How to Buy Luna 2.0 Token – Quick Guide

Checkout, a quick guide to buying Luna 2.0 in just a few simple steps:

Signup a Crypto.com Account: Go to the Crypto.com website and sign up for a free account. KYC documents are used to verify your identity.

Make a Deposit: With Crypto.com, you can buy LUNA 2.0 coins using fiat currency. Go to the ‘Wallets’ section of your account, choose the currency you want to deposit, and then use the QR-code feature or a transfer from your crypto wallet.

Buy LUNA 2.0: Search for LUNA 2.0 on Crypto.com– or Binance for lower fees; once set up, you can log in and place a buy order.

Where to Buy LUNA 2.0 Token – Best Crypto Platforms

Similar to ApeCoin, LUNA has many private equity investors and was quickly listed on the majority of the major cryptocurrency exchanges. These are some of the best places to purchase LUNA :

1. Binance: Trade LUNA 2.0 with Leading Crypto Exchange

Binance is a popular cryptocurrency exchange in the world. It has been around for quite some time and is still going strong. The exchange has grown from a small startup to one of the largest cryptocurrency exchanges in the world.

Binance offers much more to its customers than just cryptocurrency trading. They offer cryptocurrency-to-crypto, cryptocurrency-to-fiat, and fiat-to-crypto trading. They also provide margin trading, futures trading, and ICO listing.

Binance employs two-factor authentication (2FA) as well as FDIC-insured USD deposits. Binance also protects its customers in the United States through device control, address whitelisting, and cold storage. Fees for buying and selling range from 0.015 to 0.10 percent, with debit card purchases costing 3.5 percent or $10, whichever is greater, and US wire transfers cost $15.

The LUNA 2.0 is available for trading on Binance with a ticker symbol of LUNA, while the old Terra LUNA is now named as Luna classic or LUNC.

2. Crypto.com: Leveraged Trading on GMT

With over 9 million global users, Crypto.com is one of the most popular cryptocurrency wallets, allowing you to buy and sell more than 250 cryptocurrencies with low trading fees. Every day, Crypto.com processes over $2 billion in transactions. Furthermore, the company provides crypto-to-crypto and fiat-to-crypto services, as well as various payment methods such as credit cards, wire transfers, and cash deposits at any ATM worldwide.

Crypto, in addition to providing wallets, also provides trading services for Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP) via its subsidiary company, Crypto Capital Corp.

The company’s headquarters are in Hong Kong, with offices in the United States, Japan, Singapore, and South Korea. In Zug, Switzerland, Samuel Leach and Matt Mickiewicz founded Crypto on February 22, 2014.

This platform requires a $1 minimum account balance for deposits. The maker/taker fees range between 0.04 and 0.40 percent. Purchases made with a credit or debit card are free for the first 30 days after the account is opened. Additionally, users can earn up to $2,000 for each referral.

The platform’s main selling point is the ability to stake cryptocurrencies. Customers who stake or store their cryptocurrency in a crypto.com wallet can earn an annual interest rate of up to 14.5 percent. The exchange provides staking incentives, Visa card benefits, NFT trading, DeFi products, and other services in addition to trading.

Crypto.com provides trading on LUNA 2.0, as well as LUNA classic, which is available for trading as LUNC.

3. Coinbase: One of the Best Crypto Platforms to Trade Crypto

Coinbase Global, Inc., also known as Coinbase, is an American cryptocurrency exchange platform. Coinbase is a distributed company with no physical headquarters; all employees work remotely, and it is the largest cryptocurrency exchange in the United States by trading volume.

While the company offers a variety of high-value products for individual and institutional investors, corporations, and developers, its defining feature is the ability to buy, sell, and trade over 100 different cryptocurrencies and crypto tokens.

In April 2021, the company went public via a direct listing on the Nasdaq exchange. The platform’s quarterly trading volume has increased to $327 billion, and its assets have increased to $255 billion.

Coinbase has 98 million verified users and 150 crypto assets and listed the GMT coin on April 28, 2022, which caused the price of GMT to surge to nearly $4.90 on Coinbase alone. Coinbase lists almost all available cryptocurrencies, including Ethereum, Bitcoin, LUNA, Uniswap, Cardano, etc. In addition, it supports meme currencies like Dogecoin and Shiba Inu.

Coinbase charges a 3.99 % fee for purchases made with a debit or credit card; this fee is reduced to 1.49% when ACH transfers are used, or you can use Coinbase Pro for free bank transfer deposits.

The all-new Luna 2.0 is not yet available for trading on Coinbase, but the old LUNC (LUNA Classic) is. LUNA 2.0 should be listed on Coinbase soon. So it’s worthwhile to keep an eye on them.

4. eToro to List LUNA 2.0 in 2022

LUNA 2.0 is not yet available on eToro, but given its popularity, we can anticipate its addition soon. However, eToro still offers to trade on Luna Classic (LUNC). eToro is an online social trading and investment platform that allows you to trade stocks, commodities, indices, and forex. It also provides a social trading experience by allowing you to replicate other traders’ trades and share your investments with others. Furthermore, eToro has low fees, no minimum balance requirements, and a high liquidity level.

In other countries, eToro offers a comprehensive online brokerage platform. However, eToro is a newcomer to the US market and only offers crypto trading in the US. The eToro platform features 27 cryptocurrencies, a clear fee structure, and a vibrant user community. If you’re looking for low-cost crypto exchange, remember that eToro has relatively high trading fees.

Learn more about cryptocurrency staking.

It is completely free to make a deposit at eToro. Deposits can be made via wire transfer, credit or debit card, PayPal, Skrill, Sofort, or Netteller, among other methods. The minimum deposit amount varies depending on where the user is located. Before trading, individuals in the United Kingdom and the rest of Europe, for example, must make a minimum deposit of $200. Users in the United States must also deposit $10.

Update 2024 – Going forward, the only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

What is LUNA 2.0?

Luna 2.0, also known as Terra 2.0, is a new coin formed by a hard fork on the Terra blockchain that attempts to save the Terra Luna ecosystem following the collapse of the UST stablecoin. The new chain and Luna 2.0, according to a proposal submitted by TerraForm Labs developer Do Kwon, will replace the existing Terra network and the original LUNA by breaking ties with the stablecoin UST. In the coming days, most of Terra’s functionality and dApps will migrate to the new chain.

The Luna chains and tokens, on the other hand, will be used indefinitely. The original LUNA token will be referred to as LUNC, while the LUNA 2.0 token will be referred to as LUNA. Holders of LUNC (Luna Classic), USTC (UST Classic), and aUST tokens will be compensated with LUNA tokens (UST stake). When the Luna 2.0 was first released in late May 2022, its price was around $5, but it quickly increased by more than 90%. The token’s price will be discussed in greater detail later in this article. Investors who owned LUNA or UST before and after the attack, on the other hand, received Luna 2.0 for free.

Is Luna 2.0 (LUNA) a Good Investment?

Many people have been affected by Terra’s collapse, and many of them may no longer be able to obtain the coin. However, it is too soon to say whether Terra’s co-founder Do Kwon, facing charges in South Korea, is to blame for the company’s demise. As a result, Terra 2.0 should be able to fill some of the gaps left by Terra. However, as Terra is a well-known brand, price increases will be inevitable in the near future.

Terra 2.0 is protected by 130 active proof-of-stake validators (LUNA 2.0). Given the disaster that befell LUNA’s previous iteration, many in the crypto community have legitimate concerns about the coin’s stability. Even though no evidence of hacking or bad behavior has been discovered thus far, before investing in LUNA 2.0, investors should be aware of the risks.

Whether due to foul play or not, LUNA has proven to be a volatile asset in both versions. Luna 2.0, on the other hand, has the potential to be a profitable investment.

Let’s go over some of the key points to remember about this token:

Opportunity to Grab Hefty Returns

This has already been demonstrated with Luna 2.0, whose price increased by nearly 90% in the first hour of trading.

Since then, LUNA has fluctuated, demonstrating how volatile the token can be. Finally, this feature will undoubtedly draw those looking for double-digit (or even triple-digit) returns.

Despite Terra’s steep decline, the ecosystem continues to receive widespread support from the cryptocurrency community. For example, the Terra/Luna subreddit has nearly 82,000 members. The Terra/Luna Telegram server has around 50,000 members, and the ecosystem has many followers on social media platforms such as Twitter, Instagram, and Telegram.

Even if many people who use these social media platforms aren’t particularly enthusiastic about the project, it demonstrates retail traders’ interest in Luna 2.0.

The collapse of the old Terra ecosystem has been widely discussed in various places, including some of the best cryptocurrency YouTube channels. This debate even made it into the mainstream media, with articles about the initiative appearing in well-known publications like Bloomberg.

LUNA 2.0 Airdrops at No Cost

Before the crash, investors who owned LUNA or UST were given airdrops of Luna 2.0 as compensation for the event and as a thank you for sticking with the company. Pre-attack LUNA holders will receive 35% of the supply of Luna 2.0, while pre-attack UST holders will receive 10% of the supply.

Those who held LUNA following the attack will receive 10% of the total supply, while those who had UST following the attack will receive 15%. The remaining 30% of the collection will be placed in a communal pool, with developers receiving 10% of the total.

Price of Luna 2.0

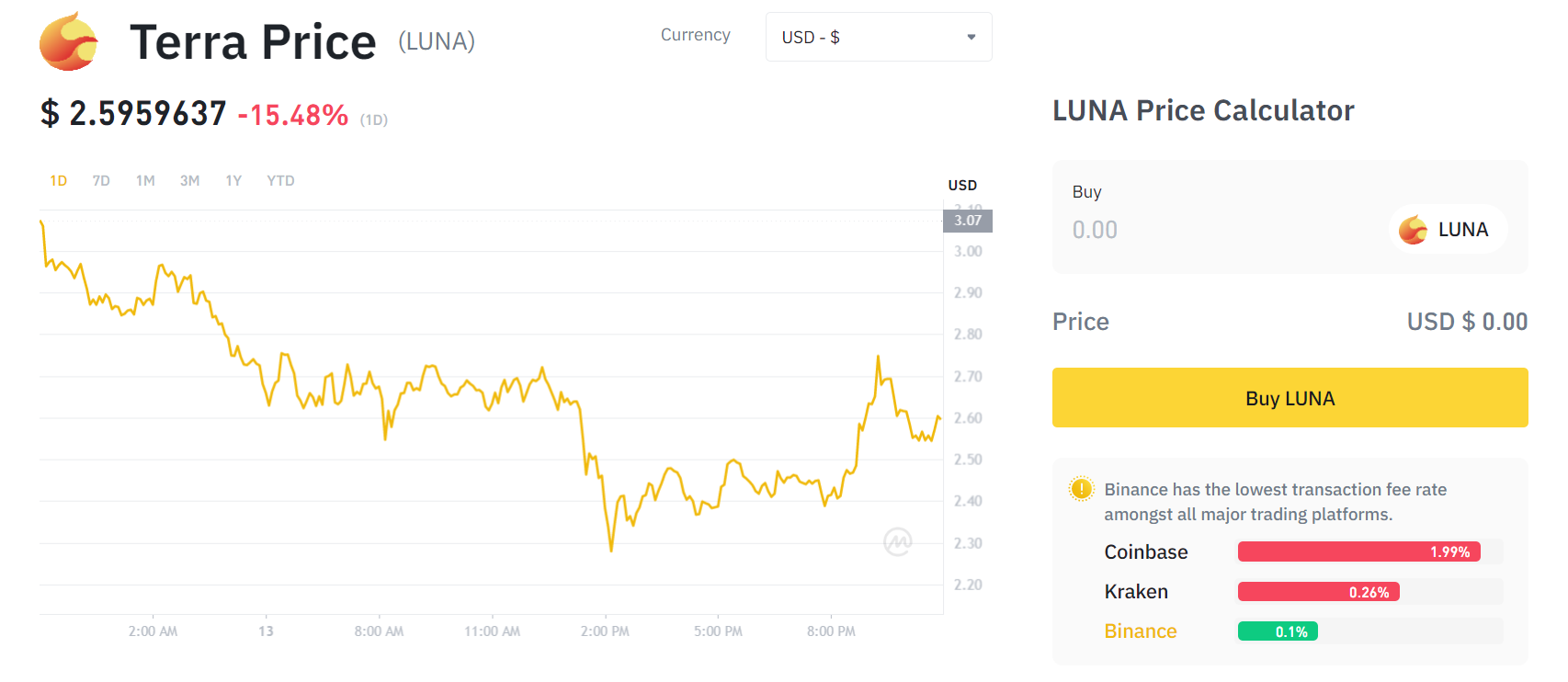

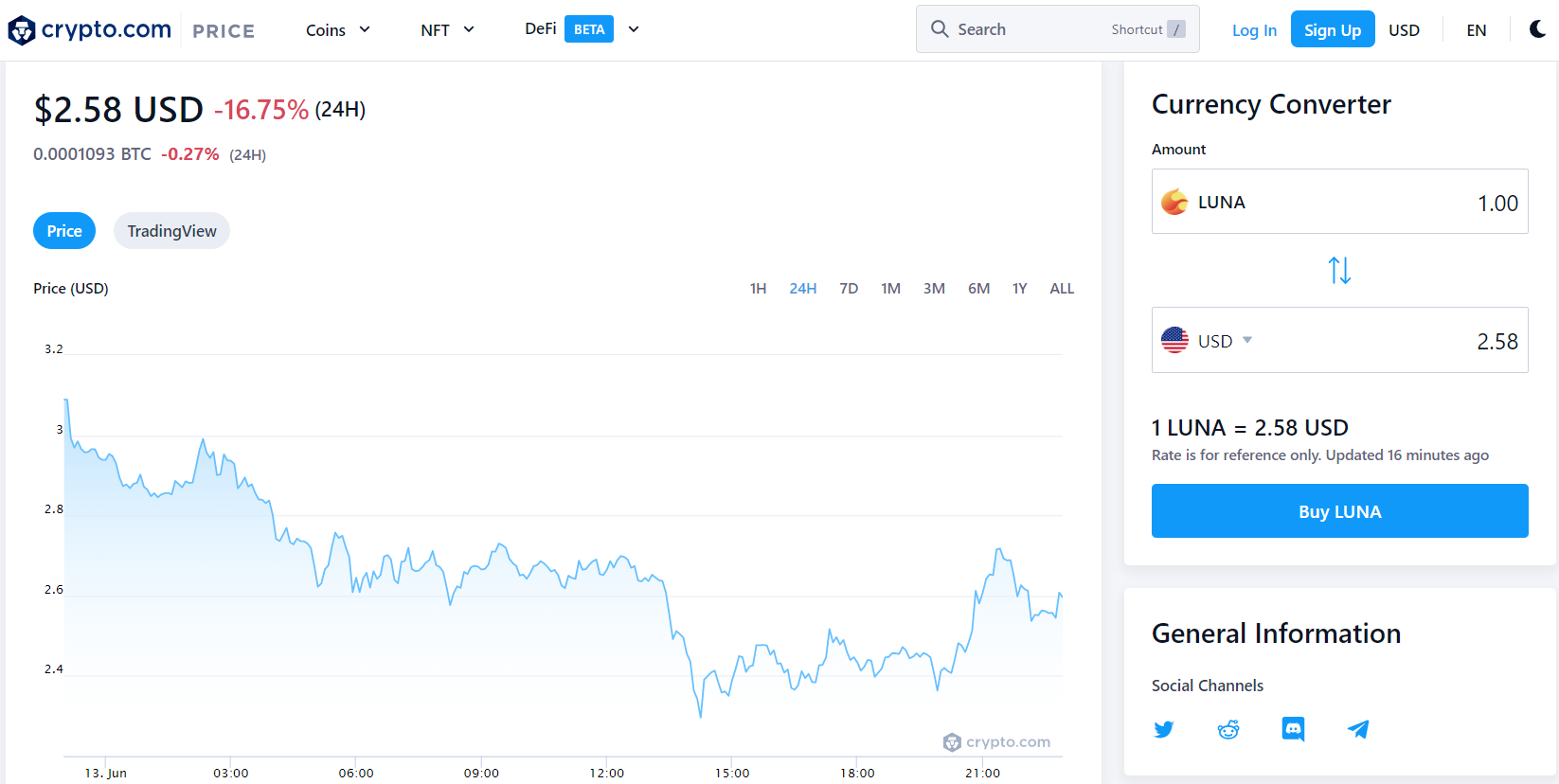

Due to the unexpected events with the previous edition of the token, the price of Luna 2.0 has had a rocky start. Terra currently trades at $2.59 with a 24-hour trading volume of $353,238,648. Terra has dropped 12.29% in the last 24 hours, while CoinMarketCap ranks at #2786. There is no circulating supply and a maximum supply of 1,000,000,000 LUNA coins.

Numerous market analysts continue to believe that LUNA is one of the best low-cap crypto coins, as it appeared to be when the coin was released and then skyrocketed by more than 90% in its first hour of trading.

LUNA 2.0 Daily Price Chart

Traders who purchased previous incarnations of LUNA and UST received free tokens via airdrop. As a result, when the price rose, it fell quickly as many investors attempted to “cash out” and recoup some of their losses.

LUNA 2.0 (LUNA) Price Prediction: Where does LUNA go from here?

Luna 2.0 is a cryptocurrency created in response to the Terra price drop (Luna 1.0). Luna 2.0 was introduced to the market on May 28, 2022. When it was first released, the Luna 2.0 was priced at $16.98.

The LUNA/USDT pair has reached its highest price to date at $19.53. The maximum price for Luna 2.0 was reached on the day of its launch, May 28, 2022. It’s also possible that the price of Luna 2.0 will skyrocket, providing crypto investors with significant returns and profits. But at the same time, it can be a total failure as investors may fear holding LUNA 2.0 considering the recent incident with LUNA 1.0 (LUNC).

Luna 2.0 is a well-known and popular cryptocurrency among cryptocurrency investors. Following the Terra (Luna) crash, many people anticipate the Luna 2.0 and expect a price increase. Many cryptocurrency investors are interested in Luna 2.0. If you’re interested in Luna 2.0’s future potential, check out our Luna 2.0 price forecast for the next few years.

Luna 2.0 Price Prediction 2022

Luna 2.0’s price in 2022 has a lot of potential and expectations from crypto investors. Many people have invested in the Luna 2.0 since its release, but the price of the Luna 2.0 is struggling to rise. It is expected that the Luna 2.0 will cost more than $10.00 by the end of 2022.

Luna 2.0 Price Prediction 2023

The price of the Luna 2.0 may be profitable in 2023, providing significant profits to crypto investors who put their faith in it. It is expected that the Luna 2.0 will cost more than $14.00 by the end of 2023.

LUNA/USD 4-Hour Price Chart – Downward Trendline to Extend Resistance

Luna 2.0 Price Prediction 2024

Many cryptocurrencies will be launched in the coming years, beginning in 2024. However, Luna 2.0 seems to have a lot of potential in the coming years. Luna 2.0 has the potential to be a game-changing coin with massive investment potential. It is expected that the Luna 2.0 will cost more than $20.25 by the end of 2024.

Luna 2.0 Price Prediction 2025

Many people are optimistic about Luna 2.0, believing that it will benefit cryptocurrency investors. It is expected that the Luna 2.0 will cost more than $27.00 by the end of 2025.

Ways to Buy Luna 2.0 Token

At the moment, Luna 2.0 coin is now only supported by a few platforms, making it difficult to find a place to buy it. Therefore, It’s can be a good idea to look into the various methods and options available to traders. Let’s dip deeper into this.

Buy LUNA 2.0 via Debit and Credit Card

You can buy Luna 2.0 with a credit card or a debit card. Nowadays, there are several cryptocurrency apps that allow users to purchase digital currencies with a credit or debit card immediately. This eliminates the need for a fiat currency or cryptocurrency deposit, simplifying the investment process.

Although Luna 2.0 cannot be purchased with a credit or debit card directly, Crypto.com offers this option via the Crypto.com App. Instead, users can purchase USDC with a credit card and then exchange it for the LUNA2/USDC pair on the Crypto.com Exchange.

Using PayPal to Buy LUNA 2.0

It is now easier than ever to purchase cryptocurrency, pull out your phone and launch the PayPal app.

PayPal is one of a few popular mobile and online payment platforms that now allow US users to buy, sell, and hold cryptocurrencies for as little as $1. However, if you want to add cryptocurrency to your portfolio, you should carefully consider which platform to use — and whether you should invest in cryptocurrency at all.

Regretfully, our recommended exchange service, Crypto.com, does not accept PayPal as a deposit method. Nevertheless, it is possible to connect PayPal to the Crypto.com App and deposit fiat currency. After this deposit has been processed, the FIAT currency can be converted to crypto, which can then be used to trade the LUNA/USDC pair on the Crypto.com Exchange.

How to Buy Luna 2.0

Like all cryptocurrencies, investors wishing to acquire Luna 2.0 must open an account with a secure and reputable cryptocurrency exchange. Currently, only a handful of platforms offer Luna coins for purchase, and Crypto.com is our top pick.

In light of this, the steps outlined below demonstrate how to invest in Luna 2.0 using Crypto.com in a matter of minutes.

Step 1: Open a Crypto.com Account

The first step in learning how to buy Luna cryptocurrency is to create a Crypto.com account. Luna 2.0 could be found on Crypto.com’s ‘Exchange’ service. As a result, you’ll need to create an account through your web browser.

Click the ‘Sign Up’ button on the Crypto.com Exchange’s main page. Following that, you’ll be prompted to enter some personal information and create an account password.

Step 2: Verify Your Crypto.com Account

To complete the Crypto.com verification process, you must first download the Crypto.com app from the App Store or Google Play. Then, log in with the information you created in the previous step, and once your account has been downloaded, select to verify it.

During the verification process, Crypto.com will request three pieces of information.

1: Full legal name

2: A photograph of a government-issued ID card (e.g., passport)

3: Take a photograph

Once you’ve submitted them, Crypto.com will begin validating them, and you’ll be notified when they’re complete.

Step 3: Deposit Funds Into Your Crypto.com Account

After your account has been authenticated, go to your dashboard, click ‘Wallets,’ and then ‘Deposit.’ Then, using an external cryptocurrency wallet, select the coin to deposit and finish the transaction with a QR code or your wallet address.

Step 4: Search the web for Luna 2.0

Enter ‘LUNA2’ into the top-right search bar, then choose ‘LUNA2/USDC’ from the drop-down menu.

Step 5: Buy Luna 2.0

To obtain Luna 2.0:

- Enter your investment information into the order box.

- Ensure the ‘Market’ area of the order box is selected so your transaction can be executed immediately.

- Complete the transaction by entering the number of LUNA 2.0 you want to purchase, double-checking everything, and then completing it.

Summary

Securing the future of LUNA 2.0 is critical to the sustainability of the ecosystem because it is the lifeblood of the crypto project. The cryptocurrency is primarily used for transaction verification via Terra’s proof of stake process. Those who stake the token and take part in this process will be able to get rewards for paying the transaction fees. It also serves as Terra’s governance token. Holders of LUNA 2.0 will be able to vote on the blockchain’s future. Investors, for example, voted on Do Kwon’s proposal to create the new Terra 2.0 blockchain.

This article explains how to obtain Luna 2.0 right now, including which platforms sell the token and how to get it at the best price. Despite its flawed reputation, the Terra community holds it in high regard, making it an appealing option for daring adventurers.

On Crypto.com, users can invest in Luna 2.0 for as little as 0.4 percent in trading fees. These fees, on the other hand, can be cut by 10% if paid in CRO. Also, Crypto.com offers more than 250 other cryptocurrencies, which makes it easy to put together a well-balanced portfolio.

Other Undervalued DeFi Projects

We recently updated our list of the best altcoins to include DeFi coin, an underappreciated DeFi project (DEFC). Despite the May cryptocurrency crash, it increased in value by 350-400 percent that month after completing portions of its roadmap.

It has also retraced 98.75% of its all-time high, as has Terra LUNA, albeit after more than a year. It’s now at a low price, but it’s still more than the presale price. It has more upside potential than downside risk, and it has room to grow as the DeFi market cap recovers in 2024.

- DeFi Coin Website

- DeFi Coin Discord

- DeFi Coin Telegram

FAQ

What exactly is the Luna 2.0 coin?

Luna 2.0 is an updated version of the original LUNA token, which crashed alongside UST in a spectacular crash. Although the previous coin is still in operation and trades under the ticker 'LUNC,' this new token is unique to the Terra network.

Is there a difference between Luna 2.0 and Luna Classic?

Luna 2.0 is distinguished from Luna Classic by its use of Terra's new blockchain. There is also no connection to the UST stablecoin, so there are no underlying 'burning and minting' mechanics like there were with the previous LUNA.

Where can I buy Luna 2.0?

If you're looking for a place to buy Luna cryptocurrency, Crypto.com is a good place to start. On Crypto.com, you can trade the 'LUNA2/USDC' pair, which provides exposure to the price swings of Luna 2.0.

Should I invest in Luna 2.0?

Since Luna 2.0 has only been trading for a short time and has already demonstrated tremendous volatility, determining whether it is a good investment is difficult. If TerraForm Labs can meet its goals, it will go a long way toward restoring trust in the ecosystem as a whole.