Join Our Telegram channel to stay up to date on breaking news coverage

After a volatile start to the year, the crypto market is showing early signs of recovery. Crypto analyst Michaël van de Poppe highlights the growing stability across altcoins. He noted that the significant losses seen from January to March were driven mainly by overleveraged positions and widespread liquidations.

In contrast, the current quarter is marked by reduced selling pressure and stronger support levels, signaling a potential shift in market momentum. Ethereum’s strong performance also adds confidence to the outlook, suggesting that altcoins could rebound further in the months ahead. For investors seeking strategic entry points, this article presents some of the top cryptocurrencies to buy now.

Top Cryptocurrencies to Buy Now

Uniswap (UNI) is currently priced at $6.07, reflecting a 16.50% increase over the past month. Meanwhile, enthusiasm around the Solaxy project continues to build, with its presale raising nearly $43 million to date. Also, activity on the Cronos network has intensified, as it recorded its highest daily transaction count in the past month on May 31, processing 68,964 transactions.

1. Dai (DAI)

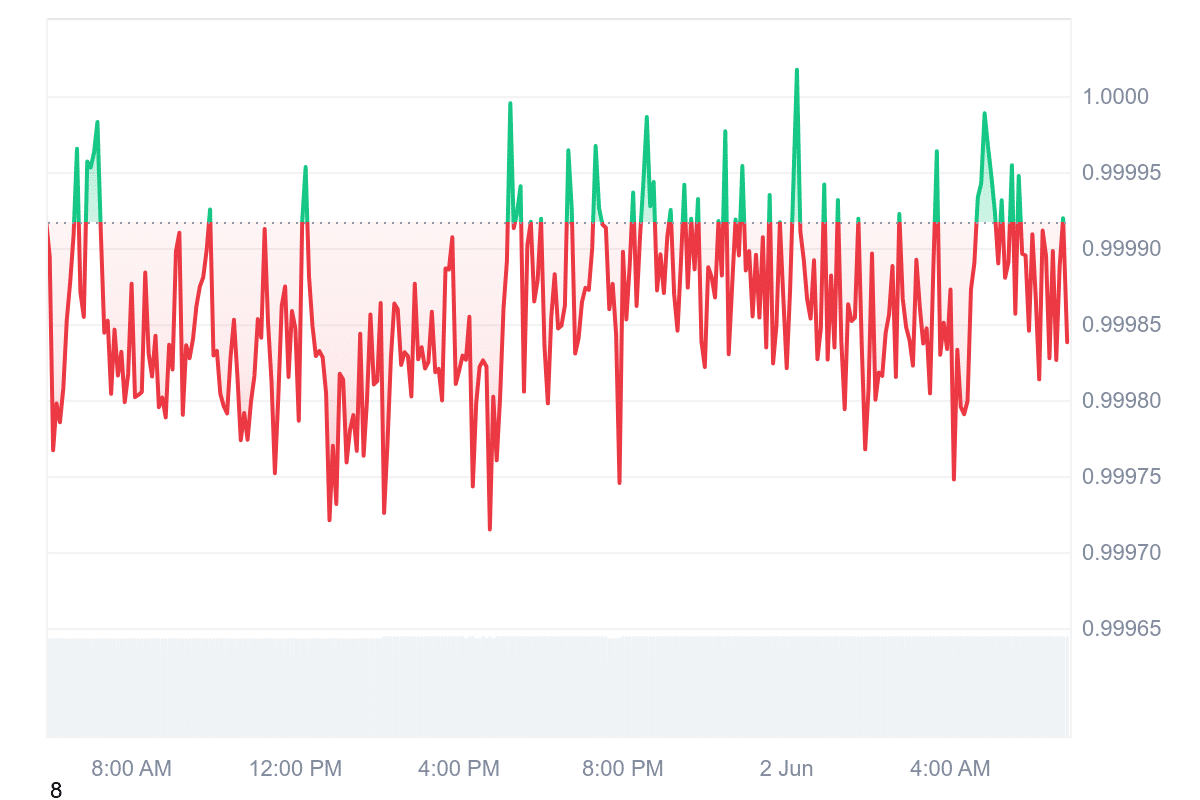

DAI is an Ethereum-based stablecoin that maintains a soft peg to the U.S. dollar. The Maker Protocol and the decentralized autonomous organization MakerDAO govern the issuance and management of its tokens.

At the time of writing, DAI is trading at $0.9998, remaining very close to its intended $1 peg. The overall market sentiment surrounding DAI is currently bullish. Supporting this outlook, the Fear & Greed Index stands at 64, indicating that market participants are in a “Greed” phase.

From a technical standpoint, DAI’s 14-day Relative Strength Index (RSI) is at 62.38. This value places it in a neutral zone, suggesting that the asset is neither overbought nor oversold and may continue to trade sideways in the near term. Additionally, the 30-day volatility is exceptionally low at just 1%, which is typical for a stablecoin and confirms that DAI’s price has remained stable without significant fluctuations.

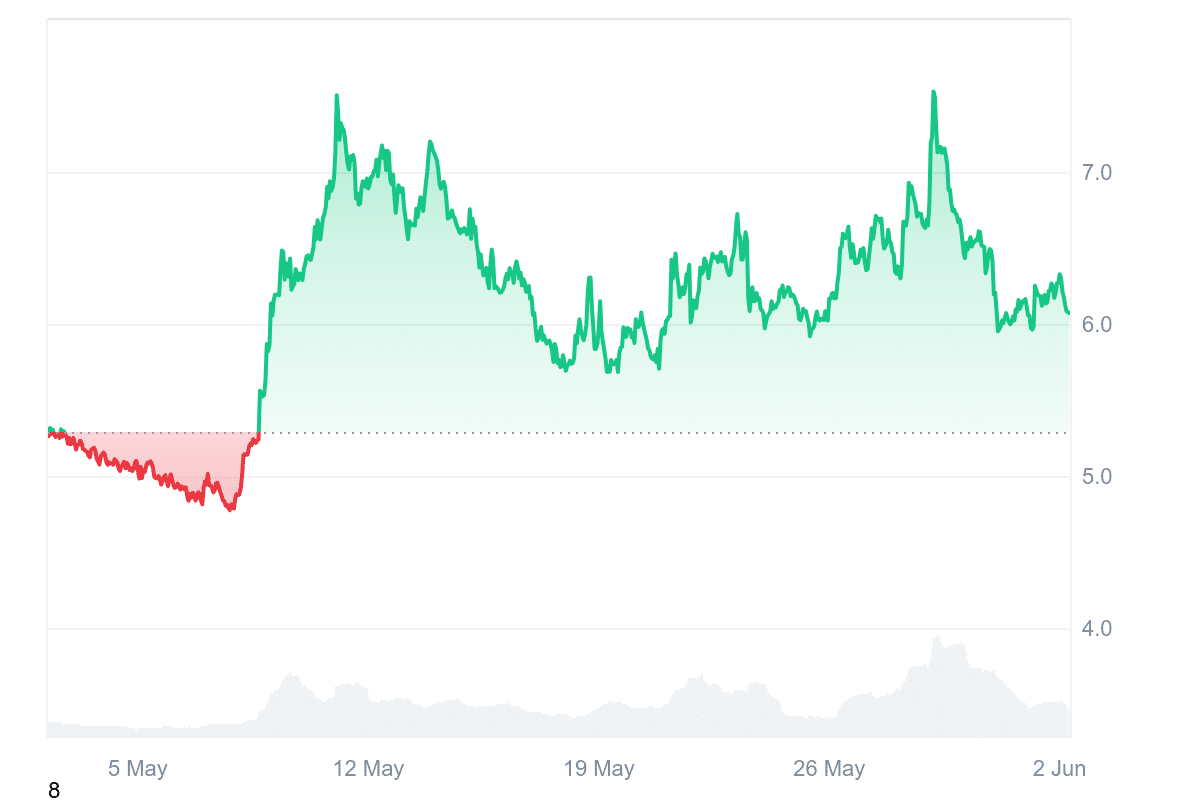

2. Uniswap (UNI)

Uniswap (UNI) is currently trading at $6.07, marking a 16.50% gain over the past month. Despite this positive short-term performance, sentiment surrounding UNI remains bearish, suggesting that investors may be cautious about its sustainability. However, the broader crypto market reflects a Fear & Greed Index of 64, indicating that overall market sentiment is in the “Greed” zone.

From a technical perspective, UNI appears to be in a neutral zone. The 14-day Relative Strength Index (RSI) is at 56.09, meaning the asset is neither overbought nor oversold. This suggests that price action may be sideways in the short term, barring any significant market developments.

Additionally, the 30-day volatility is at 11%, which is moderate for a crypto asset. This indicates some price movement but not extreme swings typically seen in smaller-cap or speculative assets.

Don’t get batched

With UniswapX, your swap is individually optimized

Fillers compete to fill your specific order, which means every swap works for you 👀 pic.twitter.com/kmMq0cFc7D

— Uniswap Labs 🦄 (@Uniswap) May 28, 2025

One notable development is recently stirring the market. After three years of inactivity, a Uniswap whale reemerged, purchasing 662,606 UNI tokens worth approximately $3.97 million. This transaction was flagged by Lookonchain and caused a stir among traders.

The average purchase price of $5.99 has already yielded an unrealized profit of roughly 1.34% as prices sit around $6.07. Given this whale’s historical success of buying UNI at $3.87 in 2020 and selling near $42.88, the move is being interpreted as a potentially bullish signal, even amid the broader bearish sentiment.

3. Solaxy (SOLX)

Solaxy is the first Layer-2 scaling solution for Solana. Its architecture is designed to ease network congestion by offloading transactions onto its chain, using rollups and bundling techniques. This approach enhances speed and reliability, particularly during periods of high demand, reducing the risk of network delays or failed transactions.

$SOLX is showing NO signs of slowing down! 🚀

43M Raised! 🔥 pic.twitter.com/kktQdy34kA

— SOLAXY (@SOLAXYTOKEN) June 1, 2025

One of Solaxy’s standout features is its modular developer toolkit, which enables the rapid creation and deployment of decentralized applications (dApps). These tools are versatile enough to support a wide range of use cases, from lightweight meme coin projects to robust decentralized finance (DeFi) platforms.

A major technical milestone is already in place: a live testnet bridge built on Hyperlane, which connects Solaxy to Solana’s Devnet and allows users to move native SOL across chains. Support for Ethereum is on the roadmap, hinting at broader interoperability and cross-chain functionality in the near future.

Adding to its appeal is the launch of the Igniter Protocol, a user-friendly token launch platform similar to Pump.fun. Igniter allows anyone to create and deploy tokens directly on the Solaxy Layer 2 chain. These tokens automatically transition to the upcoming Solaxy DEX (decentralized exchange) once their bonding curve phase is complete.

Investor interest is clearly growing as the SOLX presale has already raised nearly $43 million, with notable participation signaling rising confidence. The current presale price of $0.001742 per SOLX could represent one of the last opportunities to enter at a discounted rate before exchange listings. With only 14 days remaining in the presale, potential buyers are encouraged to act swiftly.

4. VeChain (VET)

VeChain is currently undergoing one of the most significant transformations in its history with the launch of the VeChain Renaissance: Galactica upgrade. The first phase of the upgrade has already been successfully deployed on the testnet, marking a key milestone in what is considered the most transformative technical and tokenomic overhaul for the ecosystem.

The team is now targeting July 1st for the mainnet launch, bringing renewed attention to the project as it advances toward greater scalability, decentralization, and long-term sustainability. This upgrade will unfold in three phases: Galactica, Hayabusa, and Intergalactic.

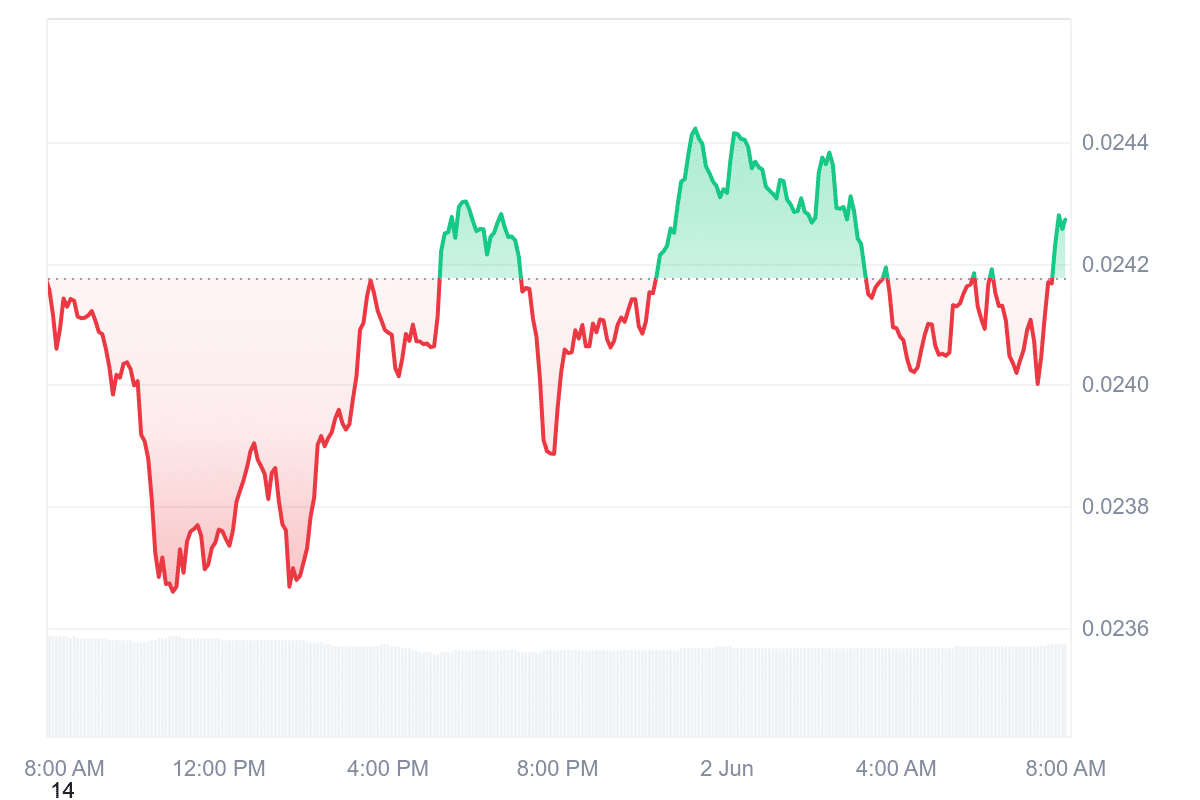

Despite the ambitious roadmap, VeChain’s price performance has been underwhelming in recent months. The VET token is currently trading at $0.02427, having failed to break through resistance at $0.034 in May.

The current sentiment surrounding VeChain is bearish, despite the broader crypto market sentiment remaining positive, with a Fear & Greed Index of 64 (Greed). From a technical standpoint, the 14-day Relative Strength Index (RSI) is at 69, approaching overbought territory but still suggesting neutral to sideways trading for now.

Despite the lackluster price action, VeChain’s development progress, strong infrastructure goals, and clear upgrade roadmap point to potential long-term value. Analysts predict a modest short-term increase, with the VET token expected to rise by 2.71% to reach $0.025041 by July.

If the July 1st mainnet upgrade is successfully executed and positively received, it could serve as a catalyst for renewed interest and upward price momentum.

5. Cronos (CRO)

Cronos (CRO) is quickly emerging as one of the most user-friendly and efficient blockchains in the Web3 space. By combining the smart contract flexibility of Ethereum with the high-speed architecture of Cosmos, Cronos offers a robust foundation for decentralized finance, blockchain gaming, and NFT marketplaces.

Its design prioritizes low fees, high throughput, and energy efficiency, making it well-suited to support the next generation of decentralized applications and users. Since its launch, the network has grown steadily, now supporting thousands of dApps and processing millions of transactions daily.

🚀 Same stack. Less friction.

Cronos zkEVM Mainnet upgrade to v27 is now live. This upgrade delivers two major improvements:

1️⃣ EVM Emulation – making Cronos zkEVM truly EVM-equivalent

2️⃣ Fflonk Verifier – reducing L1 verification costs— Cronos (@cronos_chain) May 28, 2025

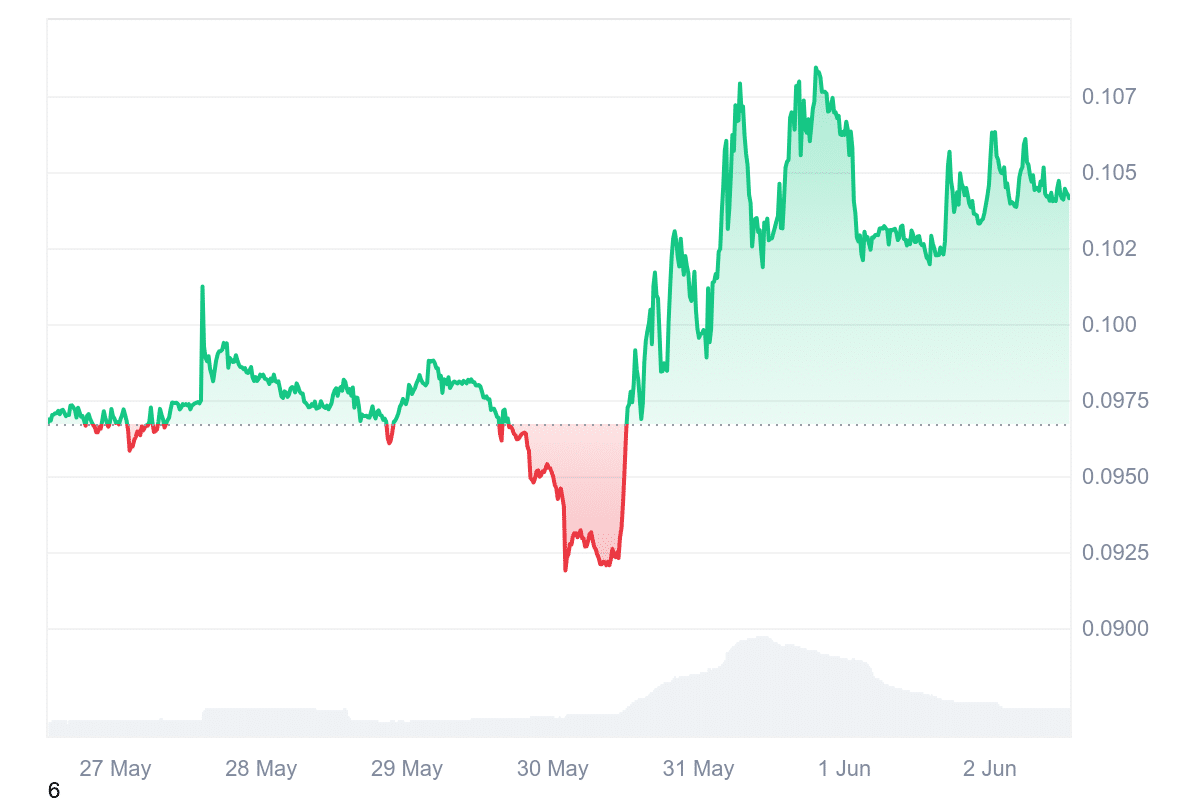

The CRO token is currently trading at $0.1041, reflecting a 1.49% increase in the last 24 hours. The price trend remains bullish, as the token trades more than 12% above its 200-day simple moving average of $0.093226. At the same time, the Fear & Greed Index stands at 64, signaling market optimism.

Network activity has also picked up notably. On May 31, Cronos reached its highest daily transaction volume in a month, processing 68,964 transactions. This rise in activity coincides with the recent rollout of the Cronos zkEVM Mainnet v27 upgrade.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage