19, 2024

Presale sales have reached past the $2.275 million threshold, with the $3.035 million target now within reach as investors buy 99BTC token for $0.0011. This price will change imminently, so buy now if you are interested.

🎉 Exciting milestone alert! 🎉

We have now raised over $2.2 MILLION in our $99BTC presale! 🚀

Secure your spot now before the #Presale price increases! 👀

Don’t miss out—get started today!

👉 https://t.co/NXD7DAamqr#99Bitcoins #BTC #Crypto #L2E pic.twitter.com/xQC6lg0euI— 99Bitcoins (@99BitcoinsHQ) June 17, 2024

Visit and buy 99Bitcoins here.

Also Read:

- 99Bitcoins Price Prediction – $99BTC Profit Potential in 2024

- 99Bitcoins Launches New Learn-to-Earn Airdrop Presale – TodayTrader Video Review

- Best Penny Crypto Investments: Top Picks for Explosive Growth in 2024!

Join Our Telegram channel to stay up to date on breaking news coverage