Join Our Telegram channel to stay up to date on breaking news coverage

Tokens associated with artificial intelligence (AI) have seen a loss of value of up to 25% in June as investors lost interest in the space following chipmaker NVIDIA’s (NVDA) most recent record-breaking quarter.

AI cryptos have been booming in 2023, helped along by the fact that products like OpenAI’s ChatGPT are helping the technology become more widely used. Some AI tokens experienced a brief surge in late May after chipmaker NVIDIA disclosed its optimistic view for AI sales.

However, the tables have turned. Despite Nvidia’s strong quarterly performance, AI tokens appear to be declining after two weeks of upsurge. According to Lewis Harland, Portfolio Manager at Decentral Park Capital, the sub-sector has dropped 16.7% over the last seven days, versus a 6.9% decline in the overall cryptocurrency market.

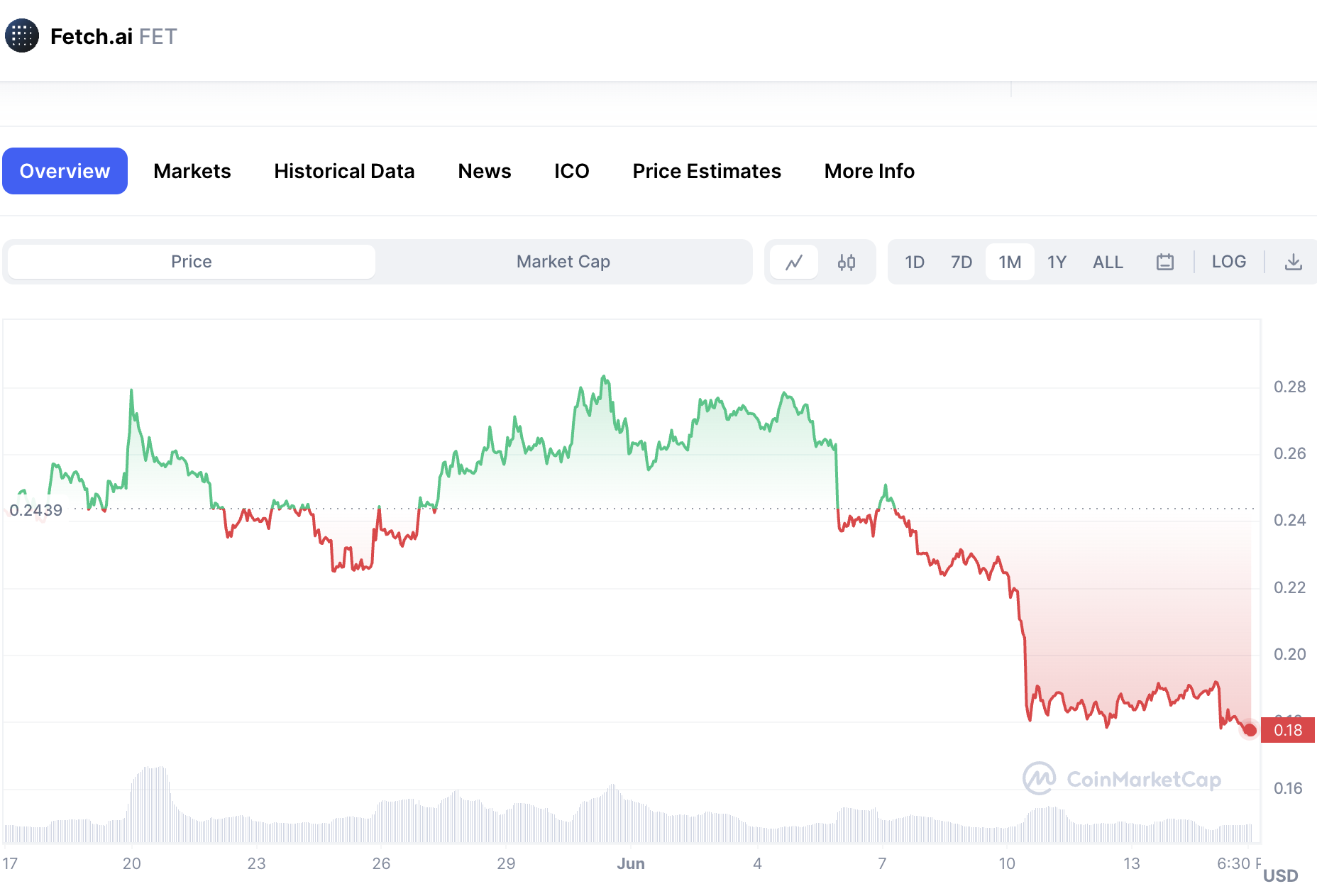

Data from CoinGecko shows that SingularityNE (AGIX), the second-largest AI token by market capitalization, dropped 19% of its value last week. CoinDesk Indices data has also revealed how The Graph (GRT) and Fetch.ai (FET) have both lost close to 25% of their value since the beginning of June.

The Promise of AI and Associated Boom

The rapid mainstream adoption of technology has aided the development of Artificial Intelligence cryptocurrencies like Render (RNDR) and Fetch.ai (FET) in 2023. These cryptocurrencies are typically the corresponding tokens of blockchain-based AI projects.

Fetch.ai, for instance, focuses on building infrastructure for “smart, autonomous services” in supply chain management, finance, travel, and other areas.

Several market experts have long argued that AI and blockchain have tremendous potential for synergy, and AI can act as a beneficial accelerator for the cryptocurrency market as well. In particular, as AI becomes smarter and better at influencing people’s identities on the internet, blockchain technology could be leveraged to scale the deployment of digital identity solutions.

While this could be a long way down the road, and it may be too early to comment on either technology, market sentiments were quick to catch up with the excitement around NVIDIA last month.

Due to rivalry among big and small tech companies to integrate generative AI capabilities into their products, NVIDIA momentarily crossed the $1 trillion market value threshold in late May. Recent Google I/O and Microsoft Build conferences placed a strong emphasis on AI tools, and NVIDIA is a vital supplier for companies aiming to create AI-based solutions. In just three months, NVIDIA made more than $2 billion in profit, according to its most recent quarterly financial report.

Simultaneously, AI-themed cryptocurrencies saw a boom with the increasing demand for chips that power AI applications. Certain AI cryptocurrency assets increased by more than 80%.

Weakening Sentiments and Piling Losses

While the first few months of investing in cryptocurrencies were fairly rewarding, with Bitcoin rising by more than 71% in Q1 and the majority of Altcoins riding along the same bullish wave, the attitude has quickly begun to wane.

The Q2 returns for BTC are at -12.2%. Even though there is still half a month to go, the macro-sentiment is still battered, so it’s possible that the situation won’t change. AI tokens are following BTC’s signals too.

Fetch.AI market trend in 1 month

All five of the top AI tokens were trading in the red daily, with losses ranging from 3% to 11%. On the weekly, the situation was considerably worse. Graph, Render, Injective, Oasis, and Singularity reduced their values by 12% to 25%.

Meanwhile, the green streak for Nvidia is still going. It increased by more than 4.8% yesterday, and it is up more than 14% every week. Therefore, it wouldn’t be incorrect to claim that the NVIDIA-caused AI token boom era has passed.

The doors leading to recovery are not shut, notwithstanding the most recent decline in AI token value. Another hype rally can be anticipated on the news of any significant bullish revelation relating to AI. These ventures must, however, rely on genuine utility if an organic long-term rally is to take place.

Related News

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage