On this Page:

Sam Altman began to attain prominence in the tech space following the success of OpenAI. The artificial intelligence company broke into the limelight with its world-changing AI models and products, mostly ChatGPT and DALL-E. Meanwhile, Altman’s net worth has soared in recent years as many of the projects attributed to him are dominating the highly competitive tech world.

Breaking Down Sam Altman’s Net Worth

| Asset or Income Source | Contribution to Net Worth |

|---|---|

| Startup & tech investments | ~$1.2 billion |

| Stake in private VC funds | Unknown stakes in Hydrazine Capital & Apollo Projects |

| Total Net Worth | $1.2-$2 billion |

Sam Altman’s Early Life

Samuel Harris Altman was born on April 22, 1985, in Chicago, Illinois, but he spent most of his early years in St. Louis, Missouri, with his brother Jack Altman. Altman grew up in a middle-class family and attended a local public school. His mother was a dermatologist. He began to show interest in computer programming at a very young age, so his parents gave him a personal computer to help him pursue his passion.

In 2004, after completing high school, Altman gained admission to Stanford University in California. He chose to study computer science due to his passion for programming. But, he didn’t complete the program as he dropped out 2 years after starting. He wanted to follow the footsteps of tech tycoons like Bill Gates, and Mark Zuckerberg who also dropped out of school to pursue their dream.

Shortly after he left Stanford, Altman established his first tech project at age 19. The project, Loopt, was a smartphone application designed to allow users to share their real-time location with friends. Loopt attracted a host of investors, enjoying the backing of the likes of Y Combinator, a renowned startup accelerator, Airbnb, Twitch, and many others.

Y Combinator invested $30 million towards the development of the project before it was eventually acquired by Green Dot Corporation in 2012 for $43.4 million. The sale helped boost his net worth and allowed him to pursue other larger projects.

Y Combinator

Before selling Loopt to Green Dot Corporation, Altman joined Y Combinator as a partner in 2011. Due to his commitment to Loopt, he only served on a part-time basis. When he joined the company, Y Combinator recorded numerous developments. For instance, in 2011, Yuri Milner and SV Angel gave Y Combinator companies a $150,000 convertible note investment. Later, the financial commitment was reduced to $80,000.

In January 2013, Michael Seibel joined Altman at Y Combinator as a part-time partner. He then became a full-time member as the firm began to extend its support to nonprofit organizations. For instance, Y Combinator invested in a nonprofit firm, Watsi around 2013.

Barely a year later, Altman’s outstanding commitment to Y Combinator earned him an appointment as the president of the organization. Under the leadership of Altman, Y Combinator changed its investment policy. In 2014, the firm began to offer $150,000 in return for 7% equity. Also, he aided the collaboration with Transcriptic to provide additional support for Y Combinator’s growing community of biotech companies.

Y Combinator has posted a number of interviews with Altman on its YouTube channel over the years if you want to learn more about his time there.

Leading Y Combinator

As the president, Altman continued to focus on enhancing support for Y Combinator’s fleet of companies. Around 2015, he announced a collaboration with Bolt and added more support for hardware companies. He also introduced new investment initiatives to the investment firm.

Later, Altman inaugurated the YC Fellowship Program. The program focused on funding companies at their development or prototype stage. With the initiative, Y Combinator provided equity-free grants for thirty-two (32) companies. This was a change from its initial practice of investing in startups in return for equity. Nevertheless, it returned to the initial policy again in 2016 after announcing a $20,000 investment initiative in startups in return for a 1.5% equity stake. Altman discontinued that initiative in 2017.

It’s worth mentioning that in 2016, Y Combinator commissioned its partners to visit eleven countries and engage various startup teams. Referring to the visits as “Office Hours,” it was done to understand how the firm could contribute to the global startup landscape. The identified countries were India, Denmark, Nigeria, Germany, Portugal, Argentina, Sweden, Russia, Israel, Chile, and Mexico.

The same year, the organization made a change to its existing administrative structure. This change paved the way for former Twitter employee Ali Rowghani to become the CEO of YC Continuity. Initially, Rowghani was in charge of the YC Continuity Fund. Similarly, Michael Seibel also became the CEO of YC Core. Rowghani later left YC Community in 2024 to start a new seed firm.

Delighted to join @ycombinator to lead the YC Continuity Fund! https://t.co/wn84jyMucY

— Ali Rowghani (@ROWGHANI) October 15, 2015

The reformation of the firm’s structure also birthed the establishment of the Y Combinator Startup School. The project is an online course that provides public videos and nurtures startups. In its first year of establishment, more than 1500 startups graduated from the program. Later, the company added more startup schools.

However, the project endured a setback following a software glitch on its network. The glitch allowed the approval of the application of all the 15,000 startups that registered for the program. Later, the startups learned that their applications weren’t successful. The issue resulted in an outcry that compelled Y Combinator to change its stance by accepting all the 15,000 companies that applied for the program.

In 2018, Lu Qi, a former CEO of Baidu and Bing, joined the company as the CEO of YC China. However, Qi left the company a year later, thereby forcing the firm to halt its activities in China.

In 2019, Altman stepped down as president, a decision that reduced his role and commitment to the firm. The tech expert made the decision in a bid to focus on his new company, OpenAI. He was replaced as the President by Geoff Ralston. Around 2020, Altman left Y Combinator.

OpenAI

Shortly after Altman became the President of Y Combinator, he co-founded OpenAI alongside Ilya Sutskever, Greg Brockman, Trevor Blackwell, Vicki Cheung, Andrej Karpathy, Durk Kingma, Jessica Livingston, John Schulman, Pamela Vagata, Wojciech Zaremba, and Elon Musk. The organization gained the support of Amazon Web Services (AWS), Infosys, and YC Research. At the development stage, the partners and board members raised $1 billion for the project.

the first day of openai, seven years ago today pic.twitter.com/4kQUQtgb6t

— Sam Altman (@sama) January 4, 2023

The firm was based out of the Pioneer Building in Mission District, San Francisco. Initially, the project was designed to be nonprofit oriented and focused on collaborating with other organizations and researchers to make its work available to the public for free. The focus attracted a host of renowned experts to OpenAI, though it wouldn’t last very long.

In April 2016, the firm unveiled its public beta of “OpenAI Gym” which serves as its reinforcement learning research. Thereafter, in December 2016, it released another software platform; Universe to measure and train the general knowledge of an AI regarding games, applications, and websites.

In 2017, OpenAI took a step forward to advance its operations and invested $7.9 million in cloud computing. Shortly after, Elon Musk left the project, citing a potential conflict of interest. According to OpenAI, Musk chose to leave, saying that OpenAI’s “probability of success is zero” and cited potential conflicts of interest with Tesla’s AI projects.

Altman revealed that Musk tried and failed to take over OpenAI for himself, leading to a major fallout between Musk and the board. Later, the billionaire left OpenAI but promised to remain a donor. However, he has yet to make any donations to the project.

Following the departure of Musk, OpenAI transitioned from a nonprofit to a “capped” for-profit model. While profit is technically capped, the limit allows for profit up to 100 times the initial investment, making the cap essentially meaningless. For example, Microsoft could profit over $1.3 trillion dollars before reaching the cap.

The new OpenAI also allowed public disclosure of compensation for top employees. This new reform put the company in a position to gain investment from venture funds. Meanwhile, Altman declined to have a stake in OpenAI, arguing that his commitment to the organization was not motivated by financial gains.

Later, the company collaborated with Microsoft and distributed equity stakes among its employees. As a result of the collaboration, Microsoft invested $1 billion in OpenAI. Altman quickly drew up a plan detailing how the firm would harness the funding within five years to build world-changing AI models. Shortly after, he realized that OpenAI would need much more funding to reach its final goal: artificial general intelligence.

Nevertheless, the firm began to put the funding into use in 2020 and consequently launched GPT-3. This project is a large language model or LLM, trained with massive datasets scraped from all over the internet. As an Artificial Intelligence initiative, the GPT-3 is a decoder-only transformer model of deep neural networks. While GPT-2 was released with limited public access, OpenAI gave full public access to GPT-3 through an API.

The following year, OpenAI also released DALL-E, an AI image-generating model with astonishing outputs. The release of DALL-E was followed by the launching of its new chatbot, ChatGPT, on November 30, 2022. ChatGPT was so much better than everything else on the market at the time so it quickly became the most popular app in the world. The preview of the chatbot pushed OpenAI into the limelight as it amassed more than a million sign-ups in less than a week.

Our new text-to-image model, DALL·E 3, can translate nuanced requests into extremely detailed and accurate images.

Coming soon to ChatGPT Plus & Enterprise, which can help you craft amazing prompts to bring your ideas to life:https://t.co/jDXHGNmarT pic.twitter.com/aRWH5giBPL

— OpenAI (@OpenAI) September 20, 2023

Unsurprisingly, the widespread acceptance of ChatGPT skyrocketed the value of OpenAI. By January 2023, the firm negotiated a funding round that would value the company at $29 billion. Microsoft also invested another $10 billion in OpenAI in a separate multi-year deal.

Altman and OpenAI immediately put its tremendous amount of cash to use, building out the massive systems of computing infrastructure necessary to train the best AI models. In return for the huge stack of cash, OpenAI allowed Microsoft to integrate nearly all of its various software and PC products with OpenAI’s various AI models.

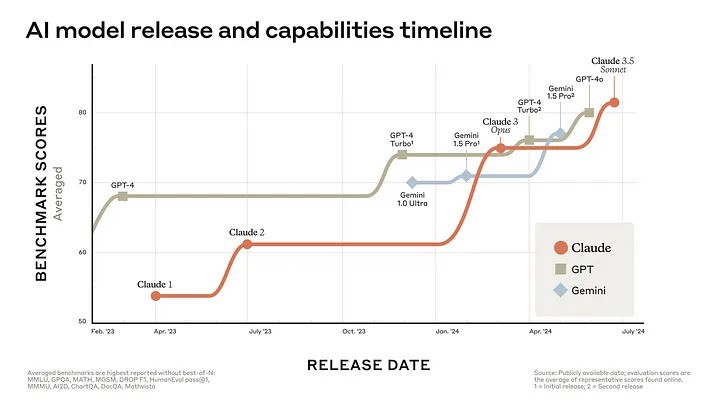

While OpenAI and its top competitors continuously predict that a form of general artificial intelligence or superintelligence is on the horizon, their models (as well as their competitors’ models) seem to be plateauing, failing to grow at the same exponential pace.

As of 2025, OpenAI is reportedly on the verge of a $40 billion fundraising deal that could more than double its current value. The completion of this deal would make OpenAI one of the most valuable privately held companies in the world.

Worldcoin

Sam Altman apparently didn’t think he had enough on his plate In 2019 and co-founded Tools For Humanity with Alex Blania. The company focuses on designing a global iris-based biometric blockchain platform that uses a native token, known at the time as World (eventually Worldcoin). The idea is to provide a universal ID for every individual to enable quick verification for any number of purposes like to differentiate humans from bots.

To obtain a World ID, you have to allow Worldcoin to scan your iris with a machine known as an Orb. Everyone who signed up for a World ID was also sent a few $WLD tokens worth about $50 (total) at the time of launch. However, the price of $WLD has cratered since, making the small airdrop almost worthless.

In April 2022, an MIT Technology Review report criticized Worldcoin for this incentive structure, especially its use in poor countries. The report argued that Worldcoin took advantage of impoverished people to grow its network by incentivizing selling their iris scans with a few nearly worthless tokens.

On July 24, 2023, Altman launched the Worldcoin project, and the initial stages were quite successful. By April 2014, it had reached 10 million users and 70 million transactions.

The Worldcoin project is now live. pic.twitter.com/xZXG4w56Ps

— World (@worldcoin) July 24, 2023

Despite enjoying significant attention, Worldcoin was criticized by prominent individuals. One of the critics is the co-founder of Ethereum, Vitalik Buterin. He raised concerns that the design of the project could put the privacy of users into jeopardy. Others noted that a rich tech CEO essentially buying millions of impoverished people’s Iris scans would fit right into any number of dystopian fantasy novels. Buterin was especially concerned that the project may serve as a pathway for malicious actors to hijack and manipulate user data.

What do I think about biometric proof of personhood?https://t.co/yozo1buW24

— vitalik.eth (@VitalikButerin) July 24, 2023

Sam Altman’s Political Engagements

Apart from his various engagements in the tech world, Altman is also active in politics. He has been a major contributor to various Democratic causes and politicians over the years. Altman reportedly considered running for governor of California in 2018. Although speculations gathered momentum, he decided not to run.

Later, Sam Altman launched an initiative, The United Slate. The political project was geared towards supporting a slate of candidates (hence the name) who would propose housing and healthcare policies for the betterment of California’s citizens. He also played a noticeable role in the run-up to the 2020 United States presidential election. First, in 2019, Altman organized a fundraiser in his house in San Francisco for 2020 Democratic presidential candidate Andrew Yang.

Shortly after Yang backed out from the race, Altman shifted his focus to Joe Biden. In May 2020, the OpenAI CEO donated $250,000 to American Bridge 21st Century, a super PAC that supported Biden.

Altman later shocked the Democratic party in late 2024 by donating $1 million to Donald Trump’s inauguration fund along with fellow tech billionaires Mark Zuckerberg and Jeff Bezos. This prompted some Democratic politicians to send Altman a letter asking him to explain the rationale behind the donation. Altman responded by saying, “funny, they never sent me one of these for contributing to democrats…”

funny, they never sent me one of these for contributing to democrats… pic.twitter.com/xjpanXSb5D

— Sam Altman (@sama) January 17, 2025

Investment Portfolio

Sam Altman is a prolific tech investor with large stakes in numerous companies. These investments likely make up the majority of his net worth. Many of his investment endeavors focus on tech startups and nuclear energy firms.

He has shares in firms like Airbnb, Stripe, Reddit, Asana, Instacart, Pinterest, Teespring, Shoptiques, Optimizely, Verbling, Soylent, and Retro Biosciences. Likewise, he’s the board chairman for Helion and Oklo, two nuclear energy companies.

Surprisingly, Sam Altman has no stake in OpenAI. Altman originally turned down an equity stake in OpenAI because the company needed a majority disinterested board to qualify as a nonprofit.

Altman later testified before Congress, when OpenAI had pivoted to a for-profit model, that he stands by that decision because he loves what he’s doing. Over the years, he emphasized that OpenAI wasn’t established to enrich his bank account. Meanwhile, he looks towards taking the firm to a greater height in the future.

Crypto and NFT Holdings of Sam Altman

Sam Altman’s crypto portfolio is dominated by Bitcoin. He was reportedly first exposed to Bitcoin as early as 2012 and that he still owns quite a bit, though he hasn’t revealed how much he owns.

@EricyuanY @kurtybot @YangTerrence I've never owned much Bitcoin but I have more now than ever before. just think there are better assets.

— Sam Altman (@sama) June 9, 2015

As an early investor in Bitcoin, it’s likely that the value of his crypto holdings has increased significantly. If he had thrown just a few hundred dollars in Bitcoin in 2012, when it traded for less than $15 per coin, it could easily be worth millions of dollars today.

However, Sam Altman once claimed he only invested a small portion of his net worth into Bitcoin. This was because he had reservations about the dominant use case of the crypto at that time.

(i personally net out to the bull case for bitcoin, but only slightly. i would not put a high percentage of my net worth into bitcoin.)

— Sam Altman (@sama) November 23, 2014

Altman is less enthusiastic about NFTs. In October 2021, he opined on X that prominent investors were spending millions of dollars into NFTs rather than investing in startups.

It is bad for society that it's easier to invest millions of dollars into an NFT than a startup.

— Sam Altman (@sama) October 6, 2021

Shortly after he made the post, Paradigm co-founder Fred Ehrsam asked, “What if investing in an NFT == investing in a startup?”

Although Altman didn’t respond to the question raised by Ehrsam, he may have taken the response to heart. In 2022, Altman joined other angel investors in a funding round for an NFT social network startup, Context.

Sam Altman’s Net Worth – Our Verdict

Altman built his net worth through shrewd and well-timed investments in emerging tech companies. He was able to gain so much experience in the field of emerging technology that he rose to the top of the pack to found and lead one of the world’s most important tech companies, OpenAI.

Altman’s greatest strength lies in his ability to envision unique technological innovations and recognize when others are doing the same. He harnessed these skills to build and lead a world-class team of experts and dominate the entire AI sector.

Altman’s invaluable efforts toward the development of tech have not gone unnoticed. Recently, he made Time Magazine’s list of the 100 Most Influential People in AI for 2024. He was also among the top under-30 investors by Forbes magazine in 2015.

Apart from being an entrepreneur, programmer and investor, Altman is also a generous philanthropist. He was one of those who funded an initiative to curtail the spread of the COVID-19 pandemic around 2020. Altman has also signed onto the Giving Pledge, promising to donate at least half of his wealth to charity.

FAQs

Who is the CEO of OpenAI?

Sam Altman is the Chief Executive Officer (CEO) of OpenAI.

What is Sam Altman’s net worth in 2025?

Sam Altman’s net worth is estimated to be between $1.2 to $2 billion in 2025.

When did Sam Altman launch the Worldcoin cryptocurrency?

Sam Altman launched the Worldcoin cryptocurrency in July 2023. However, the underlying project has been in existence since 2019.

Is Sam Altman a generous philanthropist?

Yes. Altman has committed money to fight COVID-19 as well as committed to the Giving Pledge.