Join Our Telegram channel to stay up to date on breaking news coverage

The cryptocurrency market is facing turbulent times. The U.S. recently imposed a 104% tariff hike on Chinese goods, intensifying the ongoing trade war. This move has sparked a broad sell-off in financial markets, with cryptocurrencies feeling the heat.

The total crypto market cap has slipped to $2.44 trillion, down 2.84% in just 24 hours, while the Fear & Greed Index plunges into “Extreme Fear” territory, reflecting a strong risk-off mood among investors. Amid this downturn, many digital assets have taken a hit, but some altcoins are holding their ground, buoyed by innovative partnerships and ongoing developments.

For investors looking to identify the best crypto to invest in right now, this article analyzes assets with strong resilience, utility, and growth potential.

Best Crypto to Invest in Right Now

The IOTA token trades at $0.145, reflecting a 6.18% drop over the past 24 hours. Meanwhile, Injective has added Republic as a validator. Furthermore, Solaxy’s ongoing initial coin offering (ICO) has gathered $29.5 million, indicating significant investor enthusiasm. In other news, BTC’s price has shifted between rises and dips, suggesting that crypto traders are grappling with uncertainty, possibly driven by external pressures like tariff-related developments.

1. IOTA (IOTA)

IOTA operates as a distributed ledger technology, distinct from traditional blockchains. Instead of a single chain, it uses a structure called the Tangle, a web of transactions that branch out like a tree. This setup aims to allow secure, direct transfers of data and value without a central authority. Users, businesses, and institutions can tap into this network for decentralized exchanges, with every move permanently logged.

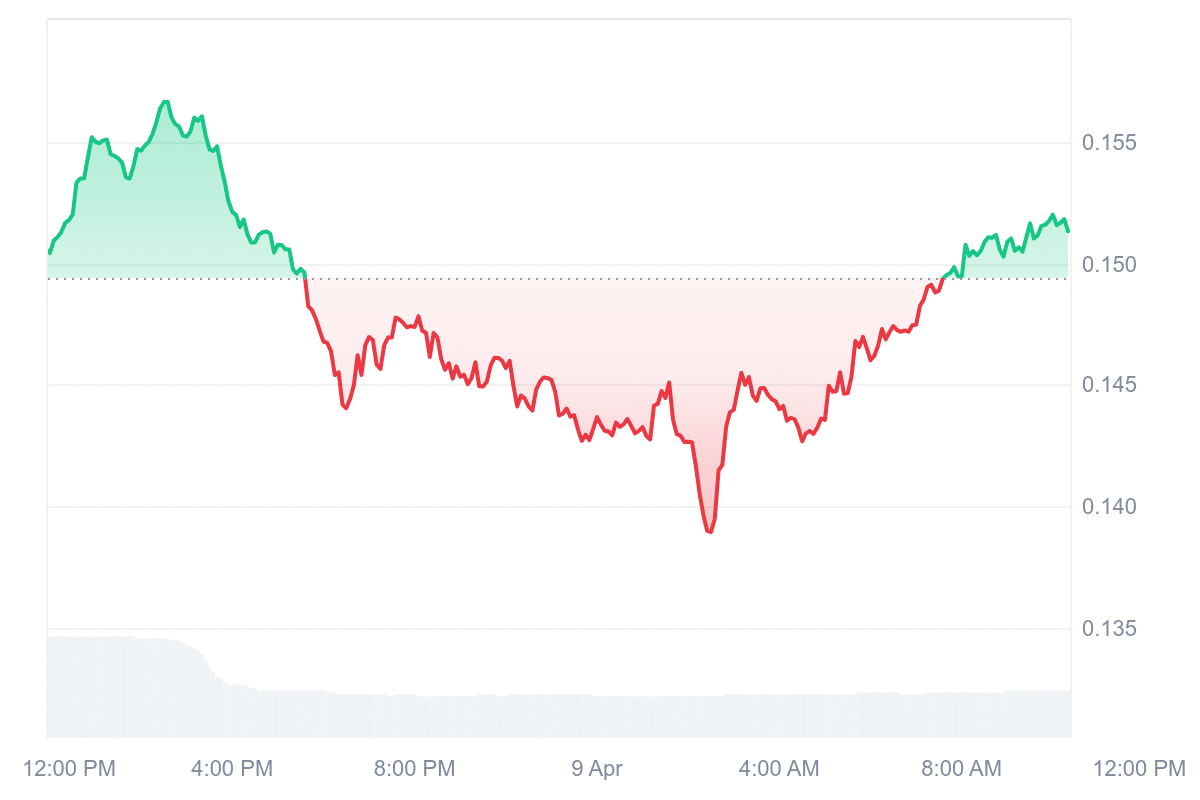

As of today, the IOTA token is exchanging hands at $0.145, down 6.18% in the past day. It fluctuated between $0.1387 and $0.1568 over that time. Compared to its peak of $5.69, it’s dropped 97.43%, showing a steep decline from its high point. Still, its trading activity remains solid, with a 24-hour volume-to-market-cap ratio of 0.0762, suggesting decent liquidity for its size.

The 14-day Relative Strength Index, a tool measuring price momentum, stands at 56.08. This score places IOTA in a neutral zone, hinting it might not swing sharply soon. Meanwhile, its 30-day volatility, which tracks price steadiness, registers at 8%, lower than the 30% threshold, indicating calmer waters lately.

IOTA’s design focuses on enabling a decentralized platform, but its price reflects a challenging journey. Its market behavior shows stability, though far from its past highs.

2. The Sandbox (SAND)

The Sandbox is a virtual world on blockchain technology that lets users design, construct, and trade digital items through a game-like setup. It uses a decentralized system, meaning no single authority controls it. It relies on community input via a decentralized autonomous organization (DAO) and unique digital tokens called NFTs. These NFTs represent ownership of in-game assets, like land or creations, that players can buy or sell.

Furthermore, the platform aims to blend blockchain into everyday gaming, as outlined in its whitepaper. It introduces a “play-to-earn” approach, where users create content and play, earning rewards in SAND, the platform’s token. SAND powers all transactions, from trading assets to buying virtual land.

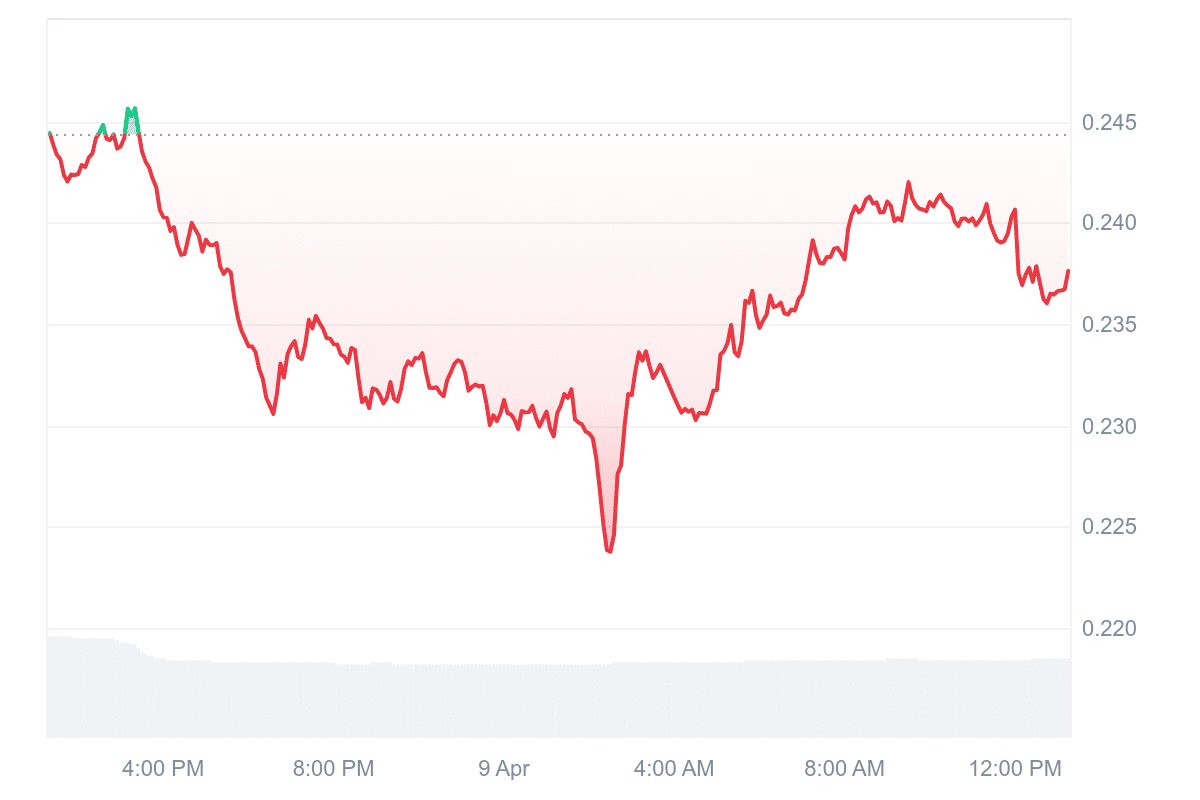

Currently, SAND is valued at $0.2356, with a 24-hour trading volume of $98.44 million and a market cap of $586.59 million. Its price dropped 3.20% intraday, fluctuating between $0.2235 and $0.2456.

The Sandbox is taking over @ParisBlockWeek! 🇫🇷✨

This year, we’re not just attending, we’re making PBW unforgettable with exclusive side events bringing together creators, builders, brands, and Web3 pioneers! 🎮🔥

We’re kicking things off with three major events, don’t miss… pic.twitter.com/nBevhcpSqG

— The Sandbox (@TheSandboxGame) April 7, 2025

Looking at performance, SAND saw 18 positive days out of the last 30, a 60% win rate. Its 14-day Relative Strength Index sits at 47.69, suggesting it’s neither overbought nor oversold, just stable, likely moving sideways. Volatility over 30 days remains low at 6%, indicating steady pricing. The 24-hour trading volume to market cap ratio, at 0.1669, shows decent liquidity for its size.

3. Flow (FLOW)

Flow is a layer-one blockchain built to support consumer apps and digital assets. Unlike many blockchains, it uses a Proof of Stake system, where users stake tokens to validate transactions, reducing energy use.

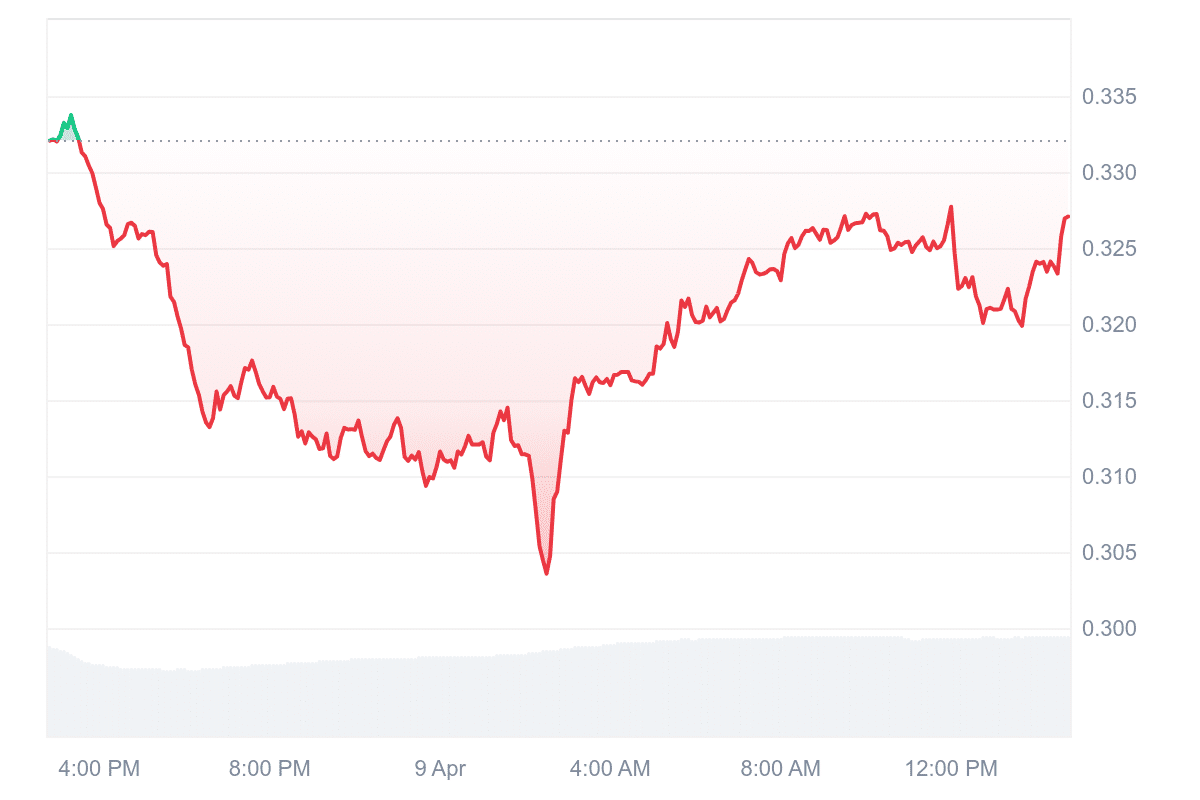

Currently, Flow’s price sits at $0.3241, with a market cap of $510.16 million and a 24-hour trading volume of $41 million, down 2% since yesterday. This gives it a volume-to-market-cap ratio of 0.1181, suggesting decent liquidity for its size. It trades 2.29% below its recent peak and 5.68% above its low, showing mild fluctuations.

The 14-day Relative Strength Index, a tool measuring buying or selling pressure, is 40.27—neutral territory, hinting at stable, sideways movement. Its 30-day volatility, at 7%, stays below 30%, indicating low price swings compared to many cryptocurrencies.

Flow was built for app developers, by app developers.

We're proud to support Flow builders by helping them engage and delight their users through our rewards program.

Congrats to @guy_chilly2 on winning the Apple Vision Pro!

Explore apps and win big! pic.twitter.com/3fgZCrW972

— Flow (🎁+🔑) (@flow_blockchain) April 3, 2025

Flow’s focus on consumer-friendly apps sets it apart, enabling features other blockchains might not support. For example, its design could suit games or digital collectibles needing fast, cheap transactions.

4. Injective (INJ)

Injective recently welcomed Republic as a validator. Republic, a platform for private investments and tokenization, now helps secure Injective’s network by verifying transactions. This partnership seeks to merge traditional finance with blockchain technology. As a layer-one blockchain, Injective serves as a foundation for tools like decentralized exchanges and lending systems.

Developers favor Injective for its ready-to-use features, which speed up app creation compared to slower options on other blockchains. It also connects smoothly with networks like Ethereum and Solana, boosting its versatility. A key feature is its decentralized orderbook, which manages buy and sell orders fairly, resisting manipulation seen elsewhere.

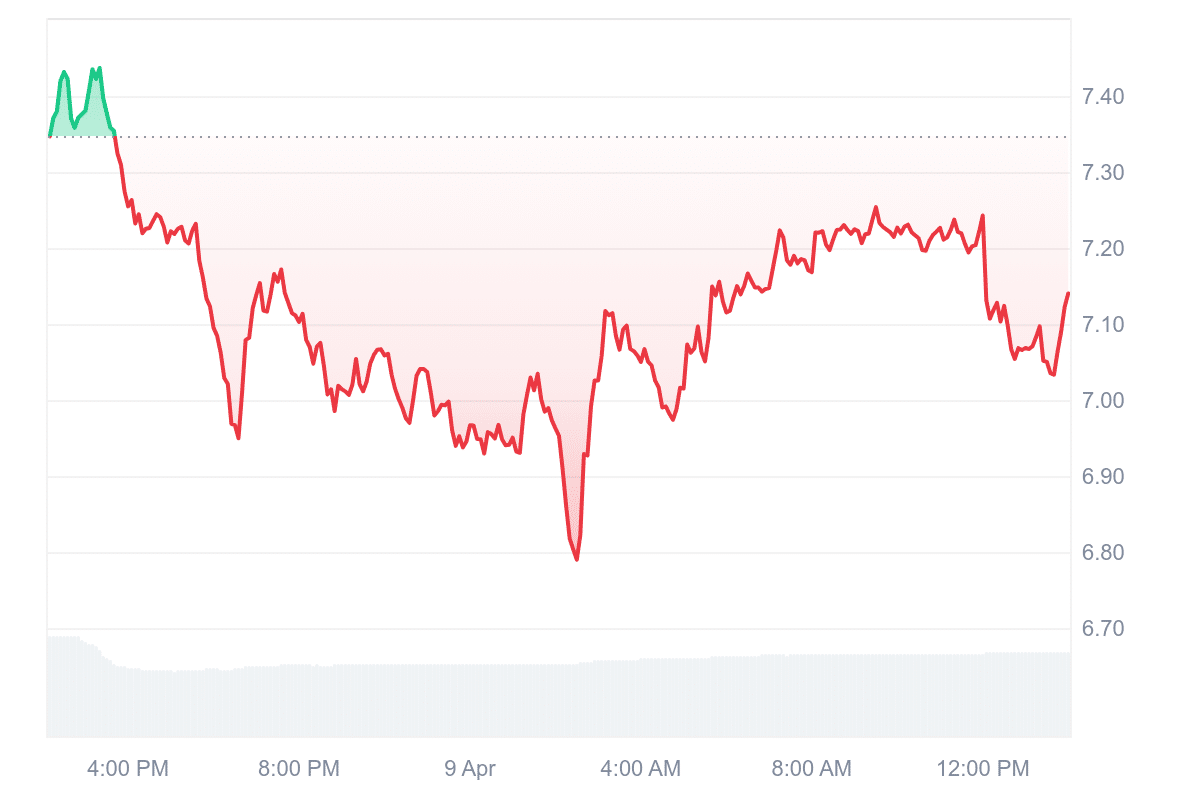

The INJ token trades at $7.15, with an intraday decline of 2.66%. It outperforms its original sale price and hovers near its cycle peak. With a 24-hour trading volume to market cap ratio of 0.2468, it shows solid liquidity, meaning it’s relatively easy to trade based on its size.

BREAKING: Institutional giant @RepublicCrypto, the company facilitating $3 Billion in funding for private co's, has launched an official validator on @injective.

Republic joins an elite lineup of other institutional validators like @googlecloud, @deutschetelekom, and @galaxyhq. pic.twitter.com/nabOWqsPkY

— Injective 🥷 (@injective) April 8, 2025

This collaboration highlights Injective’s aim to make financial tools accessible on a blockchain while keeping things secure. Republic’s validator role reinforces the network’s stability.

5. Solaxy (SOLX)

Solaxy, a new player in the cryptocurrency space, operates as a Layer 2 solution built on Solana. Solana struggles with network congestion, validator issues, and failed transactions, which slow it down and frustrate users. As such, Solaxy aims to address these pain points by boosting transaction speed and reducing costs.

The project’s token, SOLX, powers its network. During the presale, users can buy it for $0.001688 per token, though the price will rise soon. SOLX serves a practical purpose: it pays for transactions on Solaxy’s system.

Additionally, holders can “stake” their tokens—essentially locking them up—to earn rewards, with an annual return of 140%. The team has set aside 25% of the total token supply to incentivize early backers.

$SOLX is making waves. 🌊

Hop on the Solaxy rocket before it's too late! 🚀🔥https://t.co/mdaTX9aVVx pic.twitter.com/cD14Ocdrf1

— SOLAXY (@SOLAXYTOKEN) April 7, 2025

So far, SOLX’s initial coin offering (ICO) has raised $29.5 million, signaling strong interest. Investors are snapping up tokens, possibly anticipating listings on exchanges later. The project focuses on improving data throughput and transactions per second (TPS), making it one of the best crypto to invest in right now.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage