Join Our Telegram channel to stay up to date on breaking news coverage

The Bitcoin price is up almost 3% in the past 24 hours to trade for $71,187 as of 01:45 a.m. EST on trading volume that surged nearly 20%.

It comes as spot BTC ETFs (exchange-traded funds) recorded their second-best day of net inflows, reaching almost $887 million.

SO BULLISH!! 🔥

BREAKING: Spot #Bitcoin ETFs Record $887 Million in Daily Net Inflows, Second Highest Ever

— Kyle Chassé (@kyle_chasse) June 5, 2024

Fidelity led the positive flows, recording up to $378.7 million, followed by BlackRock’s IBIT with $275 million.

This is crazy.

Almost +$1b in #Bitcoin ETF net inflows today.

Fidelity: +$378.7MM

IBIT +$275.0MM

ARKB + $138.7MM

BITB +$61.0MM

GBTC +$28.2MM

HODL +$4.0MMThis is the second highest daily inflows EVER since launch.

Bullish. 📈

— Miles Deutscher (@milesdeutscher) June 5, 2024

Commenting on Fidelity’s lead, Eric Balchunas, an ETF specialist with Bloomberg Intelligence says, “The third wave is turning into tidal wave.”

Fidelity not messing around, big-time flows all around today for The Ten, nearly $1b in total. Second best day ever, since Mid-March. $3.3b in past 4wks, net YTD at $15b (which was top end of our 12mo est). The 'third wave' is turning into tidal wave. https://t.co/S9yeSHaNbV

— Eric Balchunas (@EricBalchunas) June 5, 2024

Reports indicate that BlackRock bought 3,900 BTC tokens, worth over $273 million at current rates.

Bitcoin Price Prediction Amid Growing BTC ETF Inflows

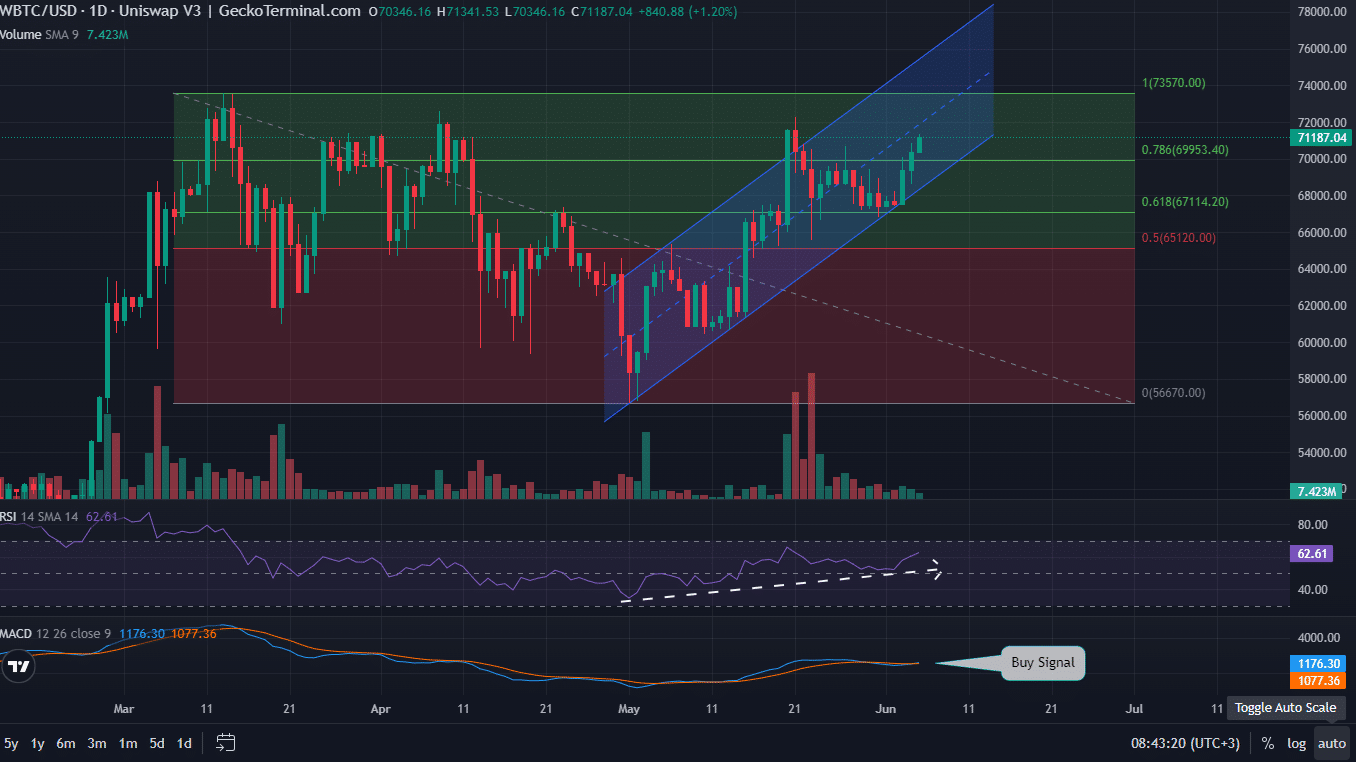

The Bitcoin price is trading with a bullish bias, consolidating within an ascending parallel channel. If bulls manage to hold the price within this channel, BTC holders are bound to realize more gains. Increased buying pressure above current levels could see the Bitcoin price reclaim the gains.

A stable close above the centerline of the channel would set the tone for the Bitcoin price to reclaim its peak at $73,570.

Noteworthy, the Moving Average Convergence Divergence has crossed above the orange band of the signal line, effectively executing a buy signal. When the MACD crosses above the signal line, it is typically seen as a bullish signal in technical analysis.

This crossover suggests that the short-term moving average (MACD line) is crossing above the longer-term moving average (signal line), indicating an upward momentum shift in the price of the asset.

Traders and investors often interpret this crossover as a potential buying opportunity, as it represents a shift towards positive momentum and potentially higher prices in the near term. It is considered a confirmation of bullish momentum.

This outlook is reinforced by the higher lows on the Relative Strength Index (RSI), suggesting growing bullish momentum.

GeckoTerminal: GME/USD 1-day chart

On the other hand, if the bears start booking profits, the Bitcoin price could pull back. In such a directional bias, BTC could drop below the Fibonacci Golden Zone, where a slip below the 50% Fibonacci placeholder of $65,120 would invalidate the bullish thesis.

Meanwhile, as the Bitcoin price pushes north, investors are also rushing to buy 99BTC, a presale that’s about to blast past $2 million in funds raised.

“If you like making money…99Bitcoins could be for you,” says Crypto YouTuber ClayBro of the project.

Promising Alternative To Bitcoin

99BTC is the powering token for the 99Bitcoins Learn-to-Earn platform. This established project brings forth a revamped educational platform committed to monetizing education for end users.

Put simply, as you learn about crypto, you make crypto via a unique mix of gamification and a leaderboard reward system. Because of this, learning brings tangible rewards.

You can also stake your 99BTC tokens for rewards of 863% annually. So far, upwards of 1.262 billion 99BTC tokens have been staked.

Exclusive access to advanced modules is available for $99BTC token holders. 🏆

Dive into topics from sophisticated trading strategies to in-depth #Blockchain technology applications.

Join the #Presale now!

👉 https://t.co/NXD7DAamqr#99Bitcoins #Bitcoin #CryptoNews pic.twitter.com/M5p0dtDc9f— 99Bitcoins (@99BitcoinsHQ) April 28, 2024

Out of a total of 99 billion 99BTC tokens, 15% have been set aside to be sold over the course of a fourteen-round presale. The objective is to raise the funds required to expedite cutting-edge development around the project’s BRC-20 integration.

Our #Learn2Earn platform is at the heart of our mission to educate. 🤝

You’ll be able to dive into a wide array of topics, from #Blockchain basics to advanced trading strategies, all while unlocking rewards!

Discover More: https://t.co/NXD7DAamqr#99Bitcoins #CryptoNews $BTC pic.twitter.com/l9sjDsjOAb

— 99Bitcoins (@99BitcoinsHQ) April 27, 2024

Each 99BTC token is selling for $0.00108 in the current stage. A price hike is coming in about six days though so buy soon if you are interested

Buy 99Bitcoins on the official website here using ETH, USDT, or a bank card.

Also Read:

- 99Bitcoins Price Prediction – $99BTC Profit Potential in 2024

- 99Bitcoins Launches New Learn-to-Earn Airdrop Presale – TodayTrader Video Review

- 99Bitcoins Token Unveils Learn 2 Earn Crypto ICO, Next BRC-20 Project To Explode?

- Top Gaming Coins to Buy Before the Upcoming Bull Run – 99Bitcoins Video Review

- Best Penny Crypto Investments: Top Picks for Explosive Growth in 2024!

Join Our Telegram channel to stay up to date on breaking news coverage