On this Page:

HongShan might be Shen’s biggest and most profitable venture, but it was not his first. The founding and managing partner of HongShan had previously co-founded at least two other companies, Home Inn and Ctrip.com.

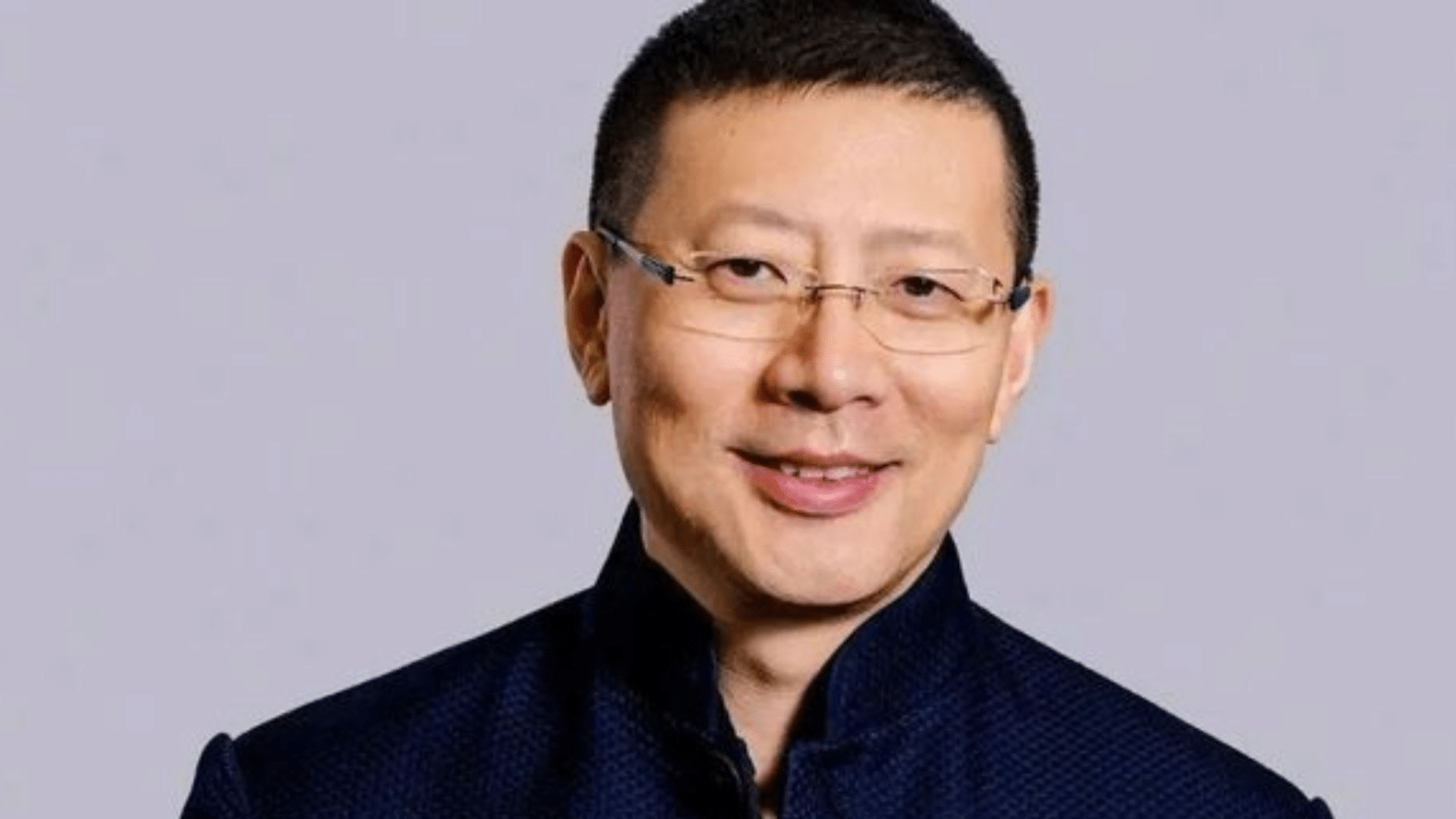

In this post, we will tell you more about the life, career, and impressive wealth of Neil Shen, the so-called ‘most successful early-stage investor in China.’

Breaking Down Neil Shen’s Net Worth in 2025

Neil Shen’s various stakes in businesses and investments remain largely undisclosed. However, we have compiled some key data on his most notable investments and assets over the years, which have undoubtedly contributed to his impressive net worth. Below is a breakdown of his financial holdings.

| Asset or Income Source | Contribution to Net Worth |

|---|---|

| Trip.com stake | 3.9 million shares in 2015 |

| Trip.com stake at IPO | ~25% worth $141 million |

| Homeinns Hotel Group stake | 375,000 shares worth $6.7 million |

| BTG Homeinns Hotels Group stake | Undisclosed |

| Sequoia China salary | Undisclosed |

| Sequoia China stake and earnings | Undisclosed |

| Other investments and assets | Undisclosed |

| Total Net Worth | $3.8 billion |

Neil Shen Net Worth: Early Life, Relationships, and Education

Shen Nánpéng, also known as Neil Shen, was born on December 16, 1967, in Haining, Zhejiang. He was raised in Shanghai where he studied at Shanghai No. 2 High School, excelling in mathematics.

After high school, Shen attended Shanghai Jiao Tong University. In 1989, he graduated with a bachelor’s degree in applied mathematics and consequently moved to the United States to study at Yale University.

In the United States, Shen attended the Yale School of Management, obtaining his master’s degree in management in 1992. After graduation, he remained in the US for two more years, working for Citibank before he moved to Hong Kong.

Neil Shen is married to Zhou Qiao, an investment banker with whom he has two daughters. The family currently resides in Hong Kong, though the details of their real estate assets remain undisclosed. Shen holds Hong Kong citizenship and speaks Mandarin and English.

Neil Shen Net Worth: The Investment Banker Who Turned Multibillionaire

After college, Shen began his career in investment banking, starting at the bottom of the ladder. He spent two years with Citibank in the United States, after which he decided to change companies and relocate to Hong Kong. Shen discussed the early days of his career in a talk with the Harvard Business School.

This path ultimately guided him into the venture capital industry, where he founded Sequoia China and amassed billions of dollars.

Shen Founds His First Business

In 1994, Shen relocated to Hong Kong and started working at Lehman Brothers as an investment banker. Luckily for Shen, he left before Lehman Brothers imploded in the financial crisis. Just two years after he took the position, he was asked to become the director of China capital markets at Deutsche Bank Hong Kong.

In June 1999, Neil Shen was ready for a new challenge. He left the banking sector and co-founded his first business, Ctrip.com, in partnership with Min Fan, James Liang, and Qi Ji. He was president of Ctrip.com between August 2003 and October 2005, overseeing its initial public offering on the NASDAQ in December 2003.

Ctrip is a Chinese online travel company, mostly focusing on airline ticketing, tour packages, and hotel reservations. Within just a few years, it was large enough to go public. By the time the market closed, the price of the new stock had skyrocketed 88.5%, making it the best first day for an IPO in three years. Ctrip was able to raise a whopping $75 million on NASDAQ, marking a major success in the Chinese market.

Over the years, Ctrip expanded aggressively through acquisitions, including Skyscanner, the UK-based travel search engine in 2016, and a majority stake in the Indian company Make My Trip in 2019. In 2019, the business’ name changed to Trip.com Group.

Specific details regarding Shen’s personal financial gain from the IPO haven’t been publicly disclosed. However, he definitely had a massive equity stake in Ctrip at the time, which made his net worth skyrocket.

Given that Shen founded the business with three other people, he likely owned between 20-30% of the company. If he owned just 25% of the company, his stake would be worth roughly $141 million after the IPO.

At the time of writing, Neil Shen continues to serve as director of Trip.com Group Limited. However, specific details regarding his current stake in the company aren’t publicly disclosed.

The most recent public record available with information surrounding Shen’s holdings, from December 2015, indicated that he held approximately 3.9 million ordinary shares in the business, representing about 4% of the total shares at the time.

The Founding and Spun-Off of Home Inn

In 2002, Shen co-founded his second venture, Home Inn. This was a joint venture between the Beijing Tourism Group and Ctrip, but it was eventually spun off from Ctrip and functioned as a separate company.

Home Inn (now BTG Homeinns Hotels Group) launched a successful IPO on NASDAQ in 2006, marking another massive milestone for the young entrepreneur. The IPO raised around $109 million, with the share value closing at $22.75. The IPO valued Home Inn at $550 million.

Again, The details are largely undisclosed, but Neil Shen, as co-founder and key investor, likely owned a significant stake at the time.

In 2016, Home Inn was acquired by Beijing Tourism Group and delisted from NASDAQ in a deal valued at $1.23 billion.

Neil Shen, as the co-founder and co-chairman of Home Inn, held 375,500 shares in the company at the time of this acquisition. Under the terms of this agreement, his shares were classified as “Rollover Shares”, meaning Shen agreed to exchange his equity in Home Inn for equity in the newly formed entity rather than receiving cash. In other words, Shen didn’t receive a cash payout from the $1.2 billion transaction, but he did maintain an ownership stake in the new company.

Specific details regarding the number of shares or percentage of ownership Shen currently holds in BTG Homeinns Hotel Group remain a secret. However, we do have a good idea of the value of his shares at the time of the sale, which should paint a clearer picture of how much he had invested in the joint venture at the time.

Since the business was acquired for $1.23 billion and ordinary shares were worth $35.80 per ADS (1 ADS = two ordinary shares), Shen’s stake in the business was worth around $6.7 million at the time.

Making Billions with Sequoia China

Sequoia Capital is a global venture capital firm founded in 1972 in the United States by Don Valentine, and at the time, it sought to expand into China’s growing tech landscape. In 2005, Shen co-founded Sequoia Capital’s Chinese arm, known as Sequoia China. He co-founded Sequoia China with Zhang Fan under the guidance of Sequoia Capital US partners Michael Moritz and Douglas Leone.

Neil Shen led Sequoia China to make incredibly successful investments in some of China’s largest and most influential companies, including:

- Alibaba, which went on to become one of the world’s largest ecommerce companies

- TikTok parent ByteDance, in which Sequoia China was an early investor

- Meituan, an influential player in the food delivery and services industry in China

- JD.com, Vipshop, Qihoo 360, and many others

In addition to its early investments, Sequoia China led several significant funding rounds in recent years. For instance, the company led a $100 million Series B funding round for Bota Biosciences, a biotech startup focused on sustainable solutions in the chemical industry. The firm also played a big role in Kuaidian’s $100 million Series C round, a platform offering storytelling to China’s younger generation.

Today, Neil Shen is the founding and managing partner of HongShan (formerly Sequoia China). When Douglas Leone, the managing partner of Sequoia Capital, retired in 2022, Shen was one of the potential successors. However, the role eventually went to Roelof Botha.

Roelof Botha to lead Sequoia Capital https://t.co/VF0w3C68YB pic.twitter.com/GjpYOYGh92

— TechCentral (@TechCentral) April 5, 2022

In June 2023, Sequoia Capital announced its split into three entities:

- Sequoia China (commonly referred to as Sequoia Capital China), led by Shen and renamed HongShan, entirely focused on the Chinese market

- Sequoia Capital, which retains its operations in the United States and Europe

- Peak XV Partners (formerly known as Sequoia India), focused on India and Southeast Asia

As of now, specific details regarding Shen’s ownership stake in HongShan aren’t publicly disclosed. As the co-founder and managing partner of the business, he most likely holds a significant ownership stake in the firm, but the exact percentage is not publicly disclosed.

In January 2025, HongShan acquired a majority stake in the Marshall Group, valuing the company at $1.15 billion.

Board Memberships and Other Roles

Neil Shen also joined Meituan, a popular Chinese shopping platform, as a non-executive director in its early years. He reportedly played a key role in guiding the company through its formative stages. Shen retired from this position in June 2024 after serving for nine years due to “other business commitments.”

In addition to this role, he was involved in the early stages and was a board member of Bytedance, the parent company of TikTok, as well as Zai Lab, a large pharmaceutical company.

Shen has held several prominent positions in China’s private equity and venture capital sectors as well. Notably, he served as the Vice Chairman of the Beijing Private Equity Association and the Zhejiang Chamber of Commerce in Shanghai. He is also a member of the Chinese People’s Political Consultative Conference.

Neil Shen has been recognized for his leadership in the industry and was named among the “Top 20 Venture Capitalists” by CB Insights in 2017. In 2024, Shen was ranked #3 on the Forbes Midas List.

Neil Shen’s Controversies Over the Years

In 2008, The Carlyle Group filed a lawsuit against Neil Shen and Sequoia Capital China over an investment dispute, alleging that Shen backdated an $11 million investment agreement with Green Villa Holdings, a Chinese medical research company, to secure the deal for Sequoia. The lawsuit sought $206 million in damages.

In the same period, Zhang Fan, the founding partner of the business, resigned from the firm, citing personal reasons. His departure occurred amid this legal dispute, which led to speculation about a potential connection between the events.

The lawsuit was eventually resolved, but the specifics of the outcome or settlement were not publicly disclosed. Some sources mention that Carlyle dropped the lawsuit, but we weren’t able to confirm this.

@MikeBenzCyber, in December 2008, the Carlyle Group, led by David Rubenstein, publicly sued China’s Neil Shen, alleging fraud. This lawsuit was especially notable considering Carlyle had previously invested in Ctrip, a company co-founded by Shen, and he was also employed by… pic.twitter.com/RwIwrjDvgJ

— Brian Costello (@bpcostello) October 21, 2024

Neil Shen’s Investments Over the Years: Crypto Assets

As far as anyone knows, Neil Shen has primarily invested his money through Sequoia China. His focus has been on consumer and biotech companies, such as Innovent and Zai Lab, both of which went public in 2017 and 2018.

When it comes to Shen’s personal investments, the details are far more limited compared to his involvement in Sequoia China.

As one of the most successful investors in the tech industry, Neil Shen has made significant connections in the cryptocurrency and blockchain space. His crypto investments remain a secret, but he is often considered an opponent of the industry. He has been active in crypto events, such as the 2019 Dragonfly Crypto Summit in Beijing. Among the notable attendees were Tao Zhang, Wang Xing, and Vitalik Buterin.

Beijing today

Left to Right: 沈南鹏 Neil Shen Sequoia Capital China, 冯波 Bo Feng Ceyuan Ventures, @VitalikButerin Ethereum, 王兴 Wang Xing @meituan, 张涛 Tao Zhang Dianping pic.twitter.com/wrC1VevSxl

— Matthew Brennan (@mbrennanchina) October 14, 2019

In 2022, Sequoia China raised a $9 billion fund, with a portion dedicated to cryptocurrency and blockchain investments. This fund was among the largest crypto-focused funds, which confirms Shen’s commitment to the growing importance of digital currency.

Finally, Shen has been actively involved in discussions regarding the development of a Hong Kong-based stablecoin to facilitate cross-border payments among China, Japan, and South Korea. In May 2020, he proposed the creation of a stablecoin backed by four fiat currencies: the Chinese Yuan, Hong Kong Dollar, Japanese Yen, and South Korean Won. The proposal was signed by several prominent figures, and the initiative was presented at the Chinese People’s Political Consultative Conference.

As of the time of writing, there haven’t been any public announcements regarding the launch of such a stablecoin.

What Can We Learn from Neil Shen’s Story?

Shen’s success is largely attributed to his ability to invest in high-potential industries early on. As an early investor in tech giants like Alibaba and ByteDance, his story highlights the importance of recognizing emerging trends – and being courageous enough to bet on them while they are still in their infancy.

Moving from the banking sector to venture capital required a big shift in skillset and mindset. Shen’s ability to diversify his ventures and careers shows how important it is to leave your comfort zone to pursue bigger opportunities.

Finally, Shen’s collaboration with industry leaders, such as his co-founders of Ctrip and Sequoia China, shows that success often comes through forming strong partnerships.

FAQs

What is Neil Shen's net worth in 2025?

In 2025, Neil Shen's net worth is estimated at $3.8 billion, which primarily comes from his stake and investments in HongShan, Trip.com, and HomeInn.

What has Neil Shen invested in crypto?

Details of Shen's investments in crypto remain largely undisclosed, but he has been active in the crypto community and involved in discussions about the development of a Hong Kong-based stablecoin.

Does Neil Shen still own his old companies?

Shen no longer directly owns his early ventures, but he most likely still maintains a stake or ties to them.

What are Shen's most notable investments?

Neil Shen's most notable investments include Alibaba, ByteDance, Meituan, JD.com, Vipshop, etc.