Merlin Chain (MERL) is a layer-2 solution for the Bitcoin (BTC) blockchain. BTC holders can access decentralized finance (DeFi) and other Web 3.0 products, which create additional income streams for the world’s largest digital asset. This guide explains how to buy Merlin Chain tokens with a safe exchange.

Learn how Merlin Chain works, why its layer-2 network solves existing problems, and discover the MERL price potential for 2025 to 2030.

How to Buy Merlin Chain in 4 Easy Steps

Here’s how to buy Merlin Chain tokens in under five minutes:

- Step 1: Choose an Exchange: Choose a cryptocurrency exchange that lists MERL tokens — options include Bybit, Bitget, Kucoin, and Gate.io, but our top pick is MEXC. You can invest in Merlin Chain anonymously, and commissions range from 0% to 0.05%. The exchange also offers instant withdrawals, so you can immediately transfer MERL tokens to a private wallet.

- Step 2: Open an Account: Visit the MEXC website and open an account. New customers only need an email address or mobile number to get started. Choose a strong password and activate two-factor authentication (2FA) and device whitelisting for extra security.

- Step 3: Deposit Funds: You need Tether (USDT) to buy Merlin Chain, as MEXC, like most exchanges, offers the MERL/USDT trading pair. The platform lets users purchase USDT with debit/credit cards and other convenient payment methods. The minimum deposit amount is just $10.

- Step 4: Buy Merlin Chain: Go to the MERL/USDT trading page and select a market or limit order. Enter the number of USDT tokens to swap for MERL and confirm. You’ve just bought Merlin Chain — the MERL tokens are in your MEXC web wallet, and they can be withdrawn instantly.

Key Takeaways on Merlin Chain

Consider these key stats when exploring how to buy MERL.

| Launched | April 19th, 2024 |

| Ticker Symbol | MERL |

| Blockchain | Merlin Chain (Native), Ethereum, BNB Chain, |

| Maximum Supply | 2.1 billion |

| Circulating Supply | 525 million |

| Staking? | Yes |

| Use Case | Layer-2 solution for the Bitcoin ecosystem. Allows BTC holders to access dApps, including DeFi yields and lending. Token holders earn staking rewards and receive governance rights. |

| Contract Address | 0x5c46bFF4B38dc1EAE09C5BAc65872a1D8bc87378 |

| All-Time High | $1.55 |

| X page | https://x.com/MerlinLayer2 |

| Website | https://merlinchain.io/ |

Merlin Chain Price Chart

(MERL)Merlin Chain (MERL)

How to Buy Merlin Chain – Step-by-Step Instructions

Here’s an extensive tutorial on how to buy Merlin Chain coin. Follow each step to invest in the MERL ecosystem at a small market capitalization.

Step 1: Create an Exchange Account

As one of the best altcoins to buy, the Merlin Chain team has secured multiple exchange listings for MERL tokens. Investors should select an exchange that offers low trading commissions and deep liquidity. Other important features include affordable account minimums and a wide range of accepted payment methods.

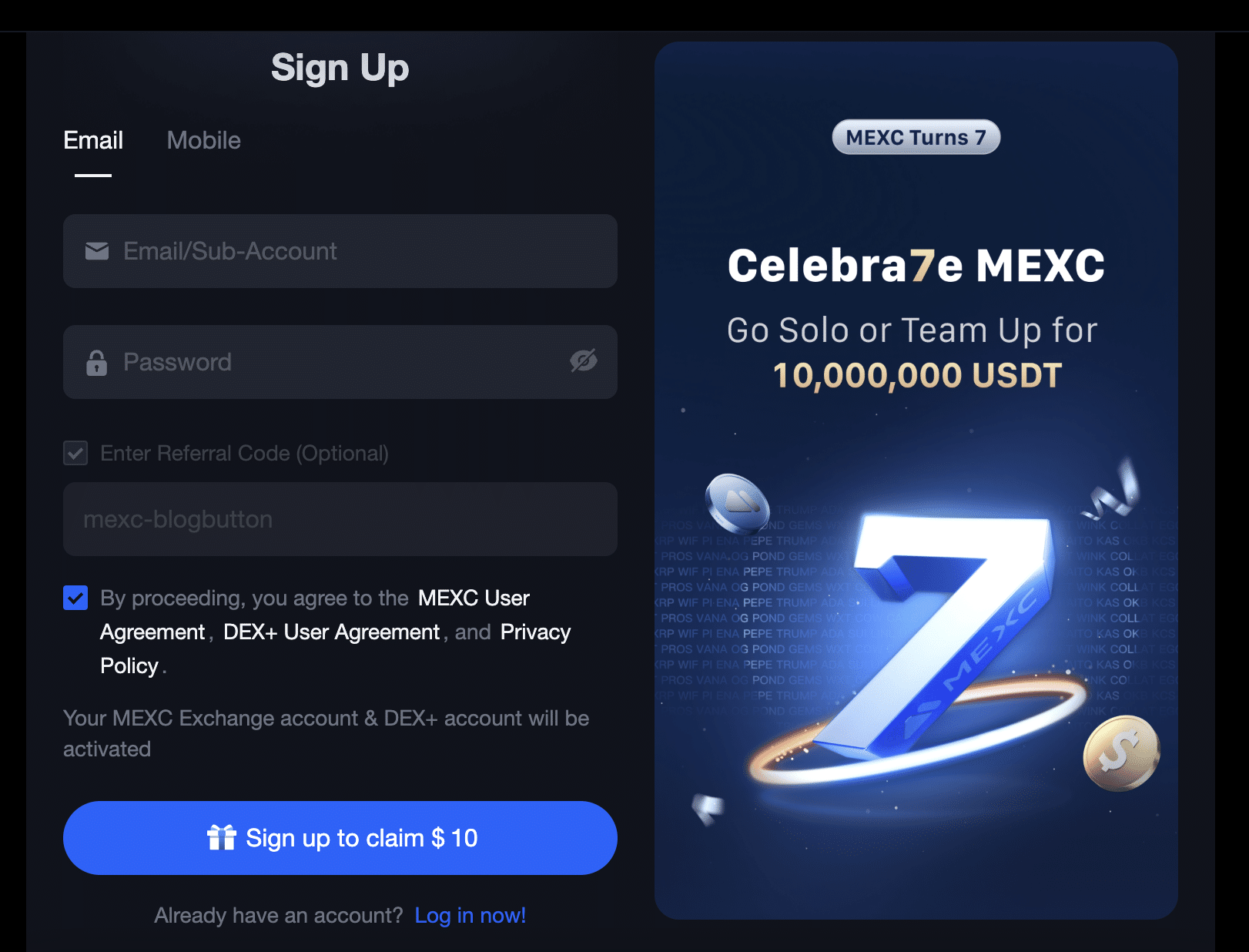

Our research shows that MEXC is the best place to buy Merlin Chain in 2025. New customers can register without providing personal information, and the minimum deposit requirement is just $10. MEXC is also one of the largest exchanges for daily trading volume, so users can access significant liquidity and ultra-tight spreads.

You can open a MEXC account in under 30 seconds — click on the “Sign Up” button and enter your email address or mobile number. Ensure you activate account security settings, including 2FA and email notifications. It’s also a good idea to download the MEXC app for real-time account monitoring and alerts.

Step 2: Purchase USDT With Fiat Money

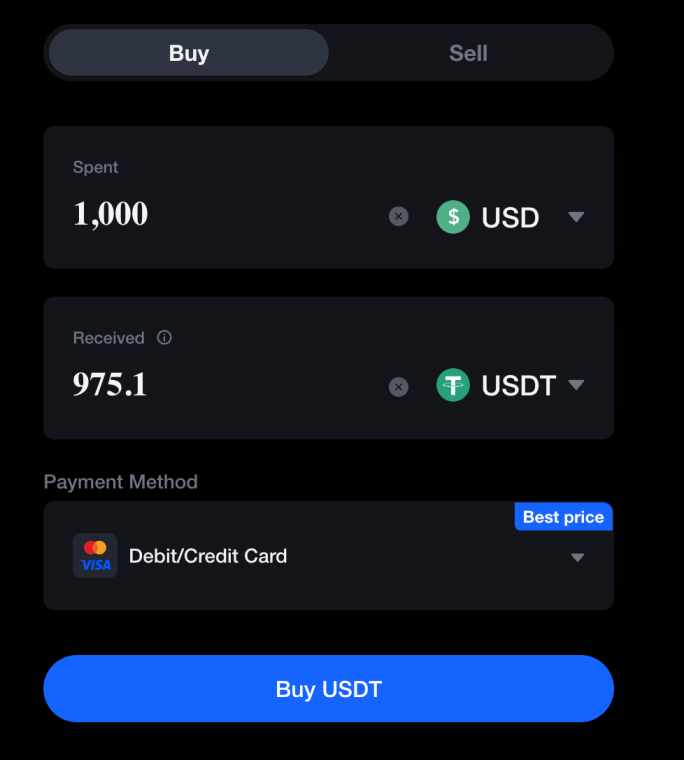

The best cryptocurrency exchanges offer the MERL/USDT trading pair — MEXC is no different. This framework means that users exchange USDT for MERL when entering the market, and vice versa when selling.

You can transfer USDT from a private wallet into the MEXC account. Click “USDT” and “Deposit” to reveal the wallet address.

Those without USDT can purchase tokens on MEXC. The platform supports multiple payment methods, ranging from debit/credit cards and local bank transfers to e-wallets like PayPal. The transaction is processed instantly and securely.

Click the “Buy Crypto” button and choose a currency from the dropdown list, such as CHF, GBP, EUR, or USD. Type in the deposit amount from $10 to $5,000 and select the payment method.

Click “Buy USDT” and follow the on-screen instructions. Your MEXC account receives the purchased USDT tokens once the payment is processed.

Note: Ensure the exchange rate is evaluated before you confirm the purchase. MEXC offers ultra-low transaction fees that often align with the USDT spot price. However, less common currencies might face wider spreads.

Step 3: Search for MERL and Choose an Order Type

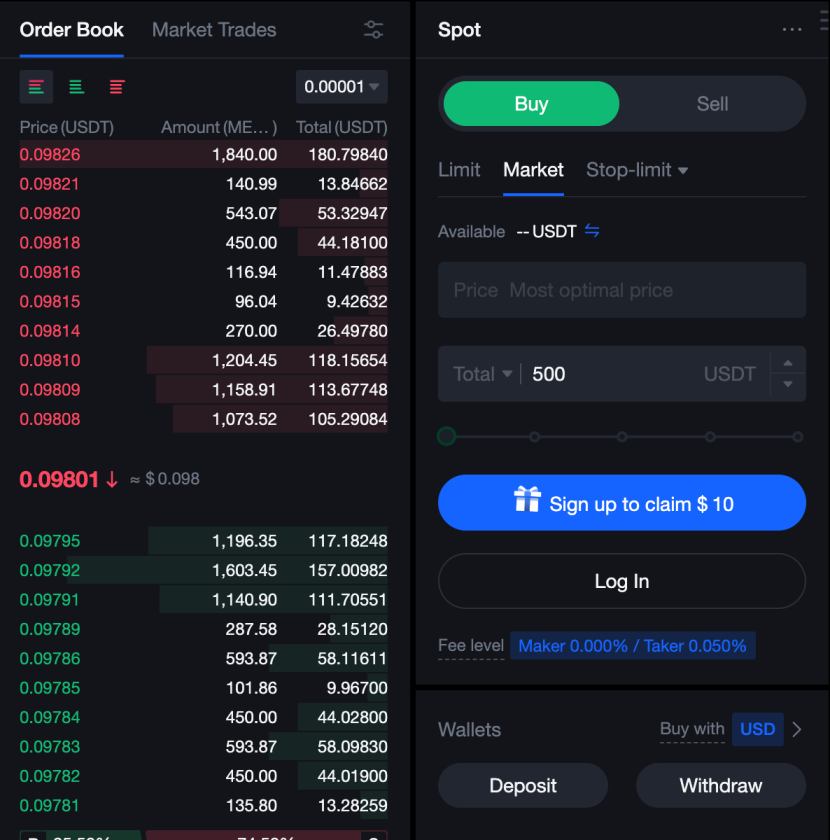

Click “Markets” and look for the search bar — type in “MERL” and select the “MERL/USDT” pair. This step takes you to the Merlin Chain trading page, where you can analyze price charts and assess order book depth.

You need to set up a limit or market before buying MERL tokens.

Limit orders trigger only at the stated price — an ideal solution to reduce slippage and catch market dips. For example, if MERL/USDT is $0.09, you may want to enter the market when it drops to $0.085. Note that limit orders remain pending until they’re matched or you cancel them manually.

Market orders allow buyers to purchase Merlin Chain tokens almost instantly, as they’re matched at the next best available price. Caution is advised, as MERL has a small market capitalization, so market orders can result in high slippage if you’re buying a large amount.

Step 4: Buy Merlin Chain

The final step is to complete the order form. Select between a market/limit order and enter the purchase amount. Limit orders also need the entry price.

Place the order, and once confirmed, you’ll see the MERL tokens in the MEXC account.

Note: MEXC offers robust security features and verified proof of reserves. However, it’s generally wise to store cryptocurrencies in a private wallet with non-custodial features. You retain full control of the MERL tokens and won’t need permission to transact.

What Is Merlin Chain (MERL)?

Merlin Chain offers an innovative solution for BTC holders, allowing them to access a range of dApps without losing control of their Bitcoins. One use case is DeFi — users can stake, lend, or borrow BTC to maximize yields and investment opportunities.

The layer-2 network also improves speed, scalability, and fees. The protocol handles transactions off-chain via sequencer nodes and ZK-Rollup technology.

It bundles those transactions into a rollup block and adds them to the main Bitcoin blockchain. Ecosystem stakeholders can verify that transactions are valid through the Zero-Knowledge Proof framework, keeping both Merlin Chain and Bitcoin secure.

Let’s find out more about Merlin Chain and its native MERL token.

History

Merlin Chain was created by Jeff Yin, and the mainnet network went live in early 2024. The project received startup capital from several high-profile investors, including OKX Ventures, KuCoin, ViaBTC, and Foresight Ventures.

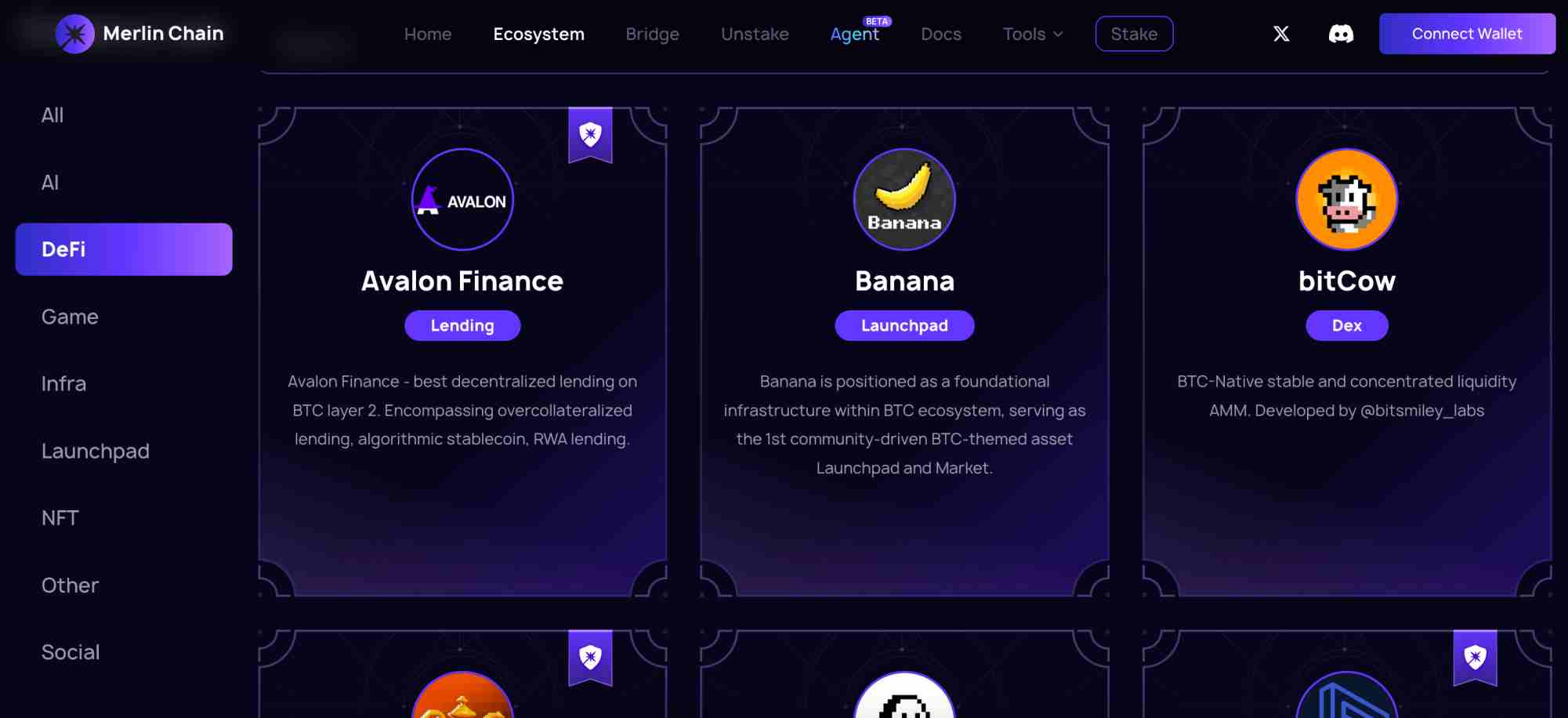

The Merlin Chain ecosystem remains in the high-growth stage — it now has a total value locked (TVL) of almost $2 billion. It has also attracted over 200 dApps across various Web 3.0 categories, including DeFi, SocialFi, and Gameification.

Tokenomics

The total supply of MERL is 2.1 billion, with token release distributed over four years to ensure steady and predictable token dynamics. Of the 2.1 billion, 525 million are circulating, which represents 25% of the overall supply.

The tokens are allocated to key areas, including ecosystem and community rewards. The team holds 4.2% of the supply, released over two years after the initial cliff. This structure ensures the founders remain motivated long-term and gives Merlin Chain the best chance possible of achieving global adoption.

MERL operates on its own network standard, similar to BTC and Bitcoin. The network is EVM-compatible, encouraging exposure from Ethereum and BNB Chain.

Use Cases

The MERL token provides several functions within the Merlin Chain ecosystem. Holders can stake MERL to help keep the network safe and earn passive rewards — the current APY is a competitive 15%. MERL is also a governance token, allowing holders to participate in core project decisions but not day-to-day operations.

Note that MERL isn’t required to pay gas fees on the Merlin Chain’s layer-2 network. Instead, BTC is required to transact — this ensures the network attracts Bitcoin users and the layer-2 solution stays aligned with Bitcoin’s growth.

MERL is, however, needed by dApps that join Merlin Chain’s layer-3 ecosystem. Similar to ETH and Ethereum, dApp transactions trigger smart contract fees, generating revenue for Merlin Chain and driving long-term demand for MERL.

Community

Merlin Chain’s community consists of several stakeholders. The protocol attracts innovative blockchain developers who want to build and launch dApps. The ecosystem offers developers a low-fee framework with institutional-grade scalability.

The project attracts a growing number of BTC holders who want to access DeFi yields, blockchain games, and other Web 3.0 concepts. Bitcoin investors never lose control of their cryptocurrencies when they engage with Merlin Chain products.

Why Buy MERL: Is it a Good Investment?

Here’s what to consider when learning how to buy MERL.

Web 3.0 Ecosystem for Bitcoin

Bitcoin is the largest cryptocurrency by market capitalization, but it lacks smart contract capabilities. This drawback means BTC holders can’t directly access Web 3.0 dApps, such as decentralized exchanges (DEXs), loans, staking, and liquidity provision. Bitcoin also lacks blockchain games, metaverses, and other innovative products. Instead, BTC holders only send and receive funds via wallet transfers.

Merlin Chain’s layer-2 network provides a revolutionary solution — it enables BTC holders to engage with dApps without losing control of their private keys. The network supports decentralized smart contracts in a highly scalable and cost-effective environment, and it initially settles transactions off-chain. To ensure security and transparency, Merlin Chain transactions are bundled into a rollup block and posted to the Bitcoin ledger.

MERL Could be Undervalued

Some analysts suggest that Merlin Chain could be one of the best low-cap coins to buy right now. In addition to its innovative ZK-Rollup technology and support for the Bitcoin standard, the network has onboarded over 200 dApps. It has also attracted almost $2 billion in TVL — a crucial metric when evaluating adoption rates and broader ecosystem trust. Even so, Merlin Chain has a market capitalization of just $51 million — an insignificant amount when you factor in the use cases and sector potential.

Stacks is one of the project’s main competitors, and it has a much larger market capitalization of $1.2 billion. On-chain data shows that Stacks has a DeFi TVL of just $77.9 million, a fraction compared with Merlin Chain.

These imbalances suggest that MERL tokens may be significantly undervalued.

Layer-3 Gas Requirement Drives Demand

Despite BTC being the layer-2 network’s currency, MERL tokens are used in the layer-3 ecosystem. This is where developers build Web 3.0 projects for gaming, DeFi, and SocialFi.

All layer-3 transactions trigger smart contract requests, and users must pay fees in MERL. The result is a direct correlation between adoption growth and demand for MERL, allowing the token price to increase organically.

15% Staking APYs

Merlin Chain lets users stake MERL tokens directly on its website — 15% APYs are competitive. Users just connect a wallet and click the “Stake $MERL” button. The staking tool is a great way to generate passive yields while the team meets its roadmap objectives and onboards more dApps.

Holding Merlin Chain Coin in a Wallet

One drawback of buying Merlin Chain is that few wallets support it — unlike ERC-20 tokens, MERL runs on its own network standard.

One option is Trust Wallet, a popular mobile wallet that supports Merlin Chain and 100 other blockchains. Trust Wallet offers a user-friendly experience on iOS and Android smartphones.

Desktop users may consider MetaMask — it offers an extension for Chrome, Firefox, and other web browsers. Users must add Merlin Chain’s RPC details manually before storing MERL tokens.

Both Trust Wallet and MetaMask provide non-custodial solutions, so you can send and receive tokens without relying on centralized entities. The private keys are stored on the respective device, so only the wallet owner can authorize transactions.

Additional providers could add support for Merlin Chain as its layer-2 network grows, including popular hardware wallets like Trezor and Ledger.

Merlin Chain (MERL) Price Prediction 2025-2030

This section provides Merlin Chain price predictions for 2025 to 2030.

MERL Price Prediction 2025

The MERL price may benefit from increased Bitcoin adoption — the more people that hold BTC, the greater demand for Web 3.0 products like DeFi and Gameification. Merlin Chain’s layer-2 network also makes Bitcoin transactions more efficient by reducing fees and increasing speed. These metrics could drive demand in 2025 as the Bitcoin blockchain becomes congested.

Broader market conditions also play a role. The MERL price can reach its true potential if Bitcoin sentiment is strong. Respected cryptocurrency analyst Tom Lee believes that Bitcoin will reach $150,000 in 2025, while Standard Chartered is even more bullish — the institution predicts a $250,000 peak by the end of the year. A $150,000 to $250,000 price range could add several trillion dollars to the broader altcoin market.

Merlin Chain’s market capitalization of just $51 million means it could grow substantially over a short time frame. Our MERL price prediction for 2025 is a 52-week high of $0.878, potentially in Q3 or Q4. This price point reflects a market capitalization of about $515 million, a small amount when MERL’s use cases are factored in.

MERL Price Prediction 2026

In 2026, we expect the Merlin Chain ecosystem to surpass 400 dApps, nearly doubling existing figures. The key focus will be on DeFi platforms that offer the perfect balance between competitive and sustainable Bitcoin yields. Collateralized loans are another high-growth area for the network to capitalize on. This DeFi feature lets BTC holders raise funds without giving up private key control.

Analysts also expect increased demand from the enterprise sector, especially businesses that want to accept BTC payments but are unable to wait 10 minutes for transaction verification. Merlin Chain handles the same transaction in seconds and at a fraction of the cost.

In terms of the MERL price forecast, the token may replace Stacks as the largest Bitcoin layer-2 by market capitalization in 2026. Merlin Chain may reach $2.61 in Q4 — smashing through its previous peak of $1.55 and valuing the project at $1.4 billion.

MERL Price Prediction 2030

The Bitcoin blockchain will have seen its fifth halving event in 2028 — history suggests that extended bull markets follow. Layer-2 networks will play a major role, especially as global cryptocurrency adoption reaches new heights.

Brian Armstrong, founder and CEO of the Coinbase exchange, believes over 1 billion people will own digital assets by the end of the decade. Merlin Chain, alongside other layer-2 solutions, will make the sector more efficient, including faster and lower-cost Bitcoin transactions. The project’s dApp ecosystem may also achieve mainstream status, allowing BTC holders to earn staking and lending yields while still benefiting from price appreciation.

All 2.1 billion MERL tokens will circulate by 2030, too, ensuring no additional strain on the broader supply. Our Merlin Chain prediction for 2030 is an all-time high of $13.09, reflecting a fully diluted valuation of about $7 billion.

Potential Highs & Lows of MERL

Here’s a summary of MERL price predictions:

|

Potential Low |

Potential High |

|

|

2025 |

$0.0712 |

$0.878 |

|

2026 |

$0.92 |

$1.55 |

|

2030 |

$9.87 |

$13.09 |

What Influences the Price of MERL?

A wide range of factors can determine MERL’s price trajectory.

Here are the most critical variables to watch.

- Layer-2 Adoption: The MERL price may experience long-term growth as ecosystem adoption rises — this means more daily users, transaction activity, and TVLs.

- dApp Innovation: The Merlin Chain ecosystem is only as good as the dApps it hosts. The team needs to attract the industry’s best Web 3.0 developers to provide innovative products and services for BTC holders.

- Bitcoin sentiment: The project directly serves the Bitcoin community, so the MERL price correlates with BTC sentiment. A strong BTC price may support MERL in reaching new all-time highs.

- Token Unlocks: Just 25% of the supply is currently circulating — each token unlock may briefly impact the MERL price. All 2.1 billion tokens will be in the public domain by 2028.

- Wallet Support: A limited number of wallet providers support the Merlin Chain — increased compatibility makes MERL more accessible, especially in the retail client space.

Conclusion: Should You Buy MERL?

Merlin Chain has a bright future — it lets Bitcoin holders access smart contracts and dApps in a safe, scalable, and cost-effective environment. Over 200 dApps already run on Merlin Chain, ranging from Web 3.0 games and lending protocols to decentralized exchanges.

In terms of where to buy Merlin Chain coin, MEXC is a popular choice. It offers high liquidity, 0% commissions, and a no-KYC experience. Investors only need an email or mobile number to get started.

FAQs

Can I buy Merlin Chain (MERL) without KYC verification?

Where can I store MERL after purchasing it?

How many MERL tokens are there?

What network does MERL run on?

Can I stake Merlin Chain?

References

- Blockstack’s Digital Currency ‘Stacks’ to be Tradable in U.S. Once New Blockchain Arrives (Reuters)

- Expect Bitcoin to do Better Than $150,000 This Year, Says Fundstrat’s Tom Lee (CNBC)

- Bitcoin Could Soar 266% to $250,000 Next Year if ETF Inflows Stay Strong, Standard Chartered Says (Business Insider)

- Cryptoverse: ‘Layer Two’ Tokens Enjoy New Life as Bitcoin Soars (Reuters)

- Coinbase CEO Predicts One Billion Crypto Users Within a Decade (Bloomberg)