Join Our Telegram channel to stay up to date on breaking news coverage

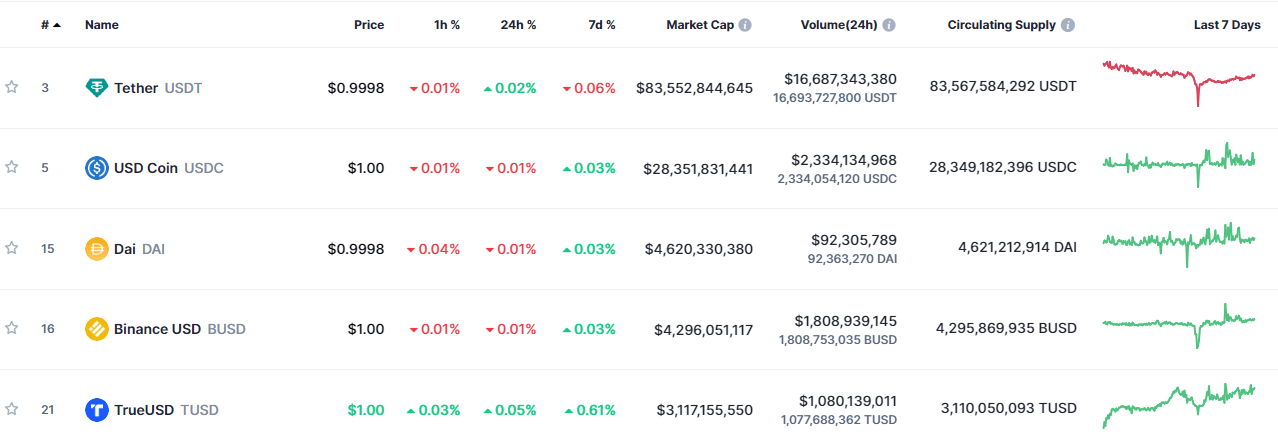

Binance USD (BUSD) dropped to the fourth spot in the stablecoin rankings because of a decline in its position. The change in rankings highlights the increasing competition and evolving dynamics within the stablecoin market. BUSD’s drop in position reflects the popularity of other stablecoins and the need for it to adapt to stay competitive.

BUSD Drops in Market Cap, Falls Behind in Stablecoin Rankings

The market cap of BUSD dropped by more than $1 billion in the last month, dropping it to fourth place. The decline in BUSD’s value reflects a decline in its overall value.

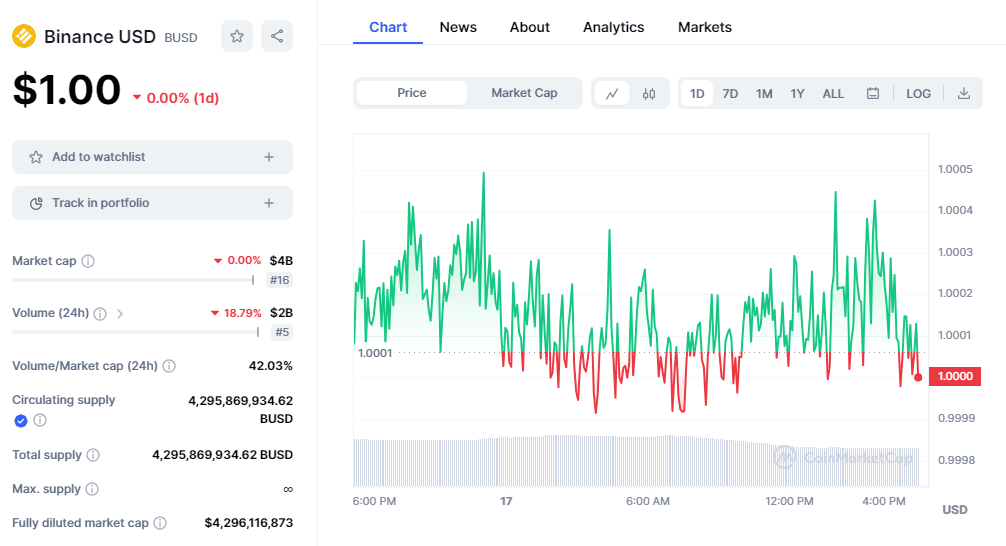

According to Coinmarketcap data, Binance USD (BUSD), which is pegged to the $1.00 value of the US dollar, has fallen to fourth place in market capitalization. During the past 30 days, the value of this stock has dropped by over $1 billion.

The market capitalization of BUSD is currently $4.296 billion, down 29% from $5.543 billion on May 18. Starting from a market cap of over $23 billion, the stablecoin has been experiencing a downward trend since December.

BUSD’s market capitalization dropped after FTX collapsed in November 2022. One week after the Justice Department targeted Binance, $3.6 billion in net withdrawals happened. Market makers, like Jump Finance, redeemed big amounts of BUSD, totaling over $245 million.

What Factors Contributed to the Decline in BUSD’s Market Share?

Stablecoin BUSD launched in September 2019 through a Binance/Paxos Trust partnership. Paxos issues stablecoins, and Binance licenses them.

However, this partnership brought new challenges for Paxos. The U.S. SEC sent Paxos a Wells Notice in February, claiming that Binance USD might be unregistered.

The SEC argued that Paxos was offering Binance USD without registering it as a security and that this could violate securities laws. Paxos denied the claims and is currently in the process of responding to the Wells Notice.

In response to the investigation, the New York Department of Financial Services (NYDFS) instructed Paxos to stop issuing BUSDs. Due to these incidents, BUSD’s market share decreased from $15.88 billion on February 12 to $8.38 billion on March 13.

The SEC sued Binance on June 5 for allegedly offering unregistered securities. 13 charges were filed against the exchange, including unregistered sales and offers of BNB and BUSD.

The stablecoins pegged to the dollar have gained traction over the past year. Other stablecoins are down, while Tether (USDT) is at an all-time high. In May 2023, USD Coin (USDC) lost market share from 34.88% to 23.05%. BUSD’s market share dropped from 11.68% to 4.18%, and DAI’s share went from 4.05% to 3.66%.

While other stablecoins have declined in popularity, Tether’s USDT is gaining traction. A year ago, USDT had a market dominance of 47.04%. In May, it was 65.89%.

The company’s market capitalization is now $83.1 billion. However, USD Coin (USDC) is down from a peak of $55 billion to $29 billion in market cap.

This is likely because Tether has been more successful in creating trust and confidence with its users, as evidenced by its higher market dominance. The company has also established a larger network of users and partners, making it more attractive for users to use and hold USDT.

Join Our Telegram channel to stay up to date on breaking news coverage