On this Page:

In January 2022, Forbes estimated that Atallah and Finzer were worth $2.2 billion each based on their stake in OpenSea. They were dropped off the billionaire list only a year later due to a steep decline in the company’s valuation as NFTs lost momentum and other NFT marketplaces sprung up.

In this article, we will tell you the story of how a pioneering software engineer cofounded the central hub of the NFT scene – as well as what he is worth today.

Breaking Down Devin Finzer’s Net Worth in 2025

Devin Finzer holds an 18.5% equity stake in OpenSea. As of the most recent valuation in 2023, his stake was worth $600 million, a steep drop from the $2.2 billion valuation in 2022.

Despite facing competition from other NFT platforms, OpenSea remains a key player in the space. After falling behind for a little while, OpenSea recently regained its position as the market leader in Ethereum NFTs in both market share and transaction volume.

OpenSea is quickly gaining NFT market share.

OS2 private beta has just been opened to Gemesis holders (snapshot taken), and it’s already starting to shift the landscape.

Now, OpenSea holds the majority of listings, and accepted bids. pic.twitter.com/MqySVvWus6

— Loki 😈 (@lokithebird) February 1, 2025

Based on this, we can estimate that Devin Finzer is now most likely worth over $600 million – perhaps even close to the billionaire status he once held. Still, this is highly speculative since there is no clear financial data for OpenSea’s rebound and current value.

| Asset or Income Source | Contribution to Net Worth |

|---|---|

| ClaimDog sale profits | Undisclosed |

| WifiCoin profits | Undisclosed |

| Stake in OpenSea | 18.5% worth <$600 million |

| Personal crypto holdings | Undisclosed |

| Personal NFT holdings | Undisclosed |

| Total Net Worth | $600+ million |

Devin Finzer Net Worth: Early Life, Education, and Family

Devin Finzer was born on October 18, 1990, in the United States. He was born into a family with a strong background in the sciences, sparking his love of technology at an early age. His father works as a software engineer, and his mother is a physician.

Raised in the San Francisco Bay Area, Finzer attended Miramonte High School in Orinda, California, where he further cultivated his interests in technology. After graduation, he enrolled at Brown University, where he pursued a degree in computer science and mathematics, graduating in 2013.

During his time at Brown University, Finzer began laying the groundwork for his future entrepreneurial success. In his junior year, he partnered with Dylan Field, the future founder of Figma, to create CourseKick, a socially-driven search engine aimed at improving the school’s course registration process.

The platform gained traction rather quickly, with 20% of Brown’s undergraduates signing up within the first two weeks of its launch.

During his time at Brown University, Finzer also took several internships at high-profile companies like Wikimedia Foundation, Google Cloud Platform, and Flipboard.

Specific details about Finzer’s personal life, such as his marital status, are not publicly disclosed. Beyond his professional work, he is a member of the Founders Pledge community, a global non-profit organization that inspires entrepreneurs to donate to high-impact charities.

Devin Finzer’s Entrepreneurial Success

After he graduated from Brown University, Finzer took a job at Pinterest in San Francisco, working as a software engineer. He remained in the company between 2013 and 2015 and eventually left to cofound his first business, Claimdog.

Let’s see how Claimdog shifted Finzer’s career and led him toward more endeavors in the tech industry.

Founding ClaimDog and WifiCoin

Upon leaving Pinterest, Devin Finzer founded Claimdog, a personal finance app acquired by Credit Karma. Claimdog was established in 2015 and sold only a year later for an undisclosed price.

Following the acquisition, Credit Karma introduced the “Unclaimed Money” feature in May 2017, using Claimdog’s technology to help users reclaim unclaimed funds.

In 2017, Devin Finzer and Alex Atallah cofounded WifiCoin, aiming to create a system where users could earn tokens by sharing access to their Wi-Fi networks. The venture was accepted into the Y Combinator Winter 2017 batch. However, inspired by the success of CryptoKitties, the duo pivoted to the non-fungible token market, deciding to build OpenSea, a premier NFT marketplace, to act as a trading hub for the market.

The pair of developers was able to build OpenSea incredibly quickly, launching it before the end of 2017, when NFTs were still in their infancy. With all of their focus on OpenSea, Finzer and Atallah ceased active development on WifiCoin.

The Rise and Evolution of OpenSea

OpenSea quickly became one of the leading platforms in the NFT space, and it didn’t take long before it became the largest NFT marketplace in the world. Finzer led the company as its CEO, and Atallah held the position of CTO until he left the company in 2022.

“The way that we came across the idea for OpenSea first started with crypto. My cofounder and I were just really excited about what was going on in crypto. There was all of this philosophizing about the future of the internet, the future of finance, these protocols, and autonomous organizations. And we were just really interested in that, just reading all the white papers, the classic falling down the crypto rabbit hole situation.” – Devin Finzer shared in a podcast.

In 2018, OpenSea gained momentum after it was accepted into Y Combinator’s accelerator program. By 2019, the company had secured $2.1 million in venture capital, even though the NFT market was still quite niche at the time. The company’s user base grew steadily, and by March 2020, OpenSea was processing $1.1 million in monthly transactions from just 4,000 active users.

As impressive as the beginning was, this was only the beginning for OpenSea.

In 2021, OpenSea erupted in popularity as NFTs went mainstream, fueled by celebrity endorsements, skyrocketing crypto prices, and viral NFT sales. OpenSea had already established itself as the go-to NFT marketplace, so it became the hub of the new craze, processing billions of dollars in monthly trading volume at its peak.

OpenSea continued to experience explosive growth, raising $100 million in a Series B funding round, which brought its valuation to over $1.5 billion. Later that same year, the platform’s monthly transactions reached $3.4 billion with 1.8 million active users.

By January 2022, OpenSea’s valuation hit $13.3 billion, which made it one of the most valuable blockchain startups globally. Finzer and Atallah, with stakes in the company worth over $2 billion each, became the first NFT billionaires in the world.

Devin Finzer explores the NFT boom and OpenSea’s role in driving it forward in an episode of the Bankless podcast if you want to learn more.

OpenSea has successfully navigated the volatile NFT marketplace for many years. However, by mid-2022, the platform’s transaction volume dropped rather drastically, which, in a way, mirrored the broader downturn in the NFT space.

This tough development forced Finzer to announce 20% layoffs at the company. Around August of the same year, the transaction volume of OpenSea dropped by 99% to just $9.34 million, and its daily users went down to a bit over 24,000.

The crisis worsened when a rival NFT marketplace, Blur.io, was launched in October 2022. Blur had more features for advanced traders and, most importantly, offered zero trading fees and optional creator royalties, making it significantly cheaper to buy most NFTs compared to OpenSea.

OpenSea continued to fight against the odds, though. That October, the company integrated a multiple listing feature for NFT trading, likely in response to Blur’s shocking success. In an announcement on X, OpenSea said its feature was aimed at serving transaction costs for users by allowing them to sell 30 NFTs in a single transaction.

We’re officially live with bulk listing and buying! 🛒

You can now list and buy up to 30 items in a single flow on OpenSea.

Let’s walk through what this experience looks like in this 🧵— OpenSea (@opensea) October 5, 2022

While Devin Finzer and his partner Alex Atallah held different positions in the company, they each held an estimated 18.5% equity stake in the firm. In January 2022, Finzer’s stake was valued at $2.2 billion. By April 2023, due to the fluctuations in the market and the decreased OpenSea valuation, his stock was valued at under $600 million.

At this point, Forbes reported that both Finzer and Atallah lost their spot on their World’s Billionaires list, along with Kanye West, Sam Bankman-Fried, Bruce Nordstrom, and several other moguls. As of 2025, specific details about the company’s current valuation and Finzer’s stake in it are not publicly available.

Finzer continues to serve as the CEO of OpenSea, though Atallah left the company in July of 2022 to focus on other projects. He explained his reasoning as well as a short history of his time at OpenSea in a blogpost, published right after he resigned.

Controversies and Legal Troubles

OpenSea’s journey hasn’t been without challenges, though. In 2021, the company faced a lot of controversy when its head of product, Nate Chastain, was accused of insider trading related to NFT sales.

Chastain was in charge of selecting NFT collections to be featured on OpenSea’s homepage, a placement which often led to increased value for those NFTs, at least in the short-term. He used this confidential information to purchase NFTs before they were featured and then sold them right after for substantial profits.

Chastain resigned, which was followed by an internal review that showed the growing pains of a company with rapid growth. He was eventually convicted and sentenced to three months of prison, making him the first person to be sentenced to prison in a digital asset insider trading scandal.

Despite the controversy, OpenSea continued to innovate, and soon enough, it acquired Ethereum wallet-maker Dharma Labs in early 2022.

Even though it was experiencing immense success in 2022, OpenSea continued to face obstacles, including a phishing attack that stole NFTs worth over $1.7 million, as well as the controversial decision to limit NFT minting (which was later reversed).

In early 2022, rumors circulated about a $200 million exploitation of OpenSea, raising concerns about the platform’s security. However, upon investigating the situation, Finzer clarified that the issue was a phishing attack and not a flaw in the company’s security system. In the same X thread, he further affirmed the company’s commitment to working with victims to identify the source of the attack.

I know you’re all worried. We’re running an all hands on deck investigation, but I want to take a minute to share the facts as I see them:

— dfinzer.eth | opensea (@dfinzer) February 20, 2022

In May 2022, the Singapore High Court issued a worldwide proprietary injunction at the request of Withers KhattarWong, representing a Singaporean NFT investor. This injunction froze the sale and transfer of a rare Bored Ape Yacht Club NFT on the Ethereum blockchain.

The dispute involved the NFT, BAYC No. 2162, which was used as collateral in a loan agreement between the investor and a pseudonymous individual known as “chefpierre”. When the investor failed to repay the loan, Chefpierre transferred the NFT to their personal wallet and listed it for sale on OpenSea.

The court’s decision was groundbreaking since it marked the first time in Asia that an injunction was granted to protect an NFT as a recognized asset. OpenSea was ordered to suspend the NFT’s listing on its platform until the dispute was resolved.

In August 2024, Finzer shared a post on his X account, confirming that OpenSea had been served with a legal notice by the United States Securities and Exchange Commission. The SEC claims NFTs on its platform are securities.

“We’re shocked the SEC would make such a sweeping move against creators and artists. But we’re ready to stand up and fight,” said Devin Finzer.

OpenSea has received a Wells notice from the SEC threatening to sue us because they believe NFTs on our platform are securities.

We're shocked the SEC would make such a sweeping move against creators and artists. But we're ready to stand up and fight.

Cryptocurrencies have long…

— dfinzer.eth | opensea (@dfinzer) August 28, 2024

In February 2025, the SEC concluded its investigation into the company without pursuing any enforcement action. The Trump administration’s SEC has been much more lax on crypto and securities enforcement in general, dropping many such cases and investigations against crypto firms.

The SEC is closing its investigation into @opensea. This is a win for everyone who is creating and building in our space. Trying to classify NFTs as securities would have been a step backward—one that misinterprets the law and slows innovation.

Every creator, big or small,…

— dfinzer.eth | opensea (@dfinzer) February 21, 2025

Devin Finzer’s Crypto Stance and Investments

Finzer has made a significant mark in the NFT space, as well as the broader cryptocurrency market. His interest in cryptocurrencies began with an early investment in Bitcoin, but the details of his investment or profits haven’t been publicly disclosed.

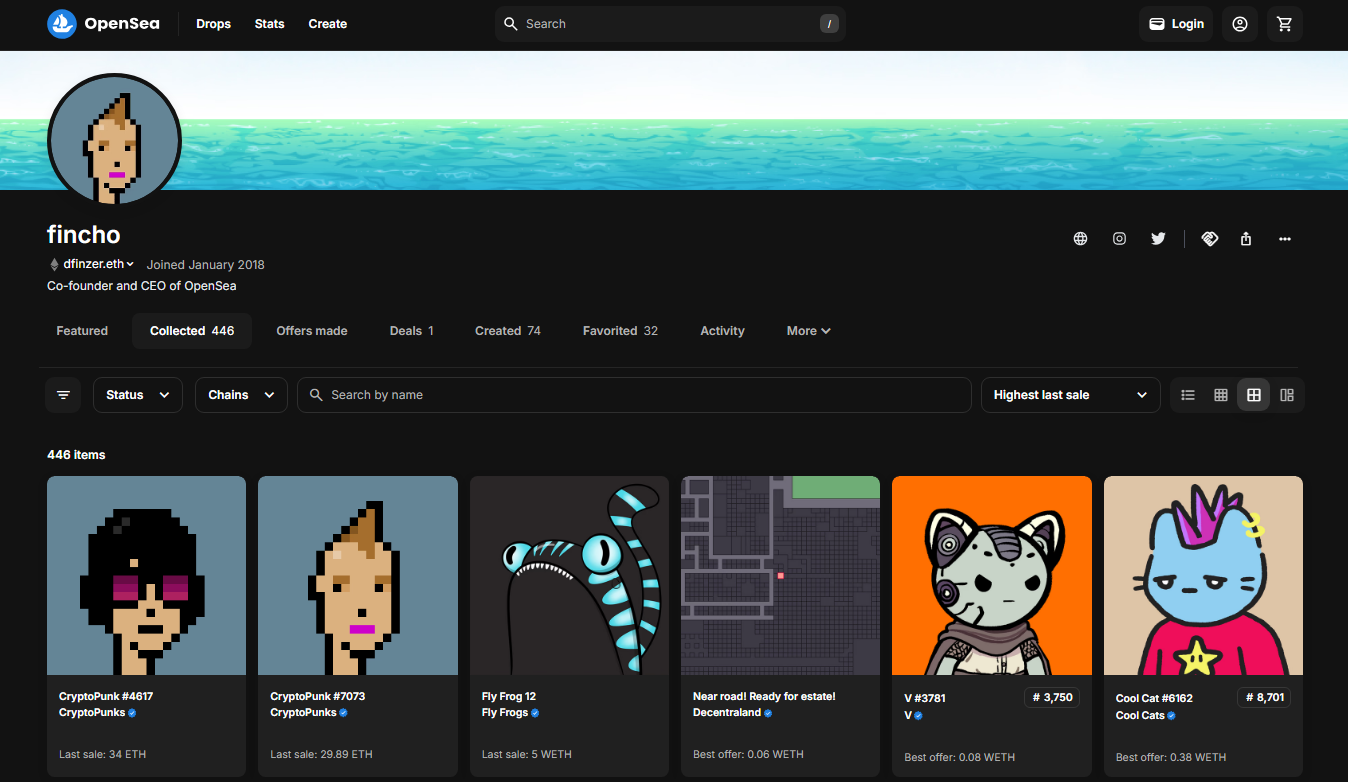

As for his personal NFT portfolio, he holds about 450 NFTs in his main wallet, dfinzer.eth, though most of them seem to be worthless (or nearly worthless). Some of his most valuable NFTs in his main wallet include two CryptoPunks, worth at least $66,600 each, and a CoolCat. He may very well own other valuable NFTs in other wallets, though they haven’t been disclosed.

Even though he hasn’t disclosed his entire NFT portfolio, Finzer often shares tips about his NFT investments on his X account.

joined the cult

affinity: Ocean

name: Hydromancer Caligari of the Sea pic.twitter.com/06Aa3ltjsI

— dfinzer.eth | opensea (@dfinzer) March 17, 2025

Lessons from Devin Finzer’s Story

Finzer’s pivot from building a successful personal finance app to launching OpenSea to revolutionize NFTs highlights the power of recognizing and acting on emerging opportunities. His willingness to pivot to an uncertain new frontier shows how adaptability and bold decision-making can lead to tremendous success.

Building OpenSea required a strong belief in an industry that was still in its infancy. Finzer’s early belief in blockchain technology and his understanding of the crypto market were instrumental in turning OpenSea into a multi-billion dollar company.

Despite OpenSea’s devastating decline in 2023, Finzer remained focused on the company’s recovery. The company is slowly returning to its former glory, which reflects the importance of resilience in the face of the brutal highs and lows of emerging industries.

At the same time, Finzer’s story is somewhat of a cautionary tale and a reminder of the inherent volatility of emerging markets. Despite OpenSea’s early success, the rapid rise and fall of the NFT market had a dramatic impact on Finzer’s wealth. Finzer’s story highlights both the benefits and risks of investing in innovation.

FAQ

What is Devin Finzer's net worth in 2025?

As of 2025, Devin Finzer's net worth is estimated at over $600 million. It's a significant decline from his net worth in 2022, but his numbers are slowly climbing.

Is Devin Finzer still with OpenSea?

Yes. As of 2025, Devin Finzer is still associated with OpenSea. He is the CEO and cofounder of the company.

Why did Devin Finzer's net worth drop?

Finzer's net worth dropped due to the steep decline in the NFT market, which suffered a major crash in 2022. OpenSea's valuation fell significantly during that time, impacting his stake in the company.

How much does Devin Finzer hold in NFTs?

Devin Finzer's exact NFT holdings remain a mystery. His portfolio is likely substantial, given his involvement in the NFT market.