Join Our Telegram channel to stay up to date on breaking news coverage

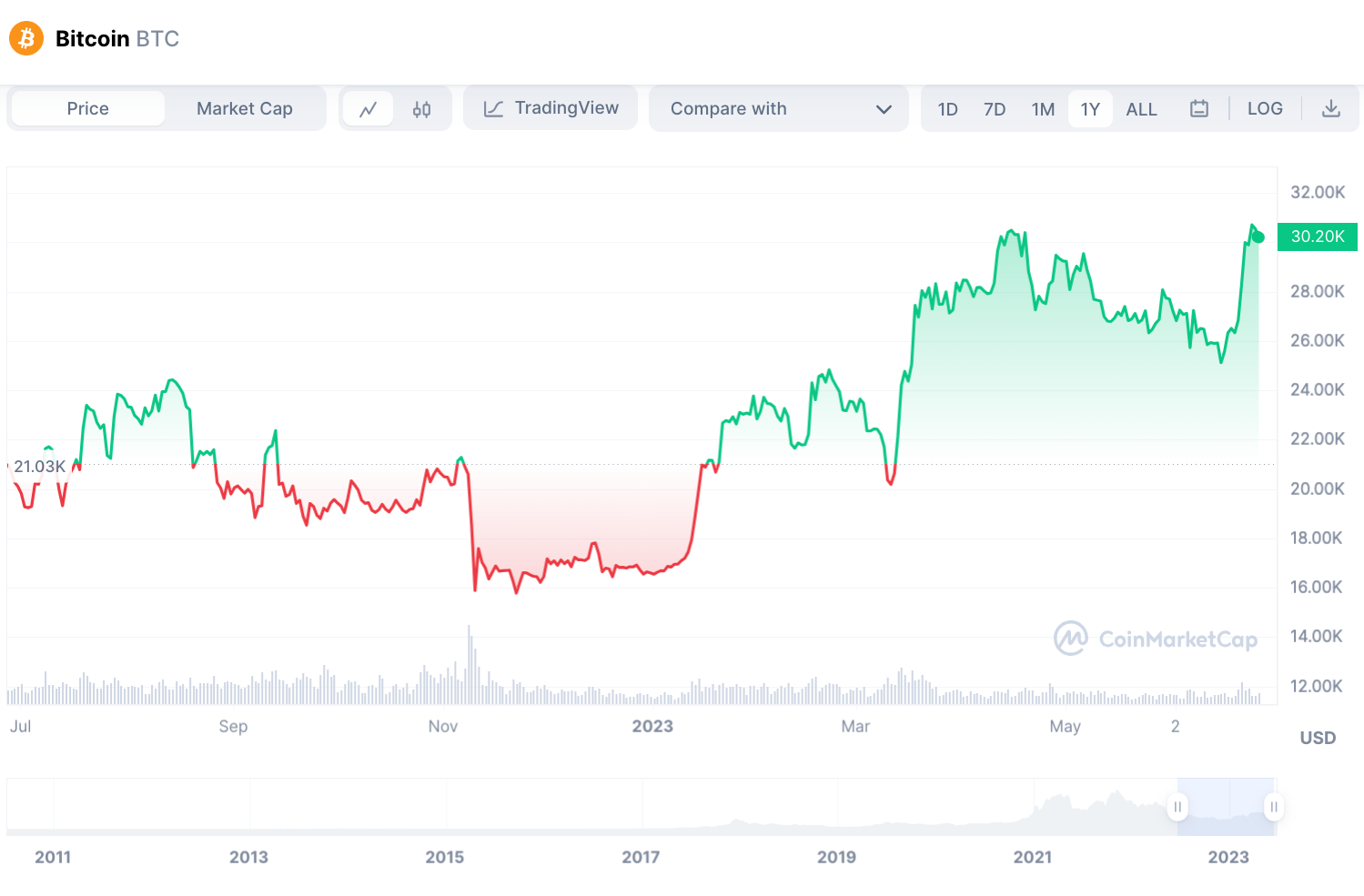

Bitcoin (BTC) soared to a staggering $31,400 on Friday, marking its highest price level since 2022. This remarkable surge has been primarily fueled by growing institutional interest in the leading cryptocurrency.

Bitcoin’s Price Surges to Highest Level Since 2022 Amid Institutional Interest

Amidst a brief retraction, Bitcoin has successfully maintained a trading value above $30,000, a significant resistance point throughout this year.

This achievement is a positive sign for the cryptocurrency market, which has been grappling with regulatory concerns and macroeconomic factors leading to prevailing uncertainty.

Renowned crypto trading expert and analyst, Michaël van de Poppe, expressed doubts about the sustainability of Bitcoin’s rally in a recent tweet. He emphasized the importance of a potential minor correction to around $28,500, stating that it would present an ideal opportunity to accumulate the asset.

One of the major contributing factors to Bitcoin’s surge is the increasing interest from major financial institutions. BlackRock, the world’s largest investment management company, recently applied to register a Bitcoin spot exchange-traded fund (ETF).

Moreover, the launch of a digital asset trading platform by EDX Markets, supported by prominent firms like Charles Schwab, Fidelity Digital Assets, and Citadel, has further instilled investor confidence in the crypto space.

Bitcoin’s price has surged this year but remains below its record high of $60,000 in 2021. Challenges, including interest rate adjustments and the collapse of the FTX exchange, caused a market sell-off.

Currently, Bitcoin comfortably trades above the resistance level of $30,000, with a valuation of $30,401. Technical analysis indicates a bullish trend, with moving averages suggesting a “strong buy.” Oscillators remain neutral.

As Bitcoin continues to attract institutional interest and maintain its positive momentum, the cryptocurrency market eagerly awaits further developments and potential milestones in the coming months.

HSBC Embraces Crypto: Allows Customers to Trade Bitcoin and Ethereum ETFs in Hong Kong

HSBC, the largest European bank, has announced that it will now permit its customers in HSBC Hong Kong, the region’s largest bank, to engage in buying and selling Bitcoin and Ethereum exchange-traded funds (ETFs) on the Hong Kong exchange.

This news comes as a significant boost to the rapidly growing cryptocurrency market, which has been enjoying a surge of optimism following the submission of spot Bitcoin ETF applications by institutional investors.

SCOOP: HSBC, the largest bank in Hong Kong, today allows its customers to buy and sell Bitcoin and Ethereum ETFs listed on the Hong Kong exchange, and is also the first bank in Hong Kong to allow it. The move will expand local users’ exposure to cryptocurrencies in Hong Kong. pic.twitter.com/vH0LieSVGw

— Wu Blockchain (@WuBlockchain) June 26, 2023

In a recent development reported by crypto journalist Colin Wu, HSBC, the prominent Hong Kong-based bank, has made a groundbreaking move by enabling its customers to trade Bitcoin and Ethereum ETFs listed on the Hong Kong exchange.

This significant step not only highlights HSBC’s progressive approach but also marks the first instance of a bank in Hong Kong offering such services to its clientele.

This development further bolsters the market sentiment and has led to a surge in crypto prices, propelling them to new multi-month highs. HSBC’s decision marks an increasing trend as more financial institutions join the ETF bandwagon, capitalizing on the growing popularity of cryptocurrencies.

Currently, there are three crypto ETFs available on the Hong Kong exchange: CSOP Bitcoin Futures ETF, CSOP Ethereum Futures ETF, and Samsung Bitcoin Futures Active ETF. The inclusion of these ETFs provides investors with more options to participate in the crypto market’s potential upside.

HSBC’s move to support crypto ETFs is a response to Hong Kong regulators urging major banks, including HSBC, Standard Chartered, and the Bank of China, to accept more crypto clients and embrace crypto exchanges.

However, these banks have shown reluctance, citing concerns stemming from recent high-profile collapses within the crypto industry. Despite this, the HKMA has encouraged them to overcome their reservations and embrace the growing demand for cryptocurrencies.

Hong Kong’s regulatory push aligns with its ambition to establish itself as a leading global hub for crypto and fintech. The city recently introduced a licensing regime for virtual asset trading platforms (VATPs) on June 1, signalling its commitment to fostering crypto growth in the region.

HSBC’s move to allow customers to trade Bitcoin and Ethereum ETFs represents a significant milestone in the mainstream adoption of cryptocurrencies. As the market continues to evolve, more financial institutions are expected to follow suit, providing investors with increased opportunities to engage with digital assets.

Related News

- Ethereum Price Forecast: Bullish Momentum Continues, Is $5,000 Within Reach?

- The Crypto Market Outlook Today-Latest Developments in the Industry

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage