The crypto market has grown significantly, giving buyers more ways to buy than ever before. In this guide, we’ll explain how to buy crypto with a credit card.

We’ll also discuss how and where to buy crypto with a credit card (not all platforms support CC purchases) and compare buying with a credit card to other payment methods. First, let’s begin with a quick walkthrough, learning how to buy Bitcoin with a credit card. Let’s get started.

How to Buy Crypto With a Credit Card in 5 Easy Steps

We’ll use the popular Best Wallet app in this example, where we can buy Bitcoin with a credit card (and no verification) in just a few minutes.

- Choose a trusted crypto platform such as Best Wallet. The Best Wallet app supports credit card buys worldwide and stores your Bitcoin securely using MPC technology to keep your funds safe.

- Create an account. Download and install the app, and then create an account using your email address, Google ID, or Apple ID.

- Choose a provider. Click the Trade button and then the Buy button to see the providers and compare prices.

- Decide how much to invest. Select BTC, choose an amount to buy, and enter your payment information.

- Buy Bitcoin. Verify your intended purchase amount and confirm the purchase if everything is correct.

Where to Buy Crypto With a Credit Card

A number of well-known crypto exchanges allow users to buy Bitcoin with a credit card instantly. These range from easy-to-use wallet apps like Best Wallet to advanced trading platforms like MEXC and Binance. Several specialty trading platforms that cater to high-leverage trades also let users buy crypto with a credit card fast, so they don’t miss a trade. Let’s look at some of the best options and what they offer.

1. Best Wallet

The Best Wallet mobile app offers one of the quickest ways to get started and supports credit card purchases. Available for iOS and Android, the app provides secure storage while also combining an intuitive interface with powerful trading features. Use the app to buy crypto with a credit card, debit card, or bank transfer, depending on the provider. Best Wallet automatically finds you the best value and lets you choose from several providers.

Once you have your account funded with crypto, you can use it with popular decentralized applications to earn a yield or swap to other cryptocurrencies.

Best Wallet uses Multi-Party Computation (MPC) technology to provide enhanced security. Instead of a single private key stored in one place, MPC creates multiple independent secret shares. This innovative approach makes it one of the safest ways to buy crypto with a credit card and safely store your blockchain assets.

Pros

- User-friendly with advanced features

- Secure storage using MPC

- Multiple payment options

- Access to decentralized exchanges

- Support for cross-chain swaps

- Live chat support

Cons

- No desktop support (browser extension in development)

- Not all features are available yet

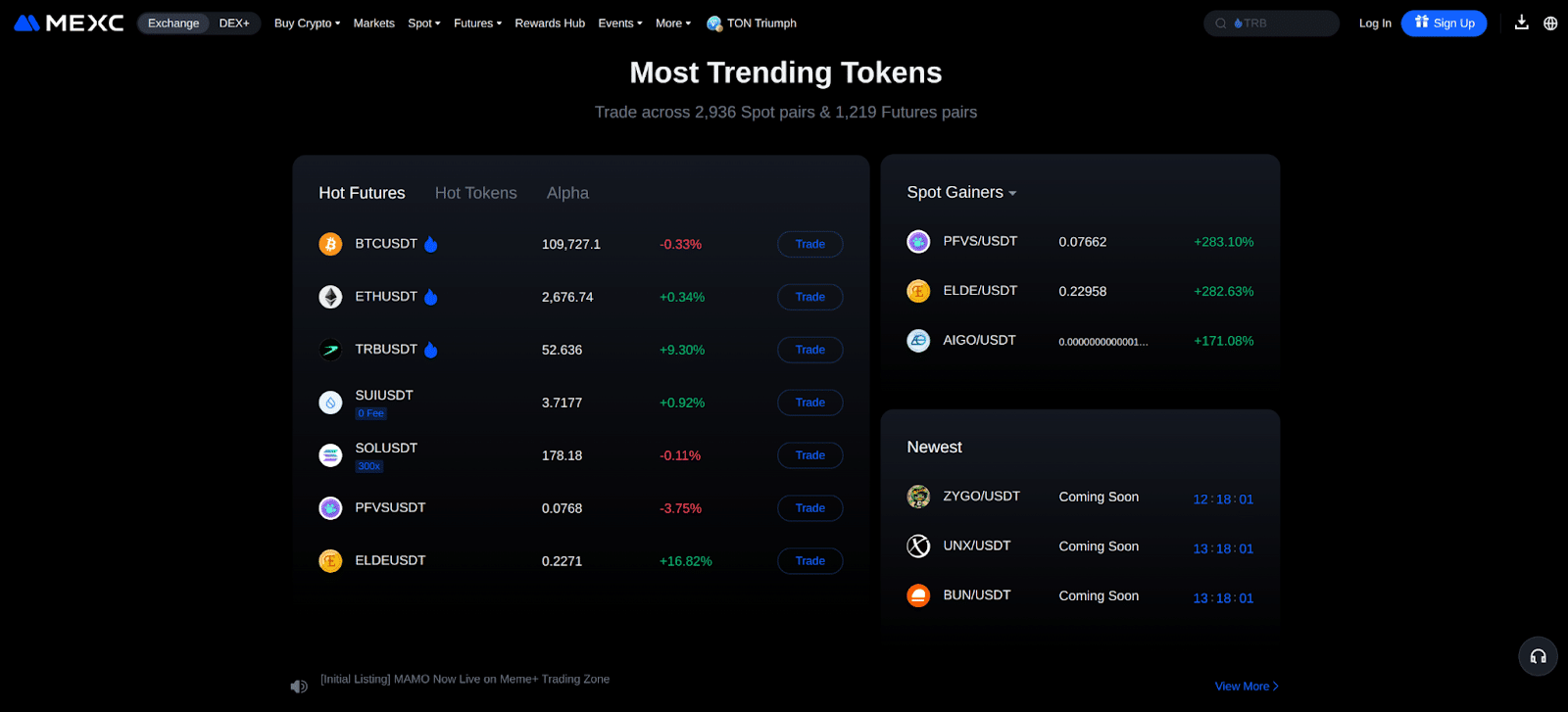

2. MEXC

Founded in 2018, MEXC has quickly become one of the most popular exchanges in the world. Part of that popularity stems from a user-friendly KYC (Know Your Customer) policy. Users can buy crypto with a credit card or other funding source with no verification unless they need to withdraw more than 10 BTC or equivalent value.

The trading platform offers a full suite of trading tools, including leverage trading, futures, yield products, and more. In addition to a comprehensive trading platform, MEXC offers one of the largest selections in the industry, with nearly 2,300 cryptocurrencies available on the platform. Often, promising coins and tokens appear on MEXC long before they reach other major exchanges.

MEXC supports credit card purchases using three methods: direct, peer-to-peer, and third-party providers. Payment options vary by location. The platform also supports direct crypto deposits on a wide range of blockchains.

Pros

- No KYC required in many cases

- Wide range of trading tools

- Massive selection of altcoins

- High liquidity on popular assets

- Staking and yield products

Cons

- Can be overwhelming for new traders

- Limited fiat withdrawals

- Not available in several major markets (e.g., USA)

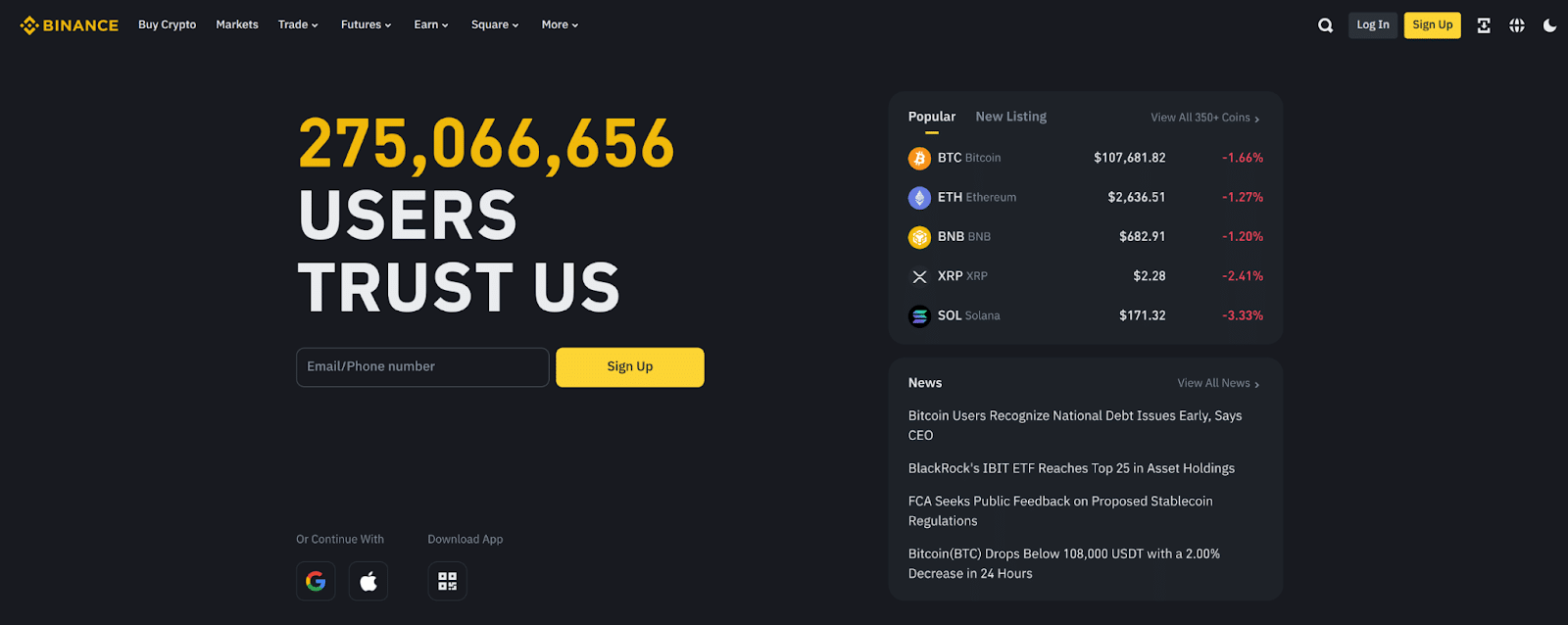

3. Binance

Binance, the world’s largest centralized crypto exchange by trading volume, offers several ways to buy crypto with a credit card. In many regions, users can buy directly from Binance using the Buy Crypto tool, which supports currencies worldwide. Other credit card buying options include Binance’s peer-to-peer marketplace and integrated third-party providers.

The platform gained popularity due to its low fees and advanced trading features, such as futures, options trading, and crypto staking. Additional trading fee discounts are available for accounts that hold Binance’s native token (BNB).

Binance currently supports trading for more than 400 cryptocurrencies, with leverage of up to 125x (BTC) and 75x to 100x for many altcoins used in futures trades. The platform provides proof of reserves and maintains an insurance fund (Secure Asset Fund for Users – SAFU), setting aside a percentage of trading fee revenue.

Binance also provides a separate trading platform for US customers (binance.us) that supports crypto deposits (no USD deposits or purchases). The US platform focuses on spot market trading to comply with regulatory requirements.

Pros

- Low trading fees (from 0.1%)

- Industry-leading liquidity for smooth trades

- High-leverage futures trading

- Proof of reserves

- Insurance fund to safeguard against volatility

Cons

- Ongoing legal challenges

- Complex interface

- Not available in several major markets

4. Margex

Margex advertises its platform as a crypto trading boutique, which speaks to its specialization. While you can buy crypto with a credit card, the crypto you purchase acts as collateral for Margex’s main trading feature: up to 100x leveraged perpetual futures. Although you can swap Asset A for Asset B using Margex, the platform isn’t intended for spot trading.

Credit card purchases are made possible through third-party providers, with the funds deposited directly into your Margex account. If you need to switch collateral (margin) assets, you can do so with Margex’s no-fee swaps. For example, you might want to switch from ETH to BTC or USDT if volatility in the collateral asset limits your leverage opportunities.

While Margex offers a much smaller selection of cryptocurrencies (about 40 pairs), the platform’s popularity stems from its ease of use, combined with a user-friendly KYC policy. In most cases, users can buy BTC with a credit card and no verification.

Pros

- No KYC requirement in many cases

- Up to 100x leverage on futures

- Copy trading

- No-fee swaps

- MP Shield insurance fund

- Use staked assets as collateral

Cons

- Limited fiat off-ramps

- Limited spot trading functionality

- Small cryptocurrency selection

5. OKX

The OKX exchange offers advanced trading features on par with other major exchanges, but with some newbie-friendly touches that make it well-suited to traders of any experience level. The platform provides a demo account, which allows users to learn the ropes or test trading strategies without risking capital. Copy trading also allows users to follow the moves of successful traders. Other features include leveraged futures, options trading, and customizable trading bots.

Users can buy Bitcoin with a credit card on OKX using integrated third-party providers or P2P providers. Other major assets are also supported. Once your account is funded, you can trade to any of 300+ other assets on the platform.

OKX also offers a separate exchange for US customers, which also supports credit card purchases. The US-only platform strips many advanced trading tools, including futures and margin trades, to comply with regulatory guidelines.

Pros

- Up to 200x leverage

- Copy trading

- Demo account to test trading strategies

- Large selection of trading bots

- Staking and yield products

Cons

- Limited fiat off-ramps

- Geographical limitations

- Withdrawal limits without KYC

6. CoinEx

With a vast selection of more than 1,300 coins, CoinEx provides trading opportunities you might not find elsewhere. The platform also offers a launchpad that offers new tokens before they get listed on the main exchange. CoinEx has become well-known for margin trading (spot market) and leveraged perpetual futures. Like some other platforms, CoinEx also offers copy trading.

A selection of P2P providers and third-party providers provides an on-ramp, letting users buy crypto with a credit card or other funding methods. The platform also supports crypto deposits on a wide range of networks, allowing users who already own crypto to fund their account without credit card fees.

CoinEx provides proof of reserves to demonstrate 1:1 backing for user funds. Similar to Binance, CoinEx allocated a percentage of trading fees to what it calls a Shield Fund to protect against market volatility.

Pros

- Broad selection of cryptocurrencies

- Frequent trading fee promotions

- Up to 100x leverage on futures

- No mandatory KYC

Cons

- Not available in some major markets

- Thinner liquidity

- Limited fiat off-ramps

7. BloFin

Although it’s one of the newer crypto exchanges (est. 2023), BloFin has become the go-to platform for leverage crypto traders and those who need automated trading tools. The platform offers pre-made trading bots and a robust API for high-frequency trading (HFT).

Trade over 400 cryptocurrencies with up to 150x leverage to maximize gains on crypto derivatives. BloFin’s trading services center on spot market and perpetual futures trades using a unified trading account (UTA). The platform also offers copy trading, allowing traders to follow the moves of high-performing accounts on BloFin.

BloFin lets you buy BTC and other assets with a credit card through third-party providers. For basic trading and lower withdrawal amounts (below 20,000 USDT), KYC identification verification isn’t generally required.

The BloFin platform received ISO 27001 certification for its security measures in 2025 and provides proof of reserves to ensure 1:1 backing for user deposits. Other security measures include cold storage and MPC technology for custodial services, as well as AI-powered fraud detection.

Pros

- Wide selection for futures trading

- Fees as low as 0.02% for futures

- Copy trading

- No mandatory KYC for withdrawals under 20,000 USDT

Cons

- New exchange with an unproven history

- Lower liquidity than leading exchanges

- Smaller selection of spot pairs

8. KCEX

The KCEX crypto exchange now offers more than 950 trading pairs with over 750 futures pairs, making it a popular playground for traders looking for the best altcoins. Low fees also drive traffic. KCEX offers spot trading and limit futures orders at 0% commission.

Trading features include spot trading, margin trades, futures (up to 100x), and copy trading. These features, combined with a user-friendly interface and massive crypto selection, make KCEX a leading choice for active traders. Hard-to-find altcoins provide another draw and allow traders to invest in coins not yet available on larger platforms.

You can buy crypto with a credit card through third-party providers that deposit funds directly into your KCEX trading account. KYC is not required in many cases, although completing identity verification unlocks higher withdrawal limits.

Pros

- Fees as low as 0%

- New user bonuses

- Up to 100x leverage on futures

- No KYC for basic use

Cons

- Reports of frozen accounts

- Relatively short track record

- Lower liquidity on smaller altcoins

What Are the Benefits and Drawbacks of Buying Crypto With a Credit Card?

Credit cards offer fast access to the crypto market. You can buy Bitcoin with a credit card instantly if you think the market will spike. However, there are other reasons to consider using a credit card to buy cryptocurrency. Interest fees, transaction fees, and potentially declined transactions give reasons to think twice about using a credit card.

Credit Card Advantages

If managed well, using a credit card to buy crypto can offer some notable advantages.

- Speed: In some cases, direct bank deposits can take days to clear, by which time the market may have moved significantly, potentially resulting in lost opportunities. Credit card purchases provide faster access to markets.

- Larger purchases: Using a credit card to buy crypto may allow for larger purchases and keep your cash available for other purposes.

- Rewards: Some credit cards offer perks, such as cash back or travel points.

- Stronger fraud protection: Every service that stores payment information is a target for hackers. If your credit card number is stolen online, you can file a dispute with the issuer for unauthorized purchases. Debit cards don’t always offer the same level of protection.

- Grace period: Credit cards offer a grace period, during which no interest accrues. Traders can make money during this interest-free period if the trading gains outpace the transaction fees for using a credit card.

Credit Card Disadvantages

Using a credit card also brings some potential risks compared to other funding methods.

- Interest fees: Many credit cards charge 20% or more in annual interest, which can add up quickly if you don’t pay the balance within the grace period.

- Transaction fees: Bank transfers and crypto deposits are generally less costly ways to fund your trading account. While the fees aren’t always clearly explained, using a credit card often adds 3% or more to the purchase cost.

- Cash advance fees: Many credit card companies treat crypto purchases as “cash advances,” which can lead to higher interest rates and additional instant cash advance fees. Notably, cash advance fees begin accruing interest immediately without a grace period.

- Higher spread fees: Credit card-funded crypto purchases use third-party providers or “instant buy” tools on exchanges. These tools use a spread (higher or lower than the market price) to lock in a price quote. In some cases, the combination of credit card fees and spread fees can reach 8% or more.

- No advanced trading: Typically, credit cards can’t be used to fund your trading account with traditional currencies, which you can then use for low-fee advanced trading. Instead, you’re buying crypto (at a markup) that you can later trade.

Purchasing BTC With a Credit Card vs. a Debit Card

Platform fees for debit and credit cards are often the same, with 4% fees for either payment method not uncommon. Some crypto exchanges only support debit cards, while others support both payment methods. In most cases, the choice to use a credit card over a debit card centers on the ability to make larger purchases, timing considerations, and better fraud protection.

Let’s start with fraud protection. In the US, federal rules favor credit cards for online purchases over debit cards. If a debit card is stolen online, consumers may be responsible for up to $500 of the unauthorized purchases, or potentially much more if the consumer waits longer than 60 days to report the loss. By comparison, the liability for unauthorized credit card transactions is likely zero if the charges derive from online transactions.

However, credit cards may also offer more flexibility, particularly if you need to keep your bank balance available for other expenses. For example, you might have $500 available with a debit card, but your unused credit card limit might be thousands of dollars.

On the other hand, debit cards come with fewer surprises. The cash advance charges (and higher fees) sometimes associated with using a credit card to buy crypto don’t apply to debit cards. Although the initial costs may be similar to credit cards at the time of the purchase, debit cards use your available cash balance, so cash advance fees don’t apply.

Alternative Crypto Buying Methods Explained

Let’s review some alternatives to using credit cards to buy crypto. Options vary based on the platform.

- Bank Transfers: An ACH bank transfer, if available, is often the least expensive way to fund a crypto trading account. Typically, you don’t pay a deposit fee, but your funds may not be available or transferable until the transfer clears.

- Debit cards: Bank debit cards access the funds in your bank account and therefore don’t incur interest charges. However, debit cards can generally only be used for instant buys, rather than cash deposits.

- Payment services: Some platforms support payment apps like PayPal. Generally, payment app costs are less expensive than credit cards. However, compare the fees before buying.

- Payment Apps: Google Pay and Apple Pay use debit cards or credit cards for purchases. Expect similar fees to those for using a debit or credit card directly.

- Direct crypto deposits: If you already own some crypto, a direct crypto deposit can be one of the most affordable ways to fund a crypto trading account. Many platforms don’t charge a crypto deposit fee. However, you’ll pay a fee to the crypto network for sending crypto to another wallet.

- Peer-to-peer: Some platforms offer peer-to-peer marketplaces where users can purchase crypto from businesses or individuals. Payment options and spreads vary.

- Crypto ATMs: Although one of the pricier options, you can also buy crypto from a crypto ATM. These typically support BTC purchases using cash or (sometimes) debit cards, although some also offer ETH or other popular assets. Fees and spreads can range from 5% to 20% or more.

What Are the Risks Involved When You Buy Bitcoin With a Credit Card?

While buying crypto with a credit card has some advantages, primarily centered around convenience, buyers should also consider potential risks. These include costs associated with the transaction and broader considerations, such as growing debt, which may affect some buyers.

Exchange Processing Fees

Expect to pay an additional 2% to 5% fee for using a credit card rather than a bank deposit. In some cases, this isn’t clearly detailed in the transaction summary. Instead, the summary may highlight the amount of the purchase and the amount of crypto you’ll receive without providing a comparison to the market price.

Cash Advance Fees

Many credit card issuers treat crypto purchases as cash advances. Unfortunately, if this is the case, it won’t show on the transaction summary on your screen. Instead, it appears on your statement.

Cash advances usually incur a one-time fee of either a minimum dollar amount or a percentage of the transaction (usually 3% to 5%). In addition, cash advance balances typically have a higher interest rate than everyday transactions.

When applying payments, the cash advance balance is often paid down after the standard balance. Additionally, rewards programs often don’t apply to cash advance balances. Read your credit card agreement carefully before buying crypto with a credit card.

Foreign Transaction Fees

If the crypto exchange or its payment processor is located in a different country, you might also pay foreign transaction fees, ranging from 1% to 3% of the transaction amount.

Volatility Risk

Crypto’s volatility introduces a new risk if you’re borrowing rather than transferring cash from your bank account. The debt, including any additional fees, must be paid back in dollars. However, if the trade loses money, you won’t have enough proceeds from the trade to pay back the debt. Cash buyers can often afford to ride out the volatility, whereas the interest compounds on credit card balances, possibly forcing traders to sell at a loss.

Wider Spreads

Expect to pay more for the coins or tokens themselves when you buy crypto with a credit card. In addition to fees, you’ll often pay a spread. In effect, the provider pads the price to provide a quote. You’ll pay more than the market rate when buying because credit card purchases use third-party providers or instant-buy tools on the exchange itself, both of which use spreads.

Other risks center around consumer finance, including rising credit balances and other potential effects on your credit score.

How Much Does It Cost to Buy Crypto With a Credit Card?

Let’s compare the cost of buying Bitcoin using a credit card with the market price. Many exchanges that don’t have their own payment processors use a familiar group of third-party providers, including Topper, Moonpay, Simplex, Transak, and others.

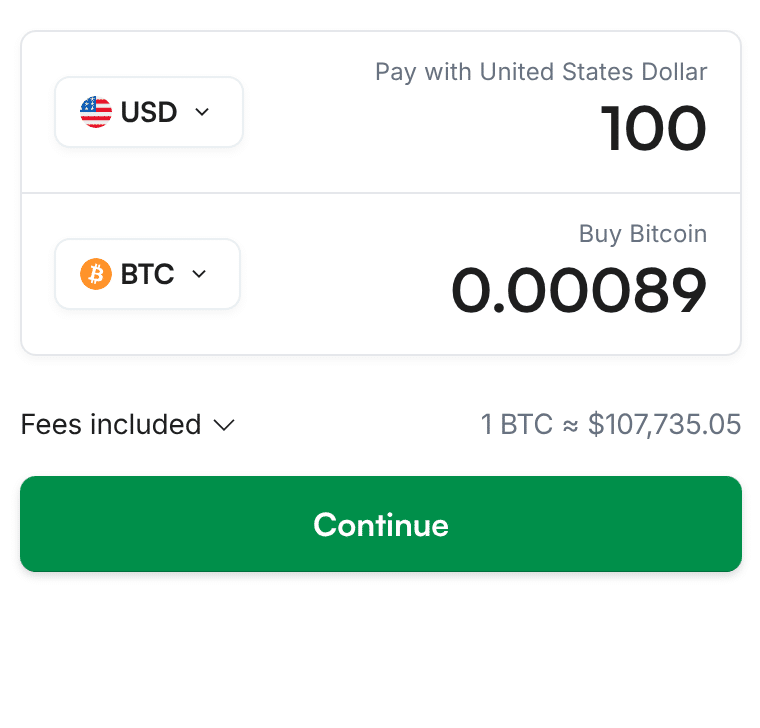

At the time of this writing, $100 buys 0.00094 worth of BTC based on the market price. The table below shows how much Bitcoin you might receive using a third-party provider or an exchange’s instant buy tool with a $100 buy. The difference compares the buying price against the market price.

| Provider | BTC Received | BTC Value | $ Difference | % Difference |

| Topper | 0.00085602 | $91.33 | $8.67 | 8.67% |

| Moonpay | 0.00087 | $92.90 | $7.10 | 7.10% |

| Ramp | 0.00089 | $95.04 | $4.96 | 4.96% |

In the screenshot below, the quoted price of one BTC from the provider differs from the market price by nearly $1,000, demonstrating the difference versus market price.

Conclusion

Using a credit card to buy crypto is one of several options, but may be the best choice if you need to use a specific exchange or keep your cash available for other purposes. Best Wallet offers the best choice for many users based on its ease of use and flexibility in using the crypto you purchase.

The Best Wallet mobile app automatically finds the best price, whether you’re buying for the first time or swapping your crypto for the next hot coin. The mobile app supports cross-chain swaps and integrates with decentralized exchanges on multiple chains, making it much more versatile than a traditional crypto exchange. Best of all, you control your wallet’s private keys, keeping your transactions private and your crypto secure.

FAQs

Can you buy crypto with credit cards?

Can I use a credit card to pay for crypto?

Why is it so hard to buy crypto with a credit card?

Is buying crypto with a credit card a cash advance?

What is the best credit card for crypto?

References

- Why is KYC Verification Necessary? (mexc.com)

- Largest cryptocurrency spot exchanges based on 24h trade volume (statista.com)

- ISO/IEC 27001:2022 (iso.org)

- What is a grace period for a credit card? (consumerfinance.org)

- Commercial Bank Interest Rate on Credit Card Plans, All Accounts (TERMCBCCALLNS) (stlouisfed.org)

- Credit Card Checks and Cash Advances (fdic.gov)

- What You Need to Know About Credit and Debit Card Billing Issues (fdic.gov)