Join Our Telegram channel to stay up to date on breaking news coverage

Even though Bitcoin’s failure to stay above the $30k mark did bother most in the crypto space, if Matrixport’s Greed and Fear Index is to be believed, Bitcoin’s upswing is coming soon.

After four weeks of downward pressure, our Greed & Fear index is now #bullish. #Bitcoin’s resilience around $29,000, despite #tech stock corrections, is impressive. Key drivers ahead: potential #SEC approval for a US-listed physical #BitcoinETF and #Ethereum’s EIP-4844 upgrade.… pic.twitter.com/kYp75chzJ0

— Matrixport (@realMatrixport) August 11, 2023

The crypto services provider showed this through its proprietary Bitcoin Greed and Fear Index, which has proven its legitimacy regarding Bitcoin’s performance in the past.

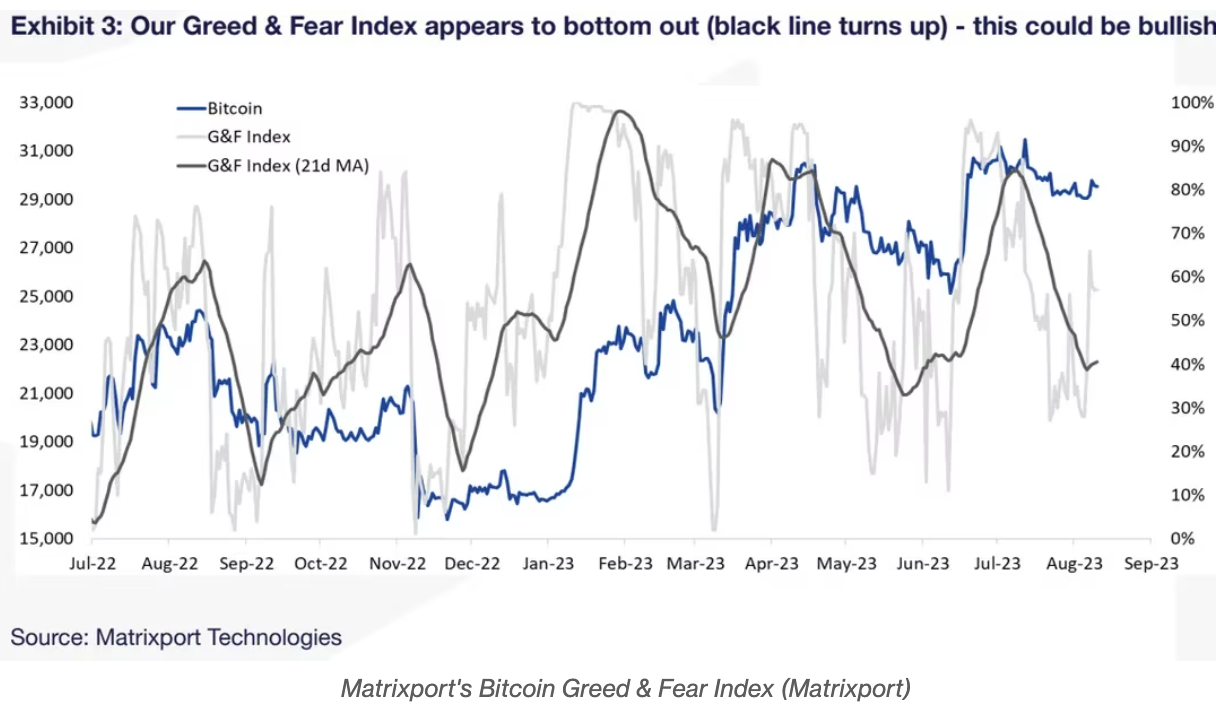

Matrixport’s Greed and Fear index is a measure of investors’ sentiments. When the signal is above 90%, it means that people are greedy and optimistic, and a below 10% index indicates that people have a pessimistic outlook about the asset.

According to the latest data, the Fear and Greed index has gone from 30% to 60%. While still below the 90% rating it showed in July 2023, the Index shows that Bitcoin is slowly building momentum, which could lead to its upcoming bull run.

This Indicator is Tactically Bullish – Matrixport’s Head of Research

Explaining Bitcoin’s Fear and Greed Index to clients, Markus Thielen, Matrixport’s head of research and strategy, said that the signal is projecting an upside pressure.

He said that if this parameter consolidates for four more weeks, the Bitcoin price will resume its uptrend.

The graph shows a Greed and Fear Index, which is greyed out. It tried to punch above 60% before landing on that mark, which indicates that it could stabilize around this point. The same goes for the Index’s 21-day moving average, bottoming around the 40% mark.

Multiple Spot Bitcoin ETF Approval Could Also Spark a Rally – Matrixport

Matrixport has gone beyond stating the current performance of Bitcoin’s Greed and Fear Index to give its positive outlook. It also expresses optimism that the SEC will most likely approve multiple spot Bitcoin ETFs, which could start another rally for BTC.

According to Markus Thielen, the approval of ETFs will create an ecosystem of spenders, backed by “ETFs spending considerable expanses to draw retail and institutional capital.”

At its peak. Grayscale Bitcoin Trust managed $43.5 billion in assets and generated $870 million in management fees alone, Matrixport noted.

Markus continued that the ETF approval could positively impact Bitcoin’s price, stepping from investors getting an “upside exposure” to Bitcoin.

Next week, SEC is scheduled to respond to Grayscale’s GBTC lawsuit and Ark Invest’s spot Bticoin filing. The Securities Exchange Commission will respond to the remaining seven applications in September.

Matrixport’s report also talked about Ethereum’s EIP-4844 upgrade. Expected to arrive in Q4-2023, it may also create an upswing for Ethereum.

Bitcoin Price Analysis

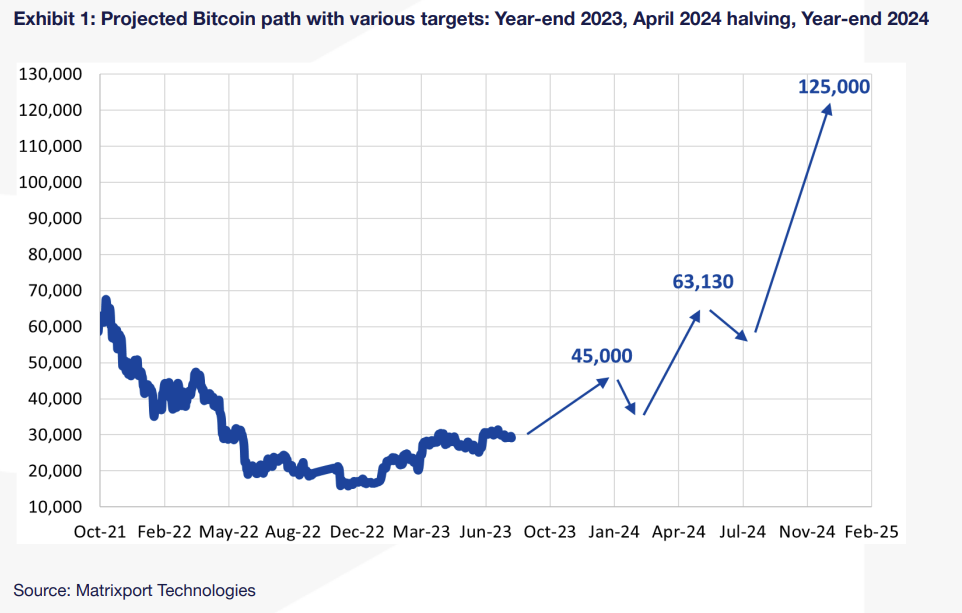

According to Matrixport’s assessment, Bitcoin is projected to reach $45,000 by January 2024 before a minor retrace, followed by an upswing to $63k in April 2024.

Matrixport projects that Bitcoin will reach $125k by February 2025.

From a technical perspective, however, Bitcoin still struggles on the price chart. There is a balance of power between bears and bulls, with bears holding slight dominance after rejecting $30k support on July 14th. Bitcoin has been trying to retouch it. On August 8th, its green candle did create a wick to $30.2k before the recent retrace.

Bitcoin is attempting to stay above the psychological support of $28.5k. At press time, Bitcoin is trading around the $29.36k mark.

Bitcoin’s RSI is in the middle, and MACD is negative, indicating indecision around this asset.

Related

- How to Buy Bitcoin

- SEC vs. Ripple Case Resumes, Critical Dates of Trial released

- Mike Novogratz Predicts Imminent Approval of Bitcoin ETF

Newest Meme Coin ICO - Wall Street Pepe

- Audited By Coinsult

- Early Access Presale Round

- Private Trading Alpha For $WEPE Army

- Staking Pool - High Dynamic APY

Join Our Telegram channel to stay up to date on breaking news coverage