Join Our Telegram channel to stay up to date on breaking news coverage

The decentralized finance (DeFi) sector has contributed a total volume of $5.22 billion, constituting approximately 10.96% of the overall crypto market volume. Concurrently, stablecoins, known for their relative price stability, have seen substantial movement, commanding a volume of $42.21 billion, making up 88.66% of the total 24-hour crypto market volume.

5 Best Altcoins to Invest In Right Now

These metrics depict a dynamic cryptocurrency market characterized by notable market cap and trading volume increases. The prominence of DeFi, alongside the stability offered by stablecoins, underscores the diversification and maturation of the crypto landscape. At the same time, Bitcoin’s dominance continues to assert its standing among digital assets.

1. MultiversX (EGLD)

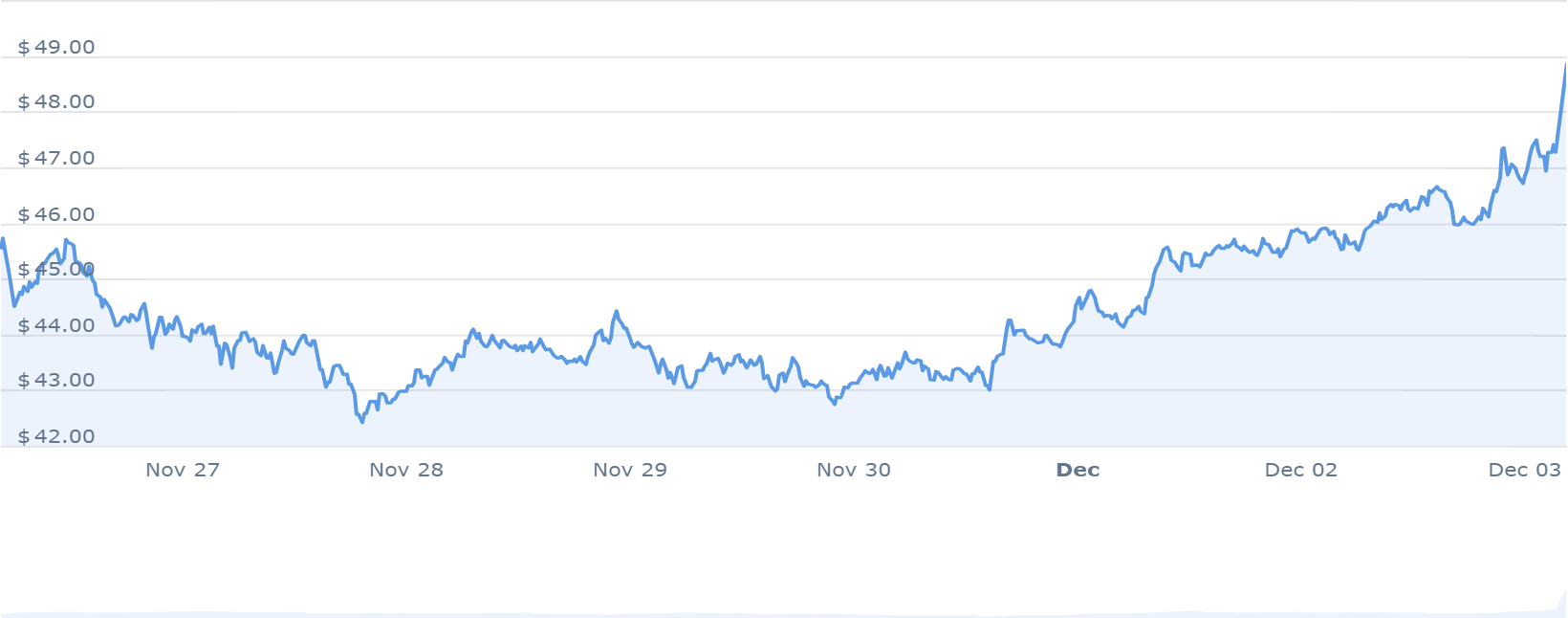

MultiversX, operating on the Elrond network, displays several notable trends and metrics. Over the past year, its price has increased by 11%, consistently trading above the 200-day simple moving average and outperforming its token sale price. Within 30 days, it experienced 15 positive trading days, constituting a 50% positive trend. Moreover, the asset maintains high liquidity, reflected in its market capitalization.

Presently, MultiversX (Elrond) is priced at $48.97, with a 24-hour trading volume of $218.73 million and a market capitalization of $1.16 billion, holding a market dominance of 0.08%. The recent surge recorded a 7.50% increase in the last 24 hours.

The current circulating supply is 23.74 million EGLD out of a maximum supply of 31.42 million EGLD. Based on the market cap, this positions MultiversX at #28 within the Layer 1 sector. Moreover, the protocol stands out for its adaptive state-sharding algorithm. Hence, it employs a modified proof-of-stake mechanism for enhanced network security and integrity.

Projections indicate a bullish sentiment for MultiversX’s future price. The Fear & Greed Index currently registers at 73 (Greed). However, price predictions suggest a maximum potential price level of $46.37 by the end of 2023.

24h left to join the Governance vote on the Sirius mainnet upgrade proposal.

All $EGLD stakers are eligible to participate.

Be part of it & contribute to the protocol development!https://t.co/TqPCAIFOIH

— Multiversᕽ (@MultiversX) December 2, 2023

Furthermore, an average anticipated value of around $39.74 is expected, assuming sustained investor interest and market stability. However, the price could drop to $34.09 in a potential bearish market scenario by 2023.

Nonetheless, an optimistic outlook foresees a substantial price increase in the latter part of the year, potentially due to a bullish rally. The projected future value of the EGLD Coin appears contingent on ongoing efforts by network developers and continued investor participation. This aligns with expectations of an upward price trajectory.

2. Bitcoin SV (BSV)

Bitcoin SV (BSV) has seen a 17% price increase over the past year. This growth has positioned it ahead of 50% of the top 100 crypto assets during this same timeframe, showcasing a comparative performance. Presently, it maintains a trading position above the 200-day simple moving average, reflecting a sustained upward trend.

Examining recent trends, BSV has experienced 15 positive trading days within the last 30, marking a 50% success rate in recent market movements. Additionally, its liquidity, measured by market capitalization, remains notably high.

Current figures indicate a yearly inflation rate of 1.74%, which has resulted in the creation of 334,201 BSV in the past year. BSV is priced at $49.25, with a 24-hour trading volume of $91.40M and a market cap of $963.67M. Despite these figures, its market dominance stands at 0.06%.

With a circulating supply of 19.57M BSV out of a maximum supply of 21.00M BSV, Bitcoin SV ranks at #31 within the Layer 1 sector based on market cap considerations.

Present indicators suggest a bullish sentiment regarding BSV’s price prediction. At the same time, the Fear & Greed Index currently reads 73, indicating a state of greed in the market sentiment.

3. PancakeSwap (CAKE)

PancakeSwap’s recent market movement showcases a noteworthy resurgence from its recent fallback near the $2.74 mark. Despite initial setbacks, the token price has exhibited signs of a bullish trend, hovering around the $2 mark.

Notably, lower price rejections at $2.15 have consistently indicated a potential comeback. Over the past three days, the token has shown a 6% growth, hinting at a potential move towards the $2.74 mark.

A detailed examination of the long-term trend reveals the formation of a significant cup and handle pattern in the PancakeSwap price trend. This pattern emerged during the bearish phase in Summer and currently indicates a neckline at the $2.74 mark.

As the ongoing recovery approaches this critical level, buyers seemingly complete the handle phase, suggesting a possible upward breakout. The CAKE price currently stands at $2.32, marking an intraday gain of 1.73%, reflecting a strengthening bullish momentum. The sentiment surrounding PancakeSwap’s price prediction is currently neutral. Meanwhile, the Fear & Greed Index stands at 73 (Greed).

🔥Boost your LP and snag extra CAKE rewards with @Range_Protocol strategies on BNB & ETH PancakeSwap!

👉Follow these easy steps:

1️⃣ Head to https://t.co/qprhv8x7EA.

2️⃣ Choose your trading pair.

3️⃣ Click on ‘Add Liquidity’.

4️⃣ Decide your stake amount and hit 'Approve & Confirm'— PancakeSwap (@PancakeSwap) December 1, 2023

Regarding supply metrics, PancakeSwap currently has a circulating supply of 234.67 million CAKE out of a maximum supply of 750.00 million CAKE. The yearly supply inflation rate is 56.19%, with 84.42 million CAKE created last year. Within its sector, PancakeSwap is ranked #13 in the DeFi Coins sector, #3 in the Yield Farming sector, and #3 in the Binance Smart Chain sector.

4. Render (RNDR)

The third quarter of 2023 marked a phase of substantial development for the Render Network, focusing on enhancing its capabilities to support various technological advancements. These efforts aimed to enable the network to accommodate general-purpose AI/ML GPU computing emerging rendering technologies in spatial computing. Moreover, it aims to improve native compatibility with Cinema4D files and implement an upgraded SPL RENDER token on the Solana blockchain.

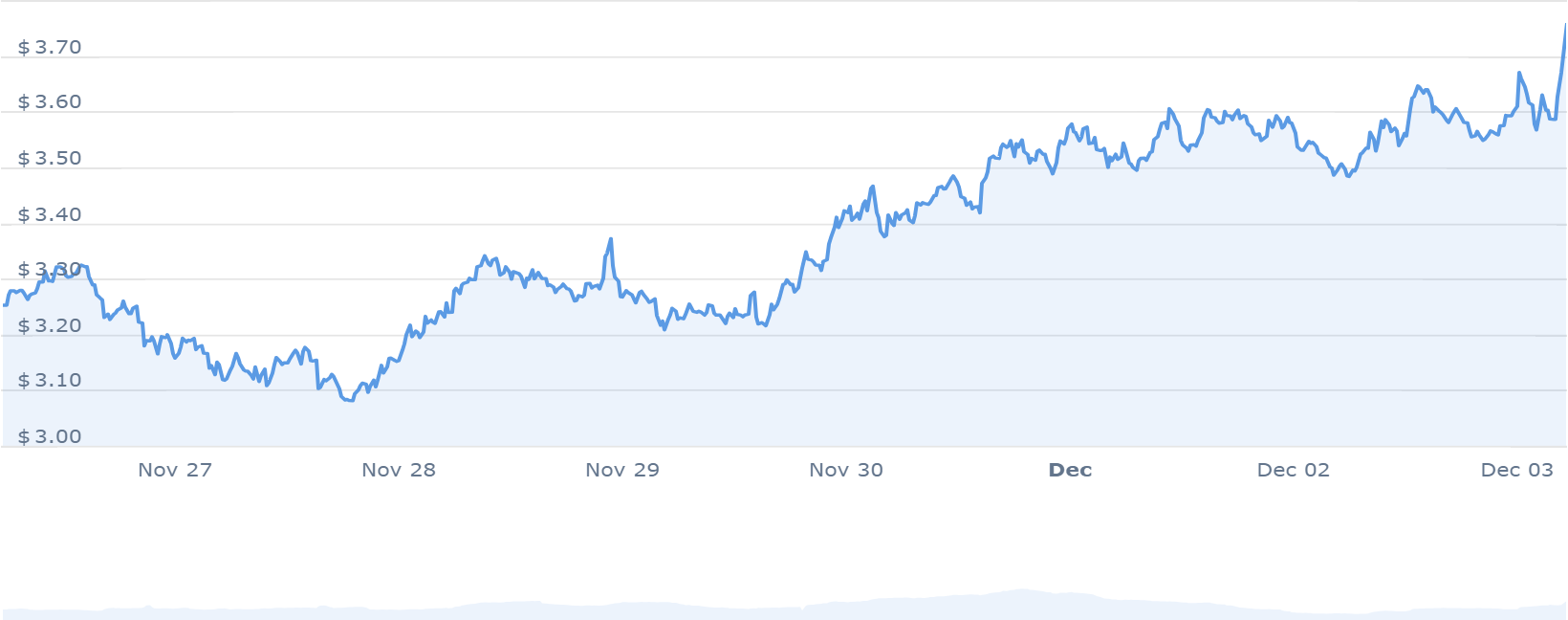

Render Token’s performance highlights include a remarkable 668% price increase over the past year, outperforming 97% of the top 100 crypto assets within the same timeframe. It notably surpassed Bitcoin and Ethereum in performance, trading consistently above the 200-day simple moving average.

Additionally, it registered 20 positive trading days out of the last 30, accounting for 67% of the period. It also hovers near its cycle high, indicating substantial market activity and liquidity based on its market capitalization.

[1/7] Q3 2023 has been pivotal for the #RenderNetwork!

Here's the TLDR breakdown of @rendernetwork's key Q3 & October 2023 metrics from this week's BTN🧵https://t.co/YL2wYJGM1Q

— The Render Network (@rendernetwork) December 1, 2023

Market sentiment predicts a bullish trajectory for the Render Token, coinciding with a Fear & Greed Index reading of 73, signifying a state of “Greed” in the market sentiment.

Market projections suggest a potential maximum price level of $3.42 for RNDR Coin by the end of 2023. However, considering a bullish market outlook, the average token price might hover around $2.67 within the same period.

5. Meme Kombat (MK)

Meme Kombat, a new entrant in the cryptocurrency market, has garnered attention during its presale phase, raising $2,380,157 out of its $2,500,000 target. This project aims to cater to crypto enthusiasts by offering an innovative gaming experience.

> 10m $MK Staked

> 1.7m $MK Paid in Rewards

> 2900 StakersNot too bad fighters💪 pic.twitter.com/N7PHj43qUe

— Meme Kombat (@Meme_Kombat) December 1, 2023

One notable aspect of Meme Kombat is its fusion of staking and betting functionalities, providing users with multiple avenues to interact with the platform and earn rewards. During the presale, 50% of the MK token supply is available at $1.667 per token, with a capped goal of $10 million. The integration of staking and betting is designed to enhance the practicality of MK tokens for the user base.

Plans for Meme Kombat include listing its tokens on a decentralized exchange. The project has allocated 10% of the total token supply to provide liquidity to facilitate decentralized trading. This strategic move aligns with the project’s vision of enabling faster and decentralized token transactions.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage