Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price has soared 4% in the last 24 hours to trade for $52,413 as of 7:10 a.m. EST time on trading volume that fell 11%.

The surge comes despite recent negative comments about BTC by US Securities and Exchange Commission Gary Gensler. Appearing on CNBC on Wednesday morning, Gensler said Bitcoin is not decentralized, and added that it is the token of choice for ransomware.

₿𝗥𝗘𝗔𝗞𝗜𝗡𝗚: News anchor @JoeSquawk defends #bitcoin in a conversation with SEC Chair Gary Gensler this morning live on television. pic.twitter.com/DRIlWmTlxK

— Documenting ₿itcoin 📄 (@DocumentingBTC) February 14, 2024

Meanwhile, reports indicate that BlackRock’s IBIT Bitcoin ETF (exchange-traded fund) accumulated $500 million BTC in a single day on Tuesday. According to market watchers, this comes as the BlackRock ETF provides the seal of approval that institutional investors around the world needed to dip their toes into Bitcoin.

https://twitter.com/HODL15Capital/status/1757498733015515197

BlackRock now manages assets worth $5.1 billion while Grayscale’s GBTC still leads with the field with more than $22.9 billion in assets.

BlackRock's Bitcoin ETF attracts $500M, propelling BTC past $50,000. The world's largest fund manager now manages $5.1 billion in assets. Growing Wall Street interest in BTC ETFs fuels crypto's surge. Grayscale's GBTC holds $22.9 billion in cash. SEC approval on 10 BTC ETFs…

— BlockVoyager (@BlockVoyagerAIO) February 15, 2024

Amid rising interest in Bitcoin, investors seem to be losing interest in gold. Bloomberg Intelligence ETF analyst Eric Balchunas highlighted in a post on X that investors continue to draw money away from gold ETFs.

Meanwhile it’s a pretty bad scene right now in the gold ETFs category… via @SirYappityyapp in our just published weekly flow note pic.twitter.com/C0T17JZpiA

— Eric Balchunas (@EricBalchunas) February 14, 2024

Bitcoin Price Prognosis Amid Growing Interest In ETFs

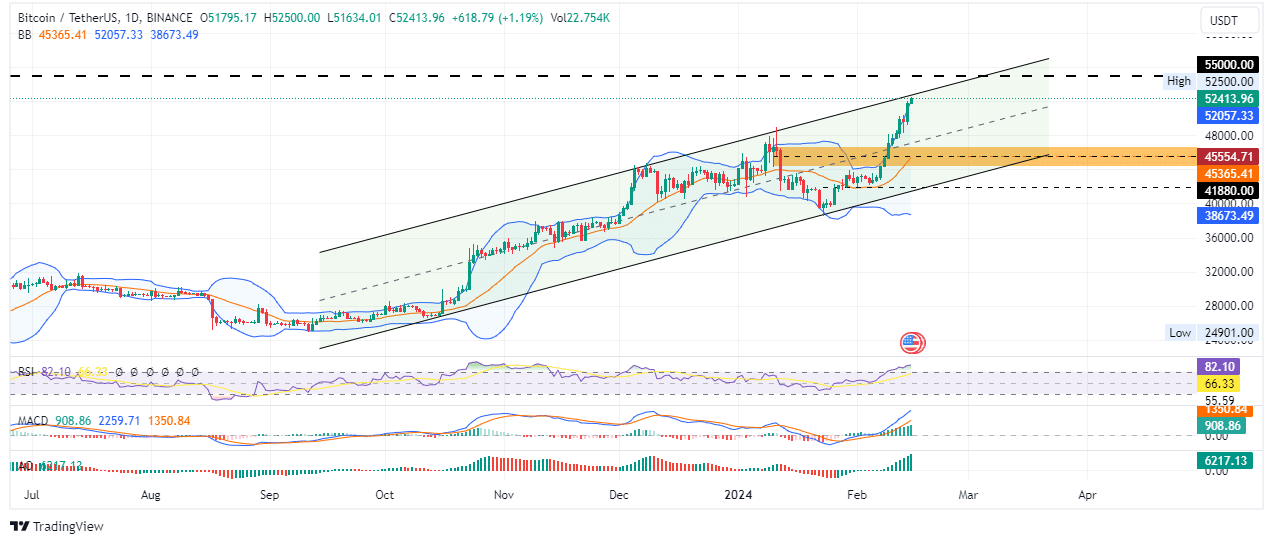

Bitcoin price remains bullish, evidenced by the series of higher highs in the daily chart for the BTC/USDT trading pair. , It remains within the confines of an ascending parallel channel, which is a bullish technical formation that promises more gains as long as the price abides.

Nevertheless, caution is advisable, considering he position of the Relative Strength Index (RSI) position at 82 shows BTC is massively overbought. That notwithstanding, the odds continue to favor the upside. This is because the RSI remains northbound, suggesting momentum is still rising, and often precipitates a continued rise in the Bitcoin price.

It is also imperative to note that the bulls continue to show resilience, evidenced by the presence of large volumes of histogram bars on both the Awesome Oscillator (AO) and the Moving Average Convergence Divergence (MACD) in positive territory.

Additionally, the MACD is still moving above its signal line (orange band), which shows a strong bullish cycle in play.

If investors increase their buying power, the Bitcoin price could enhance the gains, likely shattering resistance due to the upper boundary of the channel. Such a move would bring the $55,000 blockade into focus and would constitute a climb of about 6% from current levels.

In a highly bullish case, the Bitcoin price could extend a neck higher to the $60,000 psychological level, which would denote a 15% move from the current price.

TradingView: BTC/USDT 1-day chart

Converse Case

However, if profit booking ensues, the Bitcoin price could descend to test the midline of the ascending parallel channel. A leg lower could plunge BTC into the supply zone that now acts as a bullish breaker between $44,300 and $46,760. A decisive candlestick close below the midline of this order block at $45,554 would invalidate the bullish thesis. This would clear the way for a continuation of the fall.

In such a directional bias, the Bitcoin price could roll all the way to the $41,880 support. This would mean a 20% drop from current levels.

Even amid BTC’s bullish outlook, some investors are looking to the BTCMTX presale as an alternative way to play the Bitcoin bull run. This is at least in part because it’s a project that analysts rank among the top picks for explosive growth in 2024.

Promising Alternative To Bitcoin

BTCMTX is the powering token for the Bitcoin Minetrix ecosystem, operating as a tokenized cloud-mining platform where community members can mine BTC in a decentralized fashion.

Delving into the possibilities of #BitcoinMinetrix for mining $BTC! 🔍⛏️

✅ Smooth start-up for newcomers.

💰 Budget-friendly without upfront equipment costs.

🌟 No concerns about location, noise, or temperature.

🔄 Simple upgrades with minimal hassle. pic.twitter.com/5xJKkKKCYv— Bitcoinminetrix (@bitcoinminetrix) February 14, 2024

The token continues to gain popularity even as the countdown to the halving event in April continues. With anticipation that this event could kickstart the next bull cycle, forward-looking investors want in on the action.

#Bitcoin's Halving Impact:

– 1st in 2012: From $12 to ~$1,000

– 2nd in 2016: Skyrocketed to $20,000

– 3rd in 2020: Soared to $69,000As we approach the 4th halving in 2024, what peak can we expect for $BTC? 🤔 pic.twitter.com/mwyWLVPVFE

— IXFI | Gen 3.0 Exchange (@ixfiexchange) February 15, 2024

Bitcoin Minetrix spares investors the challenge of high hardware costs and deceptive frauds that have eroded confidence in mining BTC. It also ensures you do not need to suffer the heat, space demands, and every other hassle that comes with traditional BTC mining.

Knowing the benefits of #BitcoinMinetrix:

Easy access for convenience. 🌐

Streamlined cost structure for enhanced efficiency. 💲

Peace of mind with no worries about the resale value. 🔄 pic.twitter.com/hx3zJLXTfN

— Bitcoinminetrix (@bitcoinminetrix) January 18, 2024

The project has already gathered a huge $10.9 million in presale out of a target objective of $12.785 million.

🚀 Spot Bitcoin #ETFs are shaking up the market dynamics, acquiring #Bitcoin at a rate surpassing miner production by 10x! #WallStreet giants like @BlackRock and @Fidelity are driving this surge, fueling demand for $BTC.

What do you think this means for the future of… pic.twitter.com/sXCwRLmmJA

— Bitcoinminetrix (@bitcoinminetrix) February 14, 2024

The token is currently selling for $0.0135. With a price hike due in less than five days, this is your last chance to secure tokens at the lowest possible price.

Visit Bitcoin Minetrix to buy BTCMTX in the presale here.

Also Read:

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- Bitcoin Minetrix Presale Has Just Hours Left: Last Chance to Buy Before Price Rise

- Bitcoin Price Prediction: Top Analyst Sees BTC Price Soaring As High As 600k In Extended Bull Run As This Bitcoin Derivative ICO Nears $11 Million

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage