Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price soared almost 5% in the last 24 hours to blast through $72,016 as of 05:01 a.m. EST time on trading volume that surged 25%.

Among the signs that bulls are coming back is a recent post by Glassnode that shows nearly 1.876 million BTC tokens, comprising 9.5% of the total supply, have been acquired above $60,000.

JUST IN: On-chain data from GlassNode reveals that approximately 1.876 million Bitcoin, or 9.5% of the total supply, have been acquired above $60,000. pic.twitter.com/O2uIq7kORe

— Bitcoin News (@BitcoinNewsCom) April 6, 2024

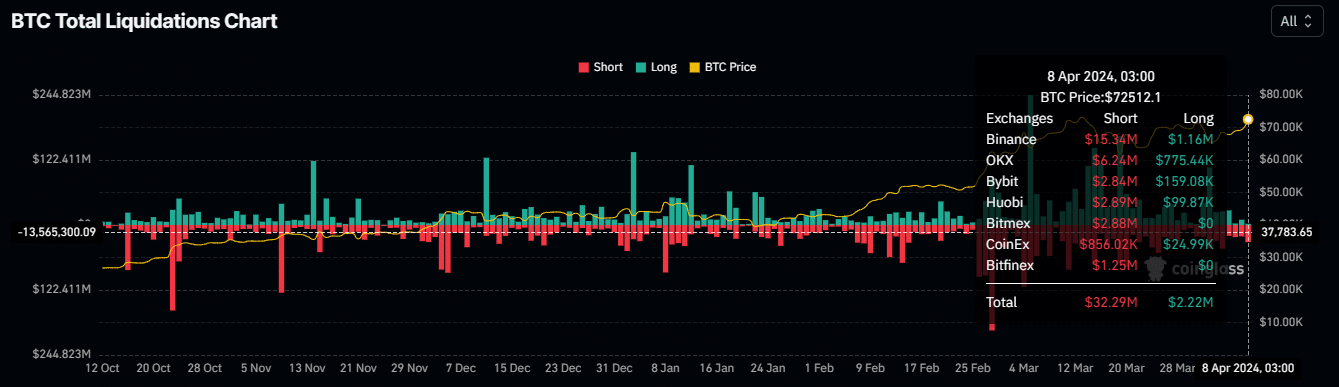

Meanwhile, Coinglass data shows that the recent surge in the Bitcoin price has seen nearly $82.3 million in long and short positions blown out of the water.

Skybridge Capital’s Anthony Scaramucci says he sees the Bitcoin price at $170,000. The entrepreneur bases his forecast on the assumption that the much-awaited BTC halving, expected on April 20, is not yet priced in.

NEW: Skybridge’s Anthony Scaramucci says #Bitcoin halving is still not priced in.

Predicts “$170000 for this cycle.” 🚀 pic.twitter.com/0uE4EAmwgS

— Bitcoin Magazine (@BitcoinMagazine) April 8, 2024

Meanwhile, some analysts are optimistic about the growing dominance in BTC ahead of the halving.

#Bitcoin dominance continues to peak pre-halving, but there's still a lot of momentum to be gained to altcoins.

They are super undervalued.

— Michaël van de Poppe (@CryptoMichNL) April 8, 2024

According to CryptoQuant founder and CEO Ki Young Ju, the Bitcoin price and market in general is giving similar vibes as those seen in the pre-halving season of 2020.

Same vibe as the previous #Bitcoin halving. https://t.co/Iez8vXkPvw

— Ki Young Ju (@ki_young_ju) April 8, 2024

The Bitcoin halving is expected in 12 days, with the latest move likely marking the onset of a pre-halving rally.

Bitcoin Price Outlook As BTC Smashes Past $72,000 In Pre-Halving Rally

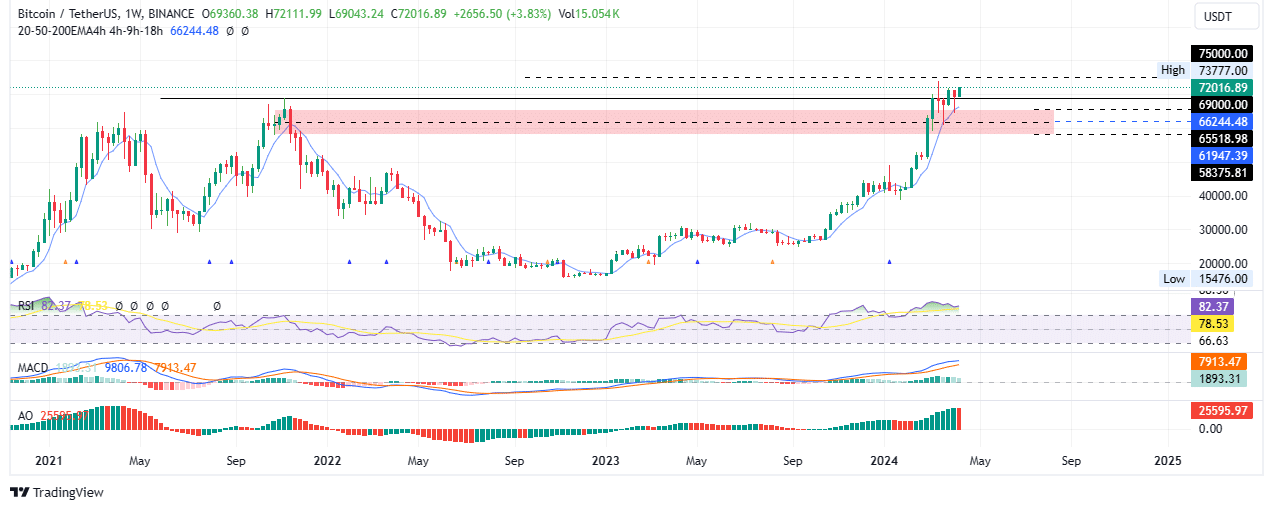

The Bitcoin price is holding above the $69,000 threshold, a critical level that longs must watch. If the price closes above this level on the weekly timeframe, it could confirm the continuation of the trend.

The first move in such a directional bias would be to clear the all-time high of $73,777 before a foray above $74,000 or $75,000.

#Bitcoin BREAKING OUT ?💥🚀#BTC could surprise us once again and go for scenario 2.

Let's wait for the daily candle close and the following one for confirmation.

For hose who want to trade the breakout already, a tight stop loss is required.

Manage your risk properly. 🤝 pic.twitter.com/fN5yPj1UEo

— Titan of Crypto (@Washigorira) April 8, 2024

The market appears to be poised for new highs, now that leverage is already washed out. Technical indicators are also flashing bullish, starting with the Moving Average Convergence Divergence (MACD), which is well above the orange band of its signal line.

This, coupled with the MACD histogram bars in positive territory suggests a strengthening bullish cycle.

Furthermore, the Relative Strength Index (RSI) is still northbound, to show rising momentum. Another momentum indicator that is leaning in favor of the upside is the Awesome Oscillator (AO), standing well above the zero mean level.

Traders looking to open new long positions for the Bitcoin price should consider waiting for confirmation. This will come by way of a candlestick close above $69,000. It is also advisable that traders avoid succumbing to FOMO, the fear of missing out, amid risk of a correction seeing as there is a CME gap that remains unfilled.

This could be a reversal zone.

#Bitcoin Has opened up with a new CME gap today. 👀

There's still one open from 2 weeks ago which only got closed about half way before price bounced again.

Like I always say, these can be good to watch for reversal zones etc, but don't value them too much the moment price… pic.twitter.com/vvDlrWp536

— Daan Crypto Trades (@DaanCrypto) April 8, 2024

Nevertheless, the fact that the Bitcoin price is enjoying support due to the 200-day Exponential Moving Average (EMA) is a good sign that the market is bullish both in the short and long term.

TradingView: BTC/USDT 1-week chart

Converse Case

On the other hand, if the BTC holders start to cash in on the gains, the Bitcoin price could retract. A slip below $69,000 would spook the weak hands as part of a broader market shake out. However, confirmation of a continued downtrend would be the Bitcoin price slipping below the mean threshold of $61,947, marking the midline of the supply zone between $58,375 and $65,518.

On-chain Metrics To Support Bullish Outlook For The Bitcoin Price

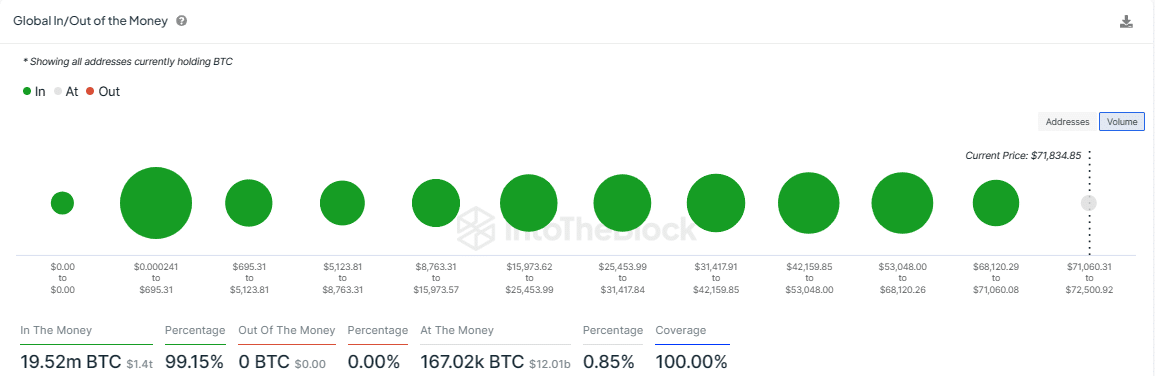

Based on the Global In/Out of the Money (GIOM) metric, the odds favor the upside, seeing as there is no seller congestion levels in the chart below. Immediate support is found between $68,120 to $71,060, where nearly 1.85 million addresses hold 1.15 million BTC tokens purchased at an average price of $69,520.

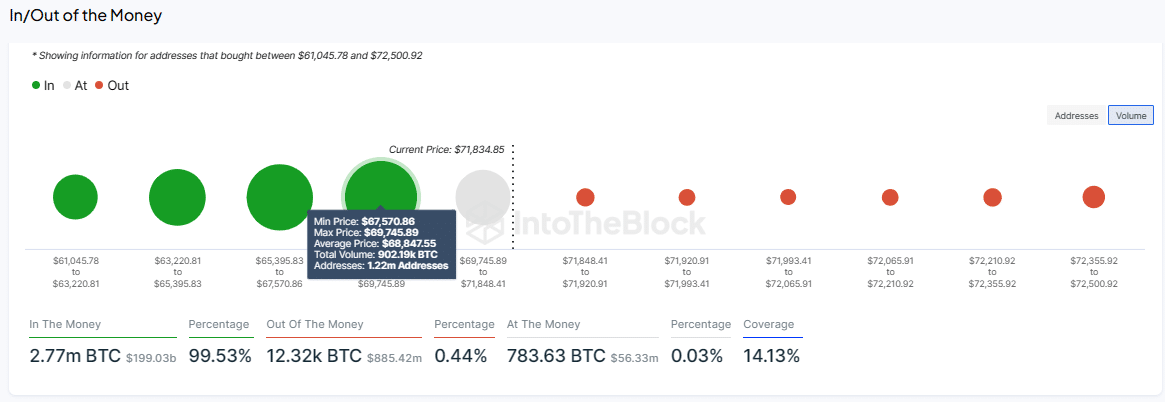

Elsewhere, the In/Out of the Money Around Price (IOMAP) metric shows stronger support downward compared to overhead pressure.

With this, and as shown above, the percentage of BTC holders sitting on unrealized profit is 99.53% (in the money). This is against the abysmal 0.44% sitting on unrealized losses (out of the money) and a negligible 0.03% that are breaking even (at the money).

Meanwhile, amid anticipation of the Bitcoin halving, derivative BTC presale Bitcoin Minetrix is closing in on $13 million in sales as it transforms the Bitcoin mining game.

Promising Alternative To Bitcoin

BTCMTX is the ticker for the Bitcoin Minetrix ecosystem. Token holders stake their holdings for credits and then redeem these credits for mining hash power. In so doing, the project spares you from the hassles that come with traditional mining, lowering the bar by eliminating the risk of fraud, and the challenges of heat, noise, space and costs.

Exploring #BitcoinMining, where giants like @RiotPlatforms and @MarathonDH lead.

Transforming mining, ensuring safety, and offering easy access to #BTC. 🚀💰

Through cloud mining and staking, we empower users to take charge of their mining journey. 🔐 pic.twitter.com/kmyPF5pMJk

— Bitcoinminetrix (@bitcoinminetrix) April 8, 2024

Buy into the Bitcoin Minetrix ecosystem for a chance to get in on the BTC halving rally ahead of time. With such an easy pathway to Bitcoin mining and therefore BTC ownership, the landscape has never been this even, with a playing field where the wealthy and the ordinary folk both have a fair chances of getting in on the action.

#BitcoinMinetrix revitalizes the landscape of cloud mining by merging stakeholding and cloud mining.

Pioneering tokenized cloud mining focusing on transparency, autonomy, and security, #BTCMTX is dedicated to providing a reliable pathway for $BTC mining enthusiasts. 🌐⚒️ pic.twitter.com/Mrxv0Hnrst

— Bitcoinminetrix (@bitcoinminetrix) January 22, 2024

For entry into the Bitcoin Minetrix ecosystem, investors must buy BTCMTX, the project’s powering token. Ranked among prominent game-changes with 1000x potential, its tokens currently sell for $0.0145.

But that price tag stands for less than another two days, so buy now if you are interested to secure the best deal.

Visit Bitcoin Minetrix to buy BTCMTX here.

Also Read:

- How To Buy Bitcoin Minetrix On Presale – Alessandro De Crypto Video Review

- Bitcoin Minetrix Presale Has Just Hours Left: Last Chance to Buy Before Price Rise

- Cilinix Crypto Presale Update of Two Bitcoin-Related Altcoin – Bitcoin Minetrix and Green Bitcoin

- Top 3 Crypto Presales to Watch for Potential 10x-15x Gains – Bitcoin Minetrix, Dogecoin20, and Green Bitcoin

Join Our Telegram channel to stay up to date on breaking news coverage