Join Our Telegram channel to stay up to date on breaking news coverage

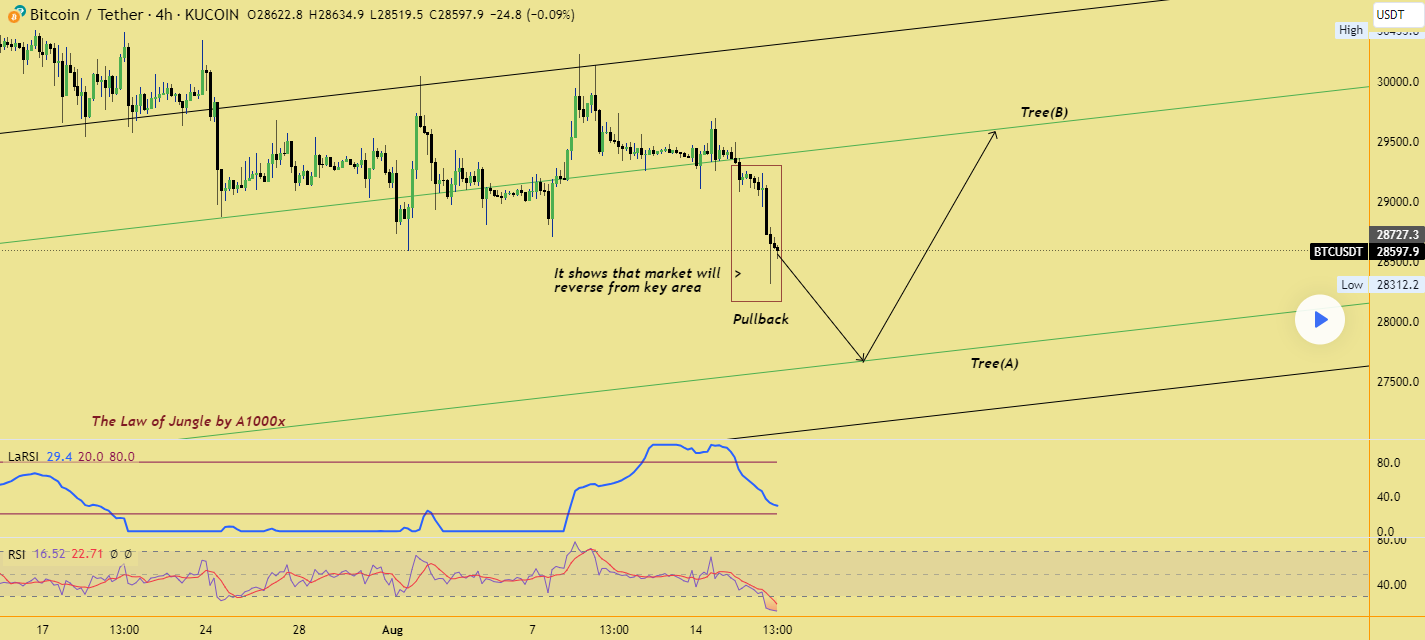

Bitcoin price dropped 3% in the last seven days, and it finally broke its support at $29k. After trading sideways with only minor fluctuations for the last week, the price broke its support at $29.3k on August 16 and dropped to $29.1k. However, it seemed like this level could hold it, and the extensive support at $29k would be there to support it even if the minor support at $29.1k broke.

But this is not what happened earlier today, August 17. When the price started dropping, the supports broke immediately, one after the other, and Bitcoin sank to $28.5k. At the time of writing, the price is 2% down compared to yesterday, currently at $28,545.

However, the experts are uncertain about what will happen next. Some believe the sudden price drop will result in a recovery as many might rush in to buy the dip. Others expect this is only the beginning, as the world economy and traders’ attitudes discourage buying now.

The market is failing hard, and for the moment, there is no obvious reversal point, which likely means that more bears will contribute to the selling pressure and take Bitcoin below $28k. Some even expect the price to sink to $25,000.

A slightly more optimistic view says Bitcoin could sink to $27.6k in days and then sharply bounce back up.

Bitcoin enthusiasts hesitant to buy

Bitcoin has seen unnatural levels of stability followed by sharp drops and surges for almost two months. Traders seem hesitant to move, as the Bitcoin Fear & Greed Index continues to point at neutral sentiment.

For now, many are uncertain whether it is time for a bull run to start or if Bitcoin is supposed to correct further. At the same time, the entire crypto industry is waiting to see whether the SEC will approve a Bitcoin spot ETF.

With the Fear and Greed index mainly in the neutral state, Bitcoin price was, in theory, supposed to remain stable. However, the coin’s value slipped after leveraged funds ramped up their bearish bets. According to observers, around two-thirds of leverage funds’ positions are short, giving the bears the upper hand.

Javier Milei wins Argentinian elections, Bitcoin soars

Fortunately, it is not all bad news for Bitcoin, as a crypto-supporting Javier Milei won the presidential primaries in Argentina. The Argentine peso (ARS) dipped, and so did other assets, but Bitcoin held steady and even hit an ATH of 10.2 million ARS yesterday. Since then, it dropped slightly to 10.1 million ARS.

🤔📈#Bitcoin’s value against the three weakest emerging markets currencies this year – the ARS, TRY and the RUB – has soared between 140% and 240% YTD.

👉Notably, its price in ARS just hit an all-time high! pic.twitter.com/G97nswb22F

— Kaiko (@KaikoData) August 14, 2023

Many are now wondering whether the US might see a similar victory of a crypto-friendly candidate next year and what implications such a move would have for Bitcoin.

Wall Street Memes raises $24.5 million as Bitcoin dips

It is no secret that Bitcoin is surrounded by uncertainty, but cryptos still in presale do not suffer from volatility. If they manage to attract buyers with their ideas, technologies, and philosophies — all the better for them.

Wall Street Memes is an excellent example of this. The token is in the final stages of its presale, ending in late August. However, before it does, it will still go through two more phases after the current one. The current phase sells WSM tokens for $0.0334; the next will boost the price to $0.0337.

Anyone interested in buying WSM can do so with ETH, BNB, USDT, or a credit card. The current phase will continue for two more days. So far, the presale has been incredibly successful, and the project raised $24.5 million.

Related

- Bitcoin’s BTC Dominance: Experts Predict 12% Growth in Coming Weeks

- Bitcoin Price Prediction: Top Financial Meme Groups Hint at Massive BTC Coin Upswing

- Milei’s Surprising Victory Sends Bitcoin to Record Heights in Argentina

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage