Cryptocurrencies are tough to understand; they’re technologies that transfer value in real-form, enable fast global transactions, and have made investors extremely wealthy. Learning how to buy cryptocurrency can be a difficult feat; it’s something that can get very confusing especially for beginners, however, with the right teacher, it can be straight forward.

One of the largest issues associated with cryptocurrencies and buying them is that their market action is extremely volatile; cryptocurrencies have demonstrated price volatility unlike any other asset in financial markets. As a result, people are hesitant to use cryptocurrencies as any type of actual currency, nonetheless as an investment, as they’re scared that they’ll never get the correct price that they want to when buying or selling the asset. To combat this, Tether was created; Tether is a cryptocurrency that is linked 1:1 to the United States Dollar (USD).

Tether derives the benefits of cryptocurrency and blockchain technology, which includes speed and efficiency while extracting the benefit of consistency and usability of traditional fiat currency. This guide will overview how to buy Tether, tricks for getting the best prices in your purchase, and also how to use and benefit from the efficiency Tether has to offer.

Best Exchanges to Buy Tether (USDT)

Buying Tether (USDT) in Your Country

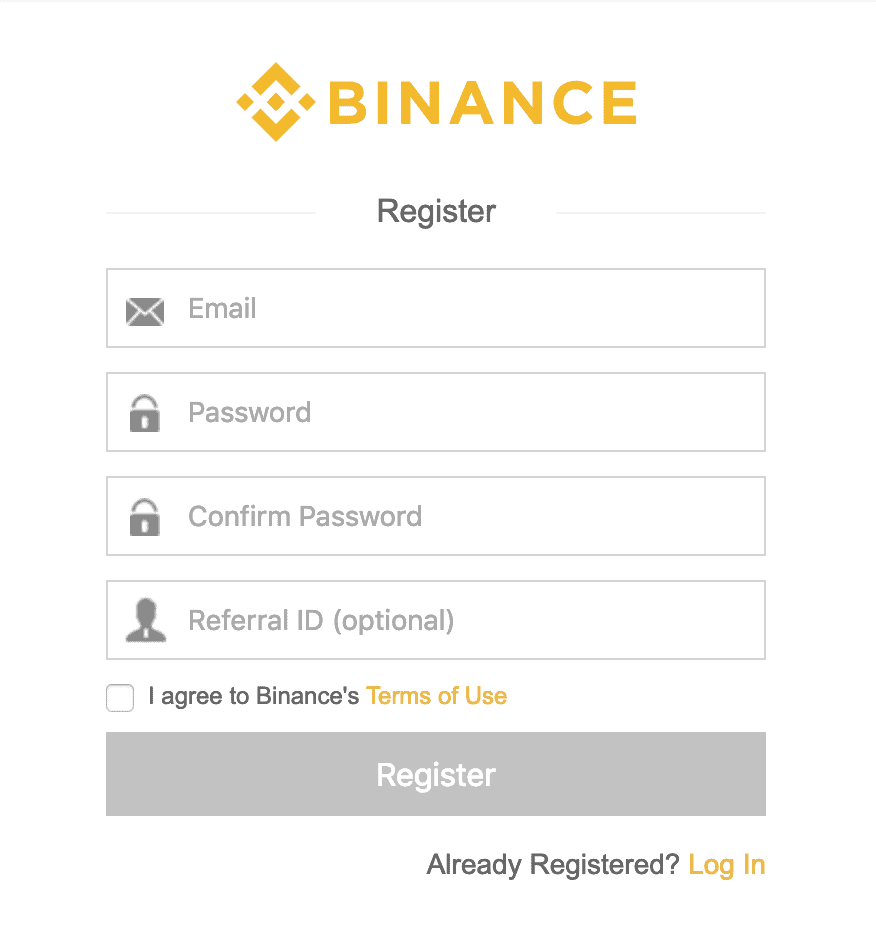

Currently, the UK does not have explicit restrictions on buying Tether, which means you can buy it on UK supported exchanges that list Tether (USDT). We recommend using Binance for this purpose, as it is the quickest and easiest option for buying Tether. Binance is a Malta-based cryptocurrency exchange that is currently legal and accessible if you’re in the UK.

Keep in mind that high-ranking UK officials have commented before on Tether; while this does not mean in anyway that it will be made illegal within the UK, it’s always best to keep up with news releases regarding your asset holdings (Tether included). At this time, however, you can buy Tether in the UK on Binance.

If you’re in the US or Canada you can buy Tether (USDT) through Binance or Changelly; both are viable and fast options. Binance and Changelly are both supported exchanges in the United States and Canada, and both exchanges list and support Tether (USDT) pairings. At this time, Tether is not prohibited for residents of Canada or the United States, however, this is subject to change.

Although Tether (USDT) is backed on a 1:1 basis by the United States Dollar, Tether is not issued by the United States government or bank. Subsequently, if anyone claims that they are a bank or government official (As is actually common) and are selling Tether at a discount it is an obvious scam. Verified exchanges that sell Tether in the United States and Canada are Binance and Changelly.

Regardless of being backed by the United States Dollar, Tether is very common in Australia. This is mainly because Tether is one of the staples that supports and makes up the cryptocurrency market. You can buy Tether (USDT) in Australia primarily on Binance. Binance is considered a standard for cryptocurrency exchanges and is widely used in Australia. You can buy Tether on Binance in Australia by depositing a base cryptocurrency such as Bitcoin and using it to exchange for Bitcoin.

Can I trade cryptocurrency using Tether (USDT)?

Although Tether (USDT) is pegged on a 1:1 basis to the United States Dollar, many wonder if it can be used for online trading purposes; the answer is yes! Tether is, at this time, a very big staple of the cryptocurrency market; because of its ability to back 1:1 to a fiat currency but still serve as a cryptocurrency fundamentally, Tether is paired to a plethora of different cryptocurrencies. This enables you to use Tether for trading purposes.

How do I use Tether to trade?

Since Tether is backed to a ‘stable’ currency, many traders utilize it as a safe-haven for their trading, almost as a risk-free cryptocurrency. Using Tether for this purpose allows you to keep funds safe and secure in the form of a cryptocurrency without volatility; maybe you’re trading cryptocurrency and don’t want to wait 3-5 days to transfer the fiat value of your trading account to your bank account; you can use Tether as an option, and convert all your holdings to Tether until you’re ready to trade again. So where can you go to trade using Tether? You can trade with Tether on Binance, as well as Kraken.

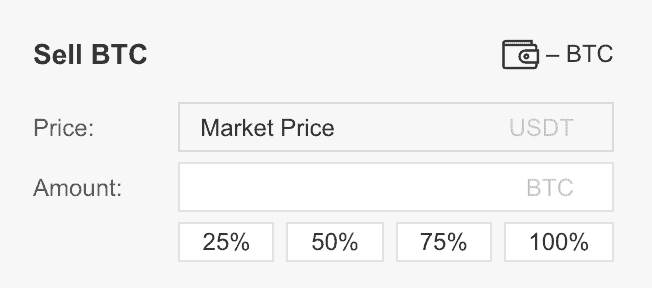

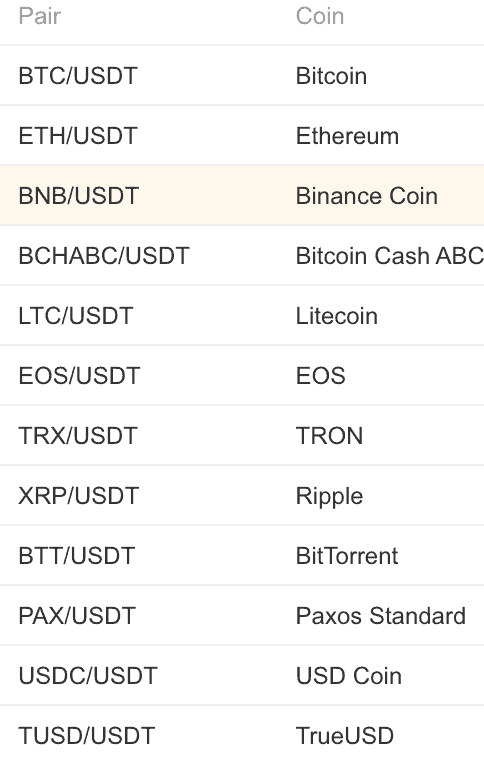

In the case of trading with Tether, you need to trade with markets that have USDT pairings. On Binance, for example, you can find these by selecting ‘USDT’ markets under the ‘All USD Markets’ section, as follows:

In order to trade via Tether, you’ll just need to remain within these USDT markets. This function enables you to trade cryptocurrency markets relative to USD while both 1.) Trading potentially profitable cryptocurrencies, 2.) Keeping the ability to convert your trade to a safe harbor cryptocurrency.

Can I trade Tether using a trading robot?

While you cannot trade Tether (USDT) itself using a Bitcoin robot, you can, in fact, use bots to trade Tether trading pairs. Similarly to how we said above where we’d be trading cryptocurrencies that are only paired to USDT, some trading robots enable you to do this as well. All that’s required is to navigate to the trading bot of choice and find the settings or ‘Traded Assets’ tab (Most if not all trading robots have this), and select only USDT pairs. Your traded assets page or settings tab that indicates which pairs the trading robot should trade, should, as a result, look something similar to:

- BTC/USDT

- ETH/ USDT

- LTC/USDT

- XRP/USDT

Once done, your trading robot will be configured to only trade pairs supported by Tether.

Alternative Methods to Buy Tether (USDT)

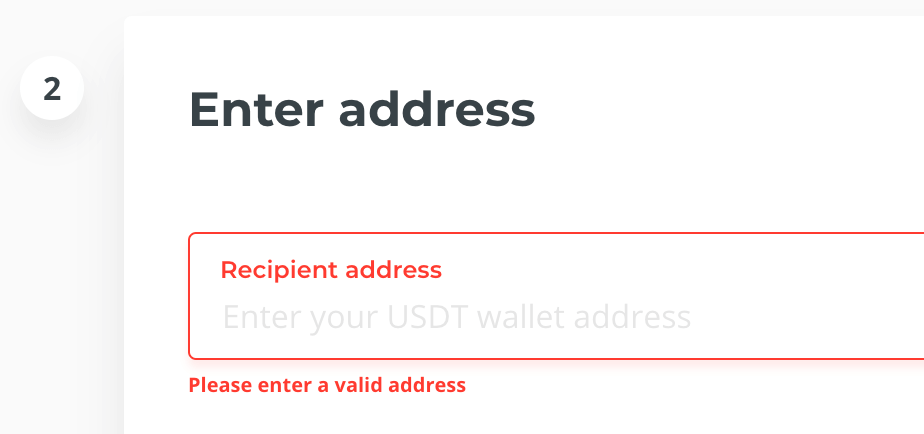

There are a few ways to buy Tether using a credit or debit card, and your option of choice typically depends on your jurisdiction or credit card provider. There are 2 main ways to buy Tether (USDT) using a credit/debit card: Buy Bitcoin with a credit card on Binance using a credit card and then exchange that Bitcoin for Tether, or link a credit card to Changelly and then use the card to purchase Tether directly after inputting your Tether wallet.

In the case of choosing Binance or Changelly, it’s important to note that a Binance credit card link is enabled by a third party provider Simplex while Changelly only supports VISA cards. This makes buying Tether with a credit card on Binance a bit more global, while Changelly is concentrated only to specific providers. Also, Binance does not require verification in order to use a credit card (Within limits), while Changelly does require verification for usage.

Both are great options for buying Tether (USDT) using a credit/debit card.

At this time, there is no exchange where you can directly buy Tether using PayPal accounts, however, you can in fact indirectly buy Tether using PayPal by first using PayPal to buy Bitcoin on an external site and then transferring that Bitcoin to a Tether supported exchange such as Binance and exchanging them for one another.

If you’re unsure how to buy Bitcoin using PayPal, you can follow our guide which is linked, or you can sign up for an exchange such as Coinbase that enables PayPal linking. Assuming you comprehended the guides and were able to buy Bitcoin on the exchanges using PayPal, the next step would be to deposit that Bitcoin to an exchange that supports Tether pairing such as Binance. Once deposited, simply sell the Bitcoin for Tether via the BTC/USDT pair and you’ll have successfully bought some Tether using PayPal.

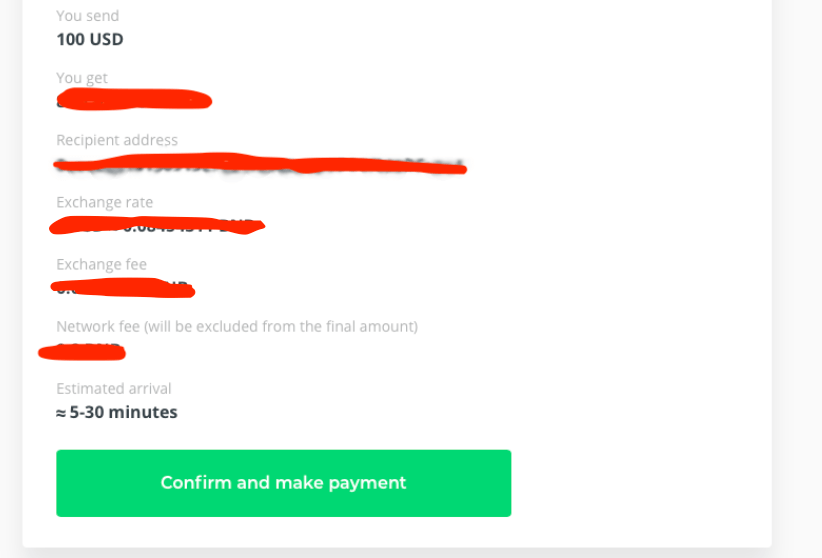

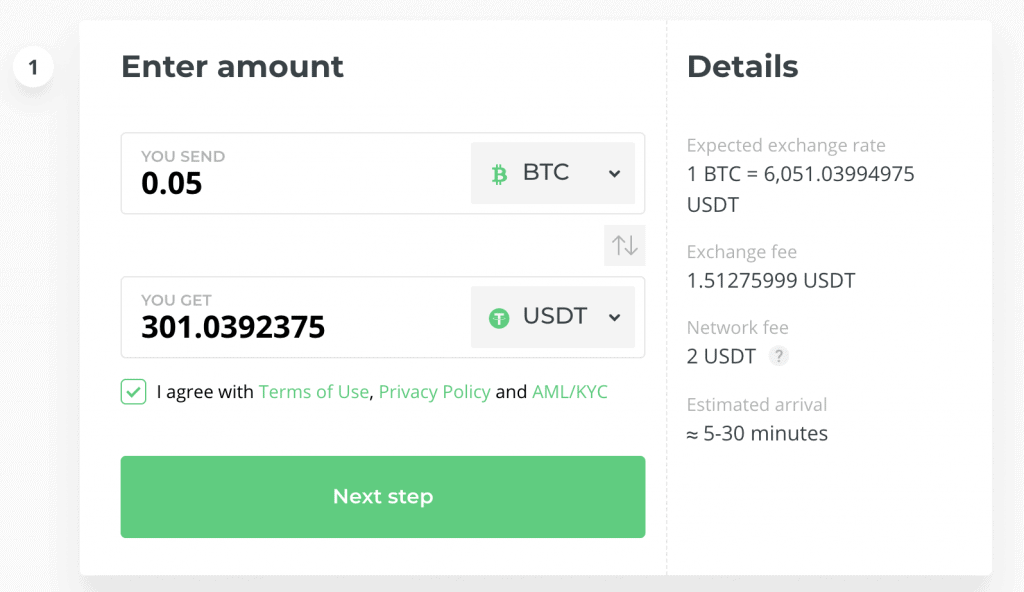

You can buy Tether with Bitcoin on Changelly very quickly and easily. The process is simple; as detailed in our guide above How to Buy Tether Using Changelly, set up a ‘swap transaction’ on Changelly and input that you’d like to use Bitcoin to pay for the Tether that you’re purchasing. That process will look similar to this:

Tether has demonstrated that the cryptocurrency market has a shot at enabling strictly digital transactions. Tether (USDT) is a fiat-backed cryptocurrency that extracts the safety and security of a consistently valued fiat currency and blends it with the technological efficiency of blockchain and cryptocurrencies. Learning how to buy Tether is a skill that once acquired can be used over and over again.

Cryptocurrencies are confusing for both beginners and seasoned users of technology, and buying them is even more confusing. With time, effort and research via guides like ours on InsideBitcoins, the learning curve can be shortened exponentially.

InsideBitcoins is up to date on news, tutorials, and guides about all cryptocurrencies, including Tether (USDT); make sure you subscribe to our newsletter to never miss out on market-moving developments.

FAQs

How does Tether keep its value of $1?

Tether (USDT) maintains its value by being backed by United States Dollars on a 1:1 basis. The actual process for this backing is a bit complex. Tether works, according to their core team, by reserving USD in banks. Each time a USDT token is bought on the digital markets, a dollar from the Tether reserve account is redeemed. More details on Tether's backing process and how it achieves the ability to retain a value of $1 despite market movement can be found in their official main whitepaper, found here.

I heard rumors Tether is illegal, is that true?

Tether receives a lot of controversy and allegations within the media about being fraudulent and a scam; this has initiated some law agencies to research the technology a bit more and see how it really works. As of this writing, there are no hard proven facts that prove Tether (USDT) is fake or fraudulent; it is legal currently in all jurisdictions where cryptocurrency is considered legal. However, this can change; be sure to stay up to date on developments and any breaking information about the legalities with Tether.

Did Bitfinex create Tether or did someone else?

Bitfinex as an entity did not actually create Tether, rather a Bitcoin Foundation director Brock Pierce did in 2014. When founded, the project was released under the name 'Realcoin' and was not publicly traded or available on a retail level near where it is today. It is unclear, however, reports conclude that Bitfinex acquired Tether around 2015 or so since the CEO for Tether that was made public ended up being the same name as Bitfinex's CEO.

What are the benefits of using Tether (USDT)?

Tether offers multiple benefits for a wide variety of users. The main benefactor that Tether presents for all users is that it enables them to cut costs associated with transferring your funds from a cryptocurrency to a fiat bank account, as well as behave in a much more faster manner. While a wire transfer of USD can cost multiple percentages to complete and will take days to process, Tether can be sent, received, and confirmed at a fraction of the cost in a fraction of the time.

I saw the price of Tether (USDT) backed to USD fall/increase, how is this possible?

Exchanges report pricings of Tether (USDT) which means that not all are up to speed. As a result, sometimes you may see the price of Tether backed by USD as fluctuating above or below the value of $1 USD. In many cases, this is nothing to worry about, however, it's important to keep up to date with news and developments in case anything fundamentally was changed.

Credit: Binance Support

Credit: Binance Support