Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin Price Key Highlights

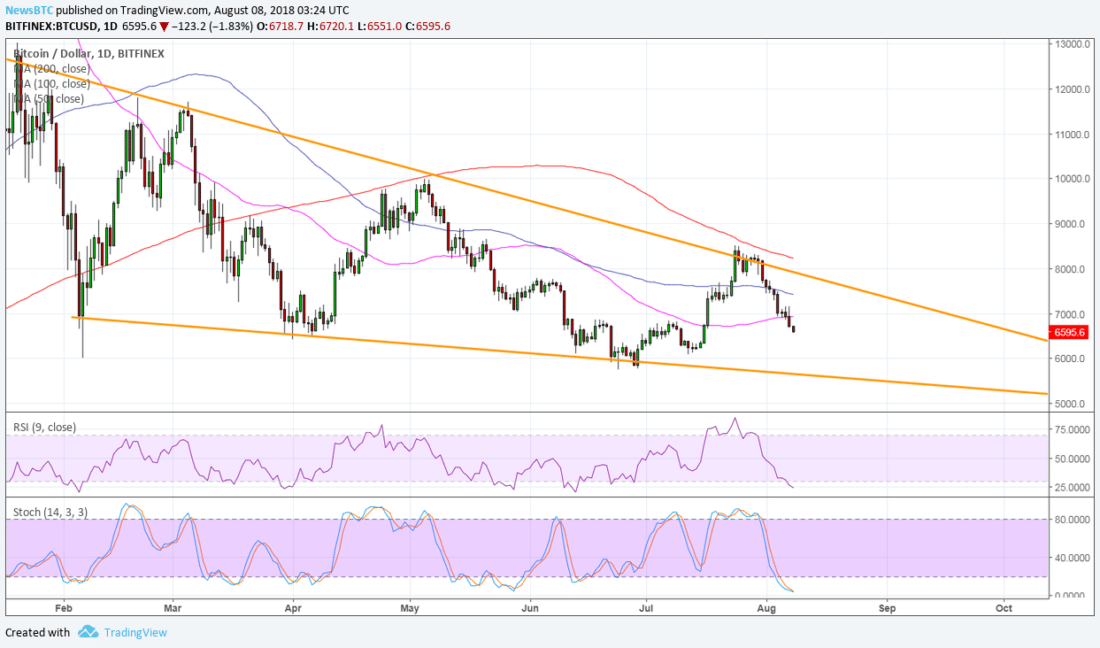

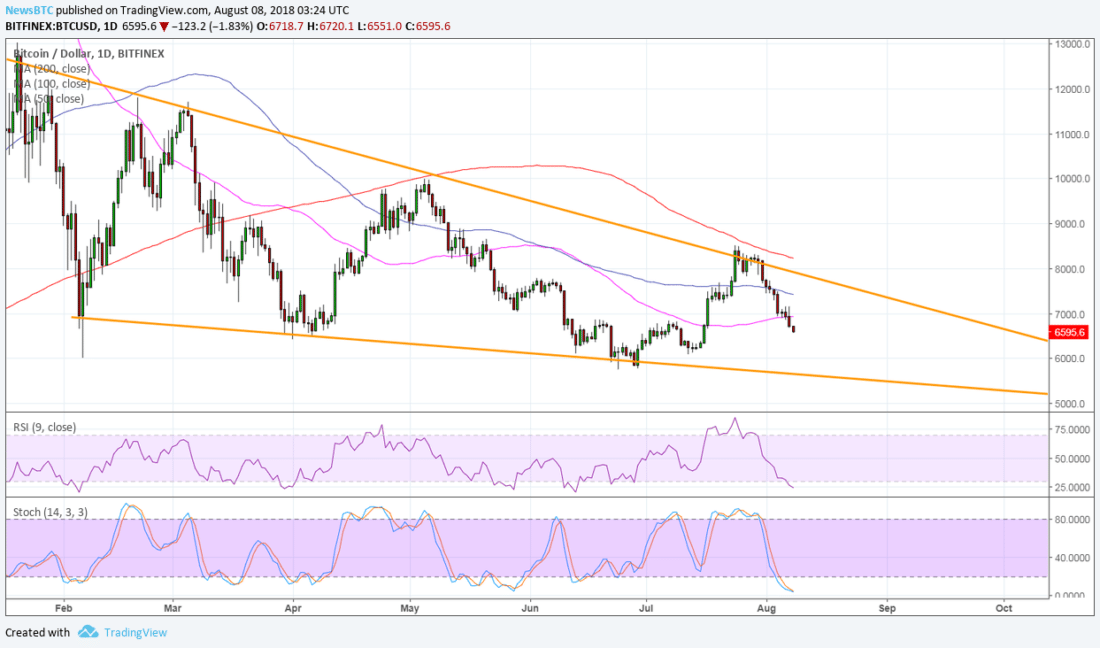

- Bitcoin price is on another day of declines, possibly setting its sights on longer-term support zones.

- Price has already closed below the 50 SMA to reflect a pickup in selling pressure.

- The next downside target might be the yearly lows or the bottom of the falling wedge on the daily chart.

Bitcoin price appears to be setting its sights on the bottom of the falling wedge pattern visible on the daily time frame.

Technical Indicators Signals

The 100 SMA is below the longer-term 200 SMA to confirm that the path of least resistance is to the downside or that the selloff is more likely to continue than to reverse. Bitcoin price has also slumped below the 50 SMA to signal a pickup in selling momentum.

RSI has reached oversold conditions, though, so there may be some exhaustion among bears. Similarly stochastic is in the oversold region to signal that sellers might take a break and allow buyers to take over. Both oscillators have yet to climb higher to indicate a return in bullish pressure.

If that happens, bitcoin price could revisit the top of the wedge, which is spanned by the dynamic inflection points at the moving averages. This means that bitcoin price has several upside barriers to contend with before attempting to break higher from the wedge. Note that the formation spans around $6,000 to $12,000 so the resulting move could be of the same size.

BTCUSD Chart from TradingView

Much of the decline has been blamed on FUD (fear, uncertainty, doubt) that led traders to dump their holdings, leading to even more losses for bitcoin price as sellers keep piling in. So far, there seem to be no major positive updates that could stop the bleeding, but many are pointing to the consistent market dominance of bitcoin even while the industry is in selloff mode.

The post Bitcoin (BTC) Price Watch: Aiming for Wedge Bottom? appeared first on NewsBTC.

Join Our Telegram channel to stay up to date on breaking news coverage