Join Our Telegram channel to stay up to date on breaking news coverage

With momentum quietly building in the altcoin market, many investors are seeking the next big opportunity, and they may not have to wait much longer. In a recent analysis, prominent cryptocurrency analyst Dan Gambardello made a bullish case for the imminent approval of multiple altcoin spot ETFs, a move he believes could spark a significant market-wide rally.

His outlook is based on strong technical and macro indicators, including months of sideways movement in total altcoin market cap. As such, large investors are quietly accumulating several altcoins ahead of a potential breakout. This article highlights some of the top cryptocurrencies to buy now.

Top Cryptocurrencies to Buy Now

Several altcoins are gaining momentum as investor interest surges across the crypto market. Hyperliquid is currently trading at $35.03, posting a 3.94% gain over the past week amid growing enthusiasm for its high-performance DeFi infrastructure. Meanwhile, Solaxy (SOLX) is entering the final week of its presale, having already raised $45.8 million. Hedera is currently priced at $0.1709 with a 1.14% increase in the past 24 hours.

1. Avalanche (AVAX)

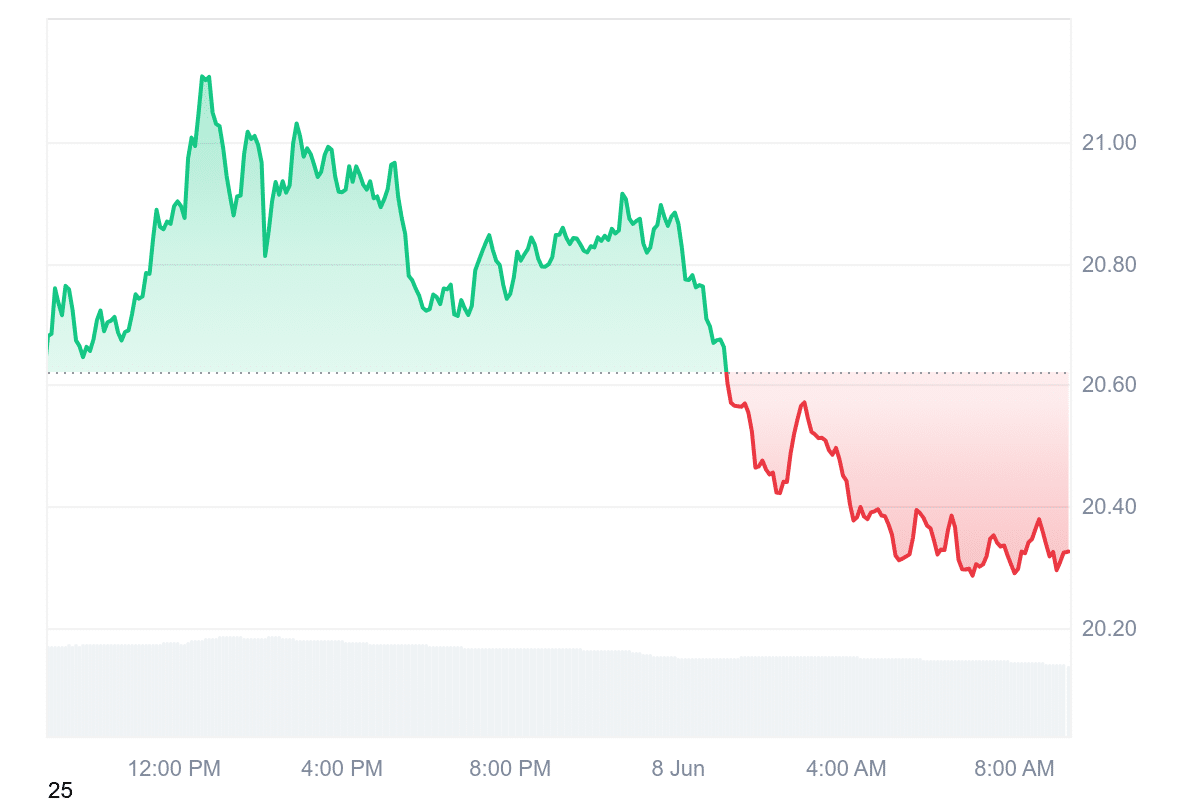

The current price of Avalanche (AVAX) stands at $20.31, reflecting a 1.89% decline over the past 24 hours. The intraday chart data reveals that AVAX experienced a steady uptrend during the early part of the day but began to dip sharply in the later hours.

Despite this recent decline, the overall technical indicators suggest a mixed outlook. The 14-day Relative Strength Index (RSI) is at 64.04, which places it just below the overbought threshold. Furthermore, the 30-day volatility is currently low at 7%, suggesting that the price has been relatively stable, with limited erratic swings or sharp changes.

Market sentiment remains moderately optimistic as the Fear & Greed Index reads 62, signaling “Greed”. This indicates that while traders may still be enthusiastic about AVAX, there could be a risk of overconfidence in the market. Additionally, AVAX has shown 16 green days out of the past 30, which further supports a cautious but constructive medium-term outlook.

Looking ahead, current projections estimate a 5.21% increase in AVAX’s price, with a potential target of $21.44 by early July.

2. Hyperliquid (HYPE)

Hyperliquid (HYPE) is currently trading at $35.03, marking a 3.94% increase over the past 7 days. Over the last 24 hours, the token’s price has ranged from a low of $34.79 to a high of $36.26, showing modest but steady price action. Despite recent gains, the price remains 12% below its all-time high, indicating that there is still recovery potential ahead.

Market sentiment surrounding Hyperliquid is currently bullish, supported by a Fear & Greed Index reading of 62, which falls into the “Greed” category. This reflects growing optimism and investor confidence in the asset’s near-term outlook. The 30-day volatility sits at 15%, which is moderate and below the 30% threshold, suggesting a relatively stable price environment without excessive swings.

From a technological standpoint, Hyperliquid is positioning itself as a high-performance Layer 1 blockchain designed specifically for decentralized finance (DeFi) applications. It boasts sub-second block times and an impressive throughput of 100,000 orders per second, which places it among the fastest DeFi infrastructures currently available.

One of the most compelling aspects of Hyperliquid is its commitment to high-frequency trading capabilities without compromising decentralization. This makes it particularly attractive to both institutional and retail traders seeking speed, transparency, and control over their assets in a non-custodial environment.

3. Chainlink (LINK)

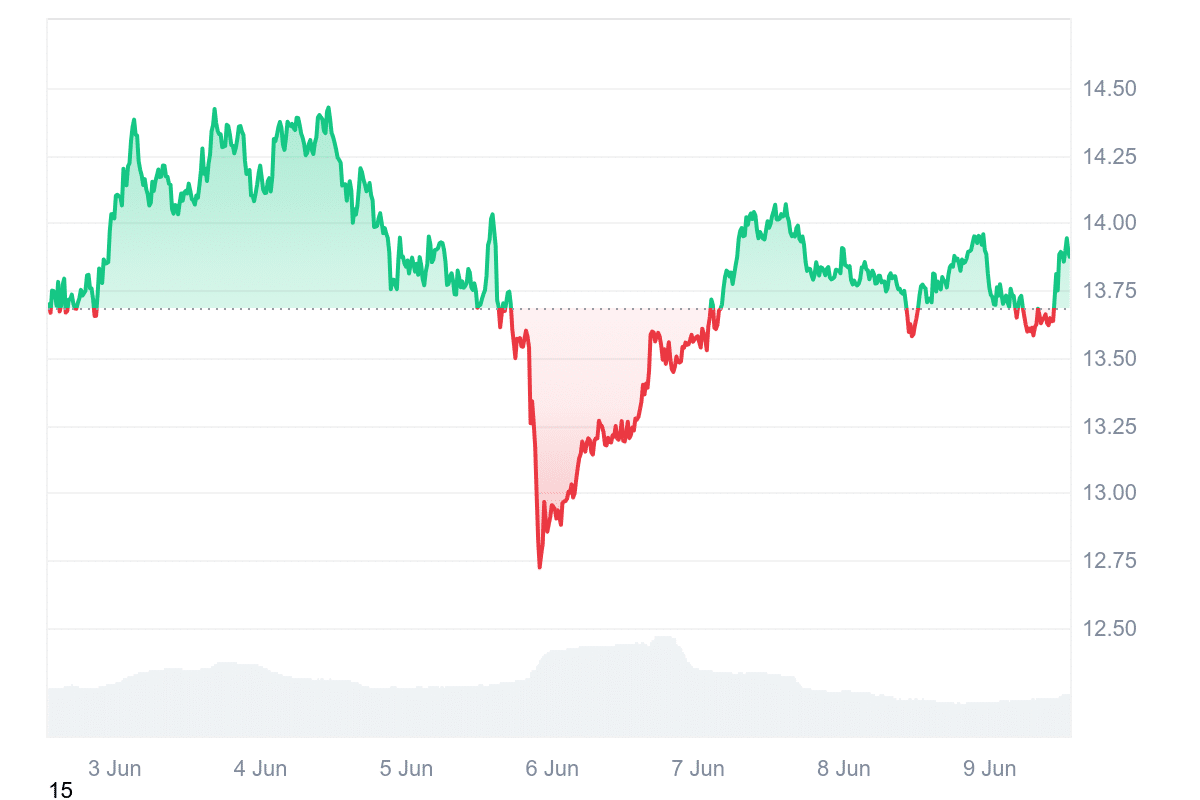

Chainlink (LINK) is currently trading at $13.87, reflecting a 1.28% increase over the past week. Despite the modest price gain, price prediction sentiment is currently bearish, suggesting caution in the short term. However, broader sentiment remains optimistic, as reflected by the Fear & Greed Index reading of 62, indicating a market leaning toward “Greed.”

On the utility front, Chainlink continues to lead innovation in the tokenization of Real World Assets (RWAs). The protocol has become indispensable in bridging traditional finance and blockchain through its decentralized oracle network, which provides reliable, secure, and tamper-proof data feeds to smart contracts. This real-world integration is a key step toward making blockchain technology viable for institutional use cases.

One of the most impactful developments recently was Chainlink’s collaboration with Lido Finance and XSwap to introduce direct Ethereum staking support on Layer-2 networks such as Arbitrum, Base, and Optimism. This was made possible by Chainlink’s Cross-Chain Interoperability Protocol (CCIP), which enables users to stake ETH directly on L2 networks in a single, streamlined transaction. This move reduces friction for users and also enhances Ethereum’s scalability and accessibility.

Additionally, Maple Finance has integrated Chainlink CCIP and adopted the Cross-Chain Token (CCT) standard to make over $500 million worth of syrupUSDC natively transferable across Ethereum and Solana. This development highlights how Chainlink is enabling institutional-grade finance tools to function securely across blockchains, expanding the utility and reach of decentralized finance.

4. Solaxy (SOLX)

Solaxy (SOLX) is entering the final stretch of its highly anticipated presale, having already raised an impressive $45.8 million. With just seven days remaining before the presale concludes, investor interest continues to surge, driven by the project’s ambitious goal of addressing Solana’s persistent scalability challenges. This substantial early funding positions Solaxy as one of the most notable crypto launches of the year.

$SOLX has got what YOU need. 🛸🪐

45M Raised! 🔥 pic.twitter.com/hamUNI7Hgz

— SOLAXY (@SOLAXYTOKEN) June 6, 2025

Solana, despite being known for its high-speed transactions and low fees, has encountered scalability bottlenecks, particularly during periods of peak activity. Network congestion has occasionally led to delayed or failed transactions. Solaxy addresses this critical pain point by bundling transactions off-chain and settling them on Solana’s mainnet.

What makes Solaxy particularly compelling is its first-mover advantage. While other chains like Ethereum and Avalanche have seen an increase in Layer-2 scaling solutions, Solana has not had a comparable sidechain or rollup infrastructure until now. Solaxy is stepping into this strategic gap with strong momentum and growing developer support.

The current presale price of $0.00175 presents a potential opportunity for early adopters ahead of SOLX‘s official exchange listing. With the project nearing its mainnet launch and significant capital already raised, many investors see Solaxy as a foundational piece in the next phase of Solana’s growth, potentially unlocking new layers of scalability, reliability, and adoption.

5. Hedera (HBAR)

Hedera (HBAR) is currently trading at $0.1709, reflecting a 1.14% gain over the last 24 hours. The price prediction sentiment for HBAR remains bearish in the short term. However, broader market indicators, such as the Fear & Greed Index reading of 62, suggest that continued investor interest and confidence remain.

Technically, the asset’s 14-day Relative Strength Index (RSI) is at 59.57, placing it within a neutral zone and implying that the price may trade sideways soon rather than experiencing a strong directional breakout. Additionally, the 30-day volatility is modest at 8%, indicating relative price stability.

🚨 Fortune 154 technology leader @ArrowGlobal has joined Hedera Council!

With $28B in revenue (2024), Arrow is now helping govern Hedera and bringing global supply chains on-chain👇

📦 Building a DLT-powered supply chain use case

🛠️ Decentralized governance

🟢 Node ops… pic.twitter.com/3DAHVHeF7N— Hedera (@hedera) June 4, 2025

HBAR has recorded 15 green days in the last 30 days, a 50% positive performance rate that underscores its consistent momentum. Liquidity remains robust, with a 24-hour volume-to-market cap ratio of 0.0302, making it relatively easy to enter or exit positions without significant slippage, an attractive trait for both retail and institutional participants.

In a notable recent development, Arrow Electronics has joined the Hedera Governing Council. This partnership enhances Hedera’s credibility and signals the growing adoption of its technology in industrial-scale, real-world solutions.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage