Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin (BTC) Price Prediction – August 27, 2020

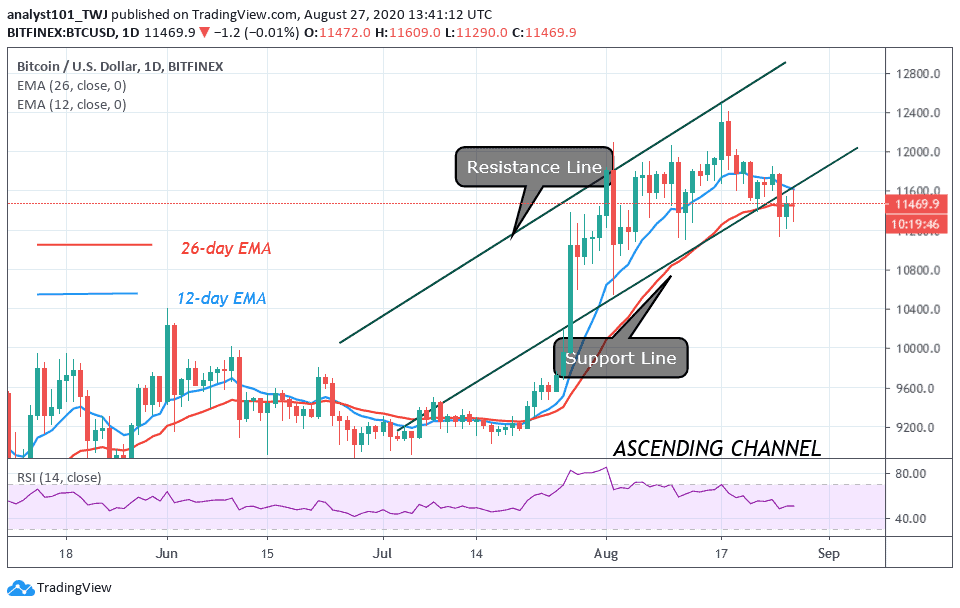

On August 25, the bears broke the $11,400 and $11,200 but corrected upward. The price retested the $11,500 high and resumed a downward move. Buyers fail to sustain the upward correction. BTC/USD will risk further depreciation if buyers fail to push BTC above 12-day EMA or $11,500 high.

Resistance Levels: $10,000, $11, 000, $12,000

Support Levels: $7,000, $6,000, $5,000

Bitcoin has been on a downward move after retesting the $11,500 high. The bears have broken the $11,400 crucial support for the second time. The price is approaching the next support at $11,200 to break it. Nevertheless, the previous price action above $11,200 has been holding since August 1. The king coin will resume a fresh uptrend to retest the $11,800 resistance if the $11,200 support holds.

If the bulls are successful, the $12,000 overhead resistance will be retested again. However, if the bears break the $11,200 support, the downtrend will resume. Bitcoin is likely to fall to a low of $10,800. Subsequently, the downward momentum will extend to $10,400 and $10,000.

Bitcoin Capital Active Exchange Hopes to Promote Mass Crypto Adoption Through Its Product-BTCA

Bitcoin Capital Active Exchange is an investment firm that trades BTCA in the Swiss Stock Exchange. According to reports, the firm can discretionarily allocate funds to fifteen different crypto currencies and fiat. Daniel Diemers is one of the directors of FICAS, the company that manages the product.

According to the director, the board of directors relies on four frameworks to optimize their portfolio namely: technical analysis, fundamentals, sentiment analysis, and agency model. Presently, about 83% has been invested in Bitcoin, 12% in Bitcoin Cash (BCH), and 1% allocated to Ethereum (ETH). The director added that the allocation is publicly available and updated every month.

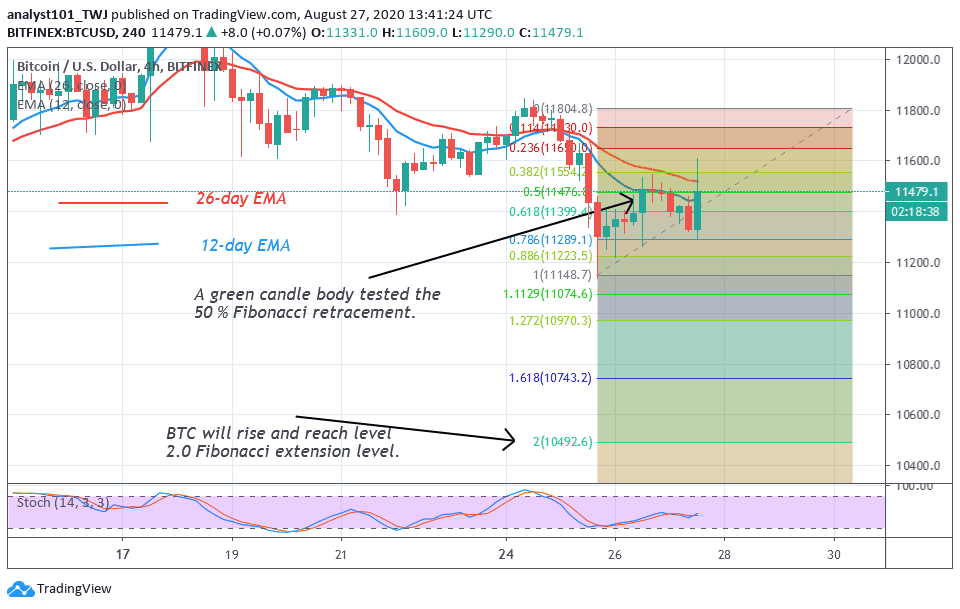

Nonetheless, Bitcoin is on a downward move and the coin will further depreciate if the $11,200 support is broken. On August 25 downtrend, BTC fell to $11,100. A retraced candle body tested the 50 % Fibonacci retracement level. This indicates that BTC may likely fall and reach the 2.0 Fibonacci extension level. That is, BTC will decline to $10,480 low.

Join Our Telegram channel to stay up to date on breaking news coverage