Given the sensitive nature of crypto funds, it is mandatory that you take time to analyze the exchange you want to use. In this CEX crypto exchange review, we have examined the key features of the exchange as well as how it works.

Given the sensitive nature of crypto funds, it is mandatory that you take time to analyze the exchange you want to use. In this CEX crypto exchange review, we have examined the key features of the exchange as well as how it works.

CEX is a widely renowned name in the crypto industry. It has been around longer than most and during its years of existence, has created quite a following in the crypto community. In fact, the site consistently ranks well in the category of top 10 crypto exchanges globally.

On this Page:

But that in itself does not make it a reliable choice. In order to assess its viability, we need to undertake an in-depth assessment of the site on the basis of a number of metrics. Our review analyzed crucial features of the exchange such as its safety features, accessibility, customer support, fee system and limits, regulatory status among others. By the end of it all, we have found out that it is not the most ideal crypto exchange for you because of its unregulated nature. Thus, it is not a recommended exchange for both new and advanced traders.

To know more about why it’s not a good exchange and how you can find a safe and regulated exchange, read on.

But that in itself does not make it a reliable choice. In order to assess its viability, we need to undertake an in-depth assessment of the site on the basis of a number of metrics. Our review analyzed crucial features of the exchange such as its safety features, accessibility, customer support, fee system and limits, regulatory status among others. By the end of it all, we have found out that it is not the most ideal crypto exchange for you because of its unregulated nature. Thus, it is not a recommended exchange for both new and advanced traders.

To know more about why it’s not a good exchange and how you can find a safe and regulated exchange, read on.

What is CEX?

CEX is one of the oldest crypto exchanges in existence. It first made its appearance on the scene in 2013, as a Bitcoin-only exchange. At the time, they also ran a cloud mining service, Ghash.io, in addition to offering exchange services.

CEX is one of the oldest crypto exchanges in existence. It first made its appearance on the scene in 2013, as a Bitcoin-only exchange. At the time, they also ran a cloud mining service, Ghash.io, in addition to offering exchange services.

At some point, its mining operations were so large that it accounted for about 42% of the total Bitcoin mining power.

But in 2015, they dropped mining and added support for trading Ethereum. The company behind it is based in London and currently operates a trading platform as well as brokerage services for cryptocurrencies.

It operates both as a web-based exchange platform and a mobile one, accessible on iOS and Android devices.

How does CEX Work?

CEX allows users to make crypto purchases using credit cards, SEPA transfers for residents of the EU and wire transfers.

Brokerage Service

Its brokerage service is primarily a provision for new users to buy crypto in a simple, yet comparatively costly process. In this case, CEX trades on behalf of its users for a premium.

Brokerage transactions operate on a Fill or Kill (FOK) basis. FOK orders are essentially orders that are executed instantly and in full. As such, they differ from placing regular orders on the trading platform as the various types of orders (e.g. market, stop loss and limit) will have different results.

Beginners looking to trade their cryptocurrencies can use this simplified approach so that they do not have to go through an entire trading course. Note however that for the ease of use and convenience, you will pay more than the normal trading fee. The fee for this can at times go as high as 7%.

When using this feature, CEX will calculate a price as soon as you enter a trade and freeze it for 120 seconds. During this time, you can enter the amount you want to spend and see the exact amount of crypto that you will get in return.

If the market allows for the fulfillment of your order on the conditions you agreed to, not worse, the order will be filled. However, if there is a sudden spike that makes conditions worse, you will get a notification. If on the other hand conditions improve, the order will be executed on better terms to give you an amount greater than the agreement stipulated.

Trading Platform

For more advanced users who understand the ins and outs of trading, CEX offers a comprehensive trading platform. On this platform, the fees are much lower than on the brokerage service, reaching a maximum of 0.25%.

It is an advanced platform with all of the necessary trading features including market and limit orders. Not only does it have a decent level of liquidity, but it also offers advanced reporting as well as cross-platform trading via APIs and a mobile platform.

Margin Trading

In the past, CEX used to support margin trading on its trading platform. However, starting in 2019, margin trading is a separate service offered on CEX.io Broker. On CEX.io Broker, traders use CFDs with various order types, advanced trading and technical analysis tools.

What cryptocurrencies does CEX support?

CEX supports four major coins:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Bitcoin Cash (BCH)

However, you can use a variety of other currencies, both crypto and fiat to purchase Bitcoin or Ethereum on the site.

These fiat currencies include USD, EUR, GBP and RUB.

The digital currencies that you can use for purchases on the other hand include Bitcoin Cash (BCH), Bitcoin Gold (BTG), ZCash (ZEC), Dash (DASH), Ripple (XRP) and Stellar (XLM)

You can also make deposits on the platform using a number of cryptocurrencies including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Bitcoin Cash (BCH)

- Bitcoin Gold (BTG)

- Dash (DASH)

- Stellar (XLM)

- Zcash (ZEC)

- Gemini Dollar (GUSD)

- OmiseGo (OMG)

- #MetaHash (MHC)

Which countries does CEX support?

CEX offers the full range of services in a majority of countries with a number of exceptions. In the following countries, users cannot use credit cards or bank transfers to fund their accounts:

- Algeria

- Afghanistan

- Burundi

- Bolivia

- Bangladesh

- Bahrain

- Bosnia and Herzegovina

- Congo DRC

- Cambodia

- Cuba

- Central African Republic

- Algeria

- Ecuador

- Iraq

- Ethiopia

- Iran

- Iceland

- Laos

- Kuwait

- Lebanon

- Libya

- Nepal

- Morocco

- Nigeria

- North Korea

- Oman

- Palestine

- Pakistan

- Qatar

- Somalia

- Saudi Arabia

- Sudan

- South Sudan

- Syria

- Yemen

- Uganda

- Vietnam

- Vanuatu

- Zimbabwe

CEX fees

One of the major complaints that CEX users have has to do with high fees and hidden charges. Let’s check out the fees and limits:

| Transaction | Fee |

| Bank wire deposit | None |

| SEPA transfer | None |

| Visa & MasterCard deposits | 3.5%+$0.25 |

| Crypto Capital | None |

| Trading | Maker: 0 to 0.16%

Taker: 0 to 0.25% Instant Buy: 7% |

| Visa withdrawal | $3.80 |

| MasterCard withdrawal | $3.80+1.2% |

| Bank transfer | $50 |

| Crypto Capital withdrawal | 1% |

Limits

Buying limits on CEX vary according to users’ account verification tires. These are:

Identity Verification – $1,000 worth of BTC daily, $3,000 worth of BTC monthly and account holders can only use credit cards to fund purchases

Address Verification – $200,000 worth of BTC daily, $500,000 worth of BTC monthly and account holders can use wire transfers

Enhanced Verification – no limits

Corporate verification – no limits

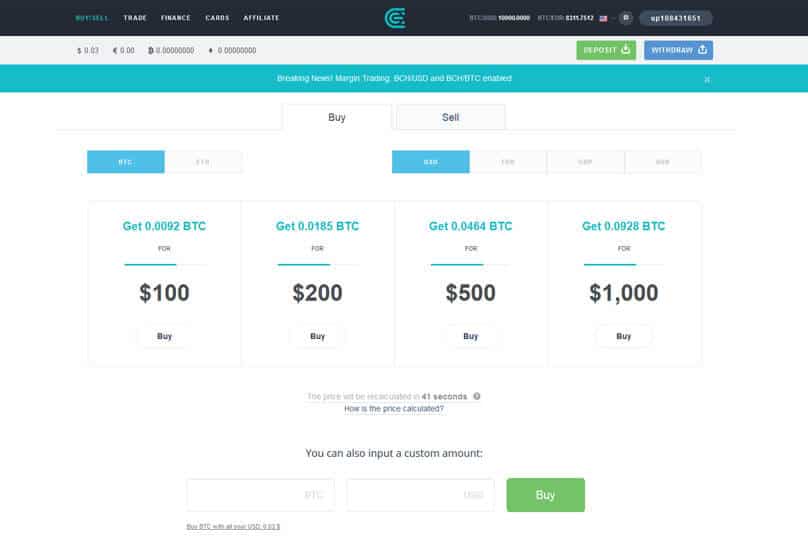

CEX platform dashboard

This is what the CEX dashboard looks like:

How to Buy Cryptocurrency on CEX: Step-by-Step Tutorial

If you would like to buy cryptocurrency on CEX, here is what you need to do:

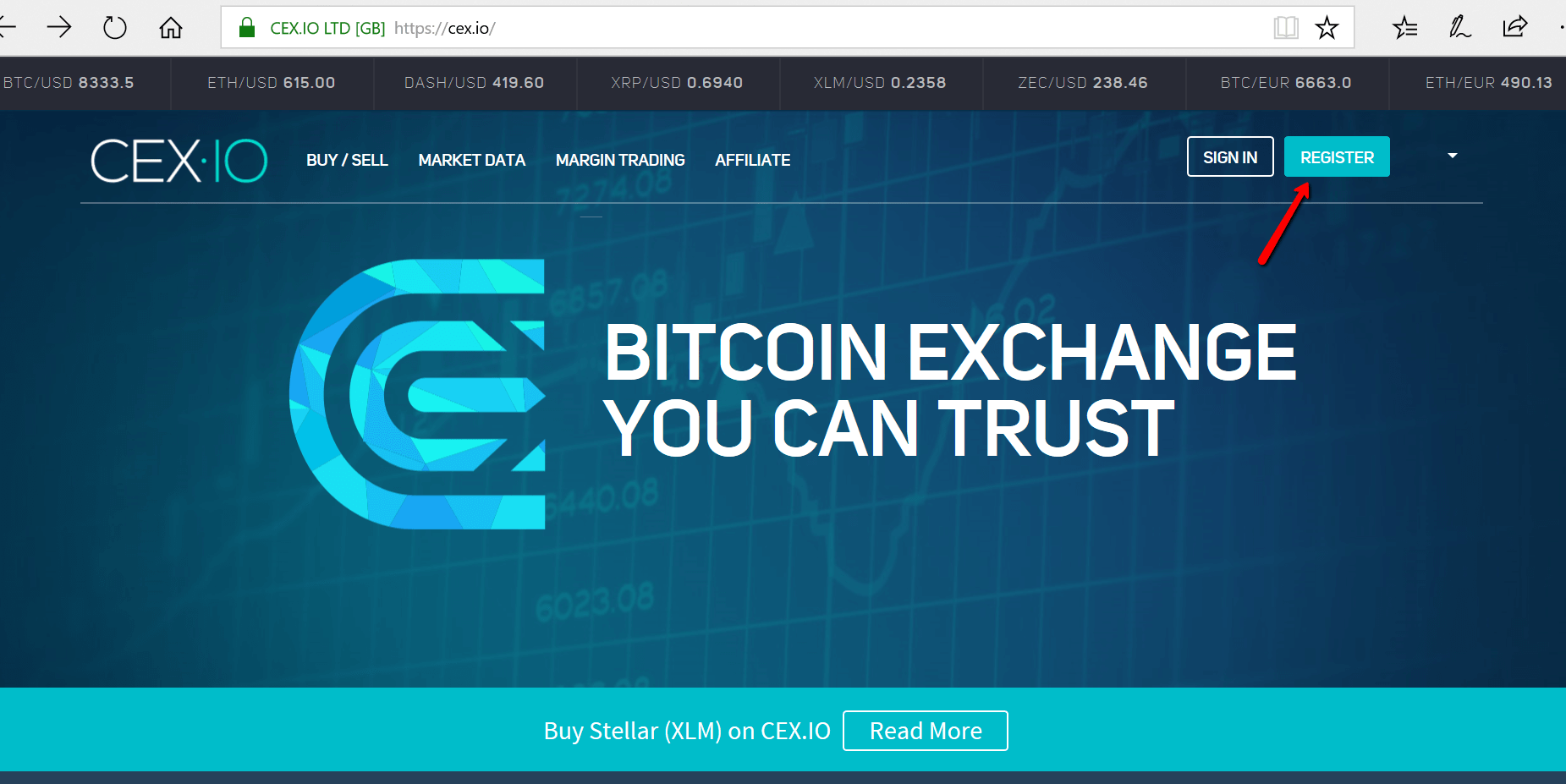

Step 1: Create an Account

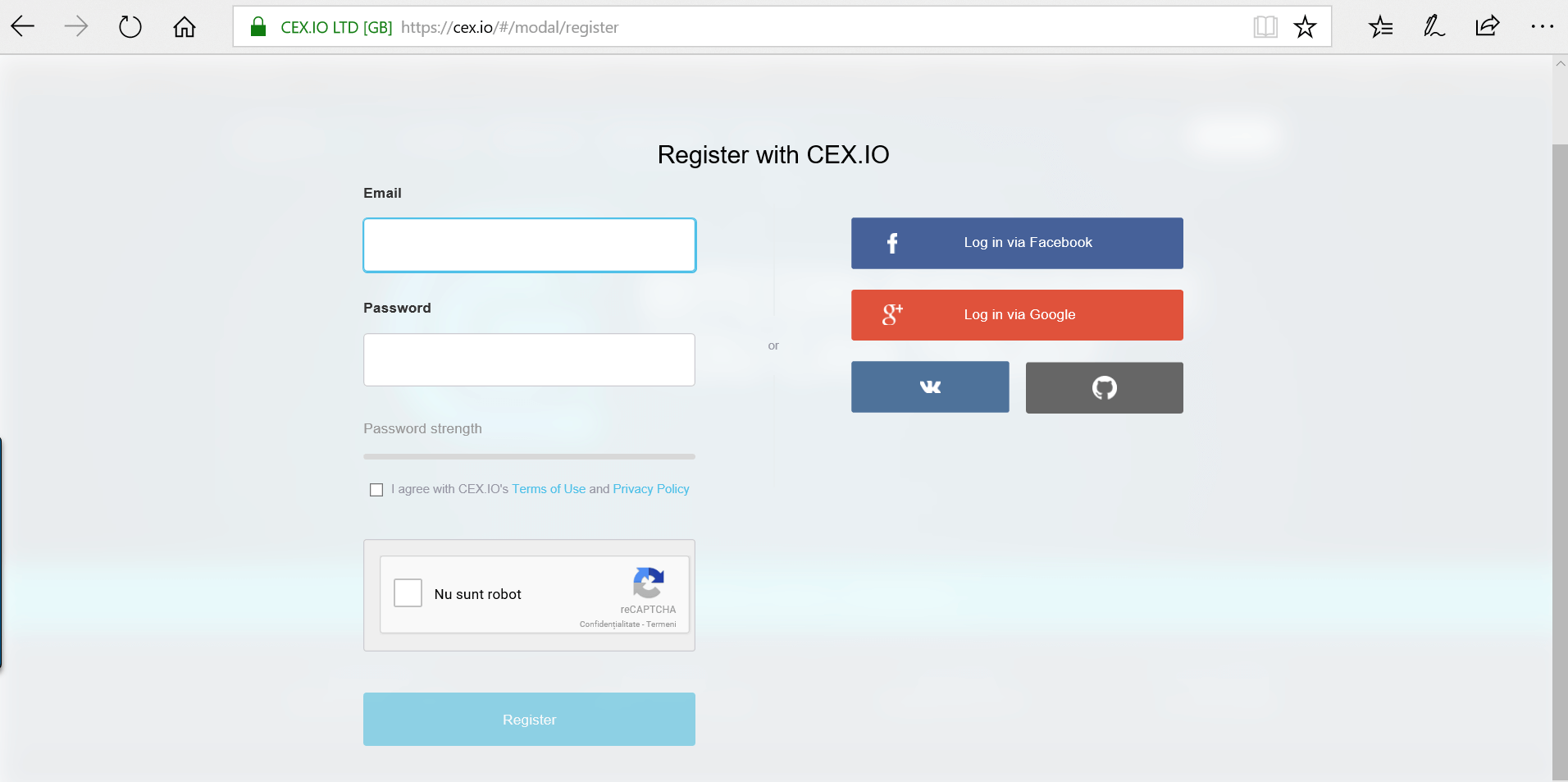

To create an account on CEX, simply go to CEX.io and click “Register” on the top right side

You can simplify your registration process by linking your Facebook, Google or Github account. Enter your email address and create a strong password to protect the account.

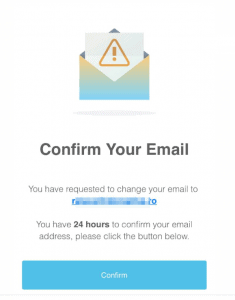

Step 2: Confirm Your Account via Email

You should receive an email from the team. Confirm the address within 24 hours.

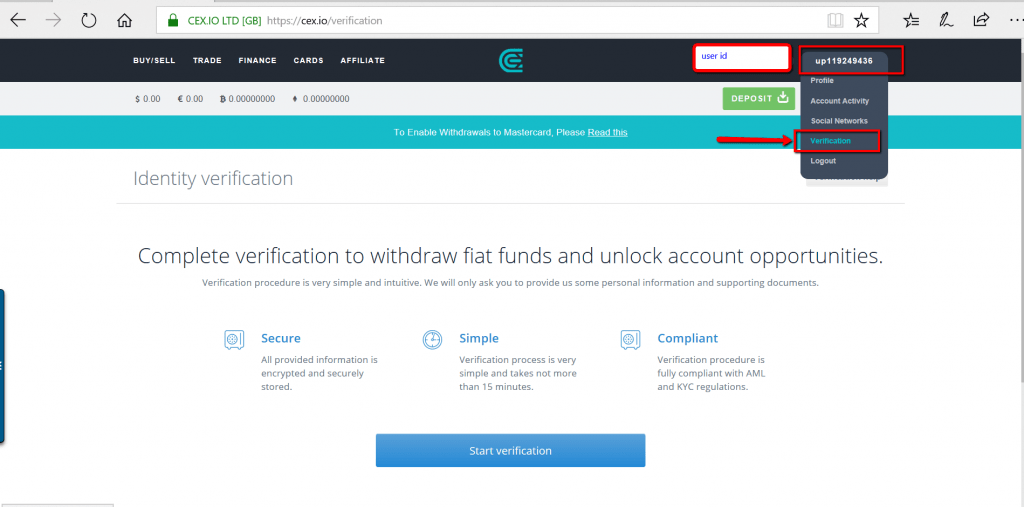

Step 3: Get Verified

Next, verify your account so as to access the full functionality of the platform. Click “Verification” under User ID at the top right side.

Add your ID information, personal details, addresses and scans of the required documents. Take a selfie holding the identification card that you used for verification.

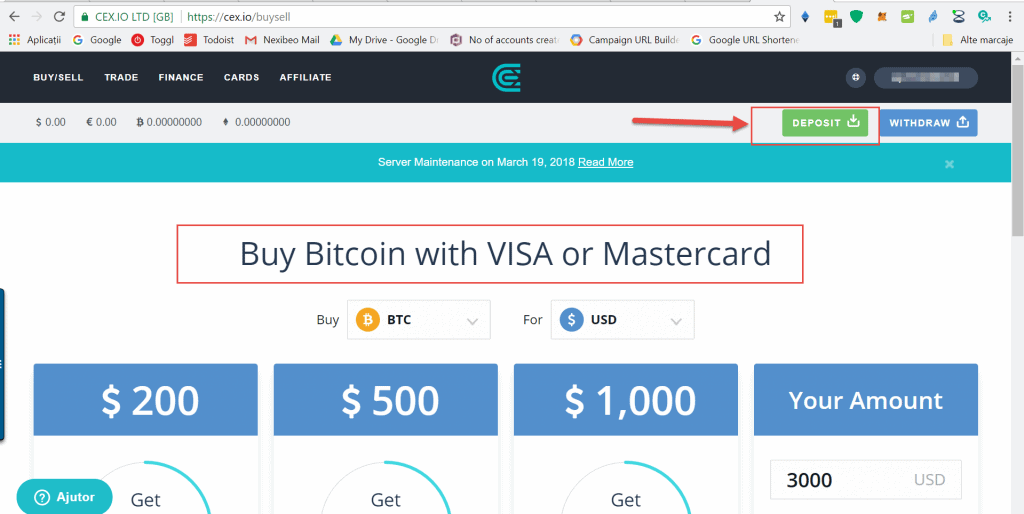

Step 4: Fund Your Account and Buy Crypto

You can choose to deposit funds into your web wallet on CEX or buy crypto directly using your Visa or MasterCard.

No matter what method you choose, the site will let you know how much crypto you will get from the deposited amount. That’s it! You have successfully ordered crypto on CEX; you should receive it within 5-30 minutes.

Is CEX regulated?

CEX is a registered with FinCEN US and the UK Information Commissioner’s Office but is not a regulated platform

Is CEX safe?

CEX strives to keep its users’ accounts and funds safe with a number of safety features. Let us discuss these features to determine whether the exchange is safe or not.

Two-Factor Authentication

For user accounts, the site uses 2FA to protect against unauthorized access. This can use Google Authenticator, an automated phone call or SMS.

Security Question

Another safety feature is a security question which as a user you will select an answer during account creation. Keep in mind the answer you set for this question.

Email and SMS Alerts

The site sends email and SMS alerts for transactions, allowing a user to take action in case the transaction in question is not authorized.

PGP Encryption for Email Communication

Email communication from the company is encrypted using PGP technology to avoid interception and leakage.

Cold Storage

The company claims to keep most of its funds in cold storage though it does not provide details on how or where it does this.

CEX is lacking in one crucial security feature:

Regulation

CEX is not a regulated company and does not have to adhere to the strict requirements that cryptocurrency industry regulators set for such companies. As such, it cannot be said to be the most secure platform out there. In contrast, Coinbase is regulated in all the jurisdictions where it operates.

Does CEX have a wallet?

Yes. CEX offers online wallets for its users to store the cryptocurrency they purchase on the site.

Does CEX have an app?

Yes. CEX has an app for both iOS and Android.

CEX customer service

CEX customer support offers services primarily via email and the team seems pretty responsive and helpful. In most cases, users get responses within a day or two.

Notably, though the site has some negative reviews on TrustPilot and has a rating of 6.1 out of 10, its customer support has made an effort to answer most of these bad reviews.

Furthermore, the site has an extensive and comprehensive FAQ section that strives to answer a majority of user queries.

CEX pros and cons

Pros:

- Available globally with a few exceptions

- Suitable for newbies and professional traders

- Has a mobile app for convenient access

- Numerous deposit and withdrawal options

Cons:

- Supports a limited range of cryptocurrencies

- No cash withdrawals

- High fees for brokerage services

- No live chat or phone support

- Not regulated

Conclusion

CEX is a decent exchange platform with features suitable for beginners as well as advanced users. In addition to its user-friendly interface, the site offers beginners a simple way to buy Bitcoin with a debit card that does not require a steep learning curve. The downside to this provision is the fact that it comes at a high premium. Furthermore, there are lots of complaints about the service having to do with high exchange rates and hidden fees.

By comparison, Coinbase is a more preferable alternative because it is regulated internationally and does not charge a premium to its new users. Its fee system us straightforward and it has more trading options and higher functionality. We give Coinbase our full recommendation.

How can I raise my deposit and withdrawal limits on CEX?

To increase your deposit and withdrawal limits, you need to reach a higher verification level. The more details you provide as required for verification, the higher your transaction limits on the platform. Make an application for higher verification by clicking “Start Verification” next to the account that offers the limits you want.

Can I use a prepaid card to fund my CEX account?

No. CEX does not support prepaid cards or commercial cards such as purchasing, gift and fleet cards.

How long will it take for CEX to verify my card?

The CEX compliance department requires 15-20 minutes to verify cards. In case you get a response saying “Card Not Verified” there was likely a mistake in the application. Check the information you provided and make amendments.

How can I use a bank transfer to deposit money into CEX?

First, make sure that your account is verified as only verified users can use bank transfers. Next, press “Deposit” on the upper right side of your screen and choose “Bank Transfer.” Choose your bank from the drop-down menu and fill out required details then click “Proceed.

I sent crypto to a wrong address. What should I do?

I sent crypto to a wrong address. What should I do

Why is my payment pending?

The most likely reason for crypto payment pending is that the payment has yet to get the required number of confirmations for the required network. Bank transfers, on the other hand, can take up to 14 days to process.

What is the withdrawal PIN code?

This is a new measure for mobile users that requires the use of a 5-digit code to authorize all mobile withdrawals.

How can I withdraw funds from CEX?

To withdraw funds, simply go to the Finance page on the site and click the Withdrawal button next to the currency you want to withdraw, enter your destination address and confirm on email.