Join Our Telegram channel to stay up to date on breaking news coverage

Australia’s central bank said the launch of a Central Bank Digital Currency (CBDC) is some years away due to unresolved issues encountered by a pilot project.

That was the conclusion of a year-long study jointly conducted with the Digital Finance Cooperative Research Centre. The report found a number of legal, regulatory, technical, and operational issues that require further research.

“Given the many issues that are yet to be resolved, any decision on a CBDC in Australia is likely to be some years away,” the report said.

RBA Expects Years of Further Research

From March to July this year, the RBA and Digital Finance Cooperative Research Centre experimented with CBDCs in various use cases.

The pilot project entailed the RBA issuing a limited-scale trial CBDC in a ring-fenced environment to specific industry partners. The participating firms ranged from emerging fintech ventures to established banking institutions such as ANZ, Commonwealth Bank, and Westpac.

The pilot phase was conducted with the aim of interacting and working with various industries to investigate use cases for a CBDC which the central bank has been working on over the past few years. Eventually, a total of 16 use cases were submitted by the industry participants.

A year-long research project by the Reserve Bank of Australia has uncovered a number of legal, regulatory, technical and operational issues that could stymie the introduction of a central bank digital currency (CBDC)

Operating in a ring-fenced environment and involving a digital… pic.twitter.com/RkGDohPURV— jamiemcintyre (@jamiemcintyre21) August 23, 2023

For instance, based on the results, the experiment found that users have an issue with key management. “For end users of tokenized assets, which include stablecoins and the pilot CBDC, key management remains a practical challenge,” the report said.

This has been a prevalent issue in the crypto community especially among businesses that use security keys for multi-tiered approval processes for significant transactions.

“Considering the broader context – where the Australian payments system is currently meeting most of the needs of end users and work on CBDC in advanced economies is generally still in an exploratory stage – it is likely that any serious policy consideration of issuing a CBDC in Australia is still some years away,” it said.

CBDC May Be Useful

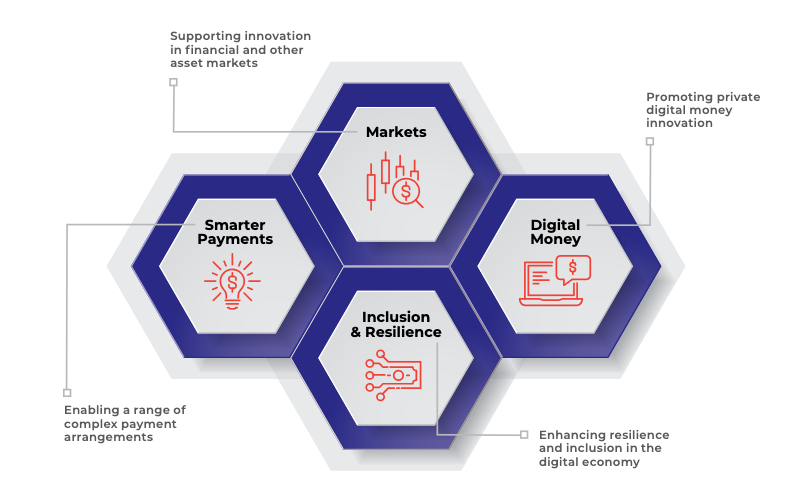

Aside from finding issues with the project, the RBA also found that the CBDC could be applied successfully in four main areas. These areas included facilitating “smarter” payments, where a tokenized CBDC enabled a variety of complex payment arrangements that are not possible with current payment systems.

The central bank also discovered that CBDCs could be used to foster innovation in developing private digital money sectors, assist financial innovation in domains like debt securities markets, as well as improve inclusion and resilience in the larger digital economy.

In addition to these main areas, the participant firms found that the tokens could be employed for atomic settlements, or transaction settlements that are both simultaneous and instant. This was termed beneficial because it would reduce settlement risks and improve efficiency in settlement processes.

Other identified benefits were programmability, where CBDCs could improve efficiency and reduce risk in a range of complex business processes and transparency which would enable users to independently verify their CBDC balances.

While the CBDC proved useful in some cases, the RBA also came to the conclusion that the digital token was not necessary in other cases. According to the report, some benefits could be attained using alternative means such as using privately issued tokenized bank deposits or asset-backed stablecoins.

“It was not clear that CBDC was exclusively required to achieve the desired economic outcomes,” the RBA said.

This shows that the CBDC will not necessarily replace crypto in Australia but will instead complement it. In fact, it highlighted that submissions by some participating industry firms spoke of the potential for privately issued stablecoins that were fully backed by CBDC to more readily compete with digital forms of money issued by regulated financial institutions.

Related Articles

- Binance Denies WSJ Report It’s Facilitating Russia Payments

- While Leading Meme Coins See Declines, Sonik Coin Surpasses $300k in Presale with Under 14 Days Remaining

- Nomura, CoinShares, and Ledger JV Wins Dubai Operating License

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage