Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin is trading at $97,302.08, reflecting a 0.2% increase in the past 24 hours. This rise has influenced the broader cryptocurrency market, with altcoins like Flare, Raydium, and Aave showing significant gains during the same period.

The current market trends indicate growing adoption and structural development driven by institutional interest, ETF activity, and technological advancements in blockchain projects. These factors suggest that the market is maturing and attracting more participants. This has led traders to look for the best crypto to buy now, expecting the bullish momentum to continue.

Best Crypto to Buy Now

Bitcoin has been reaching new record highs this month, largely driven by expectations that former President Trump could bring about a favorable environment for crypto. Increased funding rates and open interest in the futures market sparked the latest price surge.

Flockerz has gained attention after raising over $2.8 million in its ongoing presale campaign. In a similar trend, PEPE has experienced significant activity, reaching an all-time high of $0.00002524 on November 14. Meanwhile, Aave is exploring integrating with Spiderchain, a Bitcoin Layer 2 network developed by Botanix Labs.

1. Flare (FLR)

Flare is a blockchain network designed to improve the functionality of decentralized applications by providing developers with decentralized access to reliable data from other blockchains and the internet. Built on the Ethereum Virtual Machine (EVM), it allows developers to create and deploy applications with cross-chain capabilities.

The USDX stablecoin plays a central role in Flare’s ecosystem. Unlike traditional stablecoins like USDC, USDX is linked to Treasury yields, offering users access to financial returns from traditional markets. It works with the FAsset system, bridging assets from other blockchains. This system uses over-collateralization to minimize trust risks while increasing liquidity and providing real-world yields for digital assets within DeFi ecosystems.

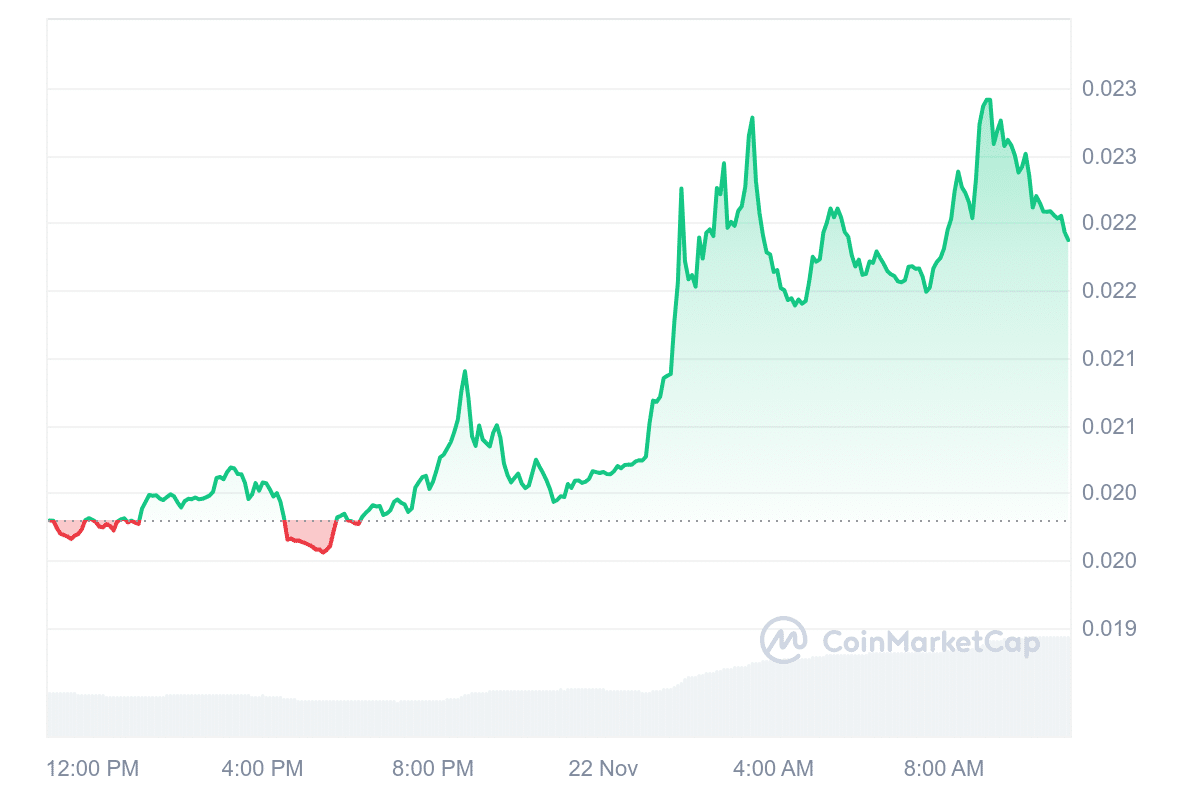

Flare’s current price is $0.02166, reflecting a 10.17% increase in the past 24 hours. Over the last 30 days, it has recorded 16 days of price gains. The Fear & Greed Index indicates extreme greed, with a score of 94, suggesting heightened market interest.

"Flare’s USDX stablecoin introduces Treasury yields to DeFi, challenging established players like USDC in terms of economic utility."

More of its role in FAssets:https://t.co/T5KHbFwe77

Written by @josullivan010 at @Cointelegraph.

— Flare ☀️ (@FlareNetworks) November 19, 2024

Furthermore, the 14-day Relative Strength Index (RSI) is neutral at 50.48, indicating potential sideways trading in the short term. The 24-hour volume-to-market cap ratio is 0.0375, suggesting lower liquidity than its market cap.

Market projections indicate a potential price increase of 227.87%, with Flare possibly reaching $0.071212 by December. These predictions highlight growth potential but should be treated cautiously, given the volatility and risks inherent in cryptocurrency markets.

2. Raydium (RAY)

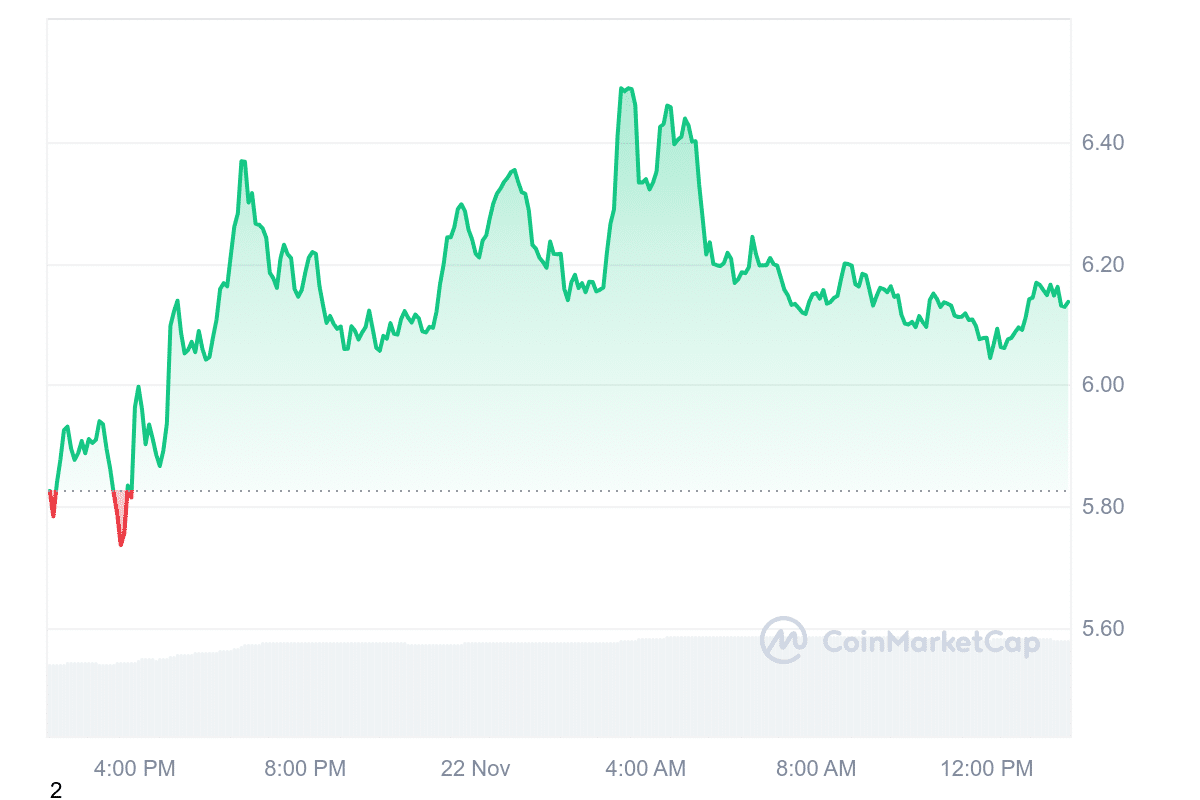

Raydium is a decentralized automated market maker (AMM) and liquidity provider built on the Solana blockchain, offering fast and low-cost transactions. Its recent listing on Bithumb, a prominent South Korean cryptocurrency exchange, contributed to a 10% price increase. The current price of Raydium is $5.90, showing an intraday gain of 6.04%.

Over the past 24 hours, the price has ranged between $5.73 and $6.49, with trading volume reaching $214 million and a market capitalization of $1.7 billion. Moreover, the price trades well above the 200-day simple moving average of $0.296, with a deviation of 1,961.27%, indicating strong upward momentum over time.

Raydium has shown positive price movement for 16 of the last 30 days, reflecting a success rate of 53%. Its high liquidity relative to its market cap further strengthens its position in the market.

Welcoming @SkyEcosystem to @solana

The best home for stablecoins just got stronger! 💪 https://t.co/tp1KL5uhcy

— Raydium (@RaydiumProtocol) November 19, 2024

The recent increase in trading volume has contributed to the price surge and highlights a favorable market sentiment. If the current trend continues, Raydium may approach the $7.00 mark, though this depends on continued adoption and its performance within the broader cryptocurrency market.

3. Flockerz (FLOCK)

Flockerz has drawn attention by raising over $2.8 million in an ongoing presale campaign. The current price of each FLOCK token is $0.0061015. In two days, the price will increase as the presale enters its next phase. This pricing model encourages early participation by offering lower costs at initial stages.

Meanwhile, a notable aspect of the Flockerz ecosystem is its “vote-to-earn” (V2E) mechanism. This model rewards participants for contributing to project-related decisions, giving them a direct role in shaping the project’s development. Unlike many meme coins that offer limited utility and user engagement, Flockerz seeks to involve its community actively. This approach aligns token rewards with participation, fostering a sense of ownership among holders.

🐦 Shout out to The Flock!! 💙

Flockerz just passed the 2.5M milestone and The Flock looks like it's just getting started! 🔥

The future of The Flock is looking bright! 💙🐦 pic.twitter.com/ZEzGWDsf6E

— Flockerz (@FlockerzToken) November 20, 2024

The broader meme coin sector has been gaining traction, with projections indicating sustained growth. Flockerz’s model, focusing on community-driven decision-making, may offer a distinct value proposition. While this framework adds a layer of engagement, the project’s long-term success depends on how well it maintains this momentum post-launch.

Market analysts view Flockerz with cautious optimism. Its unique approach and the ongoing interest in meme coins could bolster its performance upon exchange listing. Potential investors should evaluate the project’s fundamentals and broader market conditions before deciding.

4. Pepe (PEPE)

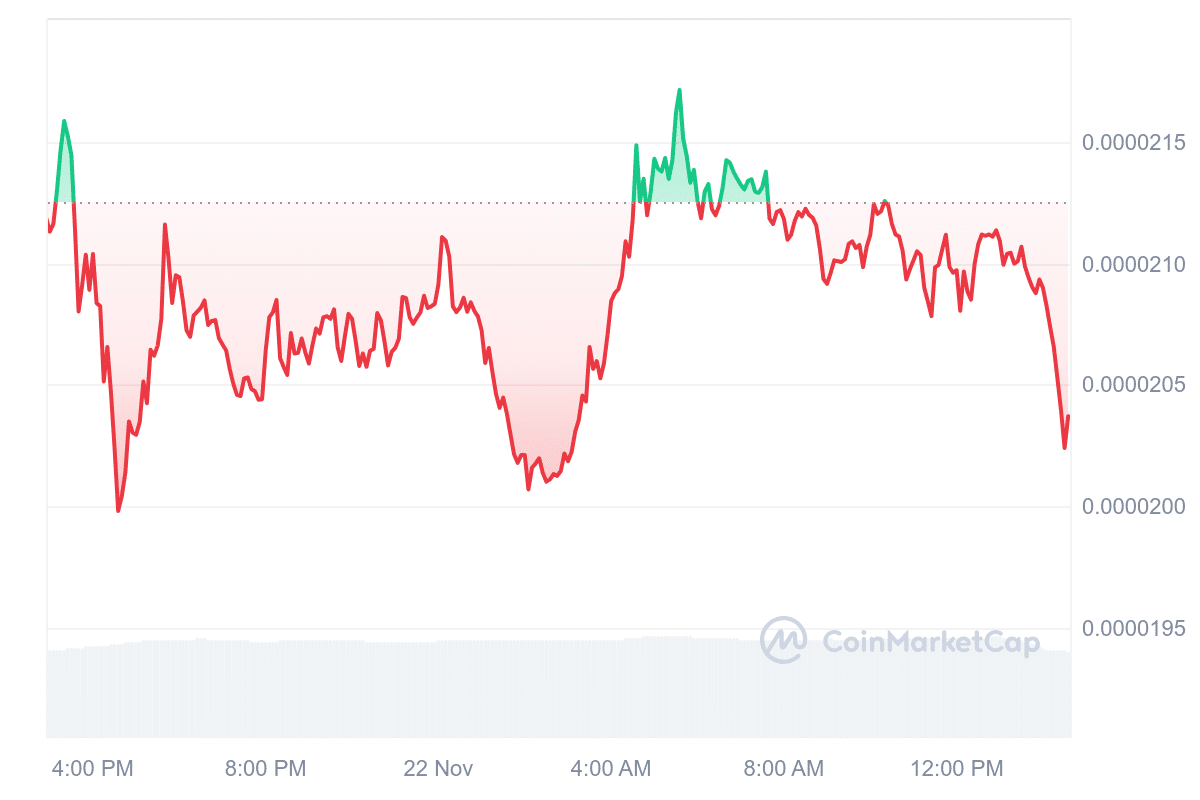

PEPE has seen notable activity recently, reaching an all-time high of $0.00002524 on November 14 before retracing to $0.00002026, marking a 5.87% decline in the past 24 hours. The token recently crossed a critical technical milestone as the 50-day moving average moved above the 200-day moving average, often considered a sign of potential bullish momentum.

Over the past month, PEPE recorded price increases on 15 occasions, reflecting steady upward movement during half of that period. The Fear & Greed Index indicates extreme greed with a score of 94, highlighting strong positive sentiment. However, the 14-day Relative Strength Index is at 42.74, suggesting the token is neither overbought nor oversold and may see sideways trading in the short term.

Meanwhile, the 24-hour trading volume-to-market-cap ratio of 0.3678 points to moderate liquidity. Community interest in the meme coin remains high, as seen in significant trading activity and price movements. While the token shows potential for further volatility, its current indicators suggest a mixed outlook.

5. Aave (AAVE)

Aave is considering integration with Spiderchain, a Bitcoin Layer 2 network developed by Botanix Labs. This proposal aims to connect Ethereum’s DeFi ecosystem with Bitcoin’s network, creating opportunities for users from both communities to engage in new financial activities.

Spiderchain focuses on attracting Bitcoin investors, particularly those exploring on-chain transactions for the first time. By integrating Aave’s lending and liquidity services, the initiative could enable Bitcoin holders to access decentralized finance tools without leaving their ecosystem. This approach can potentially bridge liquidity from Ethereum to Bitcoin, encouraging interaction between the two networks.

Users can now supply and borrow rsETH, @KelpDAO's liquid restaking token, on the Aave v3 Ethereum market.

Per the proposal, rsETH depositors into Aave will also accumulate Kelp miles and EigenLayer points.https://t.co/qVB1spxjBS pic.twitter.com/rqFJJenIYe

— Aave Labs (@aave) November 21, 2024

The collaboration may also expand Bitcoin’s use in DeFi while demonstrating how blockchain platforms can work together. However, such integrations require addressing technical, security, and adoption challenges to ensure ecosystem trust and functionality.

AAVE, the protocol’s native token, is currently trading at $164.34, significantly above its 200-day simple moving average of $78.04. This performance reflects strong market liquidity and interest.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage