In this guide, we will explore some of the disadvantages of Kraken and suggest alternative platforms that offer better usability, liquidity and safety.

What are Some of the Disadvantages of Kraken?

Kraken is a cryptocurrency exchange that offers access to 140 cryptocurrency trading pairs, hosting some of the more obscure coins and tokens. This opens up a world of highly risky trades, with the potential for rapid asset appreciation.

Kraken is one the few exchanges with a complete fiat gateway. This means that Kraken allows withdrawals in several leading world currencies, instead of only offering withdrawals of cryptocurrencies and tokens.

However, despite its popularity, especially as a vehicle for cryptocurrency speculators to switch to regular currency, Kraken has several serious drawbacks. The well-known Kraken cryptocurrency exchange has shown clear risks and discrepancies over the years.

Being an unregulated platform, like many other cryptocurrency exchanges, Kraken is always at risk of hacks or asset theft. The exchange has also shown some evidence of Bitcoin robot trading.

Other disadvantages include:

- Traders dumping their coins at scale, rapidly decreasing coin prices

- Risk of price anomalies and trading engine flaws that lead to liquidated positions, or abnormal prices

- Risks of losing the coins hosted on the exchange

- Limited regulation on trading practices

For these reasons, we turned to alternatives which operate under stricter regulations, and have a proven track record of smooth, glitch-free trading. The following platforms also free access to useful cryptocurrency tools and educational resources and operate in more markets.

Top Kraken Alternatives – Quick Review

Are you looking for the best Kraken alternative to consider this year? Check out the options below:

- Coinbase – Cheap Transaction Fees

- MEXC – Swift Processing Of Transactions

- eToro – Intuitive Interface & Low Fees

- OKX – Supports A Wide Range Of Cryptocurrencies

- Binance – Overall Best Alternative To Kraken

- Bybit – 24/7 Customer Service

- PrimeXBT – Supports Trading Of Crypto Assets, Commodities, Forex & Indices

- Margex – Top Crypto Derivatives Platform

- KuCoin – Strong Security System

- HTX – Reliable Crypto Exchange

- Pionex – Automated Trading Features

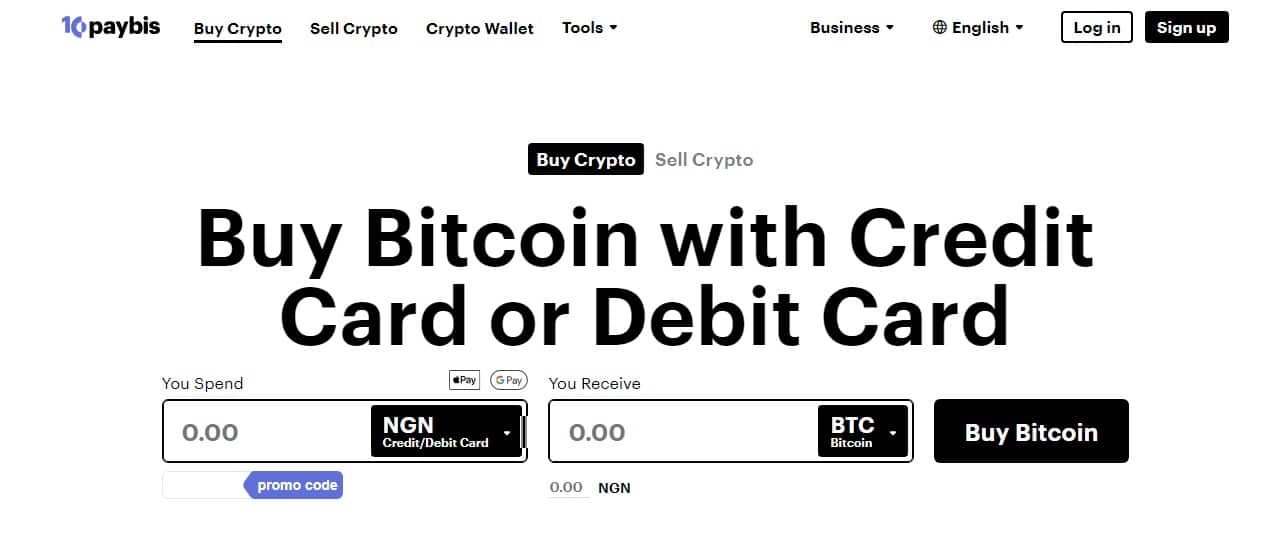

- Paybis – Own BTC With As Low As $5

Best Kraken Alternatives – Full Review

In this segment of our guide, we delve deeper into some of the key offerings provided by all the crypto exchanges listed in our quick review.

Coinbase – Cheap Transaction Fee

Coinbase has been serving crypto traders since 2012, offering them access to more than 242 cryptocurrencies. Coinbase offers cheaper transaction fees compared to Kraken, thanks to its maker-taker model. With this model, the exchange platform charges from 0.00% to 0.40% for maker fees, and 0.05% to 0.60% for taker fees.

Beyond providing a platform for traders to buy and sell a vast range of cryptocurrencies, Coinbase also offers other services like staking, crypto loans, wallet offerings, and many more. Being a global exchange, Coinbase’s services are available to more than 89 million users worldwide. At press time, the exchange is well-known as the largest crypto trading platform in North America.

In recent years, Coinbase has incorporated scores of security measures to deliver optimal security to users and their assets. Some of the mechanisms include withdrawal lock, multi-signature login, Google Authenticator, and 2FA system amongst others.

Also, 98% of users’ deposited assets are stored in a cold wallet. Hence, it is no surprise that users feel comfortable entrusting their assets with the exchange.

As a result of its appealing stature to a wide range of users, Coinbase has more than $1.8 billion worth of user assets under its management. This voluminous AUM is an attestation to how users trust the exchange’s capacity to safeguard their cryptocurrency assets.

MEXC – Swift Processing Of Transactions

MEXC has been one of the most sought-after cryptocurrency exchanges ever since its launch in 2018. The exchange has managed to attract huge patronage, attracting users from every corner of the world, thanks to its swift processing of transactions.

As of the time of writing, MEXC enjoys the patronage of more than 10 million users worldwide and over 3.6 million weekly visits. Either directly or through its subsidiary, MEXC offers crypto trading services in compliance with the regulatory standards of more than 170 countries and regions.

Since it supports over 1,700 cryptocurrencies and hundreds of trading pairs, MEXC is considered one of the top Kraken alternatives to check out this year. More so, with its constant system updates and enabling infrastructure, the exchange has the capacity to process up to 1.4 million transactions at a go.

While Kraken may be a considerable option, MEXC is a good alternative to try out owing to its robust security, high level of transparency, user-friendly interface, swift processing of transactions, and compliance with top global regulatory bodies.

Another keynote about MEXC is its continuous efforts to incorporate industry-leading features and flexibility to add more tokens.

eToro – Intuitive Interface & Low Fees

eToro stands out as one of the most credible alternatives to Kraken. Regulated by tier-1 regulators like the Australian Securities and Investment Commission (ASIC), Cyprus Securities and Exchange Commission (CYSEC), and Financial Conduct Authority (FCA), eToro provides a safe and user-friendly platform for beginners and experienced users to buy, sell, and trade cryptocurrencies.

One standout attribute of eToro is its excellent mobile experience. The platform comes with a mobile application that delivers the same experience as its web version. Users can seamlessly navigate all the features offered by the platform even while on the go.

eToro’s straightforward and simple interface also contributes massively to users’ overall experience. Newbies can carry out basic operations on the site with ease.

Furthering its appeal is its support for demo accounts, meaning users can explore all the trading tools and features on the exchange without paying a dime. Users can also find and imitate the trading strategies of successful traders to net huge returns.

To help traders make informed decisions, eToro provides daily market analysis and weekly webinars. It offers a comprehensive online trading academy featuring scores of videos and articles that are arranged by users’ experience level.

Overall, eToro is trusted by over 40 million users globally. Users can maximize their assets on the platform by taking advantage of its staking mechanism which offers attractive APY rewards.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

OKX – Supports A Wide Range Of Cryptocurrencies

Established in 2017, OKX is a top crypto exchange that caters to different preferences. Apart from buying and selling, anyone who gets started with OKX will get the opportunity to explore an ample of trading tools.

The exchange is a standout option for traders that prioritizes security, seamless trading experience, and a variety of cryptocurrencies. In terms of offering, OKX stands tall above Kraken as it provides basic trading options like spot, margin, futures, and perpetual swaps.

Similarly, OKX offers trading bots that allow traders to make profits through automated trade. At press time, not less than 500 trading pairs are available on the platform. While OKX provides a robust trading platform for beginners, some of its offerings are only suitable for veterans.

That said, there is a demo account feature on OKX for those who are still finding their feet in the crypto trading market. This feature allows users to master their trading expertise without making deposits.

Binance – Overall Best Alternative To Kraken

Binance is renowned as the world-leading cryptocurrency exchange by trading volume. Since joining the crypto space in 2016, it has continued to cater to the diverse preferences and tastes of seasoned investors and newbies, thanks to its user-friendly interface, advanced trading tools, support for a wide range of cryptocurrencies, and leading security mechanisms.

More so, the exchange offers comprehensive services that cut across spot trading, futures trading, and staking options. In addition, Binance offers trading options for more than 400 cryptocurrencies. As such, traders have more than enough options to pick from while using the platform.

Another feature that positions Binance as one of the top alternatives to Kraken is its flexible payment methods. The reputable exchange allows users to make trades using bank deposits, credit/debit cards, and crypto deposits amongst others.

Complementing the lineup of excellent features on Binance is its fully optimized mobile version which delivers the same experience as its web version. Therefore, if you are looking for the right spot to trade, particularly while on the move, Binance could be an ideal choice.

Overall, Binance stands out among its peers with its excellent trading services. Everyone who uses the platform is guaranteed maximum security. In addition, the exchange provides a staking option, making it possible for crypto investors to maximize their assets.

Bybit – 24/7 Customer Service

With more than 3 million registered users globally, Bybit is one of the most successful crypto trading platforms on the planet. It utilizes advanced technologies to deliver a swift, intuitive, and safe crypto trading experience.

Founded by Ben Zhou in 2018, Bybit offers a variety of products like spot trading, margin/leverage trading, long and short trading, derivatives trading, and more. Also, it provides an ultra-secure HD cold crypto wallet storage solution that delivers unparalleled privacy and security.

Another attribute that sets Bybit apart from other crypto exchanges is its easy-to-use interface. Users, including newbies, can shuffle between the various sections on the platform with ease.

Contributing to the overall user experience on Bybit is its well-designed mobile app that makes it possible for everyone to manage their accounts anytime, anywhere. The app is currently compatible with both Android and iOS devices, offering best-in-class trading functionalities.

Like others on this list, Bybit boasts advanced security features that guarantee the protection of users and their assets. Some of the security measures that have been adopted by the exchange are cold wallet storage, two-factor authentication, zero-trust architecture, and authentication layers.

In terms of customer service, Bybit stands out. It has assembled a team of experts who provide professional, timely, and detailed responses to users’ queries.

At press time, Bybit supports more than 640 crypto coins, making it a great choice for those seeking to diversify their investment portfolios.

PrimeXBT – Supports Trading Of Virtual Assets, Commodities, Forex & Indices

If you are looking for a place to explore industry-standard trading options on crypto, forex, commodities, and more, look no further than PrimeXBT. With PrimeXBT, you can easily diversify your investment portfolio with virtual and real-time assets in one spot.

The platform offers traders the pathway to seamlessly swap their virtual assets for forex, commodities, and indices. We consider this to be an outstanding feature, positioning it as one of the top alternatives to Kraken.

Also, the crypto exchange provides an enabling environment for traders to maximize their profits and enjoy a smooth trading experience through its wide range of advanced tools.

You can leverage the up-to-date price chart on PrimeXBT to stay abreast of the price performances of all supported cryptocurrencies. For new users, PrimeXBT offers a generous $100 welcome package that can be unlocked upon the success of their first deposits.

Other innovative features on PrimeXBT include Bitcoin leverage, long/short trading, copy trading, crypto academy, and many more.

Margex – Top Crypto Derivatives Platform

Margex is another trustworthy option for those seeking the best alternative to Kraken. Despite being a no-KYC trading platform, Margex ticks all the right boxes to provide users with optimal security.

Margex’s excellent reputation in the crypto derivatives landscape is underpinned by many factors, including its staggering 100x leverage. This standout offering makes Margex an ideal destination for those seeking to amplify their investment gains.

Margex also has other advanced trading capabilities that cater to different tastes and preferences. First, it hosts a custom-built trading engine that can process up to 100,000 transactions per second.

While experienced traders can take advantage of its accurate real-time market data to make substantial investment decisions, newbies on the site may check out its copy trading option to net huge returns.

With its highly competitive fees, Margex prides itself as an accessible crypto trading platform for all traders, regardless of their caliber. As of the time of writing, Margex does not charge deposit levies though users may be asked to pay a small amount of money as blockchain fees.

Finally, getting started with Margex is quick and straightforward. To support users who might want to navigate the global crypto markets even while on the go, Margex has designed a sleek mobile application accompanied by top charting tools.

KuCoin – Strong Security System

Founded in 2017, KuCoin has earned the trust of a wide range of traders due to its strong emphasis on security. The exchange is commonly referred to as the “people’s exchange” because of its flawless track record when it comes to safeguarding users and their holdings.

More so, KuCoin operates on a transparent, innovative, and growth-driven business model to deliver advanced trading services like margin trading, staking, lending, automated trading, futures trading, and many more. At press time, all these offerings are available to more than 35 million users across 200 countries and regions.

KuCoin supports not less than 700 cryptocurrencies, making it a great choice for traders who love to continuously update their portfolios. Also, you can make deposits on the platform with more than 50 currencies and 70 methods. Like other prominent exchanges, it has a native token, KCS, to support the smooth running of its ecosystem.

In 2023, KuCoin made the list of top crypto exchanges in the world by Forbes. More so, it was recognized as one of the most innovative crypto trading platforms in the Finder’s 2023 Global Cryptocurrency Trading Platform Awards.

HTX (Huobi) – Reliable Crypto Exchange

HTX formerly known as Huobi is a cryptocurrency exchange with an international posture as it offers virtual assets services in more than 100 countries and regions. HTX has been in existence since 2013, making it one of the longest-serving cryptocurrency exchanges on the planet.

On the exchange, users can trade more than 500 cryptocurrencies, 300 trading pairs and make payments with about 20 fiats. Available offerings on HTX include spot trading, margin trading, futures trading, derivatives trading, staking, and crypto loans among many others.

Unlike Kraken, HTX has a tiered fee structure that charges users based on how often they use the platform. Hence, the trading fees vary for users, and it is determined by how often they use the cryptocurrency exchange.

To help traders maximize their investments, Huobi has a crypto saving feature that provides annual capital gains on idle assets. Users can also qualify for its VIP program by raising their EXP (Experience Points) on the platform. You can raise your EXP by engaging in voluminous trades or holding enough cryptos in your Huobi account.

Due to its global posture, HTX supports numerous languages. Above all, the exchange has earned the trust of traders as a result of its strong emphasis on security and compliance. In fact, around 2023, Huobi offered security support and advice to Bitmart, a small crypto exchange, helping the latter improve its safety procedures.

Pionex – Automated Trading Features

Pionex is a strong alternative to Kraken due to its unique approach to cryptocurrency trading. The exchange offers more than 16 AI-powered automated trading bots to make it possible for traders to fully maximize prevailing market conditions to make profits.

Also, Pionex has an enabling feature that allows users to structure bots or select bots that suit their trading strategy. Along with its trading bots, Pionex comes with other innovative tools like spot trading, leverage, and copy trading, and supports at least 370 different crypto assets.

Complementing its unique trading tools is its elegant and easy-to-use interface that facilitates smooth navigation. Therefore, the platform is an ideal destination for those with little or no trading experience.

Traders can also take advantage of Pionex’s lineup of Earn programs. First, it offers a 20% commission rebate through its affiliate program, allowing users to earn by inviting people to use the platform. There is also a staking option on Pionex so that investors can earn passive rewards on their holdings.

Above all, Pionex offers a trial fund of 1288 USDT to new users to explore all its trading features.

Paybis – Own BTC With As Low As $5

Despite being one of the longest-serving cryptocurrency exchanges in the industry, Paybis has ensured that its offerings are in line with existing trends. At press time, it supports close to 100 cryptocurrencies and more than 48 fiats.

At the heart of Paybis is the principle of regulatory compliance. The crypto exchange is on the good books of top regulatory agencies across top countries like the United States, United Kingdom, and Canada. This regulatory feat speaks to its legitimacy and reliability.

Paybis also stands out with its flexible approach to onboarding more users into the cryptocurrency space. The cryptocurrency exchange is committed to ensuring that almost everyone owns BTC. As such, it has a feature that allows users to buy BTC for as low as $5.

Furthermore, Paybis has a simplified registration procedure that allows users to get started on the exchange easily. In addition, the exchange features a user-friendly interface, making it possible for beginners to explore its full features without needing the assistance of third parties.

How we Analyzed Kraken Alternatives

The Kraken exchange has reported $230 million in daily trading volumes. This relatively low number made us seek more liquid marketplaces. Crypto trading on unregulated platforms is also mostly anonymous, and has security concerns. Platforms like Binance remove the anonymity while offering a smoother trading experience with a well-developed trading engine. Our alternative platforms were selected based on the following factors:

- Regulations and transparency: While Kraken is registered with US-based and European regulators, its order books and trading process are entirely unregulated. We looked at alternative platforms that offer stricter oversight in multiple regions.

- Fees: Kraken will levy fees on a sliding scale, starting with 0.16% to 0.24% for market makers or takers. Fees will go down as volumes increase, thus making the exchange unsuitable for small-scale traders with smaller monthly turnovers. Therefore, we consider alternatives with low fees.

- Safety and security: We looked at the potential for losses due to technical factors unrelated to trading. In comparison to Kraken, Binance and others listed in this guide offer higher security which means no risk of hacks or cryptocurrency theft.

Our Verdict

While Kraken is one of the more secure crypto exchanges, we sought alternatives that removed some of the technological risks. So far, some of the platforms listed have not reported hacks or losses, unlike multiple crypto exchanges. Registered CFD brokers also ensure safer trading. Unlike Kraken, the alternative platforms, especially Coinbase offer a fair playground, safe from so-called cryptocurrency “whales”, which can sway the market at any one time.

FAQs

Are there other exchanges like Kraken?

The world of cryptocurrencies saw the rise of many market operators, some claiming significant trading activity. Kraken was among the first, EU-based companies to secure a fiat gateway and operate with some form of regulation. Exchanges similar to Kraken in influence and transparency include Coinbase, MEXC, eToro, OKX, Binance, Bybit, PrimeXBT, Margex, KuCoin, and Huobi.

Why is Kraken trading riskier?

Kraken has no rules on placing orders, wash trading, or anyone selling a significant amount of cryptocurrency. To estimate risk on Kraken, one would have to track cryptocurrency transactions and possibly predict large sell-offs. Kraken has also become one of the exchanges where XRP is liquidated for fiat, thus increasing wild price swings.

Why are platforms like Coinbase better?

Trading on Coinbase is quite better because it features more advanced tools that can help you maximize your investments.

Is Kraken unsafe?

So far, Kraken has not reported large-scale selling. But in the past, Kraken has seen trading anomalies that brought down the price of assets and caused liquidations and losses. Trading on Kraken may be extremely unpredictable, with wash trading and spoof orders changing the direction of prices. Kraken trading volumes also diminish without warning, leading to risks from low liquidity.

What is the best alternative to Kraken for U.S. buyers seeking lower fees?

U.S. buyers may choose Coinbase to avoid inherent fees of cryptocurrency transfers (transaction fees).

What is the difference between Kraken and trading brokerages?

Kraken is a crypto exchange and a platform offering spot trading and limited futures markets. The best trading platforms offer a wider array of assets, and offer exposure to cryptocurrencies without holding the assets.