Warren Buffet, the legendary investor, is the CEO and largest shareholder of Berkshire Hathaway Inc. Buffett’s success can be attributed to his consistency and commitment to long-term investing over a decades-long career. He started very early, making his first investment at the young age of 11, a move that launched a career marked by astonishingly consistent growth. Thanks to his hard work, commitment, and a lot of help from his right-hand man, Charlie Munger, Warren Buffett’s net worth now exceeds $171 billion.

After earning his undergraduate degree at the University of Nebraska, Buffet initially applied to Harvard Business School for his master’s degree but was rejected. He was undeterred and decided to enroll at Columbia University, where he studied under the legendary investor Benjamin Graham. Little did Graham know that he would have a profound impact on Buffet and his career, helping him become the legendary investor he is today. Decades of disciplined, value-based investing would eventually make Buffet a billionaire by 1990.

The rise of Buffett’s net worth can be attributed to the success of one company: Berkshire Hathaway. Buffett took a failing textile company and turned it into one of the most successful holding companies in the world.

Breaking Down Warren Buffett’s Net Worth

Warren Buffett’s net worth is almost entirely concentrated in Berkshire Hathaway Class A stock, with about 216,000 shares. He also owns about 217 Class B shares and a handful of investments in other companies, including U.S. Bancorp.

Here’s how his net worth breaks down:

| Asset or Income Source | Contribution to Net Worth |

| Berkshire Hathaway stake | 216,000+ Class A shares worth $171+ billion |

| U.S. Bancorp shares | <1% of shares worth ~$625 million |

| Other investments | $500-900 million |

| Total Net Worth | $171+ billion |

Warren Buffet’s Early Life

Warren Edward Buffett was born on August 30, 1930, in Omaha, Nebraska. He is the only son of Howard and Leila Buffett. The couple had two other girls and Warren was their second child. Buffett showed interest in business at a very young age. Although Buffett’s father was a politician, he was also a stockbroker and likely played a major role in inspiring his passion for business and investing.

He started his academic journey at Rose Hill Elementary School. However, in 1942, his family relocated to Washington, D.C., after father was elected into the United States Congress that year. Howard Buffett enjoyed a successful political career which saw him serve in the United States Congress for four terms, representing Nebraska.

Despite winning elections as a registered member of the Republican Party, most of Howard Buffet’s political opinions and views were libertarian-oriented. As for his son Warren Buffett, he dedicated most of his time to reading about various business strategies. A voracious reader, Buffett often borrowed and read business-themed books from the Omaha public library. At age 11, he read a book titled “One Thousand Ways to Make $1000.” This book further sharpened his orientation and exposed him to various ways of engaging in profit-yielding investments.

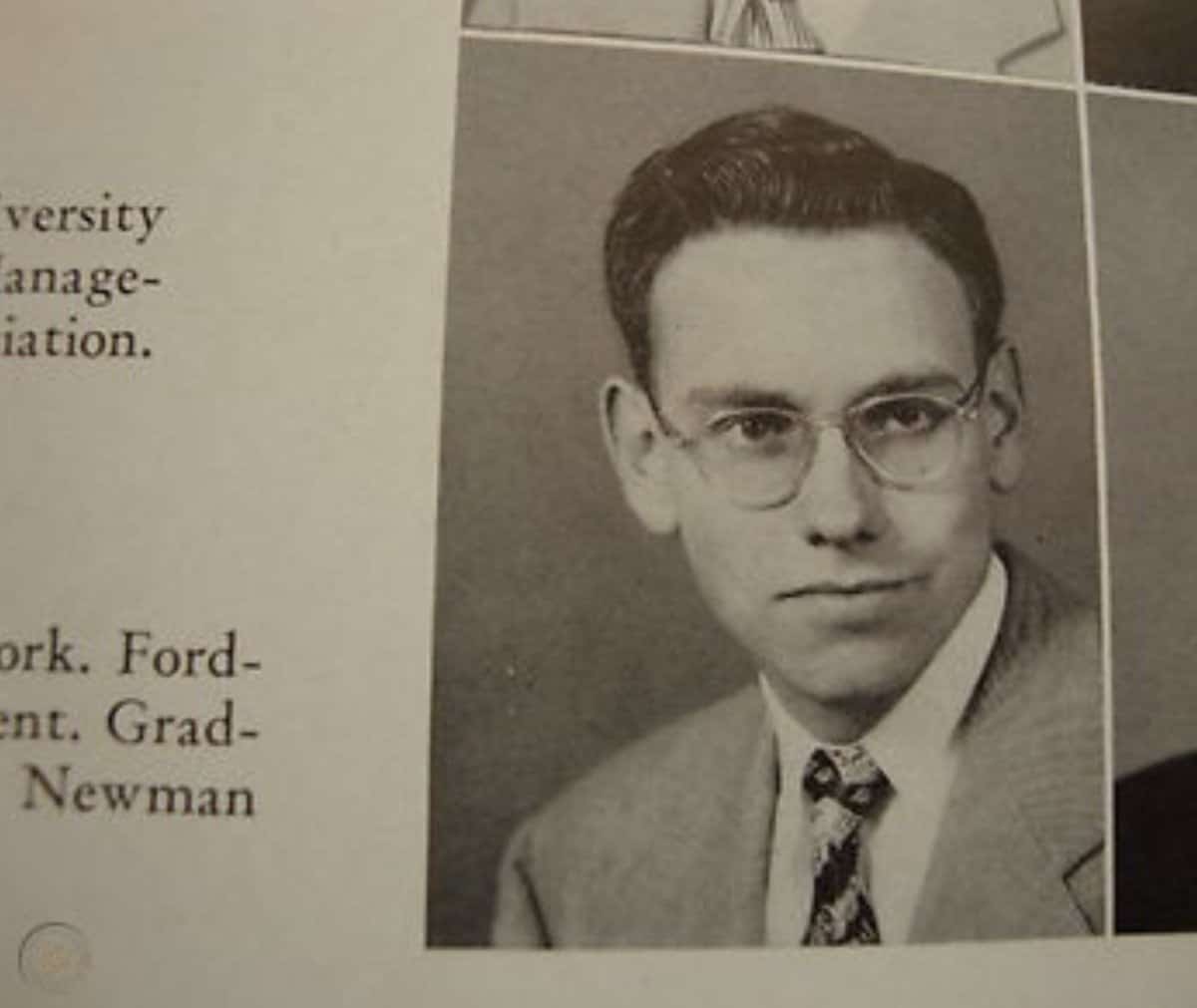

Following his relocation to Washington, D.C., along with members of the family, Buffett attended Alice Deal Junior High School and Woodrow Wilson High School, from which he graduated in 1947. Buffett showed interest in business and investing at a young age. The caption next to his yearbook picture reflects this interest as it reads, “likes math; a future stockbroker.” Upon realizing his son’s interest in business, Howard Buffett took time to educate and mentor Warren.

Warren Buffet’s Early Investment Career

Howard Buffett permitted his son to spend time in the brokerage lounge near his father’s regional stock brokerage office. At age 10, Buffett got to see the stock market in action when he visited the New York Stock Exchange under the supervision of his father. At 11, the young boy had already invested in Cities Service Preferred for himself and his two sisters. By high school, he was already investing in real estate. He acquired about 40 acres of land and rented out the property to a tenant farmer. Also, young Buffett sold chewing gum, Coca-Cola, golf balls, stamps, weekly magazines, and more in his neighborhood.

As a hardworking lad, Buffett also worked in his grandfather’s grocery store. One of his most successful ventures as a youngster revolved around his pinball machine. In 1945, Buffett and a friend acquired a second-hand pinball machine for $25 (worth $450 today). They strategically placed this pinball machine in a barber shop. A few months into the business, the pinball machine was already bringing in (relatively) massive returns. The initial profits enabled the duo to acquire more pinball machines to station across various shops in the neighborhood.

Buffet applied and was admitted into the Wharton Business School of the University of Pennsylvania in 1947 at the age of 17. While at Penn, he joined the Alpha Sigma Phi fraternity. However, he left the institution and transferred to the University of Nebraska in 1949. He graduated with a Bachelor’s Degree in Business Administration in 1951. By the time he graduated from the University of Nebraska, Warren Buffett already gathered $9,800 in savings.

After his graduation, Buffett applied to Harvard University but was rejected. Another attempt at the University of Columbia was successful. During his time at the institution, he attended classes led by Benjamin Graham, the author of “The Intelligent Investor.” Buffett had just finished reading the book, and he would later describe it as one of the books that helped form his philosophy of investing. In 1951, Buffett graduated with a master’s degree in economics, but his education didn’t stop there as he later attended the New York School of Finance for a brief period.

Full Focus on Business and Investment

Around 1951, Buffett traveled to Washington, D.C., to visit GEICO’s headquarters, knowing that his mentor, Benjamin Graham, was the company’s chairman. His goal was to get a job at GEICO, but he didn’t get it. However, Graham praised his commitment and persistence and eventually hired Buffet at his investment partnership, Graham-Newman Corp. Buffet also met Lorimer Davidson at GEICO headquarters, who later became his good friend and an important mentor in the insurance industry.

After college, Buffett returned to Omaha to sell securities at his father’s firm. Buffett paid $100 to take a Dale Carnegie public speaking course, a certificate that has been displayed in his office at Berkshire to this day. He considers it one of the most valuable educational experiences he ever had.

As a result of his newfound public speaking skills, he landed a job teaching an investing principles class at the University of Nebraska-Omaha. He also acquired Sinclair gas station, but the project struggled and failed to establish itself. In 1954, Benjamin Graham finally agreed to offer him a role in his investment company. There, he earned $12,000 (~$142,000 today) per year as his starting salary. Two years later, Benjamin Graham retired and shut down his firm. But at that time, Buffett had already gathered enough money to establish Buffett Partnership Ltd.

By 1957, Buffett already had three investment partnerships. By 1959, the number increased to seven. In 1961, Buffett revealed that he invested 35% of his partnership assets in Sanborn Map Company. During the revelation, he reflected on how the firm’s stock sold for just $45 per share about three years ago. Buffett said he acquired 23% of Sanborn’s outstanding shares and, therefore, became one of its directors. Within two years, Buffett recorded a 50% return on his investment in the organization by unlocking the value in the company’s investment portfolio.

Buying Up Berkshire Hathaway

By 1962, Buffett had already become a millionaire from his partnership investments. He merged the proceeds from his various partnership investments into one and began purchasing stock in Berkshire Hathaway, a textile manufacturing firm.

Over time, Buffett used Buffett Partnership, Ltd. to acquire a controlling stake in the firm. After gaining significant control, he gradually began shifting Berkshire’s focus away from textiles and transforming it into an investment and holding company.

After becoming the CEO of Berkshire Hathaway in 1965, Buffett leveraged his investment experience to deliver major profits for the organization. In 1967, he made the pivotal decision to acquire National Indemnity Company, a large insurance firm, from Jack Ringwalt for $8.6 million. The acquisition helped launch Berkshire Hathaway into the insurance industry, laying the groundwork for a large portion of its future growth.

Media Investments

In 1974, Buffet extended his investment efforts to the Washington Post Company. Buffett established a friendship with Katherine Graham, one of the directors of the organization. However, Buffett attracted unwanted attention from the United States Security and Exchange Commission (SEC), which launched an investigation into his acquisition of Wesco Financial. The SEC was concerned about potential conflicts of interest related to the takeover. Ultimately, the SEC didn’t bring forward any charges against Buffett or Berkshire.

In 1978, Charlie Munger joined Berkshire as vice-chairman and stayed in that position until he passed away in 2023. Munger quickly became Buffet’s right-hand man, helping him revolutionize Berkshire Hathaway for many years to come.

In 1979, Berkshire Hathaway purchased some stock in ABC, a leading media firm. A few years later, the firm acquired an additional 25% stake in the media outfit. This was after a rival media firm, Capital Cities, acquired ABC in a surprising $3.5 billion deal, one of the largest non-oil mergers ever at that time. Berkshire Hathaway helped finance the deal and ended up owning a large stake in the newly merged company, Capital Cities/ABC.

The 80s: A Decade of Success

The Capital Cities/ABC deal undoubtedly placed Berkshire Hathaway on the global map. Around 1987, Berkshire Hathaway, under Buffett, acquired a 12% stake in Salomon Inc., a large investment bank and brokerage firm. The deal made Berkshire Hathaway the largest shareholder of the firm, so Buffett took on the role of the company’s director.

In 1988, Buffet locked down another major deal when Berkshire Hathaway acquired about 7% of Coca-Cola for $1.3 billion. This move significantly strengthened the firm’s financial position and became one of its most successful investments. Buffett’s investment style, often described as “value investing,” focuses on buying undervalued strong companies at low prices and holding them long-term to try to realize their full potential.

In 1988, Berkshire Hathaway listed class A shares on the New York Stock Exchange. Berkshire Hathaway continued to thrive under Buffett’s leadership, making him a billionaire by 1990. He continued to grow his fortune over the years, notably striking an $11 billion deal in 2002 to deliver U.S. dollars against other currencies, essentially betting against the U.S. dollar. By April 2006, Buffett gained more than $2 billion from the deal.

In 2008, Forbes ranked Buffett as the richest person in the world with about $62 billion net worth. He dropped to second, behind Bill Gates, in 2009 and fell to fourth place in 2013 after donating a large portion of his wealth to charity. As of August 2014, the value of Berkshire shares exceeded $200,000 per share, boosting its market capitalization to $328 billion. Despite his massive charitable donations, Warren Buffett’s remaining 321,000 shares were worth $64.2 billion at the time. Buffet gives away large chunks of his stake in Berkshire to charity every year and has about 217,000 Class A shares left at the time of writing.

Warren Buffett: A Vocal Crypto Critic

Over the past few years, Warren Buffet has established himself as a vocal critic of cryptocurrencies. He has consistently demonstrated his harsh stance against Bitcoin and other digital assets. Buffett even described Bitcoin as “rat poison squared” and a “delusion,” urging investors not to venture into the market.

The legendary investor does not see Bitcoin and other crypto assets as productive investments, stressing that they offer nothing tangible. According to the nonagenarian, “whether it goes up or down in the next year, or five or 10 years, I don’t know. But the one thing I’m pretty sure of is that it doesn’t produce anything. It’s got a magic to it and people have attached magic to lots of things.”

This criticism shouldn’t be very surprising, given that it fits in with Buffet’s value investing strategy. He has always favored intrinsic value and tangible assets that generate consistent cash flow, such as productive businesses and real estate.

Even after the massive rise of crypto adoption in both mainstream investors and institutions, Buffet is still not convinced. He still sticks to his skeptical stance on crypto and has not shown any willingness to change it. In a recent interview, he attributed the recent success around Bitcoin to the “fear of missing out” or FOMO syndrome. According to him, this fear led investors to make bad investment decisions by investing in crypto. Buffett said he wished he could change that trend but felt he did not “know how to turn back the clock on that.”

He added that “the urge to participate in something where it looks like easy money is a human instinct which has been unleashed. People love the idea of getting rich quick, and I don’t blame them…It’s so human, and once unleashed you can’t put it back in the bottle.”

In a 2018 interview, Buffet revealed that he would “buy a five-year put on every one of the cryptocurrencies” if he could. He predicted that they would all “come to a bad ending.” Bitcoin was trading at about $14,000 at the time and has since soared to over $84,000. Despite missing out on these colossal gains, Buffet remains a staunch critic of cryptocurrencies.

Like many other critics, Buffett has a healthy skepticism toward the crypto market and those who participate in it. He labeled those venturing into the industry as speculators and not investors.

Lunch with Crypto Luminaries

In 2020, Tron founder Justin Sun won a $4.57 million bid to have lunch with Warren Buffett. Sun saw it as an opportunity to evangelize the currency of the next generation to the accomplished investor. The Tron founder was accompanied to the dinner by Litecoin founder Charlie Lee, Huobi CFO Chris Lee, Head of Binance Charity Foundation Helen Hui, and Etoro CEO Yoni Assia.

The five crypto advocates did their best to convince Buffett and make him see the long-term potential of cryptocurrency. Although they reportedly had a wonderful dinner outing together, efforts to turn Buffett into a crypto supporter proved inconclusive at best.

Buffett appeared on CNBC’s “Squawk Box” show in 2023, using it as a vehicle to criticize cryptocurrencies yet again, calling them “get-rich-quick” gambling schemes.

"#Bitcoin is a gambling token and it doesn't have any intrinsic value. But that doesn't stop people from wanting to play the roulette wheel," says Warren Buffett on #crypto. pic.twitter.com/6MQAiyrS5J

— Squawk Box (@SquawkCNBC) April 12, 2023

Despite being a known critic of Bitcoin, Buffett acknowledges the potential of the blockchain, the underlying technology behind crypto. He believes that the innovative technology could possibly reform the financial sector and disrupt the world. Describing it as “important,” Buffett is optimistic that the use cases of blockchain will expand over time.

Does Warren Buffett Own Any Crypto or NFTs?

Buffett does not own any cryptocurrencies or NFTs, and he doesn’t seem to be considering any investments in the space. He isn’t considering having one in the future either, as his mind appears totally made up about crypto.

Buffet once owned 1,930,830 TRX, equivalent to $43,536 at the time, 1 BTC, and a handful of other cryptos, which were given to him as gifts by Justin Sun. Buffett reportedly gave them all away to charity and insisted that he does not want to own crypto, stressing that the assets cannot impact his net worth.

Buffett also has undirect exposure to Bitcoin through Berkshire Hathaway, which owns shares in Nu Holdings, the parent company of Nubank, a Brazilian crypto-friendly bank. Recently, the bank announced plans to expand its cryptocurrency portfolio to numerous tokens, including Cardano, Solana, and Ripple.

Warren Buffett’s Net Worth – Our Verdict

Buffett has proven himself to be a legendary investor over the years. While Berkshire has had its ups and downs, it has been remarkably successful in the long term, making Buffet a role model for millions of investors around the world. Buffett’s strategy for investing is famously simple: find solid but undervalued companies and invest in them for the long haul. This strategy has slowly and steadily built Berkshire Hathaway into the juggernaut it is today, making Buffett one of the richest people on the planet.

Thanks to Buffett’s ability to navigate Berkshire through the volatile ocean of the American investment market, Berkshire’s stock price and, consequently, Buffett’s personal wealth has grown dramatically over the decades. While he is still highly skeptical of cryptocurrencies, he has dipped his toe in the water with a comparably small investment in Nubank, giving him indirect exposure to Bitcoin and other cryptos. This investment could soften his stance on cryptocurrencies, though it won’t be easy.

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

FAQs

Why was Warren Buffett rejected at Harvard University?

Warren Buffett’s application for admission in Harvard University was rejected because he was said to be too young at that time.

Where did Warren Buffett meet Benjamin Graham?

Warren Buffett met Benjamin Graham during his time at the University of Columbia. Graham tutored him well on how to become a successful business expert and investor.

What is the current net worth of Warren Buffet?

The current net worth of Warren Buffett is estimated to be around $117.1 billion.