Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Analysis – July 13

Bitcoin, the world’s most widely traded currency, resumed its recent downward momentum on today July 13, having witnessed a temporary reversal on Friday. The recent recovery lost legs just shy of the critical 12k mark, as the sellers returned amid a broader market sell-off.

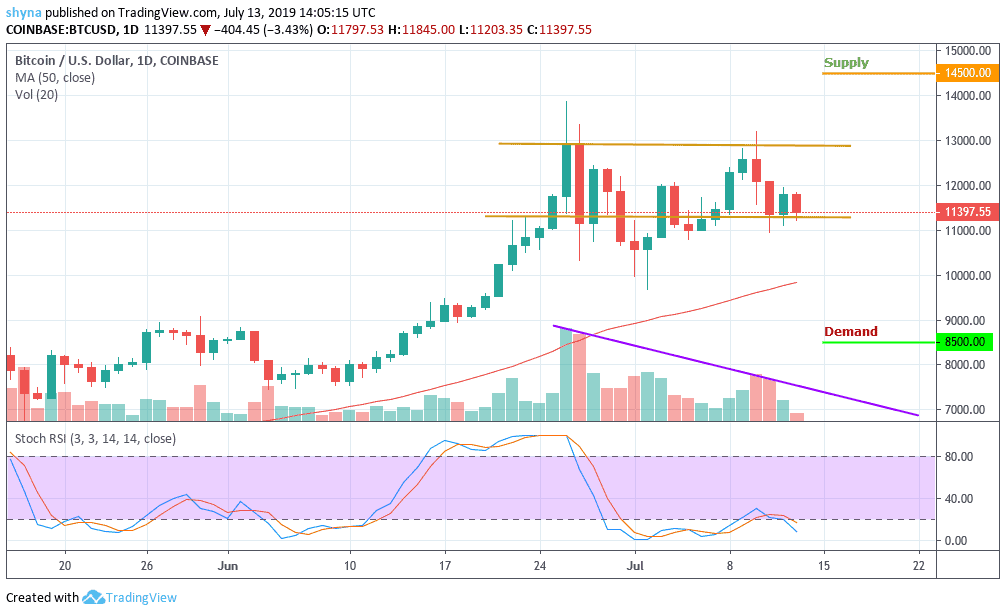

BTC/USD Long-term Trend: Bearish (Daily Chart)

Key Levels:

Supply levels: $14,500, $15,000 $15,500

Demand levels: $8,500, $8,000, $7,500

And the Bitcoin extreme volatility continues, after the $2,000 24-hour drop two days ago, Bitcoin found support on top of the ascending trend-line (daily chart). The correction was respectable; Bitcoin almost touched the $12,000 supply, but then got rejected, plunging down to where it’s currently trading at, $11,397 at the time of writing. Not surprisingly, this is accurate to another retest of the ascending trend-line.

From here, a breakdown and lower demand levels are next to be tested. However, it’s still not considered a change of momentum yet as long as the $9,500 – $9,800 is kept up. So there won’t be a lower low pattern, which is bearish. Below, the next level of demand lies at $9,000. Further down is $8,500, $8,000 and $7,500. However, should in case the bulls decide to push the price up, the main supply levels to be reached are $14,500, $15,000 and $15,500. The trading volume is relatively low, as of now while the stochastic is facing down indicating bearish signals.

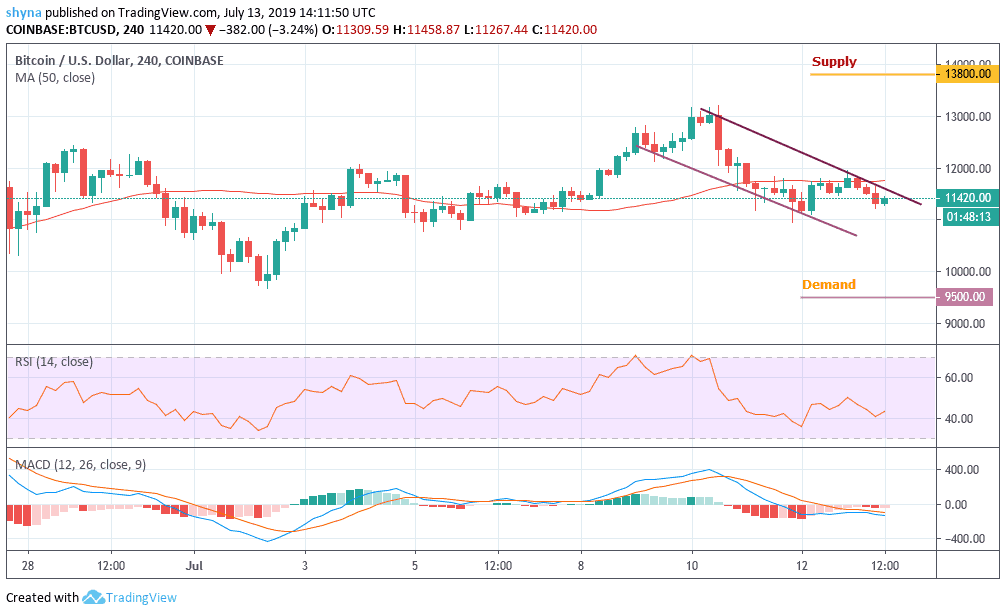

BTC/USD Medium-term Trend: Bearish (4H Chart)

Bitcoin (BTC) could trade sideways for now but it has already done what it was supposed to do. The price has now formed a double top just like it did at the end of the parabolic advance of late 2017. The price is holding below the 50-day MA just as it did back then and when it finally breaks below it, we are likely to see it flash crash in the same manner that it did back then.

However, Bitcoin will continue to bleed if buying volume stays low. The bull reaction is important to push-up price to $13,000 supply level. Otherwise, $9,500 demand will be touched shortly. The pressure is reflected in the RSI; it is moving towards the oversold area. In fact, the signal lines of MACD indicator has already crossed to the negative side which means that the sellers are still in control.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage