Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – December 21, 2020

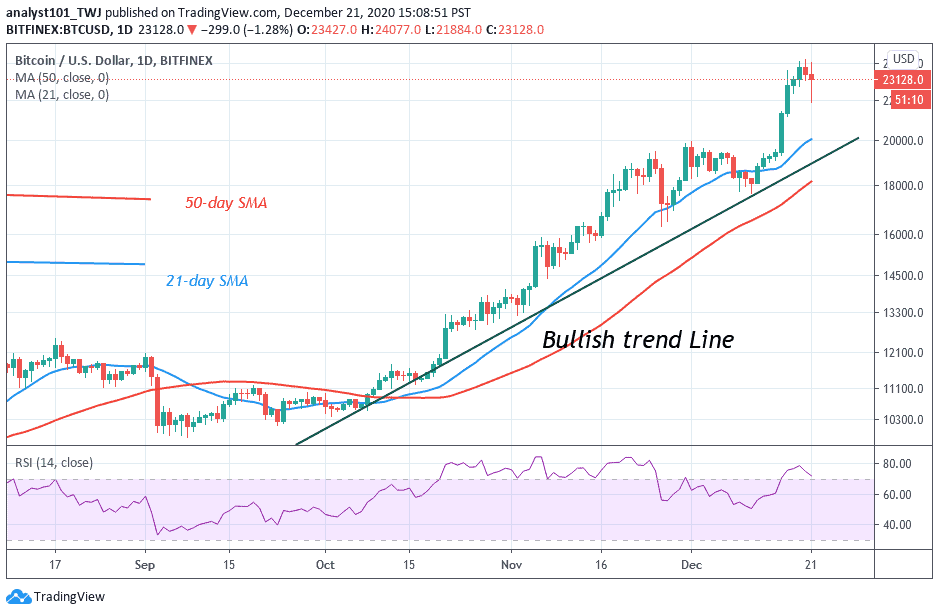

Today, BTC/USD has fallen from a high of $14,000 to a low of $22,000. BTC price resumed consolidation above the $22,000 support. The price corrected upward but was rejected at the $23,200 high. The crypto is likely to further depreciate to the downside. The downward move has continued as the price reaches a low of $22,619.

Resistance Levels: $23,000, $24,000, $25,000

Support Levels: $13,000, $12,000, $11,000

Bitcoin rally has been stalled at the $24,000 resistance. There is strong selling pressure above the $24,000 and $25,000 resistance zones. Buyers are finding it difficult to sustain the current uptrend. The recent upward move is a vertical rally. Analysts believe that vertical rallies are not easily sustainable. Therefore, the current downtrend may extend to the $20,000 support level. Nonetheless, Bitcoin continues to remain in a strong uptrend as long as the price holds above the $20,000 support level. Presently, the sentiment is changing from buying on dips to selling on rallies.

Microstrategy Buy the Dip-Now Has More Than US Government

MicroStrategy has added to its Bitcoin with a purchase of 29,646 BTC for a total of $650 million, an average of around $21,925 per Bitcoin. The $650 million purchase was done as price dips from weekend highs. The company is having a total of 70,470 BTC, bought at an average price per Bitcoin of $15,964. This makes it the fifth-largest individual holder of Bitcoin, one place ahead of the United States government, which reportedly has 69,420 BTC.

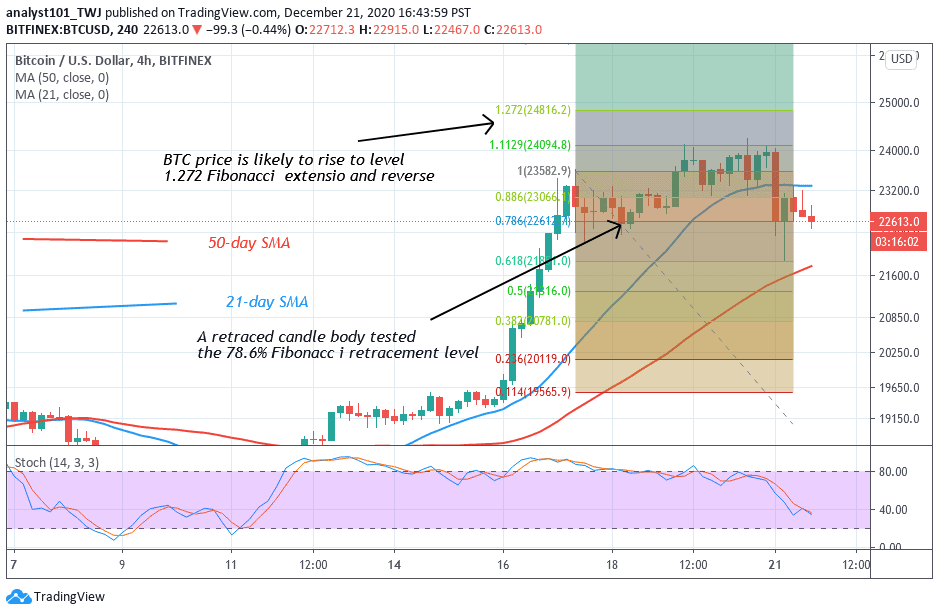

Bitcoin is now consolidating above $22,000 support. The Fibonacci tool has indicated an upward movement of the coin. On November 17 uptrend; a retraced candle body tested the 78.6% Fibonacci retracement level. The retracement indicates that BTC will rise and reverse at level 1.272 Fibonacci extension level or the high of $24,816.20.

Join Our Telegram channel to stay up to date on breaking news coverage