Join Our Telegram channel to stay up to date on breaking news coverage

The UK subsidiary of the largest cryptocurrency exchange globally has opted to revoke the permissions it had been granted by the Financial Conduct Authority (FCA) but never utilized.

Binance UK Subsidiary Revokes Unused FCA Permissions Amid Regulatory Challenges

Binance Markets Limited (BML) has officially withdrawn its permissions for activities unrelated to cryptocurrencies, effectively ending its ability to offer regulated products and services, according to a statement from the regulatory body.

As stated on the FCA’s website update from June 7, Binance Markets Limited requested the withdrawal of its registration, and this request was processed and documented on the FCA Register by May 30, 2023.

The UK financial regulator emphasized that BML is no longer authorized by the FCA, and no other entity within the Binance Group holds any form of UK authorization or registration to conduct regulated business in the country.

Binance Markets Limited was established in June 2020 when Binance acquired a company named EddieUK and rebranded it. The CEO of Binance, Changpeng ‘CZ’ Zhao, was appointed as the person with significant control over this newly acquired entity.

The purpose of the acquisition was to aid in the launch of Binance.UK, a planned cryptocurrency exchange aimed at serving customers in the UK, similar to Binance US, which caters to customers in the United States.

Despite the fact that Binance’s subsidiary in the UK was not actively operating, the Financial Conduct Authority (FCA) issued a consumer warning concerning it in June 2021. Binance clarified that its subsidiary, Binance Markets Limited, possessed several permissions granted by the FCA for activities that were never actually carried out or provided within the UK.

Binance Markets Limited made the decision to cancel certain permissions in alignment with the Financial Conduct Authority’s (FCA) advice to keep permissions up to date. The company determined that these permissions were unlikely to be necessary in the future, prompting the cancellation.

The recent changes regarding the FCA permissions have no impact on the global trading platform Binance.com, which does not operate any cryptocurrency services in the UK and is only available to UK consumers on a reverse solicitation basis, according to Binance.

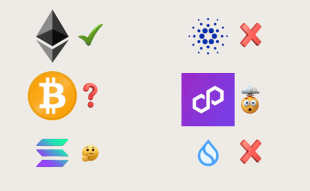

Binance has been facing regulatory challenges from different authorities. The U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Binance in June, accusing the exchange of violating U.S. securities laws. French authorities are also investigating the exchange for alleged offenses including aggravated money laundering.

In addition to the UK, Binance announced its decision to withdraw from Cyprus and focus on fewer regulated entities in the European Union. Moreover, the exchange terminated its operations in the Netherlands after failing to obtain a virtual asset service provider (VASP) license.

Binance Unleashes BNB Smart Chain’s Potential with Optimized Layer-2 Solution

Binance has launched an optimized Layer-2 (L2) solution for maximizing the potential of the Binance Smart Chain (BNB Chain), enhancing network adoption and performance.

The new solution, named opBNB, has been developed using the OP Stack and functions as a high-performance L2 solution within the BNB ecosystem. With a block size of 100 megabytes, opBNB ensures stable, affordable, and secure gas fees. It employs a fraud-proving scheme to validate transactions, making it suitable for widespread adoption in various digital environments.

opBNB is a multifunctional platform that supports gaming, decentralized exchanges, daily use, and digital collectibles, with optimal performance. With a block size of 100M, opBNB can handle 4000+ transactions per second, while keeping transaction costs below $0.005.

opBNB addresses the scalability challenge faced by the Binance Smart Chain. It is compatible with the Ethereum Virtual Machine (EVM) and leverages Optimistic Rollups to reduce computational load on the main chain. By executing transactions off-chain and updating transaction data on-chain as calldata, opBNB offers a swift and efficient solution for scalability. It bundles multiple transactions together before submitting them to the main chain.

Developers and crypto projects can reap numerous advantages from the opBNB solution. It delivers superior scalability, enabling the processing of more than 4000 transfer transactions per second. Additionally, the solution ensures developer accessibility by maintaining compatibility with Ethereum’s tooling and dApps, allowing developers familiar with Ethereum to seamlessly transition to opBNB.

opBNB provides enhanced security and trust, supports future-proof development, and enables seamless integration with diverse projects and tokens.

By introducing the optimized Layer-2 solution, Binance has paved the way for BNB Smart Chain to reach new heights, providing improved scalability, compatibility, and security for developers and projects within the Binance Smart Chain ecosystem.

Related Articles

- Binance Review

- Binance Deregisters in UK Amid Regulatory Concerns

- Binance and Crypto Industry Find Relief As Looming Threat Dissipates

- Binance CEO Pleased With SEC/Binance Resolution, Deems SEC Request for Emergency Relief as Unnecessary

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage