With how rapidly the cryptocurrency market has grown in recent years, investing in a Bitcoin ETF could be a wise move. The buzz over upcoming Bitcoin ETFs could see Bitcoin reach a new all-time high. We’ll go over the best Bitcoin ETFs and their features in this guide. We’ll also recommend some of the best brokers to invest with.

Since its launch in 2009, the first-ever cryptocurrency has become a hot topic of discussion in the financial markets worldwide. Bitcoin is independent of conventional, governmental currency systems like the US Dollar or Euro, which governments regulate. Bitcoin has no such limitations because it is free of regulations yet, and the right of ownership of BTC is regulated through the possession of computer-generated keys. There is no need for a bank when processing and administering payments in bitcoin as it is done by the so-called blockchain, a decentralised and synchronised accounting system.

The capacity of Bitcoin has been set as limited by the use of an algorithm in the network. It is the oldest cryptocurrency, and the limited supply is the factor that has been moving its prices upward in the financial markets apart from other features offered by the cryptocurrency. Furthermore, the new units of BTC are created by solving cryptographic challenges, known as mining, which require large amounts of energy and computing capacity.

Many investors are hesitant to include them in their portfolios as many people are still unfamiliar with cryptocurrencies and the processes that underpin them. Despite the increasing popularity of cryptocurrencies, many investors consider the procedure of buying and holding bitcoin and other cryptos too complicated.

The cautious behaviour of investors, along with the high risk involved due to volatility and the highly speculative market conditions, has made investing in cryptocurrency very complex for many people. However, for those interested in gaining from the new technology of cryptocurrencies and who do not want to hold or buy actual cryptocurrencies, there are still ways to have direct exposure to them through ETFs.

On this Page:

Best Brokers for Bitcoin ETFs in December 2024

The following have been consistently recommended by new and experienced investors alike for Bitcoin ETFs:

- eToro

- Libertex

- Capital

- Plus500

- Ameritrade

- Coinbase

- Changelly

- Paxful

To invest in technology ETFs, you’ll need to choose a reputable and trusted trading platform, as we indicated before in this tutorial. When looking for an ETF Broker or ETF Trading app, there are numerous variables to consider, including asset selection, fees and commissions, and the brokerage firm’s tools and platform.

Conventional brokers have the benefit of offering a broad range of investible instruments, albeit you can usually only trade Bitcoin futures directly with them. Crypto exchanges, on the other hand, are confined to digital currencies. You can own them directly and typically buy multiples, rather than just Bitcoin or Bitcoin futures, as you would with a conventional broker. PayPal has gotten in on the act as well, allowing users in the United States to purchase and trade cryptocurrencies.

The finest cryptocurrency brokers, both traditional internet brokers, and new specialist cryptocurrency exchanges, are listed below. You could also want to look into which brokers give the best sign-up bonuses to see where you can save a little money. Lastly, these are the few best brokers in the industry as they offer highly competitive spreads, 0% commissions, amazing customer support, and most importantly, these brokers have been in the market for decades, which boosts the level of confidence in them.

What are ETFs?

An ETF (exchange-traded fund) is a tradeable security that can be bought and sold on a stock exchange just like stocks. It is a type of investment fund similar to mutual funds in many ways, except that ETFs are bought and sold by other owners throughout the day on stock exchanges. At the same time, mutual funds are bought and sold by the issuer based on their price at the end of the day. The associated price of an ETF enables investors to buy and sell it as a marketable security quickly.

ETFs are usually operated as a hybrid between mutual funds and stocks. It is essentially a group of stocks, bonds, or other assets. Moreover, it’s a financial product that tracks an underlying asset or index and provides a real-time price of the fund throughout the day. ETFs are considered the most popular choice for investors seeking diversification, as when a trader buys a share of an ETF, he has a stake in the basket of investments owned by the fund.

It is crucial to mention that an ETF divides ownership of itself into shares that shareholders hold. Thus, one of the exciting things about ETFs is their low cost, tax efficiency, and traceability, making them an attractive investment option.

The name Exchange Traded Fund suggests that it is traded on an exchange just like stocks, and the ETF price tends to change throughout the day with the buying and selling of shares. In the United States, the most popular ETFs replicate the S&P 500 Index, the NASDAQ 100 Index, and gold’s price. It was reported in August 2021 that about $9 trillion had been invested in ETFs globally, out of which $6.6 billion was invested in the US.

There are numerous types of ETFs available to investors, including Bond ETFs, Stock ETFs, Industry ETFs, Commodity ETFs, Currency ETFs, Inverse ETFs, and Cryptocurrency ETFs.

Cryptocurrency ETFs

Most ETFs track an index or a basket of assets, but a cryptocurrency ETF tracks the price of one or more digital tokens. In simple words, a fund consisting of cryptocurrencies could also be known as a cryptocurrency ETF.

The share price of cryptocurrency ETFs tends to fluctuate daily, just like common stocks with the buying and selling of underlying cryptocurrency in the market by investors. The cryptocurrency ETFs are traded on exchanges like the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE).

Types of Cryptocurrency ETFs

There are two kinds of cryptocurrency ETFs. Physical cryptocurrencies back one, and the other one is a synthetic variant that tracks cryptocurrency derivatives. In the first type, the investment firm managing the fund purchases the actual cryptocurrencies, and the coin’s ownership is represented by the shares. Investors can indirectly own cryptocurrencies by purchasing the shares in an ETF. In this way, shareowners can reduce the risk associated with the ownership of cryptocurrency and the accompanying expense while gaining exposure to the cryptocurrency.

The second type of cryptocurrency ETF tracks the cryptocurrency derivatives just like futures contracts and is considered a copied variant that mimics the real price of the derivatives of underlying cryptocurrencies. Many proposed ETFs seek approval from the US Securities and Exchange Commission to track the prices of Bitcoin futures contracts traded at the Chicago Mercantile Exchange. The ETF share price does not mimic the price of an actual cryptocurrency; and instead, it follows the movements of derivatives.

Therefore, the price of cryptocurrency ETFs changes according to the price of cryptocurrency futures contracts. Synthetic cryptocurrency ETFs are considered riskier as their operations might not always be transparent, just like other derivatives.

Status of Bitcoin ETFs

Bitcoin started trading on an exchange in 2009, and five years after that date, the Winklevoss twins filed an ETF proposal with the SEC for Bitcoin. The agency did not approve their application, and since then, the SEC has not granted any Bitcoin or other cryptocurrency ETF approval, given the unstable and insecure nature of the cryptocurrency market.

Since 2014, the SEC has been receiving many applications from investment firms of all kinds to take profit from the price volatility associated with the BTC. In 2021 alone, the SEC has recorded receipt of about 12 applications for approval of cryptocurrency ETFs. However, none of them has yet received a go-ahead from the agency.

Many cryptocurrency ETFs have received approval in some financial jurisdictions, mainly in Europe and Canada, but the US SEC has been reluctant to provide green-light to cryptocurrency ETFs, citing the high number of risks associated with security and stability.

How Do Bitcoin ETFs Work?

Just like other exchange-traded funds that track the price of an underlying asset or index, a Bitcoin ETF also works the same way. The Bitcoin ETFs track the price of Bitcoin, which means whenever the leading cryptocurrency increases, the price of a share in the BTC ETF also increases and vice versa. However, instead of trading on a cryptocurrency exchange, a Bitcoin ETF would trade on a market exchange like the TSX or NYSE.

- ETC-Group Physical Bitcoin ETF (BTCE)

- 21Shares Bitcoin ETP (ABTC)

- VanEck Vectors Bitcoin ETN (VBTC)

- WisdomTree Bitcoin (BTCW)

- CoinShares Physical Bitcoin ETP (BITC)

- Iconic Funds Physical Bitcoin ETP (XBTI)

- Melanion BTC Equities Universe ETF (UCITS)

The Best Bitcoin ETFs to Buy?

Given the rising interest of investors, institutions, and even governments in bitcoin, it is assumed that the US SEC might no longer drag its feet to approve a cryptocurrency ETF. Some of the Bitcoin ETFs that have received approval from European regulators are mentioned below.

1- ETC- Group Physical Bitcoin ETF (BTCE)

On June 7, the ETC Group, a European issuer of crypto exchange-traded products, started trading in the first cryptocurrency exchange-traded product, BTCE, on a UK exchange MTF. It was the first time any cryptocurrency ETP was made available for trading on any UK or European market. ETC-Group Physical Bitcoin ETF (BTCE) was the world’s first centrally cleared BTC ETP. Thus, it was also the first crypto ETP to be approved by the German regulators.

The BTCE was initially listed on Deutsche Börse’s XETRA platform in June 2020. However, it extended its listing on the SIX Swiss Exchange in January 2021. In August, the ETC Group recently extended the listing of its entire portfolio to the Vienna Stock Exchange. The fund has been the top bitcoin exchange-traded product performer in Europe, with $459.66 million inflows in Q1 of 2021. This amount was equivalent to around 41% of the total inflows into the 8 Bitcoin ETPs during the same period.

The crypto ETP of ETC Group allows institutions and retail investors to add exposure by trading on regulated markets through their conventional brokers or banks in the same way as for conventional shares. The crypto funds by ETC Group have been listed across Europe. However, the US SEC has not approved a Bitcoin ETF as of yet. The product, BTCE, tracks the value of the cryptocurrency Bitcoin. The management fee associated with BTCE is 2.0%, and the assets under management in this fund are worth 655.17 million euros. The BTCE is currently trading at 39.0270 euros.

2 – 21Shares Bitcoin ETP (ABTC)

A Swiss pioneer crypto ETP issuer, 21Shares, launched its Bitcoin ETP under the ticker ABTC on the Aquis Exchange in June 2021. The Aquis Exchange is based in London and Paris and offers trading in one of the biggest liquid stocks across 15 European markets. The ETP was engineered like an ETF and traded on the exchange similarly to a listed stock.

The main aim of 21Shares Bitcoin ETP (ABTC) was to provide institutional UK investors with a secure and cost-effective exposure to Bitcoin without the associated custody of crypto coins and security challenges. One unit of ABTC represents exposure to roughly 0.00035 bitcoin entitlement.

The ABTC tracks the price of the original Bitcoin cryptocurrency with a management fee of 1.49%. The assets under management in the 21Shares Bitcoin ETP are worth 247.95 million euros.

ABTC is currently trading at 15.67 CHF.

3- VanEck Vectors Bitcoin ETN (VBTC)

In November 2020, a New York-based fund manager, VanEck, followed the example of other European ETF issuers and launched a bitcoin exchange-traded note on Deutsche Börse’s XETRA exchange. The VanEck Vectors Bitcoin ETN (VBTC) tracks the MVIS CryptoCompare Bitcoin VWAP Close Index and is 100% backed by bitcoin. It is also listed on SIX Swiss Exchange, Euronext Amsterdam, and Euronext Paris and can be traded there, along with Deutsche Börse’s XETRA.

The VanEck Venctors Bitcoin ETN closely tracks the rice of bitcoin by following the MVIS Cryptocompare Bitcoin VWAP Close Index. The total expense ratio of VBTC is 1%, and it enables the investors to gain exposure to the cryptocurrency without having to buy it directly themselves. The total amount of assets under management is 178.94 million euros.

VBTC is currently trading at 22.36 Euros.

4 – WisdomTree Bitcoin (BTCW)

The Bitcoin ETF offered by WisdomTree is the cheapest physically-backed bitcoin ETP in the whole of Europe as it has a total expense ratio of 0.95%. The WisdomTree Bitcoin (BTCW) is listed on Germany’s Deutsche Börse’s XETRA, SIX Swiss Exchange, Euronext Paris, and Euronext Amsterdam exchange. It was first launched on Deutsche Börse’s XETRA in April 2021.

The BTCE provides investors with simple, secure, and cost-efficient exposure to the most liquid and popular cryptocurrency, BTC. Investors can access bitcoin without holding it directly. The product BTCW tracks the price value of the cryptocurrency Bitcoin with a total expense ratio of 0.95%, and it has assets under management worth 229.88 million euros.

BTCW is currently trading at 11.67 USD.

5 – CoinShares Physical Bitcoin ETP (BITC)

CoinShares is the largest crypto ETP provider in terms of AUM with $2.9 billion. With the growing institutional investor demand for cryptocurrency, CoinShares followed the other firms and launched a physically-backed Bitcoin ETP in January 2021. The CoinShares Physical Bitcoin ETP (BITC) has a total expense ratio of 0.98% and is listed on the SIX Swiss Exchange. The product, BITC, tracks the value of the cryptocurrency bitcoin.

The BITC was funded with $100 million in assets under management so that the level could be maintained. Institutions and corporates require that to consider investing in it. Currently, the assets under management have reached 266.46 million euros. Each unit of BITC is backed by 0.001 bitcoins, which CoinShares hold.

The current price of BITC is 43.72 CHF.

6 – Iconic Funds Physical Bitcoin ETP (XBTI)

In May 2021, a crypto-asset investment manager, Iconic Funds, introduced its first exchange-traded product in Germany. In May, the Iconic Funds Physical Bitcoin ETP (XBTI) was listed on Deutsche Börse’s XETRA with approximately 10 million euros.

The ETP tracks the price movements of Bitcoin by following the fluctuations in an underlying NYSE Bitcoin Index, which measures verifiable bitcoin transactions occurring on Coinbase Exchange. The total asset under management is $4.05 million. Each unit of XBTI is fully backed by 0.0001 bitcoin. The expense ratio of XBTI is 0.95%, which is equal to the cheapest fee charged by WisdomTreee Bitcoin ETP.

The current price of XBTI is 4.03 Euros.

7 – Melanion BTC Equities Universe UCITS ETF

A Paris-based asset manager, Melanion Capital, specializing in derivatives and computer-driven strategies, has recently got approval from French regulators to launch its Bitcoin ETF in August 2021. The Melanion Bitcoin Exposure Index is set to list on Euronext in Paris soon, and when it completes its listing on the exchange, it will become the cheapest Bitcoin ETF globally with a charge fee of 0.75%.

How to Invest in the Best Bitcoin ETFs in the UK

So now that you know everything there is to know about the top technology ETFs on the market and the most highly recommended trading platforms in the UK, we’ll walk you through the steps to establish an account and begin trading with eToro.

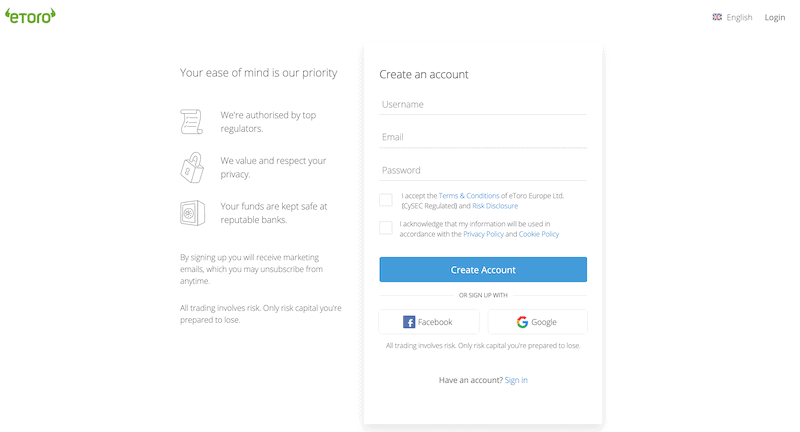

Step 1: Opening an Account and Funds Deposit

Once you decide the best Bitcoin ETF to buy, the next step is to open an account with the best Bitcoin ETF broker who will give you access to the online trading account. The process of opening an account with a top broker in the United Kingdom, eToro, is mentioned below.

The first step is to open the website of eToro and then register for a trading account by clicking on the “Join Now” button at the center of the screen.

- Full name

- Nationality

- DOB

- Address

- Contact Details

- Username and Password

Best Bitcoin ETF broker eToro

After providing the information, investors will be required to prove their identity through their driver’s license or copy of their passport. Another requirement will be to issue a recent copy of the utility bill or bank account statement. After uploading these documents, the next step will be to deposit funds into the account.

Minimum Deposit: $200 or £160

The minimum amount or the desired amount can be deposited through:

- Debit cards

- Credit cards

- Bank transfers

- Skrill

- PayPal

- Neteller

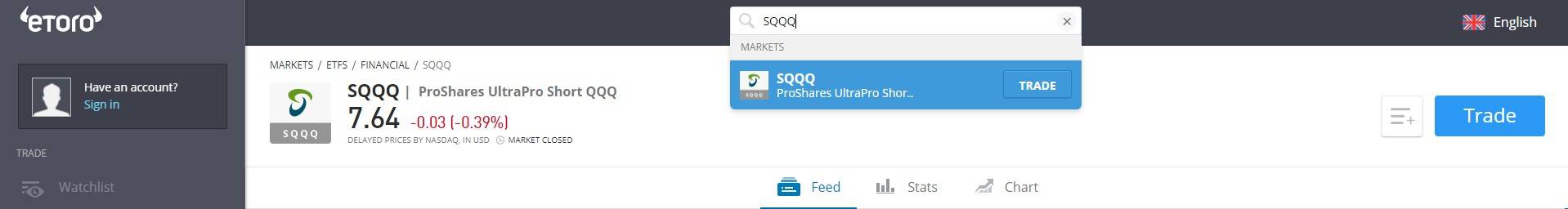

Step 2: Buy Best Bitcoin ETF via the eToro Platform.

Once the account has been funded, investors can now begin the process of purchasing SQQQ ETF. The method of buying ETFs via eToro is straightforward to follow. Let’s take a look:

- The process starts with logging into the account by entering the username and password.

- Type ProShares UltraPro or SQQQ in the search box. However, you can choose any from 257 ETFs available on eToro.

- The popped-up search results will bring forward a list, and investors will have to click on the desired stock.

Best Bitcoin ETF broker eToro

Then, click on the ‘Trade’ button and enter the desired amount of money you want to invest in the shares. Finally, clicking on ‘Open Trade’ will execute the function, and investment in the best Bitcoin ETFs will be made successfully.

Update – As of 2024, the only cryptocurrencies eToro users in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash and Ethereum.

Advantages of Bitcoin ETFs

1- Convenience

Investing in a bitcoin ETF would eliminate many complex procedures involved in bitcoin holding, another method of investing in bitcoin. The traditional method of buying bitcoin requires learning about how bitcoin works, while Bitcoin ETFs provide a convenient way of investing.

Signing up for a cryptocurrency exchange and accepting the risks of directly owning bitcoin is also required for bitcoin holdings. By investing in a bitcoin ETF, investors can free themselves from the need to hold bitcoins in a wallet.

Furthermore, many traders and investors have complained about forgetting their passwords for the wallet, which led them to lose their bitcoin forever. Investors can also avoid such misfortune by simplifying investing in Bitcoin through ETFs as it does not require holding bitcoins.

2- Diversification

The Bitcoin ETF can reduce risk by diversifying the portfolio, as an ETF can hold more than just one asset. Whereas, the Bitcoin ETF could comprise bitcoin, Facebook stocks, Apple stocks, and more, therefore mitigating the risk by diversifying the portfolio. Similarly, a bitcoin ETF also provides investors with the chance to diversify their existing equity portfolios as they are traded on a regulated market exchange.

3- Efficiency in Taxation

The majority of tax regulators and pension funds do not allow bitcoin purchases as it is unregulated and decentralized. There is no such restriction on Bitcoin ETFs because they are traded on traditional exchanges and are likely regulated by the SEC and made tax efficient.

Disadvantages of Bitcoin ETFs

1 – Management Charges

The convenience provided by the Bitcoin ETFs is not free of cost as they charge management fees for it. Therefore, a significant number of shares in a bitcoin ETF could lead to high management fees over time.

2 – ETF Inaccuracy

A Bitcoin ETF provides leverage on the bitcoin price, but it may or may not be an accurate tracker of its price due to its diversified nature. If an ETF has more underlying assets than just bitcoin, it might reflect the bitcoin price inaccurately. Thus, an ETF might reflect an inaccurate rise in the bitcoin price due to an increase in its other holdings.

Limits to cryptocurrency trading

A Bitcoin ETF can not be traded for other cryptos, as the original bitcoin cryptocurrency can. Bitcoin can be traded for Ethereum, Litecoin, XRP, or any other cryptocurrency. However, the ETF lacks such a trading opportunity as it is simply an investment fund that tracks the price of Bitcoin.

Lack of bitcoin ownership

There are numerous benefits to owning a bitcoin that cannot be obtained through investment in a Bitcoin ETF.Bitcoin is used as a hedge against central banks. Equities and fiat currencies. The risks associated with the financial system can be mitigated through bitcoin as it is independent of central banks.

The main feature of bitcoin is that it provides users and investors with complete privacy through its blockchain. All of these benefits are not accessible through investing in the BTC ETF as the government regulates it.

Best Bitcoin ETF Brokers for 2024

A reliable and trusted trading platform is needed to invest in Bitcoin ETFs. While selecting a stockbroker of your choice, many factors should be considered, like the offered assets, the fees and commissions, and the tools and platform provided by the brokerage firm. Currently, US investors cannot invest in Bitcoin ETFs as they are not available on local exchanges. However, if one might want to invest in a Bitcoin ETF outside the US, especially in Europe or the UK, he can gain exposure to real cryptocurrency ETFs through many platforms. The following are the names of the best brokers that new and experienced investors consistently recommend for trading Bitcoin ETFs:

- eToro

- Libertex

- Capital

- Plus500

- Ameritrade

- Coinbase

- Changelly

- Paxful

To narrow down the research, the review of the five most popular online trading platforms in the UK for buying and selling Bitcoin ETFs is mentioned below.

1 – Coinbase

Coinbase is among the most well-known cryptocurrency exchanges in the United States, and it’s one of the world’s largest. Nevertheless, keep in mind the hazards of trading these speculative currencies. Coinbase, the largest cryptocurrency trading platform in the United States, was founded in 2012 in San Francisco.

CoinMarketCap.com, a market research website, is also among the top crypto exchanges globally in terms of traffic, liquidity, and trading volumes. Coinbase is a cryptocurrency brokerage that provides custodial services for institutional cryptocurrency storage and a cryptocurrency payments network for businesses. Furthermore, USD Coin (USDC) is a stable cryptocurrency pegged to the US dollar.

Coinbase became the first crypto trading company in the United States to be listed on a US exchange in April, with an IPO valued at roughly $86 billion. While bitcoin brokerages are not covered by the Securities Investor Protection Corporation or SIPC, Coinbase covers its site for any losses incurred due to theft or hacking.

Pros & Cons of the Coinbase platform:

- It offers access to more than 50 cryptocurrencies.

- Low minimum to fund an account.

- Cryptocurrency is insured in the event a website is hacked.

- Higher fees than other cryptocurrency exchanges.

2. eToro – The Best Broker to Buy Bitcoin ETF UK

eToro is a 100% commission-free broker based in the United Kingdom. It was first launched in 2007, and since then, it has expanded its business throughout the UK. With more than 13 million active traders, eToro is a well-known stockbroker in the UK. Furthermore, it does not charge any commission fees to its investors. eToro is licensed by the FCA, ASIC, and CySEC and is partnered with the FSCS. This platform provides a traditional way of buying shares and offers CFDs that provide leveraged trading with low margin requirements.

It means investors do not only enjoy the benefits of commission-free trading, but they can also avoid monthly/annual charges by choosing eToro. The broker provides trading through 17 different stock exchanges with more than 1700 equities, including NASDAQ. Besides, eToro supports about 30 different cryptocurrencies and offers 100% commission-free services. It provides a user-friendly social trading platform that enables traders to interact with one another. Currently, eToro offers 1:5 leverage on ETFs and stocks, which means that by holding 20% of the total value of the transaction, traders can invest in ETFs.

Unlike traditional brokers, eToro not only charges a 0% commission fee but also does not charge any account management fees, rollover fees, or ticket fees. However, the only fee charged by eToro is a minimum buy and sell spread fee. The best feature provided by eToro is its social trading platform and tools, which are very useful for beginner investors. The interactive platform enables traders to copy the trade positions of experienced traders, giving rewards to professional traders.

Initial Deposit

Initial Deposit

The minimum investment of $50 means that investors can enjoy the leverage trading facility. In simple words, investors have a chance to own a fraction of a share if they want, and they can also buy shares worth more than the amount deposited through CFD.

Copy trading is also a feature provided by eToro to its customers, which can help beginner traders mirror an experienced investor’s portfolio.

Various Payment Options

Traders can use various payment methods through credit/debit cards, bank transfers, or e-wallets like PayPal, Skrill, VISA, or Neteller. Another exciting service offered by eToro is that investors can also buy and sell a fraction of stocks. For all newbies, it means traders can buy a fraction of stocks and have no need to buy a single share of a company with their share trading account eToro.

Regulation

eToro is regulated in the United Kingdom (UK) and worldwide, holding licenses from the ASIC, FCA, and CySEC. In addition to this, eToro is a member of the Financial Services Compensation Scheme (FSCS) that protects the first £85,000 of investors’ funds in case of the broker’s bankruptcy.

Buying and selling on eToro can be done online as well as on mobile devices through their application. The opening process of an eToro account is straightforward and takes about a couple of minutes. The payment can be deposited in various ways, including debit/credit cards, e-wallet, bank transfer, and Paypal.

Pros & Cons of the eToro platform:

- eToro offers copy & social trading

- ASIC, FCA, and CySEC regulated

- Offers to buy CFDs along with the shares.

- Commissionless shares trading.

- User-friendly GUI (graphical user interface) stockbroker.

- Renowned mobile trading app.

- eToro accepts Skrill, VISA, Neteller, and PayPal.

- Performing advanced technical analysis can be challenging for pro-traders.

68% of retail CFD accounts lose money when trading with this provider.

3. Capital.com – Trade Best ETF Commission-Free

Capital.com is a global CFD brokerage with subsidiaries in the United Kingdom, Cyprus, and Belarus.

Over 2 million traders call it home, and it has processed over $18 billion in transaction activity. Investors who seek more flexibility in their investments can choose a UK-based trading platform at Capital.com.

It is a CFD specialist platform that offers leveraged trading as well as short-selling. Bitcoin ETH can be traded through Capital.com by putting only 20% of the margin.

Over 3,000 of the most liquid assets are spread across five sectors, making it an appealing option for all sorts of traders.

Initial Deposit

Captial.com requires a minimum deposit of $20 to get an account open. Client funds are fully separated at RBS and Raiffeisen; accounting behemoth Deloitte audits two of Europe’s largest financial institutions and accounts. Through its Prime Capital division, this broker also caters to institutional clients, implying a large liquidity pool. Captial.com offers only a proprietary trading platform.

Another interesting service offered by Capital.com is that it offers services at a meager cost compared to other brokers. Along with commission-less trading, Capital.com also charges meager spread fees. CFD stock trading is recommended only for experienced investors, but Capital.com offers to help newbies with educational materials, including a trade learning mobile app. Like other brokers, it also accepts payments through debit/credit cards, bank transfers, or e-wallets. It also offers demo-account trading for risk-free trade learning. It is also regulated by the FCA.

Pros & Cons of the Capital.com platform:

- Provides 100s of UK and US-listed shares trading

- Trade learning mobile app

- AI assistance to identify weak points in trading

- Provides daily trade ideas.

- Advance trading with charts and analysis interface

- 100% commission-free

- It does not support custom trading strategies.

72% of retail CFD accounts lose money when trading with this provider.

4 – Libertex

Libertex is a trusted CFD broker with more than 250 tradable assets and 40+ international awards. The broker Libertex has been providing brokerage services for more than 23 years in the market since it was founded in 1997. It has more than 2.2 million clients and provides services in about 110 countries around the world. Libertex delivers a sense of security to its clients by ensuring proper funds protection as it is regulated by the Cyprus Securities and Exchange Commission (CySEC). They offer to trade in commodities, stocks, CFDs, ETFs, indices, cryptocurrencies, and forex.

Libertex offers a demo account service to its clients to have experience of the real market for newbies. It also provides standard accounts and Islamic accounts to its clients. Unlike eToro, Libertex is not commission-free, which means it charges brokerage commission on trades through its platform.

The commission charged can vary from asset to asset and from trade to trade. On cryptocurrency pairs, Libertex charges commission in a range between 0.47% and 2.5%. While on stocks, it charges a commission of between 0.1% and 0.2%. However, it does not charge spread fees.

There are no hidden fees, deposit/withdrawal fees, or monthly fees for trading. The only fee that Libertex charges is the commission, as mentioned above.

The platform of Libertex can be accessed through mobile apps for iOS and Android devices. The app is clean and user-friendly with easy order placement, the ability to pre-order, a stop-loss feature, live quotes, and profit-taking. Technical analysis is also freely available on the app, along with some recommendations and trading signals.

Libertex allows traders to deposit funds into their accounts through different methods, including bank transfers, Debit/Credit cards, Skrill, Neteller, SOfort, Trustly, GiroPay, iDEAL, P24, Rapid Transfer, and Multibanco.

The minimum account deposit is 20 euros, or $100.

Pros & Cons of the Libertex platform:

- 24 years of experience

- Live Chat

- Very Low minimum deposit

- iOS and Android-friendly apps

- Zero Spreads

- More than 250 tradeable assets.

- Only two account choices.

- No copy-trading.

- Commission fees

- Limited amount of educational resources

83% of retail CFD accounts lose money when trading with this provider.

5- TD Ameritrade

TD Ameritrade is one of the largest online brokers in the US, and it has become a global trading platform with a series of growth-oriented partnerships. The brokerage firm offers to trade in ETFs, equities, futures, options, common stocks, commodities, digital assets, and bonds. The primary and unique feature of TD Ameritrade is that it requires $0 as a minimum investment on all its investment options. Ameritrade also charges no management fees.

Another unique feature the platform offers is that it supports its clients through SMS, phone calls, email, and live chat. Just like eToro, it also does not charge any commission fees on trading.

It has about 700 mutual funds on its platform with expense ratios of 0.50% or less, along with over 1300 with investment minimums of $100 or less. The platform is considered an ideal broker for beginner fund investors. The platform offers mock trading accounts and provides educational offerings to its clients through videos, articles, slideshows, and quizzes. It also holds online seminars and in-branch presentations to educate new traders.

The company provides traders with two primary trading platforms, TDAmeritrade.com and Thinkorswim, each with a corresponding mobile version. The first one is the on-ramp platform, and the other one is a desktop trading platform.

Pros & Cons of the TD Ameritrade platform:

- Excellent trading platform for beginners

- $0 minimum requirement

- Educational offerings

- Extensive research capabilities and newsfeed

- Additional support channels include WeChat, Twitter, Facebook Messenger, and others.

- Mutual Fund Selection

- Customer Support

- High Margin Rates

- Not user-friendly website platform

Investing Responsibly in ETFs & 5 ETF Flaws You Shouldn’t Overlook

ETFs (exchange-traded funds) can be an excellent investment instrument for both small and large investors. These renowned funds, which are comparable to mutual funds yet trade like stocks, have been a popular alternative among investors wishing to diversify their portfolios without having to spend more time and effort managing and assigning their investments.

However, before diving into the world of ETFs, investors should be aware of potential downsides.

-

Fees for trading

One of the most appealing traits of ETFs is that they trade similarly to equities. An ETF is a fund that invests in a collection of firms that are often linked by a common industry or topic. Investors purchase the ETF to take advantage of investing in a more extensive portfolio all at once.

-

Underlying Risks and Fluctuations

ETFs, like mutual funds, are frequently praised for providing diversification to investors. It’s crucial to remember, though, that just because an ETF has multiple underlying positions doesn’t imply it won’t be influenced by volatility. The fund’s breadth primarily determines the possibility for significant swings. A broad market index ETF, such as the S&P 500, is likely to be less volatile than an ETF that tracks a specialized industry or sector, such as an oil services ETF.

As a result, it’s critical to understand the fund’s focus and the types of investments it holds. This has become even more of an issue as ETFs have become more precise in tandem with the industry’s solidification and popularisation.

-

Liquidity Issues

Liquidity is an essential component in an ETF, stock, or other publicly traded assets. When you buy anything, liquidity means that there is enough trading interest that you can get out of it relatively fast without altering the price.

Depending on the size of your position concerning the usual trading volume, getting out of an ETF that is lightly traded can be difficult. Large spreads between the bid and ask are the most obvious sign of an illiquid investment. Before buying an ETF, check sure it’s liquid, and the easiest way to accomplish so is to look at the spreads and market fluctuations over a week or month.

-

Distributions of Capital Gains

An ETF may deliver capital gains to shareholders in some instances. Since owners are responsible for paying capital gains tax, this is not necessarily beneficial for ETF holders. Rather than dispersing capital gains and generating a tax burden for the investor, the fund should keep them and invest them. Investors would typically wish to re-invest their capital gains distributions, which will require them to return to their brokers and purchase further shares, resulting in new costs.

-

Expectations for ETF Performance

ETFs are usually connected to a benchmarking index, which means they aren’t designed to outperform it. Investors seeking this type of outperformance (which, of course, comes with additional risks) should consider other options.

Taxation on ETF Earnings

Investing in exchange-traded funds (ETFs) is a way for investors to make money. There is usually no profit or loss until you sell the ETF shares, but some notable exceptions will be described later.

Determining gain

Profit is referred to as gain in the tax world. It’s the difference between your tax basis (typically what you bought for the shares plus transaction charges) and the amount you get when you sell or exchange them.

Taxation of capital gains

Two factors determine the capital gains tax rate:

- How long do you plan to keep the stock (“holding period”)?

- The shares are subject to additional restrictions, such as a tax rate other than the normal capital gains rate.

Holding period:

- If you own ETF shares for less than a year, the increase is considered a short-term capital gain.

- A long-term capital gain occurs when you own ETF shares for more than a year.

Capital gain rates:

Long-term capital gains are generally taxed at a rate of no more than 15%. (or zero for those in the 10 percent or 15 percent tax bracket; 20 percent for those in the 39.6 percent tax bracket starting in 2014).

Short-term capital gains are taxed at the same rates as your regular earnings. Nevertheless, only net capital gains are taxable; prior to calculating the tax rates, capital gains might be offset by capital losses. Certain ETF capital gains may not be subject to the 15% /0%/20% tax rate, and instead be taxed at ordinary income rates or at a different rate.

Summary

It seemed inevitable that two of the hottest investment areas, stocks and crypto ETFs, would collide at some point. An exchange-traded fund (ETF) is a type of investment vehicle that monitors the performance of a specific asset or group of assets. ETFs allow investors to diversify their portfolios without having to hold the assets.

ETFs are a simplified alternative to buying and selling individual assets for those who want to focus just on gains and losses. Traditional ETFs allow investors to readily diversify their holdings since they target larger baskets of names with something in common—for example, a focus on stocks reflecting the video game industry and related firms.

The technology sector, without a doubt, is the most lucrative and prosperous of all. Tech stocks have always been a big part of that change, and they’ve always been front and center. As a result, investing in technology ETFs is a wise long-term strategy. Otherwise, if you’re worried about a tech stock bubble forming soon, you can invest in an ETF that allows you to profit when tech stock prices collapse.

The Bitcoin ETF offers a high risk/high-profit proportion, which means investors should keep their stakes to a minimum. The minimum investment requirement while using eToro is $50, and investors can adjust this amount according to their risk-bearing capacity. The commission-free service of eToro also makes it easier for investors to earn higher profits, and in this way, investors can earn big profits from their smaller investments.

FAQs

What are Bitcoin ETFs?

Given the rising interest of investors, institutions, and even governments in bitcoin, it is assumed that the US SEC might no longer drag its feet to approve a cryptocurrency ETF. Some of the Bitcoin ETFs that have received approval from European regulators are mentioned below. 1. ETC-Group Physical Bitcoin ETF (BTCE) 2. 21Shares Bitcoin ETP (ABTC) 3. VanEck Vectors Bitcoin ETN (VBTC) 4. WisdomTree Bitcoin (BTCW) 5. CoinShares Physical Bitcoin ETP (BITC) 6. Iconic Funds Physical Bitcoin ETP (XBTI) 7. Melanion BTC Equities Universe ETF (UCITS)

How can I trade Bitcoin ETFs?

Open eToro, register for an account then type the name of the ETF you'd like to trade in the search box, there are currently 257 to choose from. Click 'open trade'.

What are the best brokers for Bitcoin ETFs?

The following have been consistently recommended by new and experienced investors alike for Bitcoin ETFs: 1. eToro 2. Libertex 3. Capital 4. Plus500 5. Ameritrade 6. Coinbase 7. Changelly 8. Paxful

What are the advantages of trading Bitcoin ETFs?

1- Convenience: Investing in a bitcoin ETF would eliminate many complex procedures involved in bitcoin holding, another method of investing in bitcoin. The traditional method of buying bitcoin requires learning about how bitcoin works, while Bitcoin ETFs provide a convenient way of investing. 2 -Diversification: Bitcoin ETF can reduce risk by diversifying the portfolio as an ETF can hold more than just one asset. It means, a Bitcoin ETF could comprise bitcoin, Facebook stocks, Apple stocks, and more, therefore mitigating the risk by diversifying the portfolio. 3 - Efficiency in Taxation: The majority of tax regulators and pension funds do not allow bitcoin to purchase as it is unregulated and decentralized. There is no such restriction on Bitcoin ETFs because they are traded on traditional exchanges and are likely regulated by the SEC and made tax efficient.