Join Our Telegram channel to stay up to date on breaking news coverage

Barry Silbert, CEO and founder of Digital Currency Group (DCG), has expressed optimism about decentralized artificial intelligence (deAI) as a transformative force in the crypto sector. In a recent shareholder letter, he emphasized DCG’s growing interest in deAI, suggesting that its long-term impact could exceed Bitcoin’s value.

Silbert sees significant potential in integrating blockchain technology with AI and describes it as a significant opportunity for the cryptocurrency industry. DCG, a key player in the digital asset market, has already committed $105 million to over a dozen projects focused on decentralized AI. In light of the positive crypto market wave, this article outlines other affordable tokens, particularly the best altcoins to watch today.

5 Best Altcoins To Watch Today

OKB, the utility token of OKX Exchange, is currently priced at $47.02. Aethir and Lyn have partnered to support video AI initiatives by launching a $5 million ecosystem fund. XRP has experienced an upward trend, increasing by 1.42% to $2.41 in the past 24 hours.

Solana (SOL), holding the fifth spot in the cryptocurrency rankings, continues to show steady growth. Meme Index ($MEMEX) has attracted attention, securing $3.4 million in its presale within a few months. Meanwhile, Ether has declined by 20% over the past week due to inflation and tariff concerns.

1. OKB (OKB)

OKB, the native utility token of OKX Exchange, is currently trading at $47.02. Its price has increased by 1.08% in the last 24 hours. The token has a market capitalization of $2.82 billion and a 24-hour trading volume of $4.85 million, reflecting solid market activity.

Market analysts predict a 12.71% growth in February 2025. The average price is expected to reach $52.95, fluctuating between $46.60 and $58.45. This offers a potential return on investment (ROI) of 24.41% compared to the current price. If this trend continues, March could see further gains. OKB’s price may rise by 15.47%, trading between $51.41 and $57.66. The projected average price is $54.25, resulting in a potential ROI of 22.73%.

Trending this week on #OKX:

❇️ Listed: $BERA Spot

❇️ Coming Soon: OKX Film Premiere

❇️ Celebrated: Best Crypto Exchange 2024 Award from @Tradingview pic.twitter.com/qeS7P8MAf5— OKX (@okx) February 8, 2025

By April, the token’s upward momentum may become even stronger. Analysts suggest OKB could reach a high of $77.86, marking a 65.72% increase from current levels. The expected price range is $54.74 to $77.86, with an average of $61.63. If these predictions hold, OKB may offer significant gains for long-term investors.

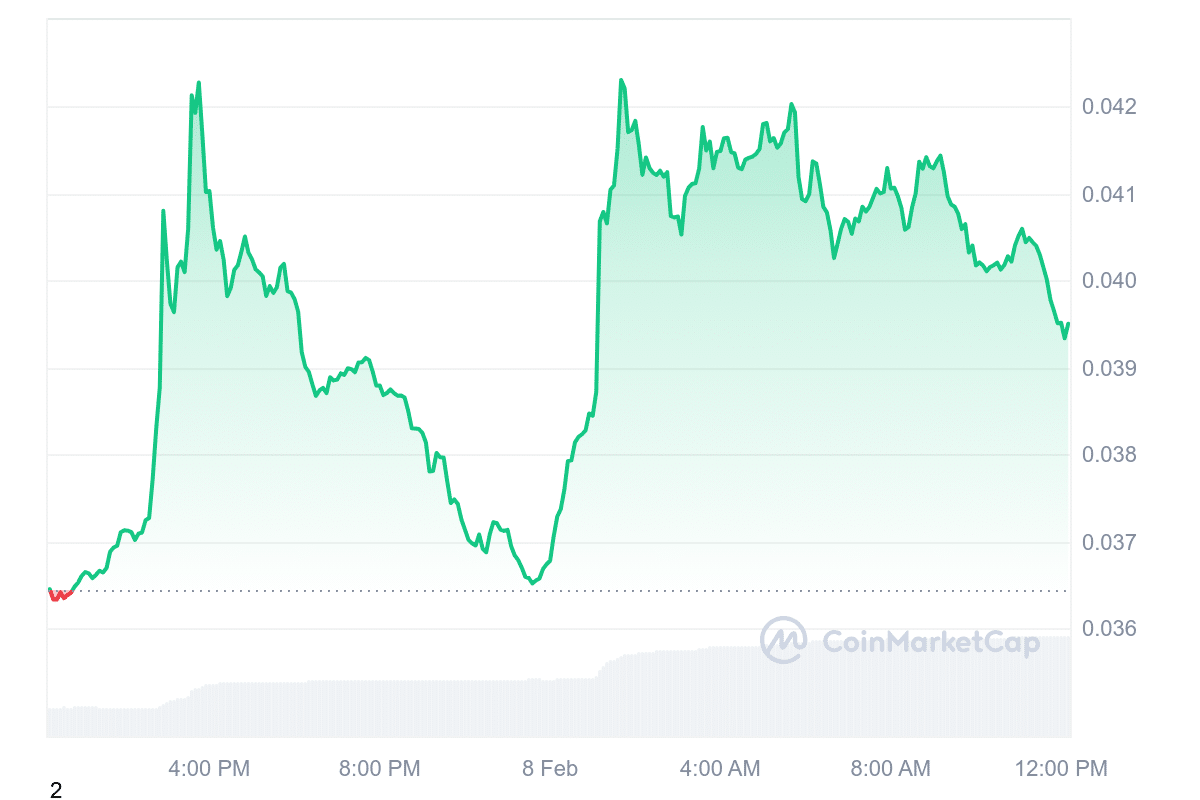

2. Aethir (ATH)

Aethir and Lyn have announced a collaborative initiative to support video AI projects, introducing a $5 million ecosystem fund. This partnership aims to advance AI-driven video generation by leveraging Lyn’s network alongside Aethir’s computing resources.

In the coming weeks, additional details regarding investment timelines for AI projects on Lyn’s platform will be disclosed. This development signals a growing interest in AI-based video applications, aligning with broader trends in machine learning and digital content creation.

Market projections for Aethir (ATH) suggest a significant price increase in early 2025. Analysts forecast a potential growth of 81.42% in February, with prices expected to fluctuate between $0.03827 and $0.132713. If this trend continues, March could increase further, with estimates ranging from $0.120691 to $0.185008. This would represent a 282.36% change from the current valuation.

📹 Aethir x Lyn: Advancing Open-Source Video AI Technology & launching joint $5 million fund

To mark our first major step into the world of Video AI, @AethirCloud is joining forces with @everlyn_ai to push the limits of video production and drive the adoption of Open-Source… https://t.co/rJXVmIn9GD

— Aethir Ecosystem (@AethirEco) February 6, 2025

By April, ATH may stabilize from $0.096702 to $0.143078, reflecting a 255.14% shift. These projections indicate a potentially profitable opportunity for long-term investors.

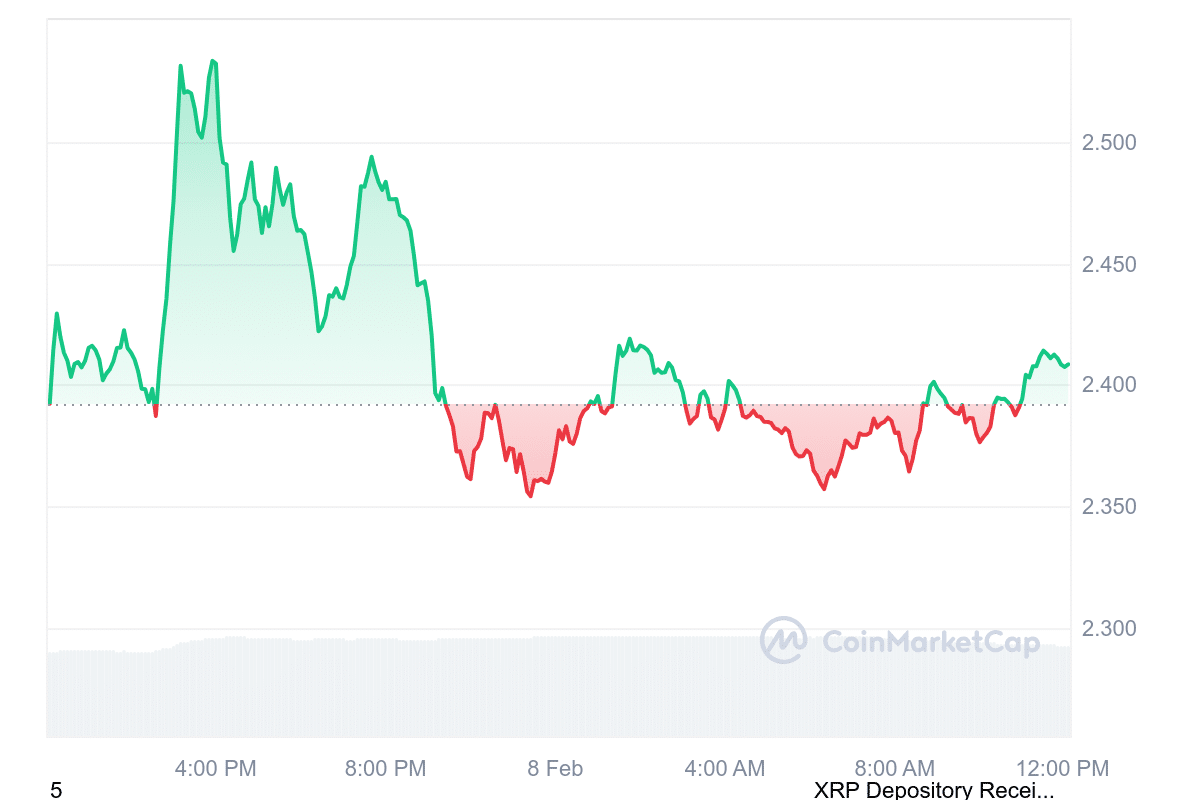

3. XRP (XRP)

XRP has shown positive movement in recent trading sessions, with its price rising by 1.42% to $2.41 in the last 24 hours. Trading volume also increased by 7.37%, reaching $8.38 billion. Over the past year, the asset has gained 363%, outperforming most top cryptocurrencies, including Bitcoin and Ethereum. It also trades 48.17% above its 200-day simple moving average, indicating sustained market strength.

Institutional interest in XRP is gaining momentum, mainly through Depository Receipts offered via Anchorage Bank. This initiative provides a structured investment route for institutional participants. At the same time, applications for spot ETFs could bring an estimated $4–$8 billion into the market if regulatory approvals are granted. These factors suggest increasing recognition of XRP in the broader financial ecosystem.

Further adoption is evident in Ripple’s RLUSD stablecoin, now integrated with the FedNow system. This development enhances real-time payment capabilities, potentially expanding the role of digital assets in mainstream financial transactions.

🚨 New partner alert: Ripple USD – a trusted, transparent, and regulated stablecoin built for payments – is now available for trading on @ZeroHashX and @RevolutApp!

Get $RLUSD: https://t.co/jrEiNBWKgN pic.twitter.com/36q5OU5xfa

— Ripple (@Ripple) February 5, 2025

Looking ahead, market projections for February suggest XRP could see a 2.81% increase, averaging around $2.49, with potential price fluctuations between $2.38 and $2.64. In March, analysts anticipate a further rise, with an estimated high of $3.14 and a low of $2.41, bringing the average to approximately $2.56. If these trends hold, the potential return on investment (ROI) could reach 29.59%, presenting an opportunity for long-term traders.

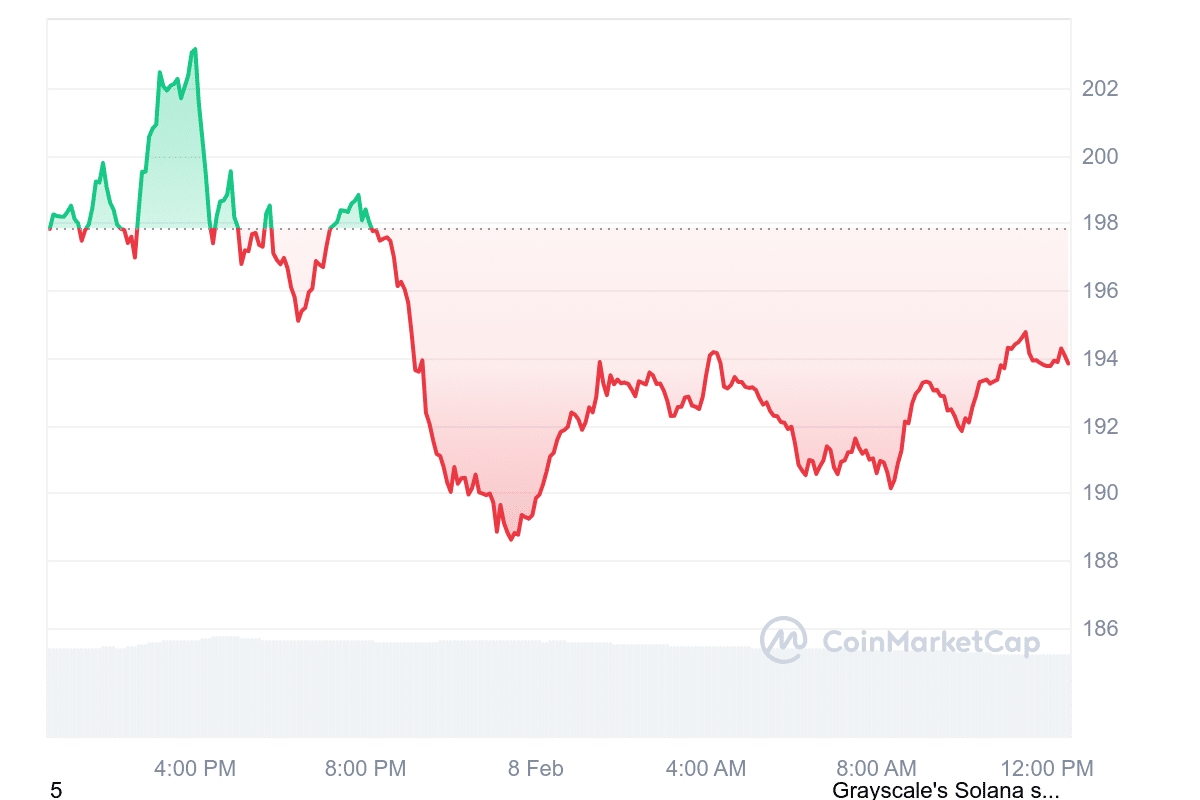

4. Solana (SOL)

Solana (SOL), ranked #5 in the cryptocurrency market, has steadily grown. It currently trades at $193.83, reflecting a 2.30% daily increase. With a market cap of $94.55 billion, SOL maintains strong liquidity. Over the past year, its value has risen by 85%, outperforming 72% of the top 100 digital assets.

SOL is also 2.20% above its 200-day simple moving average (SMA) of $190.14. This indicates an overall upward trend. Its current price remains higher than its initial token sale value, reinforcing positive market sentiment.

In February 2025, forecasts suggest a 4.75% increase, with SOL averaging $203.85. The price is expected to range between $190.83 and $210.18, potentially yielding an 8.00% return. By March, analysts predict further growth of 1.87%, bringing the average price to $198.26. The projected high is $213.75, while the lower limit is $186.04. If this trend continues, the potential return could reach 9.83%.

April projections indicate moderate gains. SOL may peak at $201.73, with a lower boundary of $186.01 and an average of $194.08. This represents a 3.66% return. Overall, Solana’s performance reflects a stable uptrend. While short-term fluctuations are possible, the company remains above key support levels.

5. Meme Index ($MEMEX)

Meme Index ($MEMEX) has gained attention in the cryptocurrency market, raising $3.4 million within months of its presale launch. The project introduces structure to meme coin investments by offering decentralized indexes with varying risk levels. As meme coins experience large price swings, a structured approach has attracted interest from traders seeking a strategic entry into this volatile market.

By late 2024, meme coins had a market cap of $130 billion. However, they declined to $70 billion by February 2025. This highlights both the potential and risks of investing in this sector. The Meme Index seeks to reduce uncertainty by categorizing investments based on market cap and risk exposure.

The platform features multiple curated indexes. These include the Meme Titan Index for established tokens like $DOGE and $SHIB, the Meme Moonshot Index for emerging projects, the Meme Midcap Index for moderate-risk assets, and the Meme Frenzy Index for highly speculative investments. A key feature is decentralized governance, where $MEMEX holders vote on asset inclusion.

The project has attracted analysts and influencers like YouTuber ClayBro. It also offers staking opportunities with dynamic APY up to 667%. Currently, 149 million tokens have been staked. However, as participation increases, rewards may decrease. Meme Index has undergone audits by Coinsult and SolidProof, ensuring security. Investors can purchase $MEMEX through the official presale site using various payment methods.

Learn More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage