Join Our Telegram channel to stay up to date on breaking news coverage

The world’s largest cryptocurrency exchange Binance today released the first report in its Decentralized Finance (DeFi) series, focusing in fiat-backed stablecoins like USDC.

Ethereum leads the DeFi revolution

Decentralized Finance, called DeFi or Open Finance is one of the most crucial aspects contributing to the development of the Ethereum network. It incorporates a new, permissionless financial ecosystem on the Ethereum platform that can be available to everyone in the network. The user gets to act as his own custodian of assets and maintains full control over his coins. This kind of ownership brings to access to all platforms without intermediaries.

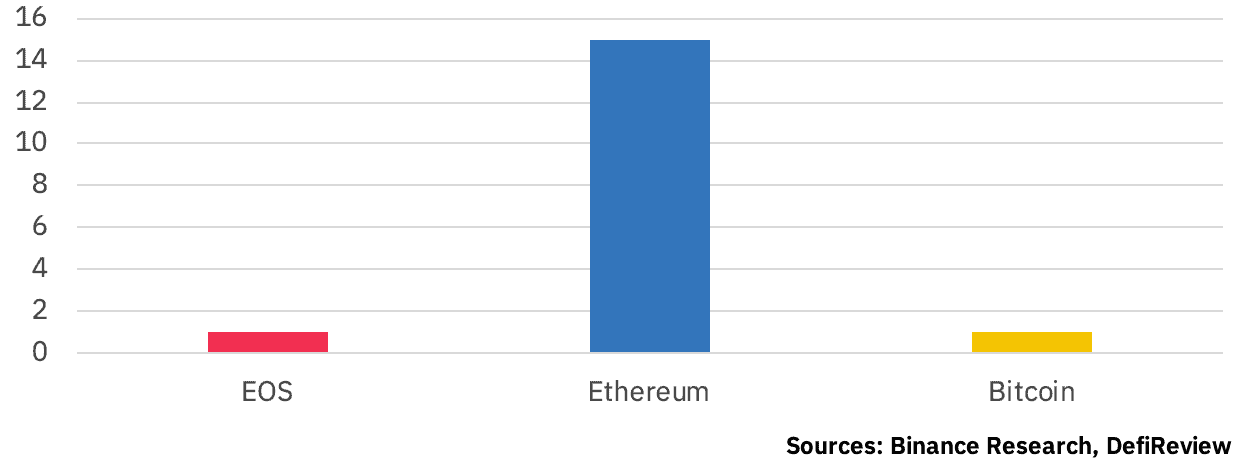

In the first article of the DeFi series, Binance covered different platforms and protocols in the financial industry. It focused more specifically on decentralized crypto asset lending and borrowing platforms. The report notes that Ethereum dominates its peers in terms of the number of existing applications, volume and transaction count as of May 31, 2019. Collaterals blocked on Ethereum’s DeFi applications are worth around $500 million (or 1.5 million ether) on June 5, 2019. Bitcoin’s lightning network and EOS pale in comparison with Ethereum’s DeFi ecosystem.

Lending and borrowing DeFi landscape

EOS leads Ethereum in terms of the total amount of USD locked in blockchains. EOS does this because of EOSRex, which enables users to lend and borrow the blockchain’s resources. EOSRex was launched only a month ago but has gained substantial traction as the total collateral value has jumped to over $90 million. BUCK Protocol, a permissionless money-market protocol, is also helping the EOS ecosystem grow.

Ethereum-based DeFi platforms are supporting a wide range of assets- both native blockchain and non-native blockchain assets. Native blockchain assets include the likes of MakerDao and its DAI stablecoin. ERC20 tokens like BAT, 0X and REP are also a part of native blockchain assets which can be used to borrow and lend resources. They could also be used as governance assets or collaterals for loans. On Ethereum, illiquid assets cannot be used as collaterals.

Non-native assets on Ethereum’s DeFi ecosystem include TrueUSD (TUSD) and USD Coin (USDC), backed by Circle. USDC is quickly becoming a popular lending and borrowing protocol. Dharma added it to its list of supported assets, after a Coinbase investment earlier this year. Popular protocols include Bloqboard, Compound, Dharma, dYdX, ETHLend, Fulcrum, Maker, Lendroid and InstaDApp amongst others. Of these, MakerDAO, Compound, and Dharma emerge as the Big 3 of the DeFi platforms as they represent nearly 80% of locked ETH.

A detailed evaluation of the Ethereum Open Finance ecosystem could be found on Binance website.

Join Our Telegram channel to stay up to date on breaking news coverage