Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price as of 1:01 AM EST is $35,549, up almost 4% in the last 24 hours with a trading volume surge of 60%.

There are four theories behind this pump, starting with the fact that October, or as others would have it, Uptober, set the tone. Secondly, November has historically (last decade) been the best month for BTC performance in terms of returns. The last two reasons are more practical, presenting the FOMC and MicroStrategy Narratives.

Bitcoin Price Surges After FOMC and MicroStrategy News

The Federal Open Market Committee (FOMC) meeting was on November 1, with the Federal Reserve Chair giving his announcement. In line with common expectations, the chair paused interest hikes for the second time in a row at 5.25% to 5.50%.

🚨 BREAKING 🚨

FOMC – FED LEAVES RATES

UNCHANGED AT 5.25-5.5%— Ash Crypto (@Ashcryptoreal) November 1, 2023

For the layperson, increasing interest rates pushes investors towards a cautious atmosphere. This draws them away from risk-based assets like cryptocurrencies. Conversely, a decrease in interest rates has a similar impact to pausing, drawing investors to more risk. Therefore, plays a catalytic effect, inspiring bullish momentum in the crypto market.

The consecutive interest rates pause has some experts thinking this could be the turning point, potentially marking the beginning of yields falling and the dollar topping, causing Bitcoin and equities to rip through year-end.

BREAKING:

Rates are unchanged from the FOMC.

The policy is ending and, most likely, hikes are done.

Short-term more positivity towards risk-on assets seems likely, including #Bitcoin.

— Michaël van de Poppe (@CryptoMichNL) November 1, 2023

Amid the optimism, long traders, and therefore the bulls, kept their bid up to avoid being trapped underwater as open interest entered a rapid pace.

MicroStrategy Adds 155 Bitcoin Tokens To Portfolio

Regarding MicroStrategy, recent revelations indicate that the American technology firm added 155 BTC tokens to their holdings in October, worth $5.3 million. This brings Michael Saylor’s company portfolio to a total of 158,400 BTC, valued at $5.54 billion at current rates.

In October, @MicroStrategy acquired an additional 155 BTC for $5.3 million and now holds 158,400 BTC. Please join us at 5pm ET as we discuss our Q3 2023 financial results and answer questions about the outlook for #BusinessIntelligence and #Bitcoin. $MSTR https://t.co/w7eRUcGobi

— Michael Saylor⚡️ (@saylor) November 1, 2023

The two reasons, FOMC and MicroStrategy, are the hindwings for the current bullish wave and managed to propel Bitcoin price past the $35,000 psychological level. It is worth mentioning that the last time this level was tested was in May 2022, before the epic collapse of the Terra ecosystem under the unscrupulous leadership of Do Kwon.

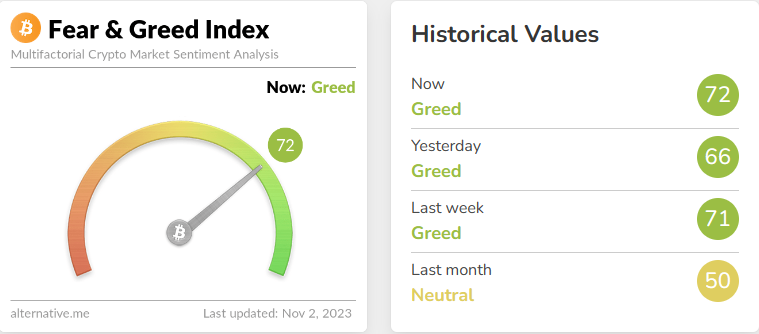

Noteworthy, the run above the $35,000 level has tossed the market into a state of greed, with the index showing 72. This comes as investors look to ride on what already looks like a bull run, even before any spot BTC exchange-traded funds (ETF) are approved.

Bitcoin Price Breaches $35,000, What Investors Can Expect For BTC

Bitcoin price shattering the $35,000 psychological level has inspired hope among investors. However, it is imperative to note that BTC is massively overbought, with the Relative Strength Index (RSI) at 81. This means a pullback could be underway. The last time the RSI was this high was in February 2021, leading to a 25% crash in Bitcoin price, moving from $40,028 to $30,307 before the bulls rejuvenated for a fresh rally shortly after.

Nevertheless, the upward trajectory of the RSI shows that BTC is still not ripe for selling. Investors should watch for a deviation of this momentum indicator to the south. Meanwhile, the odds still favor the upside, and Bitcoin price could still rise. Similarly, the Awesome Oscillator (AO) histogram bars are green and in the positive territory, showing bulls are leading the BTC market. This adds credence to the bullish outlook.

Increased buying pressure above current levels could see Bitcoin price breach the immediate hurdle at $35,987. If BTC manages to breach this obstacle, it could go all the way up to the $39,246 resistance level with eyes set on the $40,000 psychological level.

In a highly bullish case, the gains could extend to test the supply zone, extending from $44,071 to $47,122. For a confirmed uptrend, the king of crypto must record a three-day candlestick close above the midline (mean threshold) of this order block, at $45,708. This could set the tone for Bitcoin price to rally above the $50,000 psychological level, approximately 45% above current levels.

Conversely

Taking note that BTC is massively overbought, investors should not be surprised if a correction happens. A rejection from the $35,987 resistance level could send Bitcoin price to the $31,495 support level amid growing profit booking.

In the dire case, the seller momentum could see Bitcoin price lose all the ground covered in October to test the $25,320 support level for fresh demand pressure.

On-chain Analysis

According to on-chain aggregator tool IntoTheBlock’s Global In/Out of the Money (GIOM) model, the largest cryptocurrency by market cap has strong support downward. There is only one supply barrier that could prevent BTC from achieving its upside potential. This barrier ranges from $35,614 to $67,413, filled by a high number of investors that had previously purchased BTC around this price level. Here, roughly 8.46 million addresses are holding nearly 3.22 million Bitcoin tokens.

Promising Alternative To Bitcoin

Meanwhile, investors are drawing towards BTCMTX, the ticker for the Bitcoin Minetrix ecosystem, for entry into the BTC market. The project, operating on the stake-to-mine principle, has simplified the process of BTC ownership by decentralizing and tokenizing the process of Bitcoin mining.

Introducing #BitcoinMinetrix, the revolutionary cloud mining solution empowering individuals to engage in #Decentralised $BTC mining with ease. 💠

With the elimination of third-party cloud mining risks, users enjoy total control over their mining activities.#BitcoinMining pic.twitter.com/BV7BE7AfKs

— Bitcoinminetrix (@bitcoinminetrix) November 1, 2023

Bitcoin Minetrix is still in the presale stage, with $3.085 million already in the bag out of the $3.385 million target. The BTCMTX token is selling for a meager $0.0113, but this rate will change in three hours from 1:01 AM EST. Do not miss out on these early entrant rates.

Exciting Announcement 🚀#BitcoinMinetrix has raised over $3,000,000! pic.twitter.com/Hs2063y9tJ

— Bitcoinminetrix (@bitcoinminetrix) November 1, 2023

Buy BTCMTX using ETH, BNB, USDT or your bankcard here.

Also Read

- Experts Predict This New Stake-to-Mine Crypto Could 10x at Launch – The Future of Cloud Mining?

- Traders Flock To New Crypto Presale With Launch of Stake-to-Mine Protocol – $BTCMTX

- Crypto YouTuber Crypto Jimmy Shares Valuable Insights into New Crypto Platform Bitcoin Minetrix

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage