Join Our Telegram channel to stay up to date on breaking news coverage

Decentralised finance (DeFi) continues to reshape the traditional financial landscape by offering open, permissionless alternatives to services like trading, lending, and asset management. Today’s total value locked (TVL) across DeFi protocols exceeds $90 billion, highlighting the sector’s growing influence and user adoption despite ongoing market fluctuations. This surge reflects a maturing ecosystem where innovation, transparency, and user control drive sustained interest from retail and institutional participants.

This article highlights today’s leading DeFi tokens by market activity- The Graph, EigenLayer, Uniswap, and 1inch Network- each making notable progress. From new API rollouts and ecosystem expansions to surging trade volumes and cross-chain integrations, these tokens are gaining traction and shaping the future of decentralised applications. Let’s dive into what sets them apart.

Biggest DeFi Token By Market Activity Today – Top List

The Graph is a decentralised protocol that helps developers easily find and use blockchain data. EigenLayer is a decentralised protocol built on Ethereum that lets users “restake” their ETH to help secure other services beyond the Ethereum network. Uniswap is a decentralised exchange (DEX) on the Ethereum blockchain that lets users swap ERC-20 tokens directly from their wallets using liquidity pools. 1inch Network is a decentralised exchange aggregator that helps users find the best token swap rates by pulling liquidity from multiple sources. Let’s dive in fully to uncover why these tokens are ranked among the leading DeFi tokens by market activity today.

1. The Graph (GRT)

The Graph is a decentralised protocol that helps developers easily find and use blockchain data. It organises this data into open subgraphs APIs, making it easier to build and run decentralised apps (dApps) on blockchains like Ethereum, NEAR, and Polygon. This setup improves how fast and efficiently apps can access the needed data.

The GRT token powers the Network by supporting roles like indexers, curators, and delegators, who help keep it running securely. It’s also used to pay for data queries, ensuring everyone in the system is fairly rewarded and the protocol runs smoothly.

GRT is priced at $0.1141, reflecting a 7.76% increase over the past 24 hours, a 6.31% gain over the last 7 days, and an 8.19% rise over the past month.. Its 24-hour trading range spans from $0.1041 to $0.1149.

ICYMI: $GRT is going cross-chain ⚡

The Graph to adopt @chainlink CCIP to make GRT accessible across @Arbitrum, @Base, and @Solana.

Here’s what it unlocks 👇

• Secure GRT transfer across chains.

• Easier delegation with lower fees.

• Simpler dev access to GRT for dapps.

•… https://t.co/sMdS7xMimL— The Graph (@graphprotocol) May 23, 2025

The Graph Protocol recently unveiled its Token API beta, offering developers reliable access to token balances, transaction histories, and pricing across multiple chains, including Ethereum, Arbitrum, BSC, Polygon, Optimism, and Base. This enhancement aims to streamline data retrieval processes for decentralised applications.

By providing standardised and verifiable token data, The Graph simplifies the development of Web3 applications, ensuring that developers can access accurate and consistent information. This move is expected to bolster the ecosystem by facilitating the creation of more robust and user-friendly decentralised applications.

2. EigenLayer (EIGEN)

EigenLayer is a decentralised protocol built on Ethereum that lets users “restake” their ETH to help secure other services beyond the Ethereum network. This means staked ETH can be used in more ways, allowing validators to support multiple apps simultaneously. The goal is to boost innovation and scalability by creating a shared layer of security.

The EIGEN token is used for governance, allowing holders to vote on changes and upgrades. It also helps motivate users to participate in the Network and keeps everyone’s interests aligned so the system runs smoothly.

EIGEN is priced at $1.517, reflecting an 11.85% increase over the past 24 hours, a 13.76% gain over the last 7 days, and a 48.56% surge in a month. Its 24-hour trading range is from $1.305 to $1.526.

wen apps?

now apps

The Verifiable Apps page v1 is here!

A non-exhaustive, growing list of apps built on EigenLayer.

– Filter by AVS or category

– Explore app cards

– Submit your ownv1 is read-only. Interactive tools coming soon. 🔜

Let’s build on the verifiable cloud. ☁️… pic.twitter.com/wu1zb873Sr

— EigenLayer (@eigenlayer) May 22, 2025

EigenLayer has launched the first version of its Verifiable Apps page, a curated list of dApps built using its restaking technology. This new page highlights the growing ecosystem of projects that rely on EigenLayer’s unique security model and modular setup, showcasing the creativity and innovation within its community.

The Verifiable Apps page is a valuable tool for developers, investors, and users to discover how restaking is applied in real-world projects. It reinforces EigenLayer’s role in building a secure and dynamic environment for decentralised applications.

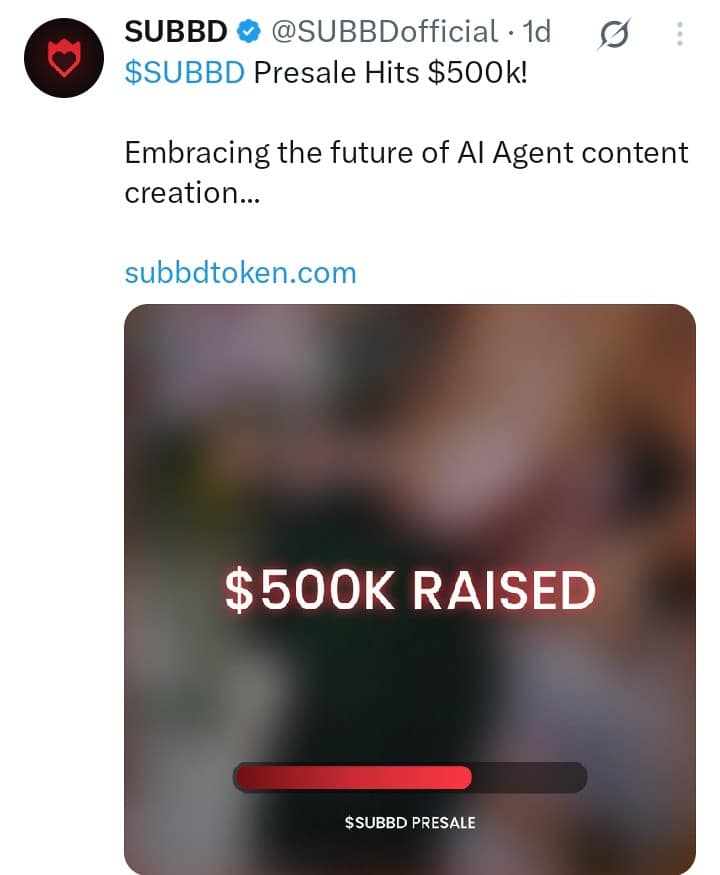

3. SUBBD Token (SUBBD)

SUBBD is an AI-powered platform revolutionising content monetisation in the creator-subscriber economy. Combining AI tools and Web3 enables creators to manage and monetise content, efficiently cutting out middlemen. With features like AI live streams, voice generators, and a 24/7 personal assistant, SUBBD offers a decentralised alternative to platforms like OnlyFans.

The $SUBBD token powers the platform, enabling access to content, offering tips, and facilitating creator requests. Currently in presale at $0.0555, with over $520,000 raised, the token provides exclusive perks, VIP access, and a 20% annual return through staking. Ten per cent of the total supply is allocated for airdrops and rewards.

It has also been featured on major cryptocurrency platforms, including Cryptonomist, Coinspeaker, Bitcoinist, 99Bitcoins, and TradingView via NewsBTC, highlighting its growing presence in the AI and Web3. With its increasing influence, $SUBBD is gaining rapid traction. The launch of the AI Personal Assistant further strengthens its position, offering creators continuous fan engagement and support. As AI and Web3 redefine digital content, $SUBBD shapes the future of creator income.

4. Uniswap (UNI)

Uniswap is a decentralised exchange (DEX) on the Ethereum blockchain that lets users swap ERC-20 tokens directly from their wallets using liquidity pools. Instead of relying on a central authority, it uses an automated market maker (AMM) system, where users provide tokens to pools and earn a share of the trading fees. With the release of Uniswap v3, features like concentrated liquidity and multiple fee levels were added to improve efficiency.

The native token, UNI, serves as the governance token for the Uniswap protocol. UNI holders can propose and vote on protocol upgrades, fee structures, and other critical decisions affecting the platform’s development.

UNI is priced at $6.517, reflecting an 8.71% increase over the past 24 hours. Over the last 7 days, it has gained approximately 13.25%; over the past month, it has risen by 9.98%. Its 24-hour trading range spans $5.911 to $6.587, making it one of the leading DeFi tokens by market activity.

Uniswap apps aggregate liquidity in one place

That means when you swap using Uniswap Web and Wallet, you’re not just accessing the Uniswap Protocol

You’re also tapping into other liquidity sources via UniswapX to get the best swap, every time 🫡 pic.twitter.com/JxwLRY9KKY

— Uniswap Labs 🦄 (@Uniswap) May 21, 2025

Uniswap has proposed allocating $250,000 worth of UNI tokens over six months to boost liquidity on its v3 pools within the Saga ecosystem. The plan focuses on five key trading pairs, SAGA/USDC and ETH/USDC, aiming to strengthen Uniswap’s presence as the top DEX on Saga’s Liquidity Integration Layer (LIL).

This move allows Uniswap to tap into Saga’s scalable infrastructure, attract more liquidity providers, and improve cross-chain trading. If successful, it could set a precedent for future partnerships, highlighting Uniswap’s dedication to growing its ecosystem and staying at the forefront of DeFi.

5. 1inch Network (1inch)

1inch Network is a decentralised exchange aggregator that helps users find the best token swap rates by pulling liquidity from multiple sources. Since its launch in 2019, it has combined different protocols to make trading more efficient and supports multiple blockchains, such as Ethereum, BNB Chain, and Solana, for cross-chain swaps.

The 1INCH token powers the platform’s governance and utility features. Token holders can vote on protocol changes through the DAO. After the Fusion upgrade in 2022, users can also stake 1INCH to earn Unicorn Power (UP), which can be delegated to earn rewards, adding more ways to participate in the Network.

1INCH is priced at $0.2294, reflecting a 3.92% increase over the past 24 hours. Over the last 7 days, it has gained approximately 8.58%; over the past month, it has risen by 16.60%. Its 24-hour trading range spans from $0.2185 to $0.2317.

1inch recently announced a significant milestone, processing $4.5 billion in trading volume within 24 hours, marking a 10–12x growth. This surge underscores the platform’s robust infrastructure and capacity to handle substantial DeFi activity.

This achievement highlights 1inch’s pivotal role in the DeFi ecosystem, offering users efficient and scalable solutions for decentralised trading. For traders and developers, this growth signifies increased liquidity and improved execution capabilities, reinforcing 1inch’s position as a leading aggregator in the decentralised finance space.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage