Join Our Telegram channel to stay up to date on breaking news coverage

1Inch Network token (1INCH) has experienced a significant decline, dropping by nearly 45% from its mid-month high of $0.593 on July 17. The overall bearish sentiment in the crypto market, coupled with the lack of direction from Bitcoin (BTC), has contributed to the downward trend.

Bitcoin’s movements often influence the performance of altcoins, as its rallies attract capital inflows, while pullbacks can negatively impact altcoin gains.

The recent crypto restrictions imposed by the CMA in Kuwait are part of a wider ban on cryptocurrencies, raising concerns about the acceptance and use of virtual assets in the country. Despite these regulations, users believe that decentralized finance (DeFi) cannot be effectively banned.

Indeed, Bitcoin price has something to do with the slump in the 1INCH token price. However, it is not the only source of headwinds. Here is what analysts Jacob Bury has to say about 1INCH

Why does the 1INCH price continue to slump

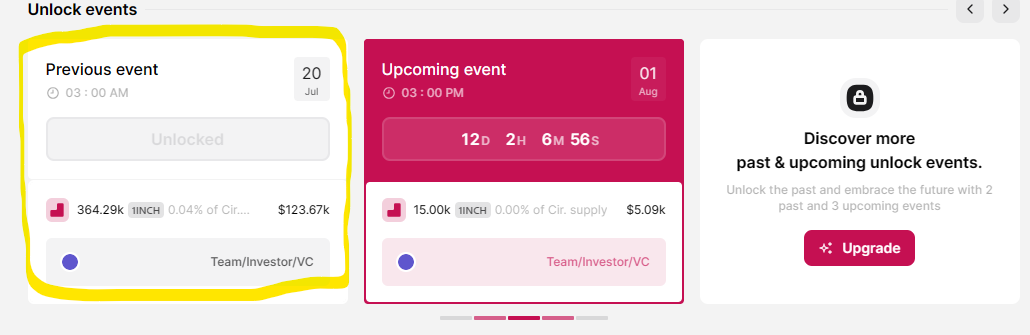

The recent surge in the 1INCH network token’s price is attributed to the anticipation of the token unlocks event on July 20, where whales typically accumulate tokens before their release.

In the most recent event, approximately 10 hours before this report, 0.04% of the token’s total supply (364,290 1INCH tokens) was unleashed into the circulating supply.

After rallying on the news and creating a narrative around the event, the 1INCH token is now experiencing a significant slump due to a mass sell-off by investors.

The drop in price following an unlock event can be attributed to several factors, including the low entry price and high current profit margin offered during the event, poor liquidity in the trading pair, the simultaneous release of a large volume of tokens, and the presence of “flippers” who sell their tokens immediately after the event.

Traders should be prepared for a potential mass selloff after such events.

1INCH price Forecast Amid Massive Selloff

1INCH token is currently trading at $0.340, down 2% for the day and 45% from its mid-July peak. Bulls are attempting to defend against further decline, as indicated by the flattening Relative Strength Index (RSI) and a budding green candlestick on the H1 chart.

If bullish momentum strengthens, the token could surpass the immediate 50-day Exponential Moving Average (EMA) at $0.343 and target the 100-day EMA at $0.377.

Confirmation for conservative traders would be a daily close above the $0.436 level. The RSI and Awesome Oscillator (AO) indicators still support the bulls, with the RSI at 50 and AO above the midline.

If sellers dominate the market, 1INCH price may decline towards the $0.293 support level, resulting in a potential 13% drop.

However, LPX is experiencing significant growth amid the release of nearly 370,000 tokens into the supply.

1INCH Alternative

LPX is the ticker for the Launchpad XYZ ecosystem, an avenue where users can find every tool necessary for successful Web3 operation. The platform is committed to seamlessly delivering the training requisite for successful trading. It can also uniquely empower Web3 to help them maximize their profit-making potential.

Enjoy seamless swaps with our Decentralised Exchange on #LaunchpadXYZ

Trade a wide range of digital assets with unmatched liquidity and experience the freedom of #DeFi today!

Learn more at 👉 https://t.co/CrJA4Rk91H#Web3 #CryptoCurrency #Trading pic.twitter.com/DURbggw0s1

— Launchpad.xyz (@launchpadlpx) July 20, 2023

The LPX token is available to buy in presale, where $1.17 million has already been raised. Buy LPX using ETH, BNB, USDT, or a bank card before it lists on public exchanges.

Also Read:

- Societe Generale Unit Wins First Crypto Licence in France

- CoinGecko’s Q2 Crypto Industry Report: Six Key Takeaways

- Vitalik Buterin Portrait Auctioned as NFT Has $636k Minimum Price

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage