Join Our Telegram channel to stay up to date on breaking news coverage

The Ethereum-to-Bitcoin (ETH/BTC) pair is approaching a crucial resistance level, sparking anticipation of a potential breakout that could fuel a broader altcoin rally. Crypto analyst Michael Van De Poppe has identified the 0.0285 BTC mark as a pivotal point, suggesting that a breakthrough at this level could trigger Ethereum’s first major surge.

Additionally, macroeconomic developments may further influence market sentiment. With the possibility of altcoins gaining 10-30% in the near term, investors are closely monitoring market movements. As momentum builds, this could be the perfect time to explore the Best Altcoins To Watch Today.

6 Best Altcoins To Watch Today

MANTRA is a security-driven Layer 1 blockchain designed to align with real-world regulatory requirements. Ethena (ENA) has been showing strong market activity, currently priced at $0.4776 after a 7.33% gain in the last 24 hours. Meanwhile, Worldcoin (WLD) has expanded its World ID verification services to Jakarta.

Meme Index ($MEMEX) is gaining momentum in the crypto market, with its presale already exceeding $3.6 million. Render Network is improving access to high-performance GPU resources, providing cost-effective rendering solutions for 3D artists. Solana, ranked #5 among cryptocurrencies, is trading at $198.21, reflecting a 1.25% increase in the past day. Despite reporting a surge in Q4 revenue, Coinbase shares have declined.

1. MANTRA (OM)

MANTRA is a security-focused Layer 1 blockchain designed to meet real-world regulatory standards. It is built using the Cosmos SDK, is compatible with IBC, and supports CosmWasm. Its infrastructure allows institutions and developers to create permissioned applications on a permissionless network.

Recently, MANTRA’s native token, OM, was listed on Bybit Spot, enabling users to deposit and trade OM/USDT. As part of this launch, traders can participate in a 120,000 OM prize pool. Moreover, Bitget Wallet has integrated MANTRA’s mainnet, allowing users to add the network, transfer OM, and engage with MANTRA’s decentralized applications (DApps).

🕉️ $OM is coming to the Bybit Spot trading platform on @Bybit_Official, and you're invited to participate in the token splash event.

Grab a share of the 120,000 $OM prize pool: https://t.co/gZTzglFq7P

Deposits are now open.

Listing time: Today, 13th February 2025 (10:00 UTC). https://t.co/Avl2fOdfrK

— MANTRA ✈️ Consensus 2025 HK 🇭🇰 (@MANTRA_Chain) February 13, 2025

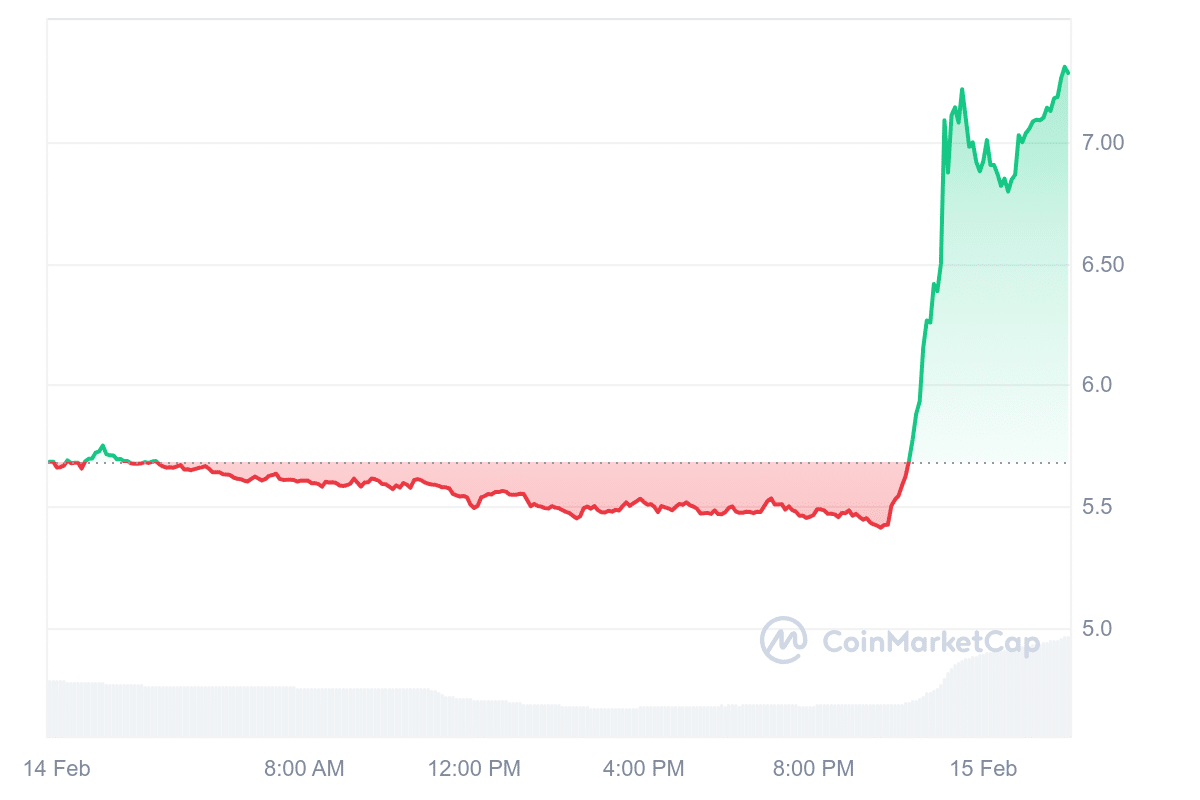

OM’s market performance has shown significant movement. As of the latest update, it has a market capitalization of $7.08 billion and a 24-hour trading volume of $427.02 million. These figures reflect the growing interest in the token, supported by increased exchange listings and ecosystem developments.

2. Ethena (ENA)

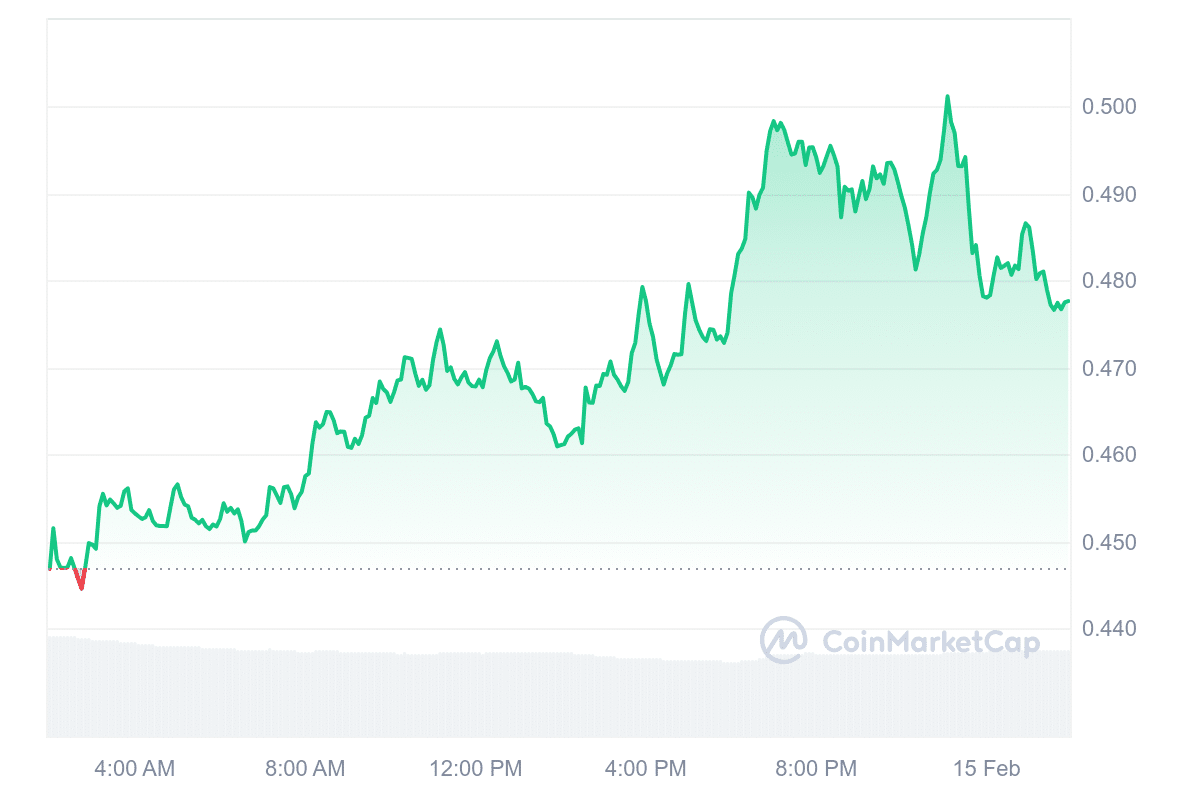

Ethena (ENA) has been experiencing notable market activity. Its current price is $0.4776, a 7.33% increase over the past day. The cryptocurrency has a market capitalization of $1.49 billion, reflecting a 7.51% rise. Trading volume in the last 24 hours reached $228.11 million, contributing to a 15.26% volume-to-market-cap ratio, which indicates significant liquidity.

Market forecasts suggest that ENA may see a 92.42% increase in February, with an estimated average price of $0.9219. Expected price movement ranges between $0.4893 and $1.6626. If the trend follows predictions, the asset could offer a potential return on investment (ROI) of 247.02%, making it an interesting option for traders considering short-term growth.

Excited for USDe to join @USDT0_to as a day one integration partner on @ton_blockchain powered by @LayerZero_Core OFT https://t.co/jpRZbPZhWy

— Ethena Labs (@ethena_labs) February 11, 2025

March projections indicate further gains, with a projected 302.34% increase compared to current levels. The asset may fluctuate between $1.5133 and $2.31, averaging around $1.9276. With an estimated ROI of 382.62%, the trend suggests a continuation of February’s positive momentum. Given the high trading volume and strong market capitalization, ENA appears to have substantial liquidity, which may support price stability.

3. Worldcoin (WLD)

Worldcoin (WLD) recently expanded its World ID verification services to Jakarta. This allows Indonesians to manage their digital identities while keeping pace with AI advancements. This development aligns with Worldcoin’s broader goal of building a decentralized global network.

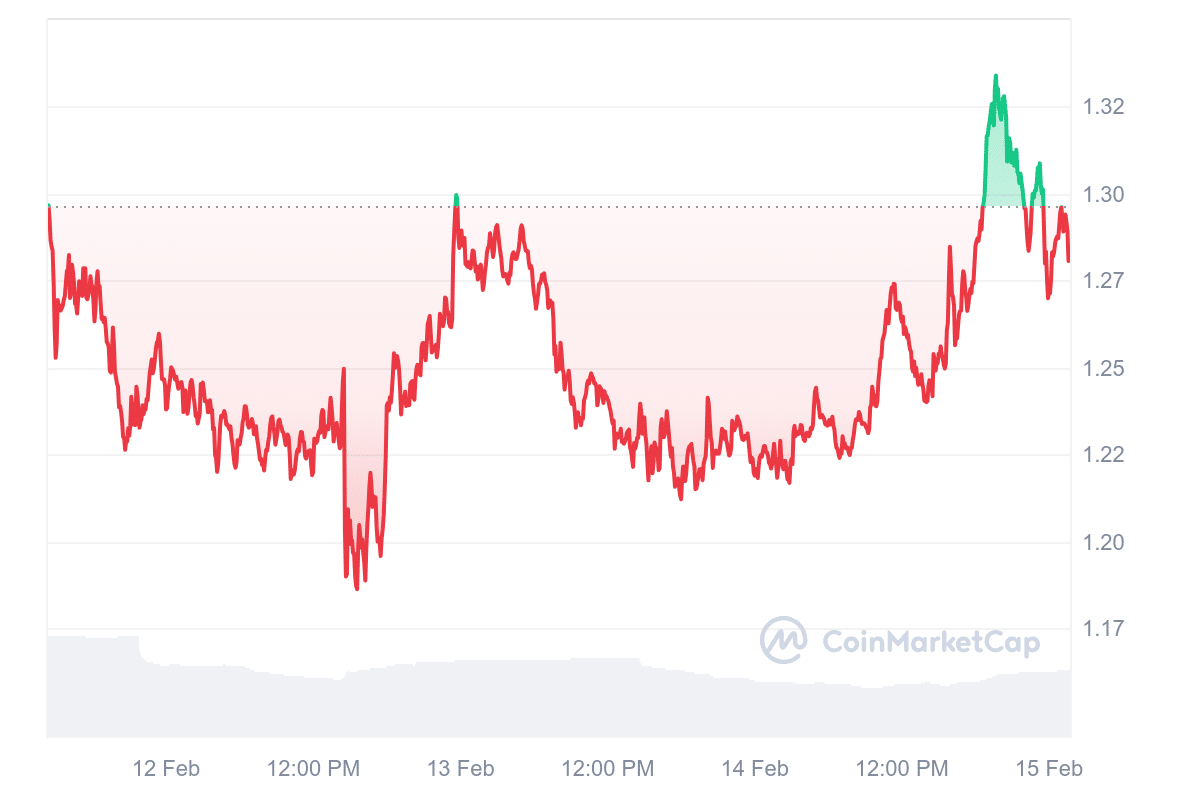

As of mid-February, WLD is trading at $1.28, with a market capitalization of approximately $1.3 billion. Its 24-hour trading volume stands at $192.9 million, reflecting a liquidity ratio of 0.3336. This suggests relatively strong trading activity compared to its total market value. Market projections indicate that WLD could experience notable price growth in the coming months.

World ID verification is now available in Jakarta, helping Indonesians own their data & stay ahead of AI.

Welcome to World Network 🇮🇩 pic.twitter.com/BQTtSQ93pw

— World (@worldcoin) February 12, 2025

Analysts expect its price to rise by 90.46% in February, reaching an estimated average of $2.46. The predicted price range is between $1.31 and $4.42, offering a potential return of 242.45% from its current value. In March, WLD is projected to see further growth, with a potential increase of 296.83%. The expected price range varies from $4.02 to $6.13, with an average of around $5.12. This trend suggests a 375.76% return, presenting an opportunity for traders looking for potential gains.

4. Meme Index ($MEMEX)

Meme Index ($MEMEX) is gaining traction in the cryptocurrency space. Its presale has already surpassed $3.6 million. The project introduces a platform that enables users to invest in meme coin indexes directly on the blockchain. With major cryptocurrencies like Bitcoin, Ethereum, and BNB remaining stagnant, meme coins are becoming more attractive. Meme Index aims to capitalize on this trend by offering diversified exposure.

The platform provides structured index baskets, allowing investors to diversify their holdings. Users can choose from four baskets with varying volatility levels, ranging from high-market-cap coins to speculative microcaps. This approach reduces the risk of investing in individual meme coins while maintaining exposure to the sector.

The meme coin market has outpaced the broader crypto market. Over the past year, its total market cap has grown 3.5x. Some tokens, like Pepe and SPX69000, have surged significantly. However, identifying high-growth tokens remains difficult. Meme Index simplifies this process by offering diversified investments.

Holding $MEMEX grants access to the platform’s investment options, governance, and staking. Investors can buy the Meme Index through its website or the Best Wallet app. Solid Proof and Coinsult have verified its security.

5. Render (RENDER)

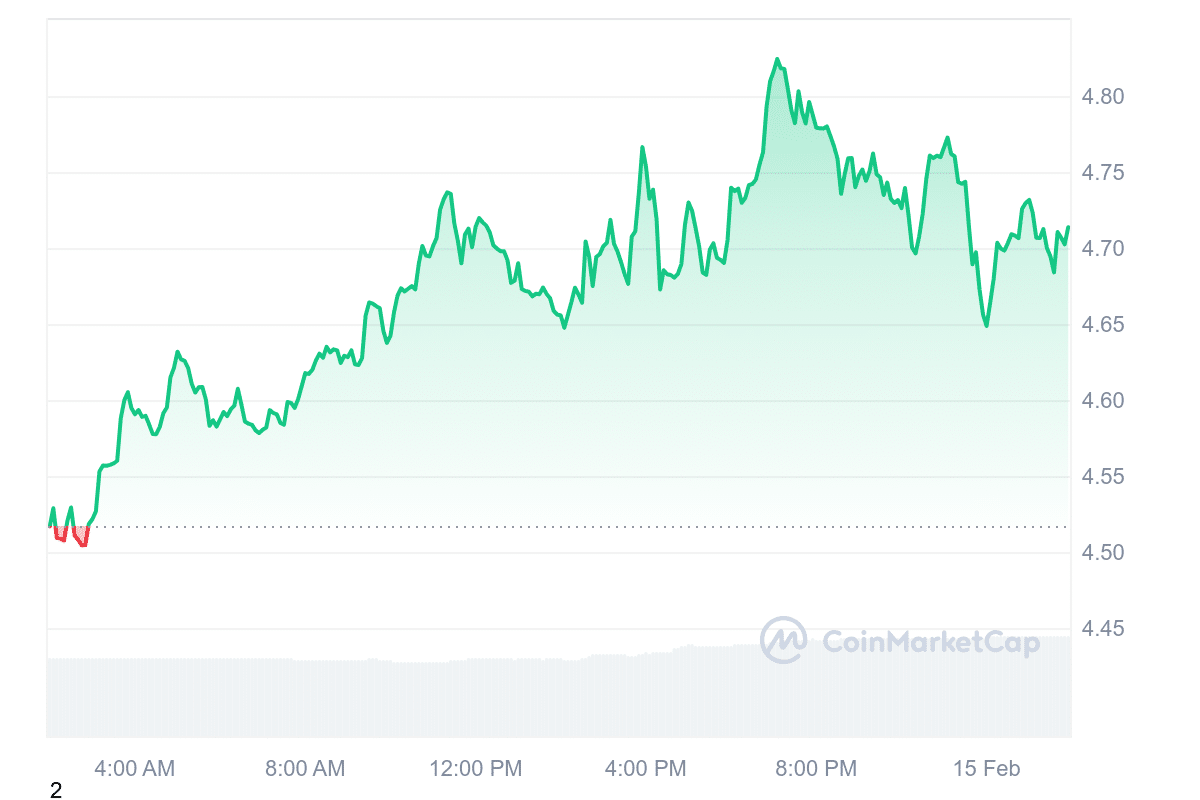

Render Network offers cost-effective rendering solutions to enhance 3D artists’ access to high-performance GPU resources. By utilizing idle GPU power globally, the platform provides scalable computing capacity, reducing creators’ costs.

Currently, Render Token (RENDER) is priced at $4.71 and has a market capitalization of $2.44 billion. Over the past 24 hours, the trading volume reached $73.72 million, indicating a strong liquidity ratio. Looking ahead, analysts predict moderate growth in February 2025, with a potential 3.80% increase, placing the average price around $4.89. The price is expected to fluctuate between $4.68 and $5.27, offering a projected return on investment (ROI) of 11.74%.

In contrast, March 2025 forecasts suggest a slight decline of 4.06%, with prices averaging $4.52. Expected fluctuations range between $4.40 and $4.64, presenting a possible 6.67% ROI for short-term traders. Render Network continues to expand its ecosystem by improving GPU cloud workflows and increasing accessibility for digital artists.

6. Solana (SOL)

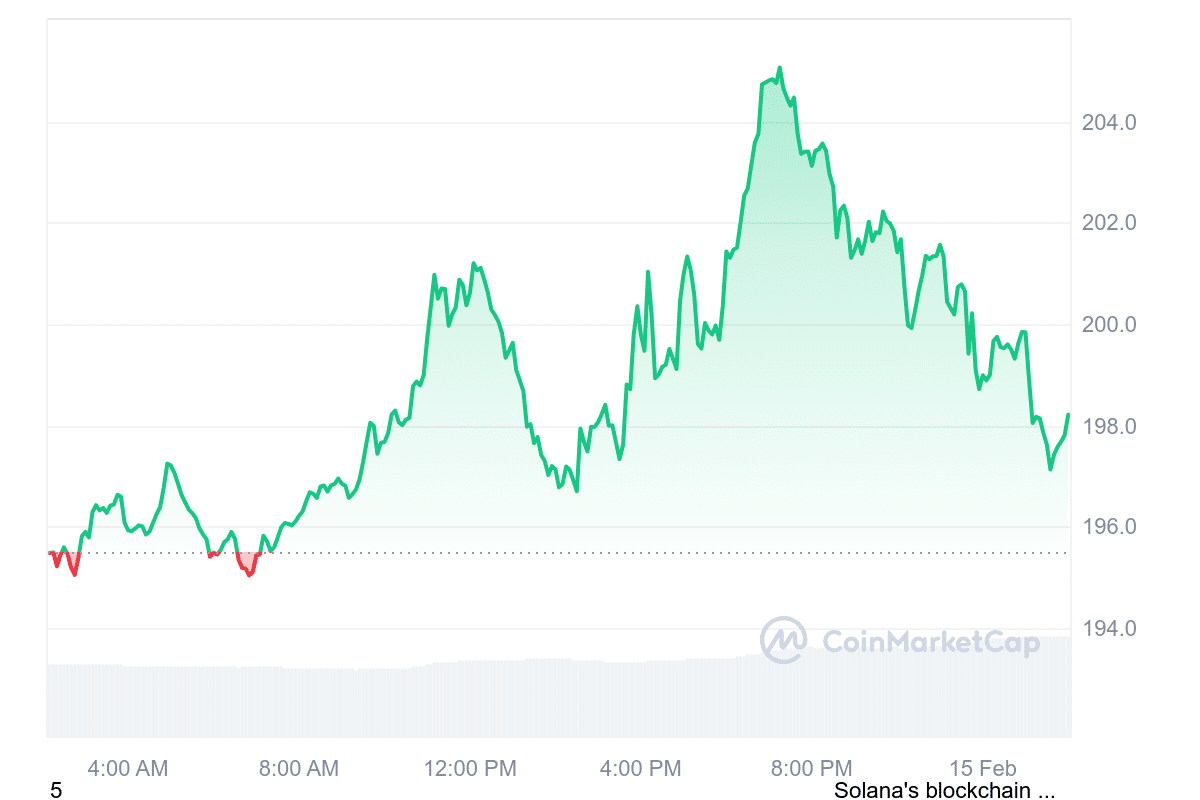

Franklin Templeton, a major asset management firm with $1.5 trillion in assets under management, has expanded its blockchain presence by making its tokenized money market fund (FOBXX) available on Solana. This move highlights the growing adoption of blockchain technology in traditional finance.

Solana, currently ranked #5 among cryptocurrencies, is trading at $198.21, reflecting a 1.25% increase in the past day. Over the last year, its value has risen by 76%, surpassing 67% of the top 100 digital assets in performance. It is also trading above its 200-day simple moving average (SMA) of $190.14, with a 4.49% premium, indicating sustained upward momentum.

Breaking news: $1.5T AUM firm Franklin Templeton’s tokenized money market fund (FOBXX) is now available on Solana!

This is finance evolving in real-time 🧵 pic.twitter.com/Yuv3otnuOk

— Solana (@solana) February 12, 2025

With a market capitalization of $96.78 billion and a 24-hour trading volume of $3.77 billion, Solana demonstrates strong liquidity. Its price remains above its token sale value, suggesting positive investor sentiment. The integration of Franklin Templeton’s fund with Solana reflects confidence in the blockchain’s efficiency and scalability. This development could further drive institutional interest in tokenized assets and decentralized finance.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage