Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin price is down almost 3% in the last 24 hours to sell for $36,424 as of 12:05 a.m. EST. The king of cryptocurrency has pulled back from its weekly highs above $37,500 amid waning momentum.

The slump comes as hope for spot Bitcoin exchange-traded funds (ETFs) approvals coming this year continues to die down. This is because the eight-day window for the US Securities and Exchange Commission to approve the product, as ETF specialist James Seyffart had indicated, closes today, November 17.

Delays coming in for November 17th #Bitcoin ETF applications.

This means the window is now closed for the SEC to approve all ETFs this week.

Expecting more delays this week, and most likely no approvals this month.

Which means hopefully by early 2024 we can see a #BitcoinETF

— QuantumChain Ventures (@QuantumChain_) November 16, 2023

As the countdown started on November 9, the crypto market displayed volatility and is now losing momentum. However, one certainty continues to abound, there is a deadline in the first half of January, which means there are two months left for some deadlines to expire. Towards these dates, the market could rise again even as the BTC halving closes in.

Bloomberg Intelligence gives it a 90% chance of approval by January 10, 2024. However, in playing devil’s advocate, one must consider whether the analysts forecasting an approval by the hard deadline of the 10th know something or it could still be speculation.

Heading into the weekend, today, Friday, will see BTC holders at the edge of their seats with all eyes peeled on the SEC. If there be approval, Bitcoin price could move higher, but silence from the SEC may not disturb the markets as this outcome, where the financial regulator does not give a green light today has already been priced in.

Bitcoin Price Outlook As the Eight-Day Window Elapses

No much movement is expected from the BTC market today unless an approval does come – and that’s still possible. As such, Bitcoin price could stay sub $37,000 through the weekend as the retail market walks into the weekend, or erupt if the SEC does grant an approval.

Nevertheless, the $36,788 mean threshold of the supply zone extending from $36,276 to $37,301 remains critical for Bitcoin. A decisive break and close above it would, confirmed by a breach of the range high at $37,972, would set the tone for Bitcoin price to continue north.

The position of the Relative Strength Index (RSI) holding above 50 and the Awesome Oscillator (AO) keep hope alive as they show the bulls are still in play. This means the upside potential for Bitcoin price remains alive.

Still, it is important that Bitcoin price holds above the ascending trendline as this could lead to more gains. In a highly bullish case, the climb could set BTC at $40,000 or in very ambitious cases, send it to the $50,000 psychological level. This would signify a 40% climb above current levels.

Converse Case

On the flip side, if profit takers pull the trigger, Bitcoin price could slip below the ascending trendline. This would be attributed to the selling pressure from the supply barrier and could send BTC below the $35,410, or lower to test the $34,000 psychological level.

In a highly bearish case, the slump could send Bitcoin price to the supply zone that now acts as a bullish breaker, extending from $30,126 to $31,524. A break and close below $30,824 would solidify the downtrend, bringing the $30,000 level within reach.

The trajectory of the RSI heading to the south shows that momentum is already reducing. Also, the AO shows red histogram bars that are edging to the midline and could eventually flip negative. These add credence to the bearish thesis.

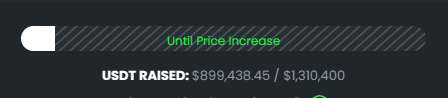

Meanwhile, BTCETF, a Bitcoin ETF tracking coin, continues to pump. It’s attracted almost $900,000 in presale collections, as of the time of writing, with the $1.310 million target on the horizon.

Promising Alternative To Bitcoin

BTCETF is the powering token for the Bitcoin ETF Token project, presenting the only token that rewards holders as BTC ETF approval hypes up. With ETFs for Bitcoin now appearing inevitable, enlightened investors are already sprinting to the buy BTCETF at the current rate of $0.0054.

#BitcoinETF is a #Cryptocurrency tied to the fate of $BTC and the expected #ETF approvals coming from the #SEC.

Our news feed will keep you updated on all the latest news. 📰

Follow, activate notifications, and stay ahead of historic Bitcoin events! 🔔 pic.twitter.com/hVO6LhxMOj

— BTCETF_Token (@BTCETF_Token) November 16, 2023

Cognizant that a BTC ETF is a long-awaited dream for BTC enthusiasts, believers, and hobbyists, the Bitcoin ETF Token project gives you a chance to get ahead of it.

A #BTCETF is a long-awaited dream for #Bitcoin believers.

From the earliest speculations to an official application by @BlackRock, ETFs for $BTC now appear inevitable.

A flood of spot #ETFs is expected to bolster the #Crypto market with billions or trillions. 📈 pic.twitter.com/qozhXHjR7W

— BTCETF_Token (@BTCETF_Token) November 15, 2023

The third stage of the Bitcoin ETF Token presale has commenced, and with it, more buyers front-running the imminent launch of a Bitcoin ETF. Do not be left behind, as the token will never be this affordable again.

Stage 3 of the #BitcoinETF is now well underway! 🏁 pic.twitter.com/rJ5cnfkpDV

— BTCETF_Token (@BTCETF_Token) November 16, 2023

Experts say the token will record a 10X return on investment upon launch, meaning now is the time to enter to be among those who reap these returns. Read here our Bitcoin ETF Token Price Prediction guide.

Visit Bitcoin ETF Token website to buy BTCETF here.

Also Read:

- How To Buy Bitcoin ETF Token – BTCETF Presale Review

- 5 Best Crypto ICOs To Buy In 2023 – Next Altcoins Set To Explode

- Best Deflationary and Staking Crypto to Invest in Before 2023 Ends – Bitcoin ETF Token Presale Review

- Bitcoin ETF Approval Anticipated – High-Staking Bitcoin Alternative Raises Over Half Million In Presale

- CoinCodex’s YouTube Channel Features a New ERC-20 Token Linked to Potential Bitcoin ETF Approval

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage