Bitcoin, one of the popular blockchain networks, has flipped in non-fungible token trading sales volume after rumours about the United States Securities and Exchange rejecting some of the filled Bitcoin Exchange Traded Funds began to spread. The regulatory commission has until January 10, 2024, to either approve or decline the Bitcoin ETFs.

MatrixPort, a firm that I've never heard of comes out and says that (in their view) the spot #Bitcoin ETFs won't be approved by the SEC this month.

They are one firm. They might be right. They might be wrong.

This report is causing this selloff in #Bitcoin this morning. pic.twitter.com/K8UMifAsOY

— Caleb Franzen (@CalebFranzen) January 3, 2024

Bitcoin ETFs Stir Up A Heated Discussion

On January 03, an analyst from Matrixport, a little-known crypto news website, convinced the crypto community that the highly anticipated Bitcoin Exchange Traded Funds will likely be rejected again this January. The reckless statement has instilled fear, doubt and uncertainty in the crypto industry.

Matrix on Target projects a January rejection for Bitcoin Spot ETFs by the SEC, cautioning traders to hedge long exposure. With #SEC Chair Gensler’s skepticism towards #crypto, a potential -20% #Bitcoin price drop is anticipated upon #ETF denial, though a positive end-of-2024… pic.twitter.com/IgaMhBJtiP

— Matrixport (@realMatrixport) January 3, 2024

By description, Bitcoin ETFs are exchange-traded funds that track the value of Bitcoin and trade on traditional market exchanges rather than crypto exchanges. Bitcoin ETFs will allow investors to invest in Bitcoin without going through the hassle of using a crypto exchange while providing leverage to its price.

The United States Securities and Exchange Commission has issued a deadline on December 29 for Exchange Traded Fund applications. Firms that submitted amendments during the open period include BlackRock, VanEck, Valkyrie, Bitwise, Invesco, Fidelity, and WisdomTree. Other firms, including Ark Invest and Grayscale, recently also submitted amendments.

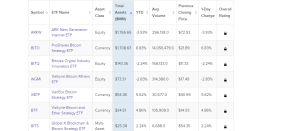

Source: VettaFi, Bitcoin Exchange Traded Funds

Bitcoin NFT Sales Dip 8% In The Past 24 Hours

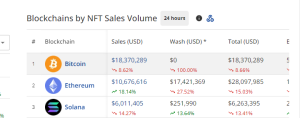

The non-fungible token market has reacted sharply to Matrixport’s reckless statement, with Bitcoin-based NFTs losing their initial streak in just hours. In the past 24 hours, Bitcoin-based NFTs have recorded a trading sales volume of $18 million, down 8% from the previous day.

Source: CryptoSlam.io, Bitcoin NFT Trading Activity

On the other hand, Bitcoin, the leading digital asset by market capitalization, has reacted to the bearish statement, plummeting 5.49% in the past 24 hours. Bitcoin moved from the $45,000 level to the $40,000 level after the publication began to spread. At the time of writing, Bitcoin has regained some strength and is now trading at $42,439.

Source: Google, Bitcoin Trading Activity

It’s worth noting that the non-fungible token market has a strange and strong relationship with the crypto market, similar to that of a parent and child. In that context, whatever impacts the crypto market automatically impacts the NFT market. That’s why the Bitcoin ETF narrative impacts the NFT market.

Related NFT News:

- NFT Gaming Prediction: P2E NFT Gaming To Rise In 2024 And Reach $8B By 2028

- Disney’s Steamboat Willie Tokenized As An NFT Shortly After Entering Public Domain

- NFT Sales Hit $1.7B In December – Here’s The NFT Market Prediction For January 2024

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users