Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – September 1, 2020

Today, Bitcoin rebounded above the $11,700 as price broke the $11,800 resistance. The next resistance is the $12,000 and $12,400 price levels. The king coin is trading at $11,940 at the time of writing.

Resistance Levels: $10,000, $11, 000, $12,000

Support Levels: $7,000, $6,000, $5,000

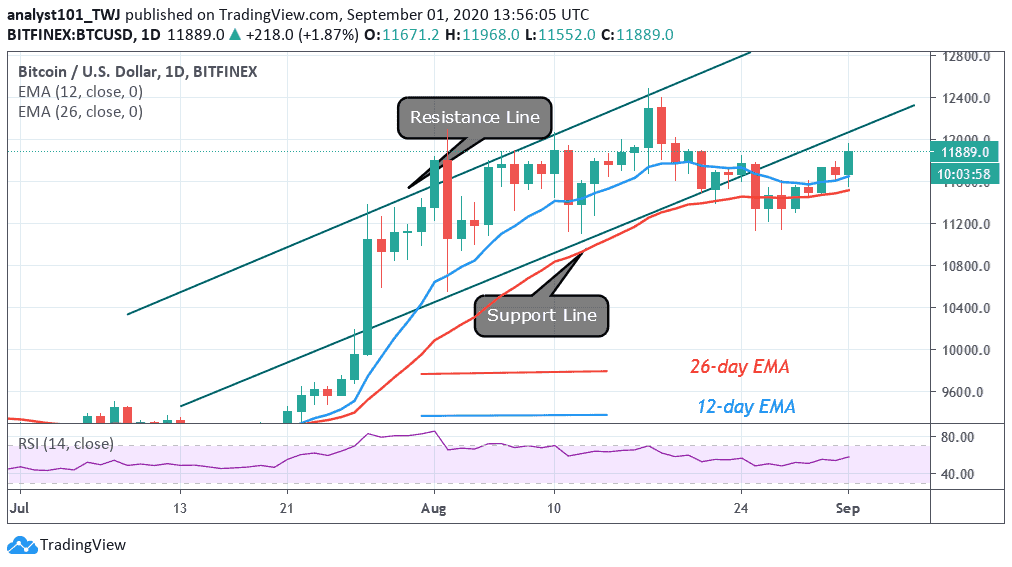

Following the August 22 breakdown and subsequent retest at the $11,800 resistance, BTC/USD was compelled to a sideways trend. On August 27, the bulls buy the dips as price rallied to $11,600. Buyers could not break the $11,600 resistance until after three days of consolidation. BTC was trading marginally above 11,700 before the eventual breakout. The rebound above $11,700 propel price to break the $11,800 resistance but came close to the $12,000 overhead resistance. Today, buyers are pushing the coin to retest the overhead resistance.

In previous price action, on August 17, the king coin made a strong bounce above $11,800, as price rallied to break the $12,000 resistance. The momentum continued to the high of $12,500. The upside momentum was lost as buyers failed to sustain the uptrend. Today, Bitcoin is falling after reaching a high of $11,968. If price retraces to $11,800, a strong bounce above it will propel price to break the $12,000 resistance. Thereafter, the price should be sustained above the $12,000 resistance. There are indications that the price movement will be accelerated above the overhead resistance.

Japanese Financial Giant SBI Holdings Launches CDF for Bitcoin, Ether, and XRP

With effect from August 31, SBI Holdings will commence CDF trading service for crypto assets, including Bitcoin (BTC), Ether (ETH), and XRP. The new service will be offered by the SBI’s foreign exchange focused arm, SBI FX trade. According to reports, SBI FX trade will become the first forex exchange business in Japan to offer CDF trading for crypto currencies. The SBI clients will trade crypto CFD contracts against the Japanese yen and the U.S. dollar. Besides, in Japan, Monex Securities became the first online securities company to launch crypto CFD services. This enables traders to speculative on the asset price movement against the Yen and the US dollar.

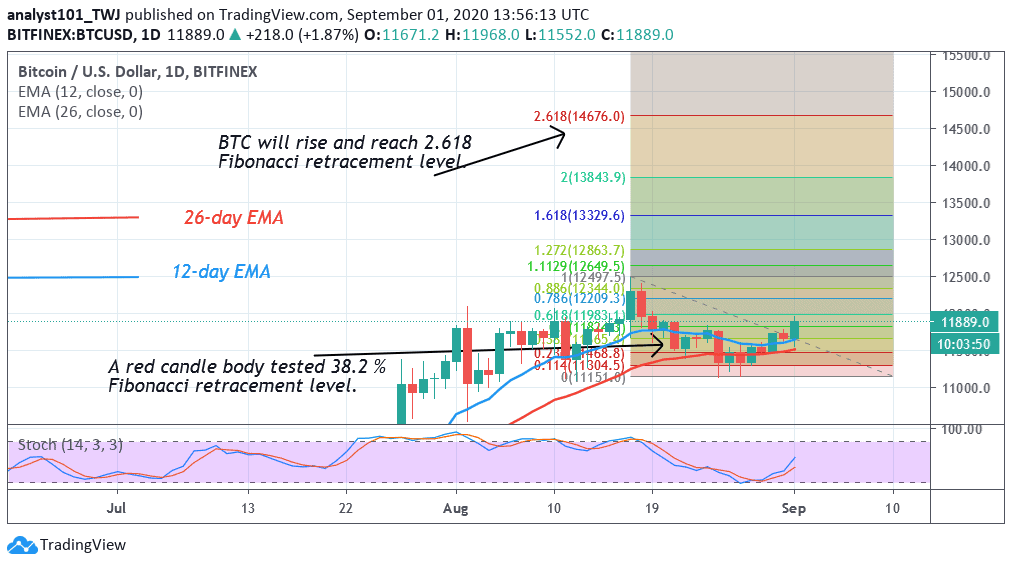

Meanwhile, from the daily chart, Bitcoin has resumed an upside momentum to break the $12,000 overhead resistance. According to the Fibonacci tool, Bitcoin will rise and reach 2.618 Fibonacci extension level. That is the high of $14,500. This is given the retracement on the August 17 uptrend. In the last bullish impulse, a retraced candle body tested the 38.2% Fibonacci retracement level. This suggests that BTC will rise to a new high after breaking the resistance levels.

Join Our Telegram channel to stay up to date on breaking news coverage