Dan Morehead is the founder and CEO of Pantera Capital, one of the biggest investment firms in the crypto industry. Pantera Capital first invested in Bitcoin in 2013 and has since become one of the largest blockchain-focused hedge funds worldwide. As of 2025, Dan Morehead’s net worth is estimated at over $1 billion.

In this article, we will dive into how Morehead founded his multibillion-dollar business, accumulated his wealth, and what continues to drive his fortune today.

Breaking Down Dan Morehead’s Net Worth in 2025

Dan Morehead’s net worth is largely a mystery, as most of the detailed information about his company stake and financial assets remains undisclosed. What we do know is that he is likely a billionaire, building his wealth through a combination of high-level executive positions, his leadership role at Pantera Capital, and early investments in cryptocurrencies.

Over the years, Morehead has held many influential positions at major financial institutions. This has undoubtedly contributed significantly to his financial standing. However, the specifics of his holdings, salaries, bonuses, and crypto portfolio are not publicly available.

Let’s break down what we can infer about his net worth based on available information.

| Asset or Income Source | Contribution to Net Worth |

|---|---|

| Previous salaries | Undisclosed |

| Stake in Pantera Capital | Undisclosed |

| Stake in venture funds | Undisclosed |

| Personal crypto holdings | Undisclosed |

| Total Net Worth | $1+ billion |

Dan Morehead Net Worth: Early Life and Education

Despite leading an important role in the crypto industry, details about Dan Morehead’s early life, including his birth date and place, are not publicly disclosed.

As for his education, Dan Morehead graduated magna cum laude from Princeton University in 1987 with a Bachelor of Science in Civil Engineering. He was honored with the Carmichael Prize for his outstanding thesis at Princeton University.

Dan Morehead’s Career from Goldman Sachs to Pantera Capital

These days, Dan Morehead is still the CEO of Pantera Capital, a leading investment firm specializing in the blockchain industry. However, his journey in finance began many years before Pantera Capital existed.

Morehead’s Versatile Career in Finance

Morehead held several positions in the finance industry before he founded his investment firm. His first major position was at Goldman Sachs, where he traded mortgage-backed securities for two years.

For the next six years, Dan Morehead held the position of the managing director of the Global Portfolio Group at Bankers Trust. In this role, he managed a global macro fund and derivatives trading units in North America and Japan.

After his stint at Bankers Trust, Morehead continued to move up in the finance world and was hired as the Global Head of Foreign Exchange Options at Deutsche Bank, growing his new team significantly over his time there.

Next, Dan Morehead became the Head of Global Macro Trading and the Chief Financial Officer at Tiger Management. Even today, he is considered one of the fund’s “tiger cubs.” His tenure at Tiger Management was four years between 1996 and 2000.

Before Pantera Capital, in 2000, Morehead cofounded and led Atriax, an electronic platform for foreign exchange, as its CEO until 2002. The exchange platform had offices in London, New York, and Tokyo.

The Birth of Pantera Capital and Its Bitcoin Fund

In 2003, Morehead founded Pantera Capital Management LP in San Francisco, California. The firm employed a macroeconomic investment strategy, studying broad market trends and various economic indicators to guide its investments. Soon enough, the business expanded with offices on Silicon Valley’s Sand Hill Road, boasting over $1 billion in assets under management.

In 2013, Pantera Capital launched the first institutional investment fund for Bitcoin in the United States. Fast forward to 2021, the fund extended its operations, establishing a base in Puerto Rico.

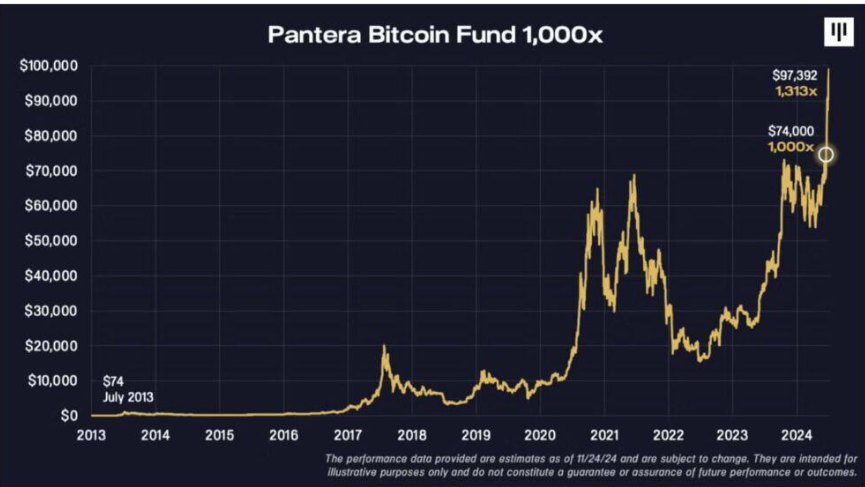

The Pantera Bitcoin Fund was a significant milestone for the crypto market. At its inception, the fund acquired around 2% of the world’s Bitcoin supply when the coin was trading at around $65-$75 per coin.

In Dan Morehead’s newsletter, published on the Pantera Capital website, he shared his email from 2013, offering his early predictions and analysis about Bitcoin’s potential market movements. The image below, extracted from the newsletter, visualizes the forecast he made back then.

I wanted to share the original logic for launching Pantera Bitcoin Fund in 2013 – as it is equally compelling to me today.

That first investment memo still reads well.

In 2013-15 we bought 2% of the world’s bitcoins.

Even after eleven years, bitcoin is **still** squeezing up… pic.twitter.com/crtMzMEQBw

— Dan Morehead (@dan_pantera) November 27, 2024

Here is what Morehead shared about his initial thoughts on the Bitcoin investment:

“I think it’s north of 50% chance that the world adopts a global currency/payment system in which free cryptography replaces the very expensive ‘trust’ charged by banks/VISA-MasterCard/Western Union/PayPal/etc. Bitcoin dominates cash, electronic fiat money, gold, bearer bonds, large stone discs, etc. It can do all of the things that each of those can. It’s the first global currency since gold. It’s the first borderless payment system ever.”

When I was introduced to Bitcoin and finally wrapped my head around it, I believed it was the biggest trade of all time. I still think that. Around 300mm people own it now, but it’s probably going to be 3bn in the not-too-distant future.

Great chat! @novogratz @intangiblecoins https://t.co/NSyNqjTVmq

— Dan Morehead (@dan_pantera) February 20, 2025

Back when ICOs were the name of the game in 2017 and 2018, Pantera Capital offered an Initial Coin Offering fund. The company launched the Pantera ICO Fund LP, aiming to capitalize on the market by investing in tokens that power public blockchain protocols. The fund had an initial target of $100 million, with $35 million secured from existing and new investors, as well as venture capital firms.

However, the fund’s performance was crushed by the downturn that followed in the crypto market. By October 2018, reports indicated that the ICO fund had incurred a year-to-date loss of approximately 72.7%, with a life-to-date loss of 40.8% since its inception in December 2017.

Eventually, as Bitcoin grew in value, the Bitcoin Fund delivered colossal returns as Bitcoin skyrocketed – a 1,000-fold increase and a lifetime return of over 131,000% net of fees and expenses.

Pantera Capital’s Success Over the Years

Despite the initial setbacks, such as Morehead’s lack of confidence in his investment and the significant market crash in 2013, the investment firm’s commitment to Bitcoin paid off. In 2016, after 170 meetings with investors, Pantera Capital raised just $1 million. Still, the team continued supporting Bitcoin.

Today, Pantera Capital is one of the most pro-crypto hedge funds on Wall Street. It has since expanded into other cryptocurrencies like Ether, ZCash, and XRP, to mention a few. As of January 31, 2025, the firm oversees around $5 billion in assets.

Morehead’s exact ownership at the firm hasn’t been publicly disclosed. However, as its founder, CEO, and managing partner, he almost certainly owns at least a large portion of the firm. Other managing partners include Paul Veradittakit, who leads the investment team, and Lauren Stephanian, who focuses on venture and early-stage token investments.

Pantera Capital’s Legal Trouble Explained

Morehead is currently under federal investigation concerning potential violations of U.S. tax laws following his relocation to Puerto Rico. The inquiry was initiated by the U.S. Senate Finance Committee (SFC) in January 2025. The SFC’s investigation focuses on investment profits exceeding $850 million that Morehead reportedly earned after he moved to the island in 2021.

Senator Ron Wyden, the committee’s top Democrat, has raised concerns that Morehead may have improperly classified the gains as exempt from federal taxation. His letter suggests that such income, despite being reported as sourced from Puerto Rico, might have actually originated from the United States – and thus is subject to federal taxes.

In response to these allegations, Dan Morehead has defended his tax practices, saying:

“I believe I acted appropriately with respect to my taxes.”

The investigation is still ongoing and the outcome of it might have implications for him personally, as well as for the broader cryptocurrency industry and community, especially those utilizing Puerto Rico’s tax incentives.

Michael Saylor, the famed cofounder of MicroStrategy and a fervent crypto advocate, fought relatively similar allegations that he evaded over $25 million in D.C. income taxes over 15 years. He claimed that he lived in Florida or Virginia despite allegedly residing in Georgetown during that period. He eventually settled with D.C. and agreed to pay $40 million. It’s uncertain whether Morehead will have more luck with his allegations.

Dan Morehead’s Crypto Stance and Holdings

Dan Morehead is extremely bullish about Bitcoin and the crypto market’s future, arguing that Bitcoin could reach $740,000 by April 2028, which translates to a $15 trillion market cap. For a more in-depth understanding of his perspective on the crypto market, you might find this CNBC interview insightful:

Morehead has also expressed optimism about the U.S. government’s evolving stance on blockchain technology, noting that the election of a pro-crypto president could significantly benefit the industry.

“We believe the broader industry will benefit greatly from the first pro-blockchain U.S. president in office,” he shared in the Pantera Capital newsletter of October 2024. However, the new regime of tariffs seems to have only pushed crypto prices down, along with stocks and other similar assets.

While Morehead has often spoken of Pantera Capital’s investment positions, he hasn’t disclosed any details about his personal crypto holdings. Pantera Capital maintains a strong position in Bitcoin, viewing it as a revolutionary digital asset and gold equivalent.

In May 2024, Morehead identified Toncoin as Pantera’s largest investment, highlighting its potential due to the vast user base of Telegram. The token surged to a new all-time high in June 2024, though it has since fallen over 60%.

Pantera Capital also holds a substantial portion in Solana and ONDO, the native asset of Ondo Finance, a leading real-world-asset tokenization platform.

Lessons to Learn from Dan Morehead’s Success

Morehead was an early investor in Bitcoin and one of the first institutional professionals to take the cryptocurrency seriously. He launched his Bitcoin fund in 2013 when most people considered crypto a fringe asset at best. His story highlights the power of recognizing emerging technology early – and having the courage and conviction to bet on it.

Morehead’s background in Wall Street and trading gave him an edge when entering the highly volatile world of crypto. He brought structure and discipline to the crypto space at a time when it was still finding its footing, and he was remarkably successful.

Despite early criticism and financial losses, Morehead didn’t give up on crypto. His belief in the long-term value of blockchain technology persisted, which is what ultimately made him a billionaire.

However, the ongoing federal investigation into Morehead’s tax practices is a serious concern. If proven, these allegations could tarnish his reputation and legacy and lead to significant personal and professional consequences. It is a stark reminder that even the most successful players in the industry must stay compliant with all laws and regulations, especially in industries under increasing regulatory scrutiny like crypto.

FAQ

How much is Dan Morehead worth?

Dan Morehead is worth over $1 billion as of 2025. This is all subject to speculation, though, since he hasn't disclosed any of the details about his assets or investments.

What is Dan Morehead known for?

Morehead is best known as the founder and CEO of Pantera Capital, one of the first and largest investment firms in the cryptocurrency industry. He launched the first institutional Bitcoin Fund in the U.S. in 2013.

When did Dan Morehead first invest in Bitcoin?

Pantera Capital, led by Morehead, began investing in Bitcoin when it was trading between $65 and $75 per coin. This early move played a huge role in the firm's growth and financial success.