Join Our Telegram channel to stay up to date on breaking news coverage

Binance, the world’s largest cryptocurrency has been again in the news due to some legal complications. The exchange is dealing with some major fluctuations in the tokens’ prices after being a part of a lawsuit filed by the Commodity Futures Trading Commission (CFTC).

This, however, is an indirect sign of how the federal authorities have been increasing their scrutiny of crypto exchanges and platforms in the last few years.

According to the lawsuit, Binance has allegedly violated and evaded US laws, which includes failing to register in the country.

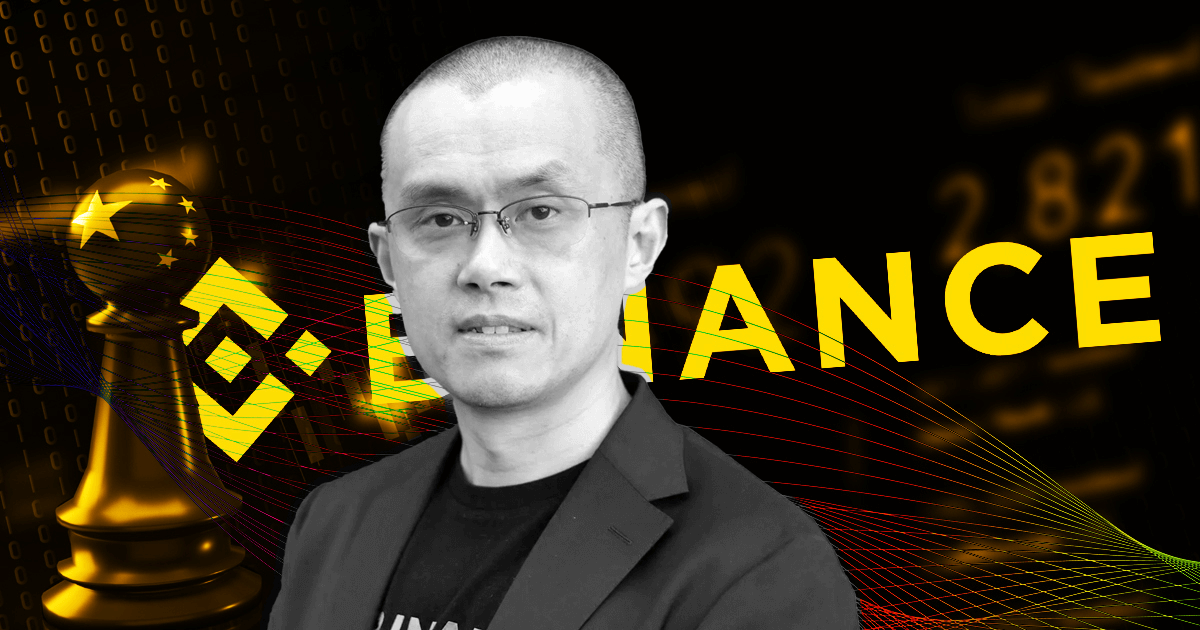

The documents obtained by Financial Times have revealed that Binance CEO Changpeng Zhao (CZ) and other executives have been concealing their ties with China for several years.

What makes this even more controversial is that Binance has maintained for a long time that it had severed its ties with China after the government’s strict crackdown on the cryptocurrency industry in 2017.

What Exactly Happened With Binance?

According to the investigation conducted by The Financial Times, Binance had been conducting activities in China, and even in fact had an office space in the country to operate from. Apart from this, its employees from China were paid via a Chinese bank too.

Furthermore, the documents also mention that Binance even instructed its employees to attend a tax session being hosted in China, in 2019, which directly went against the company’s statements about the lack of presence of the exchange in the country.

Many sources have claimed that the exchange even went to extensive lengths to hide its track of Chinese influence, which included the use of virtual private networks (VPN) for operation.

All of this led to the CFTC filing a lawsuit against Binance on 27th March 2023, at a federal court in Chicago.

The lawsuit alleged that the exchange and its CEO Changpeng Zhao (CZ) had broken the rules of American derivatives by enabling US customers to trade in crypto derivatives without first registering with the agency, as per a Bloomberg report.

Investors Pull Out $1.6 Billion From Binance After CFTC Lawsuit

Binance investors withdrew $1.6 billion worth of cryptocurrency from the exchange following the news of the CFTC lawsuit.

The U.S. Commodity Futures Trading Commission (CFTC) filed a lawsuit against Binance on alleged charges that the exchange was running an “illegal” exchange and a “sham” compliance program.

Investors pull $1.6 billion from Binance after CFTC lawsuit https://t.co/m83kbB47X8 pic.twitter.com/GOIA7MRTyZ

— Reuters (@Reuters) March 29, 2023

Since the news of the lawsuit broke, Binance has witnessed over $1.6 billion being withdrawn from the exchange $852 million in the last 24 hours alone.

While investors are spooked and pulling out their money from the exchange, the thing that’s to be noted is that Binance hasn’t been charged with money laundering or exploiting their users’ funds.

Bitcoin Rising Despite Investors Pulling Out Billions

However, at a time when investors have been considering pulling out billions of dollars from Binance, the world’s largest cryptocurrency, Bitcoin, seems like it’s on a different trajectory altogether.

Bitcoin rose for the second day straight, gaining up to 4.9% and closing at $28,600 levels, and even hitting the $29,000 mark after finally dropping today by 0.5% on Thursday.

The same pattern was followed by other cryptocurrencies, with XRP jumping by about 4.4%, Cardano by 7%, and so on.

Many experts are of the notion that the two contradictory events happening in the crypto industry id due to underlying speculation that the lawsuit might just result in a few minor lawsuits.

The sentimental and emotional analysis of Bitcoin has also been increasing steadily over the last few months, even though the global banking sector is wobbling.

Binance Isn’t Alone, Coinbase Joins The Club

Another cryptocurrency exchange, Coinbase has been in the limelight. According to a report in the Wall Street Journal, Coinbase mentioned that it had received a Wells notice from the Securities and Exchange Commission (SEC).

A Wells notice is a letter that is used to convey that the regulator is of the notion that a company or an individual possibly violated investor-protection laws. This SEC notice has raised concerns about different parts of Coinbase’s business including the assets listed on the exchange, its staking platform as well as its wallet.

This has put a major dent in Coinbase, which is a publicly-traded company and provides an avenue for a lot of customers to enter the digital currency markets.

What should be noted here is that since it’s a Wells notice and not a lawsuit, Coinbase will have the right to respond to this notice and argue its case. After that, the SEC will have a six-month period from the time of the delivery of notice to decide and go ahead with the lawsuit, It can also extend this timeline.

What Does This Mean For The Crypto Industry?

Binance, which has been the largest cryptocurrency exchange in terms of trading volume, has been under the scanner of U.S. regulators for a long time now.

What needs to be understood is the fact that in the lawsuit filed against Binance, there lies a scenario in which the exchange wilfully tried to bypass the US regulations by enabling the customers of the United States to indulge in illegal purchases and trades via VPN and other wrongful tactics that wouldn’t reveal their location.

The lawsuit by CFTC further brings forward the overall sentiment that the regulators have for digital currencies. This lawsuit is somewhat similar to the Securities and Exchange Commission against Ripple Labs.

These actions might seem like a hurdle to the overall crypto market, but experts believe these might not be able to affect the crypto industries by a lot.

Instead of the crypto exchanges facing the burnt of these regulations, the US regulators need to differentiate between regulations and stringent rules that might end up pushing these companies outside the United States.

Read More:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage